Introduction

Forex trading, with its allure of fast-paced movements and the potential for significant returns, remains a favorite among financial market enthusiasts. But as any seasoned trader will tell you, staying informed is the cornerstone of success. Enter the Forex Factory News Calendar, a tool that promises to keep traders abreast of market-moving events.

Understanding the Fx Factory News Calendar

The Forex Factory News Calendar isn’t just another economic calendar. At first glance, the organized layout and the detailed structure make it clear that this is designed for traders by traders. Comprehensive in its coverage, it ensures users are aware of events that could shake the forex market.

Features range from detailed explanations of news events to historical data on how currencies responded in the past. And if a one-size-fits-all approach doesn’t work for you, the customization options allow tailoring the calendar to one’s specific trading interests.

Utilizing the Fx Factory News Calendar Effectively

1. Comprehensive Event Overviews

Begin by familiarizing yourself with the events listed on the Forex Factory News Calendar. Each event comes with a brief description, offering insights into what the event is and why it might be relevant to forex traders. Knowing this helps traders anticipate potential market movements, giving them an edge in their trading strategies.

2. Customization is Key

The Forex Factory News Calendar offers a wide array of customization options. Traders can filter events based on their impact, country, and even the currency they’re interested in. By tailoring the calendar to their specific needs, traders can ensure they only see the news that’s relevant to their trading strategy, minimizing distractions.

3. Setting Up Alerts

Timeliness can often make the difference between a profitable trade and a missed opportunity. By setting up alerts on the Forex Factory News Calendar, traders ensure they are instantly notified of key events, giving them ample time to adjust their strategies.

4. Analyzing Historical Data

One of the standout features of the Forex Factory News Calendar is its rich archive of historical data. By looking back at how specific events impacted the market in the past, traders can make informed predictions about potential future movements. This retrospective analysis can be pivotal in refining trading strategies.

5. Pairing with Technical Analysis

While the Forex Factory News Calendar offers a wealth of fundamental data, it’s crucial to pair this with technical analysis for a holistic trading approach. By combining insights from the calendar with technical indicators, traders can corroborate their findings and trade with increased confidence.

6. Joining the Community Discussions

The Forex Factory News Calendar isn’t just about events and data. It’s part of a larger community where traders from around the world discuss market movements and predictions. Engaging in these discussions allows traders to gain diverse perspectives, enriching their understanding and interpretation of the data presented in the calendar.

7. Regularly Update Preferences

The world of forex is ever-evolving, and so should a trader’s strategy. Regularly updating preferences on the Fx Factory News Calendar, be it because of a change in trading pairs or a shift in strategy focus, ensures the tool remains a relevant and effective ally.

Technical Aspects of Fx Factory News Calendar

The Fx Factory News Calendar is not just another economic calendar on the market. It’s designed with intricate details, engineered to cater to the precise needs of forex traders. Here, we will delve deep into the technical nuances that make this tool an indispensable asset for traders worldwide.

