Introduction

The world of trading is replete with myriad strategies, and one that stands out for its efficacy and popularity is momentum trading. It essentially hinges on the axiom of buying assets that have showcased a good performance trajectory and unloading those that haven’t. To assess the viability of such strategies, backtesting becomes indispensable. Enter Python – a tool that makes this evaluation seamless. This article delves into how to backtest momentum strategy Python.

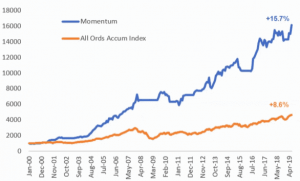

Understanding Momentum Trading

Momentum trading rides on the wave of an asset’s recent performance to predict its future. It’s akin to pushing an already moving swing to make it go higher. In financial terms, the logic is simple: buy what’s performing well and sell the laggards. But how does one gauge if this approach holds water? That’s where the magic of backtesting enters.

Why Python is a Preferred Tool for Backtesting

Python has steadily emerged as the darling of the financial world. Its versatility in managing financial datasets, combined with an extensive library system like Pandas and NumPy, makes it a front-runner. For those aiming to backtest momentum strategy Python, the language offers clarity, speed, and efficiency.

Setting the Stage for Backtesting in Python

The Allure of Python in the World of Backtesting

Python, with its user-friendly syntax and a rich library ecosystem, has cemented itself as the go-to tool for financial analysis and strategy development. Its adaptability allows both novice and expert traders to backtest momentum strategy using Python with relative ease. But, like any performance, the success lies in the preparation. So, how does one set the stage?

1. Choosing the Right Environment:

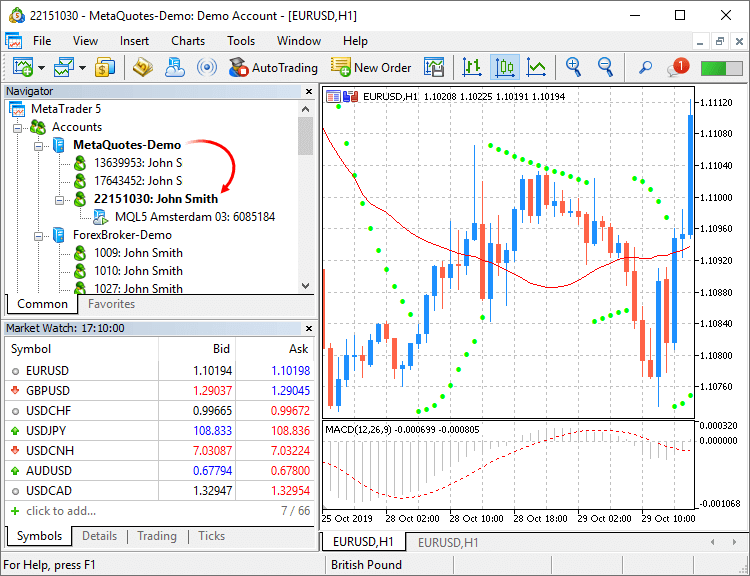

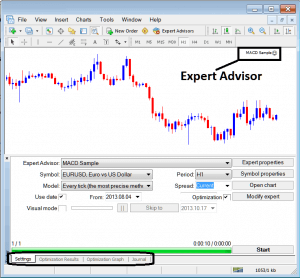

The first step in any Python project is to choose the right development environment. For backtesting purposes, Jupyter Notebook or any Integrated Development Environment (IDE) like PyCharm can be a good starting point. The interactive nature of Jupyter, for example, allows traders to visualize data and results on-the-fly, crucial when you backtest momentum strategy Python.

2. Harnessing Python’s Library Ecosystem:

The real power of Python in backtesting lies in its libraries. Libraries like Pandas for data manipulation, NumPy for numerical operations, and Matplotlib for visualization are essential. These tools not only streamline the backtesting process but also provide robust capabilities to dissect and analyze the data.

3. Data Sourcing and Preprocessing:

At the heart of any backtest momentum strategy Python is data. This data, which includes past prices, trading volumes, and other relevant metrics, should be accurate and comprehensive. Once sourced, data preprocessing becomes paramount. This involves cleaning the data (removing any errors or outliers), normalizing it (to ensure consistency), and then segmenting it into training and testing sets.

