Introduction to  Exness

Exness

Exness is a leading forex broker, providing traders with access to the global forex market. Founded in 2008, it has quickly established itself as a reliable and trustworthy broker, offering a range of features and benefits to traders around the world.

Exness broker is regulated by multiple financial authorities, ensuring that the company operates in a safe and secure manner. This provides traders with peace of mind, knowing that their funds are protected and that they are trading with a reputable broker.

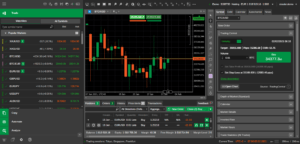

In addition to regulation and security measures, Exness offers a range of trading platforms, including MetaTrader 4 (MT4) and its proprietary trading platform. This allows traders to choose the platform that best suits their trading style and requirements.

Exness also provides traders with access to a wide range of instruments, including forex currencies, indices, commodities, and metals. This allows traders to diversify their portfolios and take advantage of opportunities in multiple markets.

Exness is a leading forex broker, offering traders a range of features and benefits, including regulation and security measures, multiple trading platforms, and a wide range of instruments. Whether you are a seasoned trader or just starting out, Exness is a valuable tool for anyone looking to succeed in the forex market.

Trading Platforms

Trading platforms are an essential component of a forex broker’s offering, as they provide traders with the tools they need to execute trades and manage their portfolios. A broker with a user-friendly and feature-rich trading platform can help traders be more successful in the market.

Exness broker offers a range of trading platforms, including the popular MetaTrader 4 (MT4) platform. MT4 is a well-established and widely used trading platform that provides traders with a range of features and tools to execute trades and manage their portfolios.

Exness’ MT4 platform is user-friendly and customizable, allowing traders to customize the platform to meet their specific needs and preferences. The platform includes a range of technical analysis tools, trading indicators, and automated trading options, allowing traders to develop and implement their trading strategies with ease.

Regulation and Security

Regulation and security are two of the most important considerations for traders when choosing a forex broker. It is crucial to ensure that your broker is regulated by a reputable financial authority and implements measures to protect your funds.

Exness broker is regulated by several well-respected financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). This provides traders with the assurance that Exness operates in a transparent and trustworthy manner, and that their funds are protected by reputable regulators.

In addition to regulation, Exness also implements a range of security measures to protect trader funds. These measures include segregated accounts, SSL encryption, and two-factor authentication. This provides traders with peace of mind and confidence in their trading activities with Exness.

Sp reads and Trading Costs

reads and Trading Costs

Exness broker offers competitive spreads and trading costs for its traders, allowing them to trade with lower costs and maximize their potential profits. The company offers both fixed and floating spreads, giving traders the flexibility to choose the type of spread that best suits their trading style and strategy.

In terms of fixed spreads, Exness broker provides traders with a consistent spread that remains constant, regardless of market conditions. This offers traders a level of certainty, as they know exactly what the cost of trading will be, even during volatile market conditions.

For floating spreads, Exness broker offers spreads that change dynamically based on market conditions. This type of spread may offer more flexibility for traders, as it can adapt to changing market conditions. However, it may also result in wider spreads during volatile market conditions, which could increase the cost of trading.

In addition to spreads, Exness broker also charges other trading costs, such as overnight financing fees for holding positions overnight. These fees are transparently displayed in the trading platform, allowing traders to fully understand the costs associated with their trades.

Exness offers competitive spreads and trading costs, with the option to choose between fixed and floating spreads. By offering competitive spreads and transparent trading costs, Exness helps to reduce the cost of trading and provide traders with a level of certainty and flexibility in their trading activities.

Account Types and Minimum Deposits

- Standard account: This is the basic account type, suitable for traders of all levels of experience. The standard account offers competitive spreads, fast execution, and 24/7 customer support. The minimum deposit for a standard account is typically $100.

- VIP account: The VIP account is designed for high volume traders who require more advanced features and benefits. The VIP account offers lower spreads, faster execution, and priority customer support. The minimum deposit for a VIP account is typically higher than the standard account, with specific requirements depending on the trader’s location.

- Corporate account: The corporate account is designed for businesses and corporations, providing a range of features and benefits for institutional traders. The corporate account offers lower spreads, faster execution, and dedicated account management. The minimum deposit for a corporate account is typically higher than the standard and VIP accounts, with specific requirements depending on the trader’s location.

Exness broker offers several different account types, including standard, VIP, and corporate accounts. Each account type offers its own set of features and benefits, with minimum deposit requirements that vary depending on the account type and the trader’s location. By offering multiple account types, Exness provides traders with the flexibility to choose the account type that best suits their trading style and requirements.

Range of Trading Instruments

Exness broker offers a wide range of trading instruments, allowing traders to diversify their portfolios and take advantage of opportunities in multiple markets. The range of instruments offered by Exness includes:

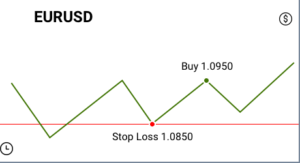

- Forex currencies: Trade major, minor, and exotic currencies, including EUR/USD, GBP/USD, USD/JPY, and more.

- Indices: Trade popular stock market indices, such as the S&P 500, NASDAQ 100, and more.

- Commodities: Trade commodities such as gold, silver, crude oil, and more.

- Metals: Trade precious metals, including gold and silver, and take advantage of price movements in the metals market.

The range of instruments offered by Exness broker provides traders with the opportunity to diversify their portfolios and take advantage of opportunities in multiple markets. Whether you are a forex trader, commodity trader, or stock market trader, Exness has a range of instruments to meet your trading needs.

Exness broker offers a wide range of trading instruments, including forex currencies, indices, commodities, and metals. This allows traders to diversify their portfolios and take advantage of opportunities in multiple markets.

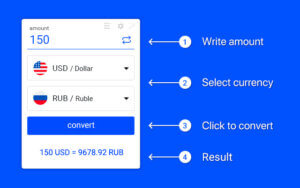

Deposit and Withdrawal Options

Deposit and withdrawal options are an important considerati

Exness broker offers a range of deposit and withdrawal options for its traders, including credit/debit cards, bank wire transfer, and online payment methods such as Skrill and Neteller. The availability of deposit and withdrawal options may vary depending on the trader’s location, and traders should check with Exness broker for the latest information on available options in their region.

The process for making deposits and withdrawals with Exness is straightforward and secure, with fast processing times and low fees. Whether you are looking to make a deposit or withdraw your profits, Exness provides you with the flexibility and convenience you need to manage your trading funds.

Customer Support and Education

Customer support and education are important components of a forex broker’s offering, as traders need access to help and resources to succeed in the market. A broker with excellent customer support and education resources can provide traders with the guidance and support they need to improve their trading skills and knowledge.

Exness broker provides its traders with excellent customer support, including a range of education and training resources to help them succeed in the forex market. The company offers 24/7 customer support through live chat, email, and phone, allowing traders to get the help they need when they need it.

In addition to customer support, Exness broker also provides a range of education and training resources, including webinars, video tutorials, and trading guides. Whether you are a seasoned trader or just starting out, Exness provides you with the resources and support you need to improve your trading skills and knowledge.

Conclusion

Exness is a well-established forex broker that offers a range of features and benefits for its traders. With its competitive spreads, user-friendly trading platforms, and regulatory oversight from multiple financial authorities, Exness broker provides traders with the tools and resources they need to succeed in the forex market. Additionally, the company implements a range of security measures to protect trader funds, providing traders with peace of mind and confidence in their trading activities. Whether you are a seasoned trader or just starting out, Exness is a valuable tool for anyone looking to succeed in the forex market.