Introduction

OctaFX Copy Trading is a revolutionary platform that allows traders of all levels to benefit from the expertise of successful traders. With the power of automated copy trading, investors can replicate the strategies of top traders and potentially achieve similar results. In this comprehensive guide, we will explore the benefits, strategies, risk management techniques, and tips for successful OctaFX Copy Trading.

Benefits of OctaFX Copy Trading

OctaFX Copy Trading offers a wide range of benefits for traders, enabling them to enhance their trading experience and potentially improve their investment outcomes. Let’s explore some key advantages in detail:

1. Access to Expertise: One of the primary benefits of OctaFX Copy Trading is the ability to access the expertise of successful traders. With this platform, even inexperienced traders can benefit from the knowledge and skills of seasoned professionals. By selecting and copying the trades of expert traders, individuals can leverage their strategies and insights to potentially achieve better trading results.

2. Diversification of Trading Portfolio: OctaFX Copy Trading allows traders to diversify their trading portfolios effectively. Rather than relying solely on their own trading decisions, individuals can allocate a portion of their funds to copy multiple expert traders. This diversification helps spread the risk and reduces dependence on a single trading strategy or market condition. By copying traders with different approaches and asset focuses, investors can create a more balanced and resilient portfolio.

3. Time-Saving and Convenience: Copy Trading through OctaFX saves traders significant time and effort. Instead of conducting in-depth market analysis, monitoring charts, and executing trades manually, individuals can automate the process by copying the trades of expert traders. This frees up time for traders to focus on other aspects of their lives or pursue additional trading opportunities.

4. Learning Opportunity: OctaFX Copy Trading offers an excellent learning opportunity, particularly for novice traders. By observing the trades and strategies of successful traders, individuals can gain valuable insights into the dynamics of the financial markets. They can learn about different trading styles, risk management techniques, and market trends. Over time, this exposure to expert traders can help traders enhance their own trading skills and knowledge.

5. Flexibility and Control: OctaFX Copy Trading provides traders with flexibility and control over their investment decisions. Traders can choose the expert traders they want to copy based on their performance, trading style, and risk tolerance. Additionally, traders have the freedom to adjust their allocations to different expert traders or even stop copying them altogether if their performance or strategy no longer aligns with their goals. This level of control allows traders to tailor their copy trading activities to their specific preferences and changing market conditions.

6. Transparency and Performance Monitoring: OctaFX Copy Trading ensures transparency in the trading process. Traders have access to comprehensive performance data, including historical performance, risk metrics, and trading statistics of expert traders. This transparency empowers traders to make informed decisions when selecting the traders to copy. Additionally, traders can continuously monitor the performance of the expert traders they are copying, allowing them to assess the success of their copy trading strategy and make necessary adjustments if required.

7. Lower Barrier to Entry: OctaFX Copy Trading lowers the barrier to entry for individuals who want to participate in the financial markets. It provides an opportunity for those with limited trading experience or knowledge to still benefit from the potential profitability of trading. By leveraging the expertise of experienced traders, even beginners can enter the trading world with confidence and increase their chances of success.

8. Emotional Discipline: Emotions can often hinder traders’ decision-making processes, leading to impulsive or irrational actions. OctaFX Copy Trading helps overcome this challenge by removing the emotional component from trading. Instead of making emotionally driven decisions, traders can rely on the proven strategies and disciplined approaches of expert traders. This can result in more consistent and objective trading outcomes.

Getting Started with OctaFX Copy Trading

OctaFX Copy Trading provides a seamless and user-friendly platform for traders to tap into the expertise of seasoned professionals and replicate their trading strategies. If you’re new to OctaFX Copy Trading or considering joining this innovative community, this guide will walk you through the essential steps to get started and make the most of your copy trading experience.

1. Create Your OctaFX Account The first step to embarking on your OctaFX Copy Trading journey is to create an account on the OctaFX platform. Visit the OctaFX website and click on the “Sign Up” or “Create Account” button. Fill in the required information, such as your name, email address, and password. Make sure to choose a strong password to protect your account. Once you’ve provided all the necessary details, click on “Create Account” to proceed.

2. Complete the Verification Process After creating your account, you’ll need to complete the verification process to ensure the security and integrity of your trading activities. OctaFX follows strict regulatory guidelines and requires customers to verify their identity. Typically, this involves providing a copy of your identification document (such as a passport or driver’s license) and proof of address (such as a utility bill or bank statement). Follow the instructions provided by OctaFX to submit the required documents for verification.