1. User-Friendly Interface

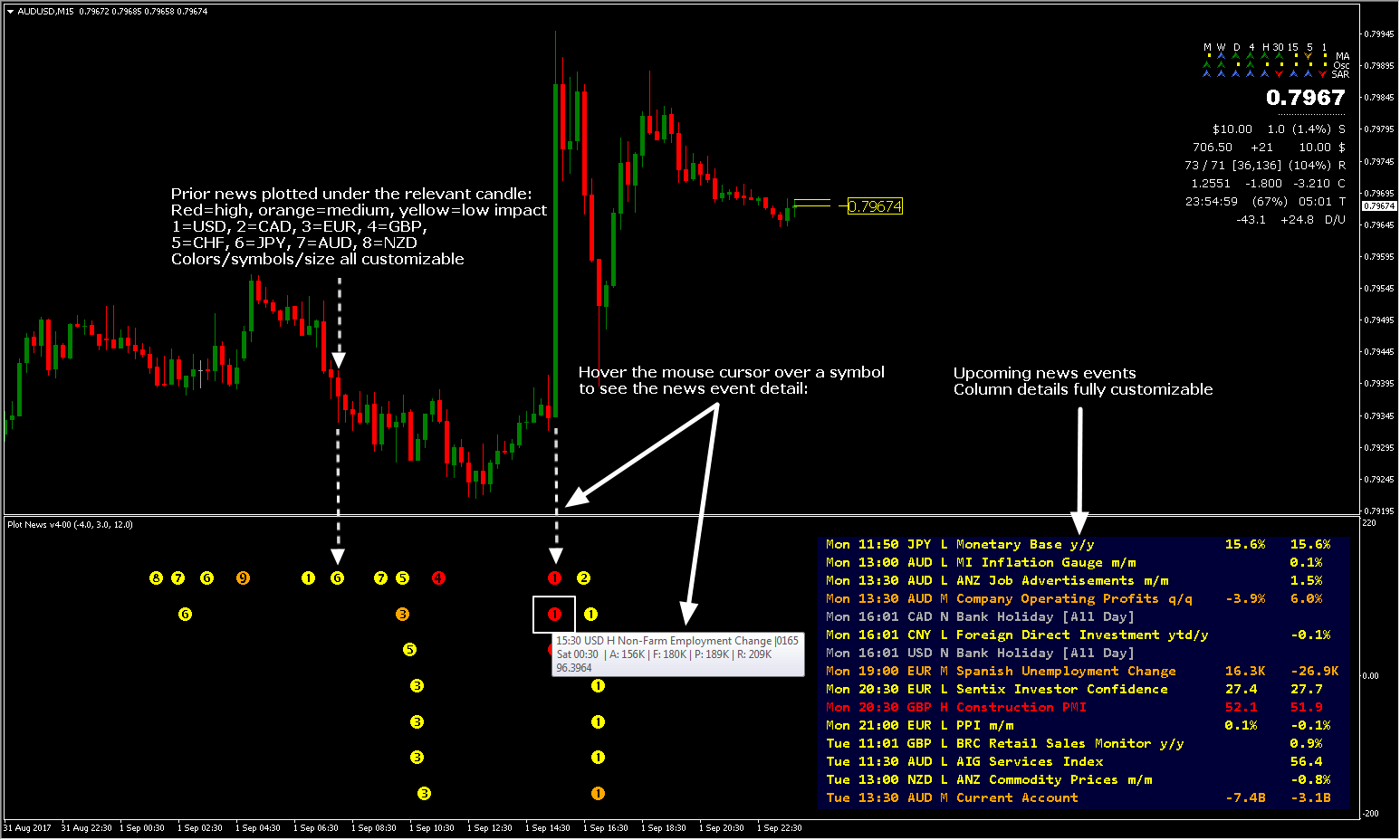

The Forex Factory News Calendar stands out due to its intuitive interface. For traders, time is money, and the calendar’s design ensures that users can access information seamlessly, with filters allowing quick navigation to specific data points. The color-coded system is more than just visually appealing; it offers at-a-glance insights into the potential market impact of different news events.

2. Comprehensive Economic Indicators

At the heart of the Fx Factory News Calendar is its vast array of economic indicators. These indicators are vital, providing insights into the economic health of nations. The calendar lists everything from Gross Domestic Product (GDP) data to employment numbers, each accompanied by a detailed explanation. This ensures that traders understand not just the ‘what’ but also the ‘why’ behind market movements.

3. Historical Data Insights

One of the standout technical features of the Forex Factory News Calendar is its rich archive of historical data. This allows traders to analyze how particular news events have influenced currency pairs in the past. By comparing current situations with historical trends, traders can make more informed predictions on potential market movements.

4. Real-time Data Updates

In the fast-paced world of forex trading, real-time data is paramount. The Forex Factory News Calendar guarantees up-to-the-minute updates. Whether it’s a surprise interest rate change or an unexpected geopolitical event, traders receive timely notifications, ensuring they’re never caught off-guard.

5. Customization and Integration

A noteworthy technical aspect of the Forex Factory News Calendar is the ability to customize it to fit individual trading needs. Traders can set up personalized alerts, ensuring they’re notified about events relevant to their specific trading pairs or strategies. Additionally, the calendar’s API integrations mean it can be easily incorporated into a trader’s broader digital infrastructure, be it trading platforms or other analytical tools.