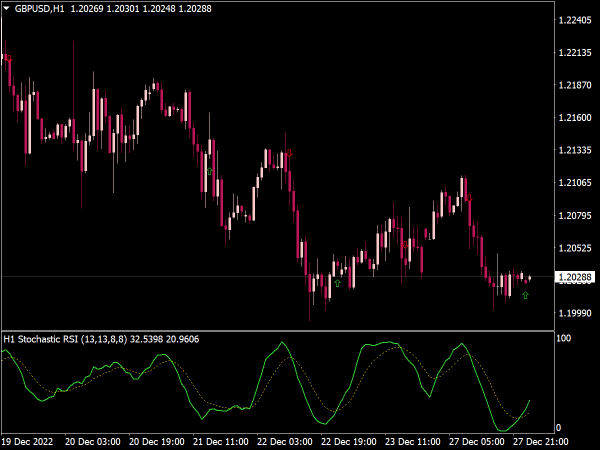

4. Strategy Definition:

Before you dive into the actual backtesting, it’s essential to have a clear momentum strategy in place. Whether it’s a simple moving average crossover or a more intricate RSI-based approach, defining the logic and rules clearly is crucial. This definition will form the basis when you backtest momentum strategy Python.

5. Modular Approach:

One of the many beauties of Python is its ability to allow modular programming. When setting up for backtesting, it’s wise to break down the process into modules – data retrieval, strategy application, performance metrics calculation, etc. This not only streamlines the process but also makes troubleshooting easier.

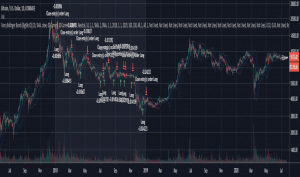

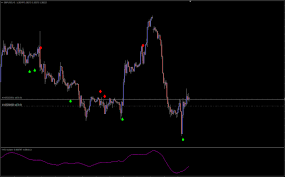

Building a Simple Momentum Strategy in Python

Crafting a momentum strategy in Python involves two components: understanding the trading logic and transcribing that logic into code. The fundamental principle is selecting assets rooted in past performance. With Python, this task becomes intuitive. By leveraging its robust syntax and libraries, one can quickly draft a script that evaluates an asset’s past performance, making decisions based on predefined criteria.

Backtesting Basics

To backtest momentum strategy Python means to put your trading strategy to the test against historical data. This retrospective analysis is crucial to understand potential profit points, possible pitfalls, and, most importantly, the viability of the strategy. Essential components include ensuring data integrity, making realistic assumptions, and ensuring risk is quantified and managed.

Implementation of Backtesting for the Momentum Strategy

Momentum trading strategies have gained immense popularity amongst traders, primarily due to their straightforward approach and potential profitability. But how can one ensure the strategy’s effectiveness in the real world? The answer lies in backtesting. With Python’s computational capabilities and a rich ecosystem of financial libraries, it’s never been easier to backtest momentum strategy and refine it to perfection. Let’s delve deeper into how Python can be utilized for this crucial task.

Why Backtesting is Crucial

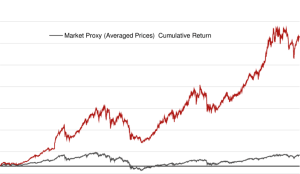

Before diving into the implementation, it’s essential to understand the significance of backtesting. It’s the practice of testing a trading strategy against historical data, essentially letting traders see how their strategy would have performed in the past. By choosing to backtest momentum strategy using Python, traders can get invaluable insights into potential pitfalls, profit points, and areas of improvement for their strategy.

Preparation Steps

The first step to backtest momentum strategy Python is ensuring that you have the right data. This data should be clean, comprehensive, and relevant to the assets you’re focusing on. The next step involves setting up the Python environment. With the vast array of Python libraries available, tools like Pandas and NumPy become indispensable for handling and analyzing financial data.