3. Fund Your Account To start copy trading on OctaFX, you need to deposit funds into your trading account. Log in to your OctaFX account and navigate to the “Deposit” section. Choose your preferred payment method, such as bank transfer, credit/debit card, or electronic wallets. Enter the desired deposit amount and follow the instructions to complete the transaction. Ensure that you deposit an amount that aligns with your risk tolerance and trading goals.

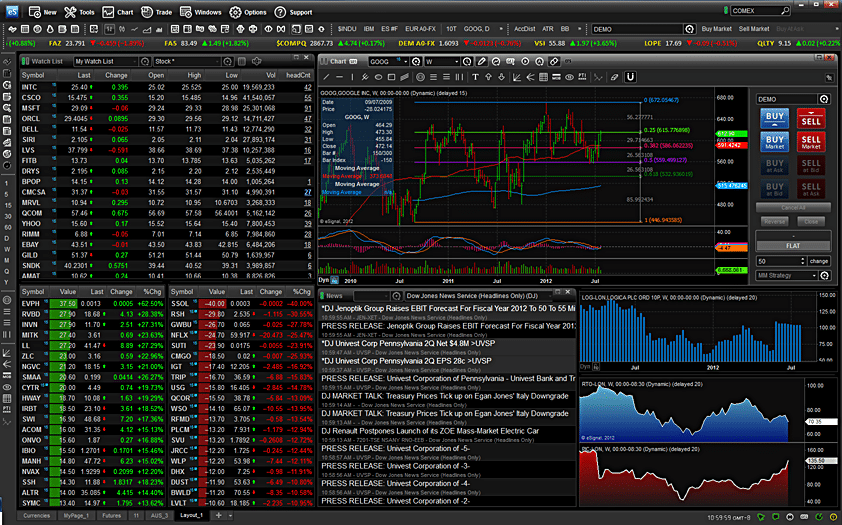

4. Explore the OctaFX Copy Trading Platform Once your account is funded, it’s time to explore the OctaFX Copy Trading platform. Access the platform by logging in to your OctaFX account and navigating to the “Copy Trading” or “Social Trading” section. Here, you’ll find a wide range of expert traders to choose from, each with their own unique trading strategies and performance metrics.

5. Find Expert Traders to Copy OctaFX provides comprehensive profiles of expert traders, allowing you to evaluate their performance and select the ones that best suit your investment objectives. Use the search filters to narrow down your options based on factors such as profitability, risk level, trading style, and preferred asset classes. Review the performance metrics, including historical returns, drawdowns, and risk-adjusted measures, to make informed decisions.

6. Assessing Trading Strategies and Risk Levels As you browse through expert traders’ profiles, pay close attention to their trading strategies and risk management techniques. Consider whether their approach aligns with your trading preferences and risk tolerance. Some traders may focus on short-term scalping strategies, while others may adopt long-term trend-following techniques. Evaluate their risk levels and assess whether they are compatible with your risk appetite.

7. Allocate Funds to Expert Traders Once you’ve selected the expert traders you wish to copy, it’s time to allocate funds to their trading strategies. Determine the amount of capital you are comfortable allocating to each trader, considering factors such as their historical performance, risk levels, and your overall portfolio diversification strategy. Allocate your funds accordingly to distribute your risk and maximize potential returns.

8. Set Risk Management Parameters Risk management is a crucial aspect of successful copy trading. OctaFX provides various risk management tools and features to help you control your exposure. Set parameters such as maximum trade size, maximum drawdown limit, and stop-loss levels to ensure that your copy trading activities are aligned with your risk tolerance. Regularly review and adjust these parameters as needed.

9. Monitor and Evaluate Performance Once your funds are allocated and the copy trading is active, it’s important to regularly monitor and evaluate the performance of the expert traders you are copying. OctaFX provides comprehensive performance data, including real-time updates on trades, equity curves, and returns. Keep track of the performance metrics of your portfolio and assess whether adjustments or reallocations are necessary.

10. Engage with the Copy Trading Community OctaFX Copy Trading fosters an active community of traders where you can interact, share insights, and learn from others. Engaging with fellow copy traders and expert traders can provide valuable knowledge and support. Participate in discussions, forums, and social media groups to exchange ideas, gain new perspectives, and enhance your copy trading experience.