6. Impact Prediction Mechanism

The Fx Factory News Calendar doesn’t just list events; it goes a step further by predicting potential market impacts. Using sophisticated algorithms and taking into account historical trends, the calendar offers insights into how the forex market might react, helping traders refine their strategies.

Benefits of Using Forex News Calendar

In the dynamic realm of forex trading, having a tool that facilitates informed decision-making is crucial. The Forex Factory News Calendar serves as that quintessential tool, packing in several benefits that aid both novice and veteran traders in navigating the market currents with finesse. Let’s delve deeper to unearth the manifold benefits that the Forex Factory News Calendar brings to the table.

Timely Access to Vital Information

One of the standout benefits of the Forex Factory News Calendar is its provision of real-time, up-to-date information on various economic events and indicators that have the potential to influence the forex market. Traders can utilize this feature to stay a step ahead, making calculated moves that align with the most recent data. The calendar, renowned for its accuracy and timeliness, ensures that you are not left in the dark in the fast-paced forex market environment.

Enhancing Trading Decision Making

When it comes to making informed decisions, the Forex Factory News Calendar stands as a trader’s ally. The calendar presents a comprehensive view of market events, offering insights into potential market reactions based on historical data. This feature aids in crafting strategies that are not just reactive but also proactive, empowering traders to position themselves advantageously before a significant market movement occurs.

Aiding in Risk Management

Risk management is a cornerstone of successful forex trading, and here too, the Forex Factory News Calendar shines. By presenting a clear picture of expected market volatility associated with various events, it assists traders in implementing risk management strategies effectively. It could be setting stop-loss levels or adjusting leverage; the calendar serves as a guide, helping traders to shield themselves from unwanted market surprises.

Customization for Personalized Use

Another benefit of the Forex Factory News Calendar is the level of customization it offers. Traders can personalize the calendar to display information relevant to their trading interests, thereby avoiding unnecessary clutter and focusing on what truly matters. This personalized approach means that traders can streamline their strategies, focusing on specific currencies or economic indicators that align with their trading goals.

User-Friendly Interface

The Fx Factory News Calendar doesn’t just score on the information front but also offers a user-friendly interface that makes navigation a breeze. Whether you are a seasoned trader or just starting, the calendar’s intuitive design ensures that you can find the information you seek without hassle. This user-centric design translates to saved time and increased efficiency, attributes that are highly prized in the forex trading world.

Community and Networking Opportunities

Beyond just being a tool, the Forex Factory News Calendar is also a gateway to a community of like-minded individuals. Traders can exchange insights, discuss strategies, and share experiences, fostering a collaborative environment that can be a learning ground, especially for new traders. This community aspect amplifies the benefits of the calendar, making it more than just a tool but a hub for forex enthusiasts.

Integrating Forex Factory News Calendar with Other Tools

In the ever-evolving realm of forex trading, having access to timely and accurate information is paramount. While the Fx Factory News Calendar has established itself as a premier tool for tracking market-moving events, its real strength emerges when integrated with other trading tools. Here’s a deeper look into how this powerful synergy can be achieved.

1. Trading Platforms Integration

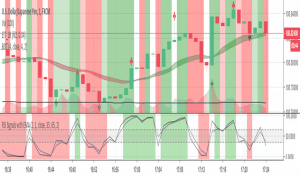

Most traders utilize platforms like MetaTrader 4, MetaTrader 5, or cTrader for executing trades. Integrating the Forex Factory News Calendar with these platforms ensures real-time news alerts and data are reflected directly on the trading interface. This seamless connectivity reduces the time lag between receiving an update and acting on it, providing traders with a competitive edge.