Crafting the Momentum Strategy in Python

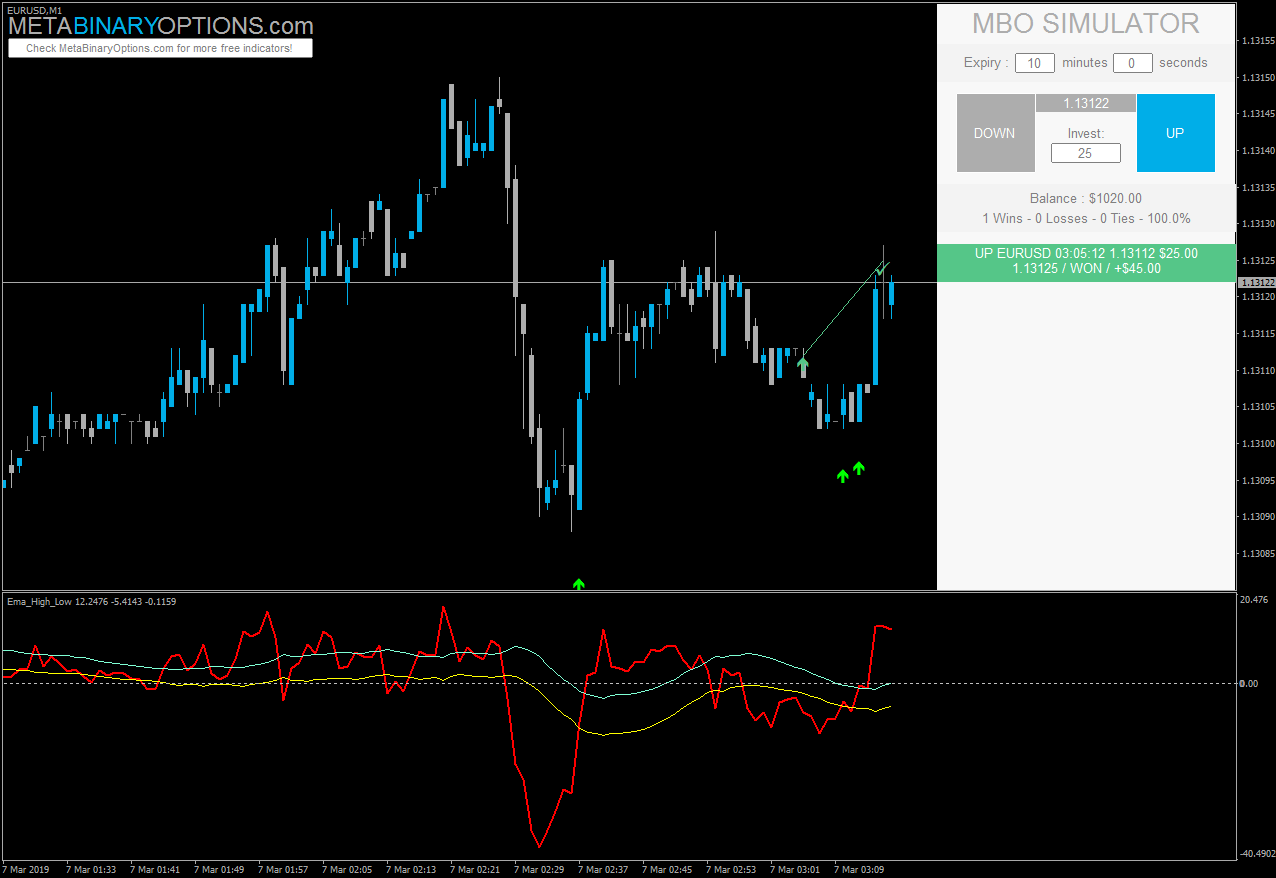

The heart of the process is crafting the momentum strategy. While the specifics can vary based on individual preferences, a simple approach might involve buying assets that have showcased a specific percentage increase over a defined period. Using Python, this logic can be transcribed into code efficiently, setting the stage for the backtest.