Understanding Copy Trading Strategies

Copy trading has gained significant popularity in the financial markets, and OctaFX Copy Trading offers a unique opportunity to leverage the expertise of successful traders. To make the most of this platform, it is crucial to understand the various copy trading strategies available. In this section, we will explore some popular strategies and how they can be applied through OctaFX Copy Trading.

1. Trend Following Strategy

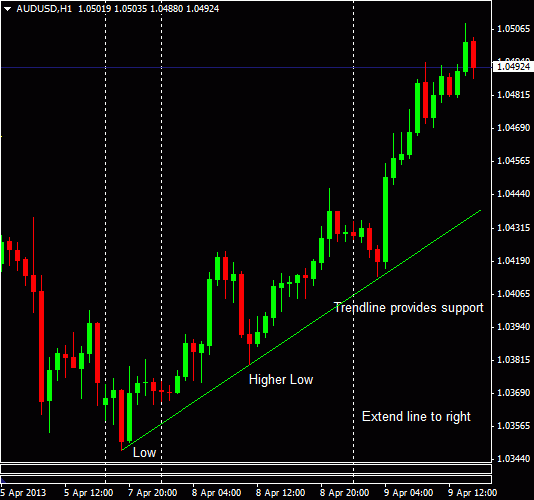

The trend following strategy is based on the belief that assets tend to continue moving in the same direction over a certain period. Traders following this strategy analyze historical price patterns and identify trends to determine the best entry and exit points for their trades.

When implementing the trend following strategy through OctaFX Copy Trading, investors can search for expert traders who have a proven track record of successfully identifying and trading in line with market trends. By copying these traders, individuals can capitalize on sustained price movements and potentially achieve profitable outcomes.

2. Breakout Strategy

The breakout strategy focuses on capturing significant price movements that occur when an asset’s price breaks through a defined support or resistance level. Traders utilizing this strategy aim to identify key levels where price volatility is likely to increase and initiate trades accordingly.

OctaFX Copy Trading enables individuals to discover expert traders who specialize in breakout trading. By copying their trades, investors can benefit from their ability to identify breakout opportunities and effectively manage risk. This strategy can be particularly useful during periods of market volatility or when assets are consolidating within specific price ranges.

3. Mean Reversion Strategy

The mean reversion strategy is based on the concept that prices tend to revert to their average or equilibrium levels after deviating from them. Traders utilizing this strategy identify assets that have experienced significant price movements and anticipate that they will eventually return to their average values.

OctaFX Copy Trading provides opportunities to copy expert traders who employ mean reversion strategies. These traders focus on identifying overbought or oversold assets and take positions that anticipate a price correction. By following these traders, individuals can benefit from their expertise in timing their trades and capitalizing on price reversals.

4. Event-Driven Strategy

The event-driven strategy involves analyzing and trading based on significant market events such as economic announcements, earnings reports, or geopolitical developments. Traders employing this strategy aim to anticipate the impact of these events on asset prices and take positions accordingly.

Through OctaFX Copy Trading, individuals can find expert traders who excel in event-driven trading. These traders closely monitor economic calendars, news releases, and other market catalysts to identify potential trading opportunities. By copying their trades, investors can benefit from their ability to analyze and react quickly to market events.

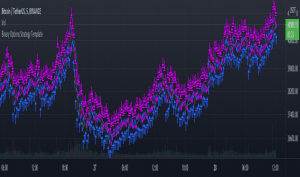

5. Portfolio Diversification Strategy

Diversifying one’s portfolio is a key principle in successful investing, and it can also be applied to copy trading. The portfolio diversification strategy involves allocating funds to multiple expert traders with different trading styles, asset classes, or geographical focuses.

OctaFX Copy Trading allows individuals to build a diversified portfolio by copying multiple expert traders who specialize in different strategies. By spreading their investments across various traders, investors can reduce the dependency on a single trader’s performance and potentially achieve a more stable and balanced portfolio.

6. Risk-Adjusted Returns Strategy

Risk-adjusted returns are a vital consideration in copy trading. Some expert traders may achieve high returns, but they might also take on significant risks. The risk-adjusted returns strategy involves assessing a trader’s performance not only based on returns but also by considering the level of risk undertaken to achieve those returns.