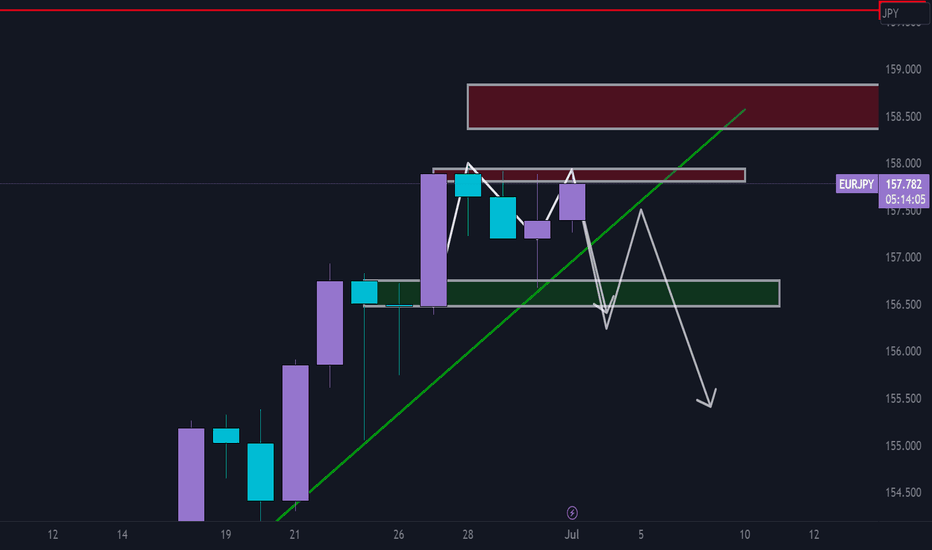

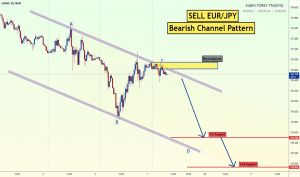

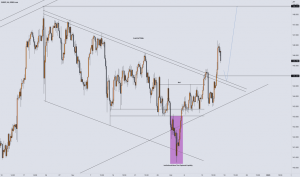

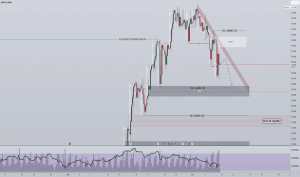

2. Analytical Tools

Tools like TradingView or Autochartist offer comprehensive charting solutions, allowing traders to visualize data and identify patterns. By syncing these tools with the Forex Factory News Calendar, traders can overlay economic events onto price charts. This helps in identifying correlations between market events and price movements, giving depth to analytical insights.

3. Risk Management Software

Risk management is pivotal in forex trading. Software solutions that help traders assess and manage their risks can be enhanced by integrating them with the Forex Factory News Calendar. By doing so, traders can factor in upcoming economic events when determining position sizes, stop-loss points, and take-profit levels.

4. Algorithmic and Automated Trading Systems

For traders employing automated trading strategies, the Forex Factory News Calendar can provide a crucial data feed. By incorporating economic news events into algorithm parameters, these systems can adjust their trading strategies in real-time based on the latest news, ensuring trades are always in line with the current market sentiment.

5. Portfolio Management Software

For those managing multiple accounts or diversified portfolios, integrating with the Forex Factory News Calendar can offer holistic insights. Portfolio management software can factor in economic events to provide a more comprehensive view of potential market movements, aiding in better asset allocation and hedging strategies.

6. Custom Alerts and Notification Systems

While the Fx Factory News Calendar offers its own alert system, integrating it with custom notification tools can personalize the experience further. Traders can receive alerts on multiple devices, customize the type of news they’re alerted to, and even integrate with platforms like Slack or Telegram for team-based trading strategies.

Tips for New Users

1. Familiarize Yourself with the Interface

Before diving deep, take time to explore the various facets of the Forex Factory News Calendar. Understanding the layout and where to find the different kinds of information can save you a considerable amount of time in the long run. Familiarize yourself with the filters, settings, and various categories that can be customized according to your preferences.

2. Understand the Significance of Economic Indicators

The Fx Factory News Calendar provides a detailed analysis of numerous economic indicators that significantly impact the forex market. Spend time understanding what these indicators mean and how to interpret them to make informed decisions. The calendar offers concise explanations, making it easier for new users to grasp the intricacies involved.