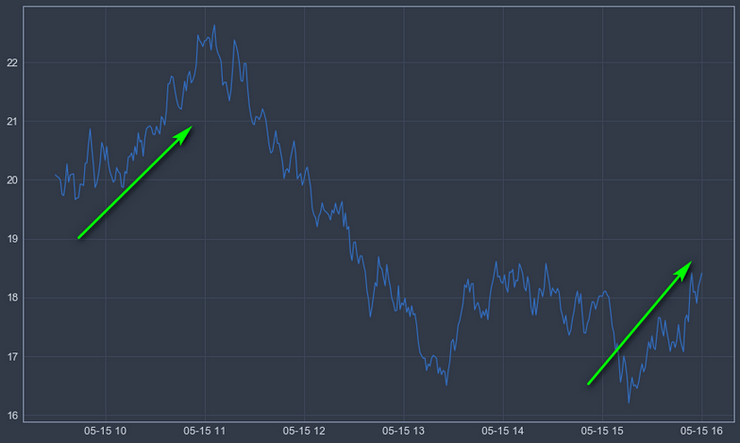

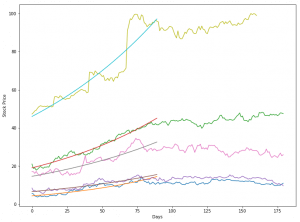

Running the Backtest

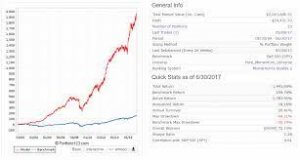

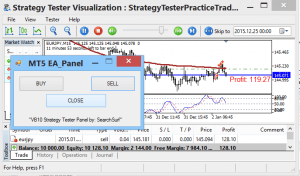

Once your momentum strategy is coded, it’s time to put it to the test. Using Python, historical data is divided into training and testing sets. The training set allows the strategy to be “taught” using past data. The backtest momentum strategy Python then evaluates how this strategy would have performed during this historical period. Performance metrics, like profit and loss ratios, provide a clear picture of the strategy’s effectiveness.

Fine-Tuning Based on Results

One of the benefits of choosing to backtest momentum strategy Python is the ease with which the strategy can be refined. Python’s computational prowess allows traders to quickly adjust their strategy based on backtesting results. This iterative process ensures the strategy remains relevant and effective amidst ever-changing market dynamics.

Incorporating Advanced Python Libraries

For traders keen on a more in-depth analysis, Python offers advanced libraries tailored for backtesting. Libraries like Backtrader and Zipline offer more sophisticated features for those looking to backtest momentum strategy Python at a granular level.

Potential Pitfalls in Backtesting and How to Avoid Them

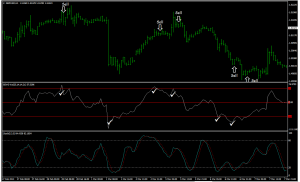

1. Overfitting: The Mirage of Perfection

Overfitting happens when a strategy performs exceptionally well on historical data but falters in real-time trading scenarios. This usually occurs when one customizes their strategy too closely to past data, making it too rigid to adapt to new market conditions. Solution: When you backtest momentum strategy Python, ensure you’re not making your model overly complex. Simpler models often perform better as they can adapt to various market scenarios. Also, consider out-of-sample testing, where you test the strategy on data it wasn’t trained on.

2. Look-ahead Bias: An Unintended Glimpse into the Future

Look-ahead bias creeps in when future data inadvertently influences the backtest, leading to deceptively optimistic results. Solution: While using Python to backtest momentum strategy, ensure strict data partitioning. This means keeping your training and testing datasets separate and ensuring the training data doesn’t have any hint of future data points.

3. Survivorship Bias: Ignoring the Fallen

Survivorship bias occurs when backtesting only considers assets that have ‘survived’ or are currently active, ignoring those that might have been delisted or bankrupted in the past. This can give a skewed perception of success. Solution: To accurately backtest momentum strategy Python, always ensure you’re using a dataset that includes all assets, not just the survivors. This offers a fuller, more realistic view of potential risks and rewards.

4. Ignoring External Market Shocks: The Unpredictable Element

Major geopolitical events, regulatory changes, or even global pandemics can create abrupt market fluctuations. If your backtesting doesn’t account for these, it might show an inaccurate picture. Solution: It’s crucial to contextualize results when you backtest momentum strategy Python. Recognize periods in your historical data when major market events occurred and understand how these might influence your results.

5. Unrealistic Assumptions: The Perfect World Scenario

Often traders might ignore transaction costs, assume unlimited liquidity, or neglect the tax implications while backtesting, leading to overly optimistic projections. Solution: To ensure the most realistic results when you backtest momentum strategy Python, always factor in all costs, limitations, and potential external impacts on your trades.