When utilizing OctaFX Copy Trading, individuals can evaluate expert traders based on risk-adjusted metrics such as drawdowns, volatility, and risk management techniques. It is essential to select traders who have a track record of achieving consistent returns while effectively managing risks. This approach can help investors achieve a balance between returns and risk tolerance.

Managing Risk in OctaFX Copy Trading

As with any investment activity, risk management is crucial in OctaFX Copy Trading. Here are some essential risk management strategies to consider:

1. Setting Appropriate Allocation Carefully determine the amount of capital you are willing to allocate for copy trading. It is advisable to diversify your portfolio by distributing your investment across different expert traders to minimize risk exposure.

2. Monitoring Performance and Adjusting Allocations Regularly monitor the performance of the expert traders you are copying. If their performance deteriorates or no longer aligns with your investment goals, consider reallocating your funds to other successful traders.

3. Diversifying the Portfolio Copying multiple expert traders with different trading strategies and asset classes helps spread the risk and reduce dependency on a single trader’s performance. Diversification ensures that potential losses from one trader can be offset by gains from others.

Leveraging the Social Trading Community

OctaFX Copy Trading fosters a vibrant social trading community where traders can interact, share insights, and learn from each other. Engaging with fellow copy traders and experts offers several benefits:

1. Knowledge Exchange Interacting with other traders allows you to exchange ideas, strategies, and market insights. Engaging in discussions and forums can enhance your understanding of different trading approaches and improve your overall trading knowledge.

2. Learning from Successful Traders Observing the trades and strategies of successful traders can provide invaluable learning opportunities. By following their activities closely, you can gain insights into their decision-making processes, risk management techniques, and overall trading approach.

3. Staying Updated with Market Trends Being an active member of the social trading community keeps you informed about the latest market trends, news, and events. This knowledge can help you make more informed trading decisions and adapt to changing market conditions.

Tracking and Evaluating Performance

Monitoring the performance of copied trades is essential for evaluating the success of your copy trading strategy. Consider the following aspects when assessing performance:

1. Analyzing Returns and Drawdowns Evaluate the profitability of the copied trades by analyzing the overall returns. Additionally, consider the drawdowns, which measure the peak-to-trough decline in the equity curve. Balancing returns and drawdowns is crucial for assessing risk-adjusted performance.

2. Making Informed Decisions Based on performance data, identify patterns and trends to make informed decisions. If necessary, adjust your copy trading strategy by reallocating funds or diversifying across different expert traders.

Overcoming Challenges in Copy Trading

While OctaFX Copy Trading offers numerous benefits, it’s important to acknowledge and address potential challenges:

1. Trader Inconsistency Expert traders’ performance can vary over time due to market conditions or changes in their trading strategies. It is essential to regularly review and assess the performance of the traders you are copying to ensure their consistency aligns with your investment goals.

2. Managing Psychological Factors Copy trading can evoke emotions similar to traditional trading, such as fear or greed. It’s important to remain disciplined and rational, adhering to your predefined risk management parameters and not being swayed by short-term market fluctuations.

3. Adapting to Market Volatility Market volatility is a natural part of trading. It’s crucial to understand that even successful traders may experience periods of drawdown or underperformance. Stay focused on long-term goals and avoid making impulsive decisions based on short-term fluctuations.

Tips for Successful OctaFX Copy Trading

Follow these tips to maximize your success with OctaFX Copy Trading:

1. Thorough Research on Expert Traders Before selecting expert traders to copy, conduct comprehensive research on their performance history, trading strategies, and risk management techniques. Choose traders with consistent performance and aligning trading styles.

2. Realistic Expectations and Long-Term Goals Set realistic expectations for your copy trading activities. Remember that copy trading is a long-term investment strategy and requires patience and discipline. Focus on steady growth rather than short-term gains.

3. Continuous Monitoring and Evaluation Regularly monitor the performance of the expert traders you are copying. Evaluate their results, adjust allocations if necessary, and stay updated with market trends. Active monitoring ensures that your copy trading strategy remains effective.

Conclusion

OctaFX Copy Trading is an innovative platform that empowers traders to benefit from the expertise of successful traders. By leveraging the power of automated copy trading, individuals can enhance their trading efficiency, diversify their portfolios, and learn from experienced professionals. Remember to implement effective risk management strategies, stay informed about market trends, and actively monitor the performance of expert traders. With careful selection, diligent monitoring, and a long-term approach, OctaFX Copy Trading can unlock opportunities for traders of all levels of experience.