3. Utilize the Alert Feature Wisely

One of the standout features of the Forex Factory News Calendar is its alert system. This feature helps you stay ahead, notifying you of critical market-moving events. Set up alerts for the events you are interested in, and stay prepared to make swift trading decisions based on real-time data.

4. Integrate with Other Analytical Tools

Though the Forex Factory News Calendar is a comprehensive tool, it works best when integrated with other analytical tools. Combining it with technical analysis and charting tools can provide you with a well-rounded view of the market trends, assisting in making informed trading decisions.

5. Join Online Communities

Beyond just using the Forex Factory News Calendar as a standalone tool, consider joining online communities where other traders share insights and strategies centered around the data from the calendar. Engaging with a community can provide new perspectives and trading ideas you might not have considered.

6. Continuous Learning and Adaptation

The forex market is dynamic, and as a new user, continuous learning should be your motto. The Forex Factory News Calendar can be a great learning platform, offering insights into how economic events influence market movements. Be open to adapting your strategies based on the knowledge acquired from using the calendar over time.

7. Avoid Information Overload

While the Forex Factory News Calendar is a repository of valuable data, avoid the pitfall of information overload. As a new user, you might be tempted to track every event and news update. Focus on the events that have a direct impact on your trading strategy to prevent burnout and make more targeted decisions.

The Broader Impact of Factory News Calendar

Facilitating Discourse in Trading Communities

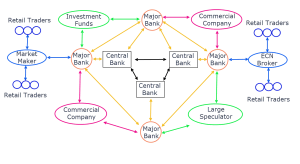

Trading communities, whether found on social platforms or dedicated forums, have become bustling hubs of discussion, where traders of all levels come together to discuss strategies and market movements. The Forex Factory News Calendar, being a rich source of economic indicators and events, serves as a springboard for many of these discussions. Traders reference the calendar to explain market fluctuations and to hypothesize future market movements, fostering a community of informed and collaborative traders.

Guiding Financial Analysis and Reporting

In the financial sector, analysis and reporting constitute significant components. Analysts rely heavily on tools like the Forex Factory News Calendar to develop insights and forecasts. The calendar, with its detailed compilation of past, present, and anticipated market events, acts as a reliable base for analysts to craft comprehensive reports that can guide investors and stakeholders in making informed decisions.

Driving Educational Initiatives

The Fx Factory News Calendar is not just a tool for seasoned traders but has also found a place in the educational sector. Numerous educational platforms incorporate insights and data from the calendar in their curriculum, aiding budding traders to understand market nuances better. By dissecting real-time data and events from the calendar, learners can grasp complex forex concepts in a much more hands-on manner, thus nurturing a new generation of well-informed traders.

Influencing Policy Making and Regulatory Oversight

At a broader level, the Forex Factory News Calendar even touches upon policy-making and regulatory oversight spheres. Authorities and financial institutions might use the detailed insights from the calendar to understand market trends better and to foresee potential economic shifts. This, in turn, can influence policy decisions, with efforts being aligned to stabilize markets or foster growth, underscoring the calendar’s role in shaping a stable and responsive financial landscape.

Enhancing Global Connectivity

The forex market is inherently global, with traders from different parts of the world participating in this financial melee. The Forex Factory News Calendar, with its global economic indicators and events, fosters a sense of global connectivity. Traders across borders can align their strategies based on global events, thus fostering a market that is more synchronized and interconnected, transcending geographical boundaries.

Pros and Cons of Using Forex Factory News Calendar

Like any tool, the Forex Factory News Calendar has its set of advantages and potential drawbacks. The breadth of information, user-friendly interface, and customization options make it a favorite. However, some might find the sheer volume of data overwhelming. When compared to other news calendars, it stands out for its depth, but users must be prepared to invest time to reap the full benefits.

Conclusion

The Forex Factory News Calendar has solidified its position as an indispensable tool in the arsenal of forex traders worldwide. Its comprehensive nature, combined with its user-friendly interface, ensures that traders, whether seasoned or newbies, can navigate the tumultuous waters of forex trading with informed precision.