6. Data Snooping: Subconscious Biases

This occurs when one inadvertently tweaks a strategy to cater to specific datasets, mainly because they’re aware of the dataset’s nuances. Solution: Regularly refresh and diversify datasets. When you backtest momentum strategy Python, employ various data sources to ensure your strategy isn’t being subconsciously tailored to one specific set of data.

Optimizing Momentum Strategies with Python

Why Optimization Matters

Momentum trading, at its core, involves riding the wave of existing market trends. However, no two market trends are identical, and a strategy that worked brilliantly in one scenario might falter in another. Therefore, continuous optimization ensures that a momentum strategy remains relevant, adaptive, and lucrative.

Python: The Game-Changer for Momentum Strategies

With its powerful libraries and unparalleled versatility, Python has become a cornerstone for traders worldwide. Whether you’re devising a new trading algorithm or looking to backtest momentum strategy Python, this language offers precision, speed, and adaptability.

Steps to Optimize Your Momentum Strategy using Python

- Data Gathering: Before you can optimize or backtest momentum strategy using Python, you need quality data. Python’s vast library ecosystem, including Pandas and Quandl, makes data acquisition and preprocessing exceptionally streamlined.

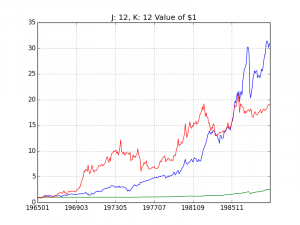

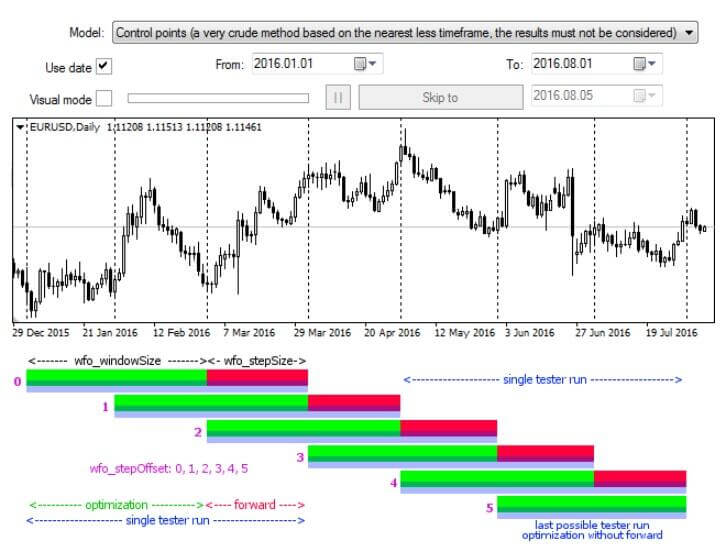

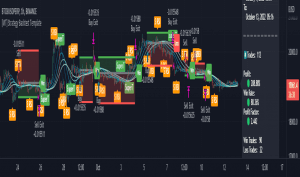

- Initial Backtesting: Using historical data, backtest your existing momentum strategy. Libraries like Backtrader or Zipline can facilitate this. Initial backtesting helps identify the strategy’s strengths and areas needing refinement.

- Parameter Tuning: Every strategy has certain parameters – thresholds, time frames, or indicators. Python allows for systematic parameter tweaking, making it easier to identify which combination offers the best results when you backtest momentum strategy Python.

- Risk Management Integration: No strategy optimization is complete without a robust risk management component. Python can help quantify risk, allowing traders to make informed decisions.

- Machine Learning Enhancement: For those with a penchant for advanced techniques, Python’s scikit-learn and TensorFlow libraries can integrate machine learning. This can further refine momentum strategies, making predictions more accurate.

- Iterative Backtesting: As you make changes, continually backtest momentum strategy Python. This iterative approach ensures that each optimization enhances the strategy’s performance.

Avoiding Over-Optimization

While Python offers robust tools for optimization, traders must be wary of over-optimization. A strategy that’s too finely tuned to past data might underperform in real-world scenarios. Thus, while it’s tempting to achieve perfect backtest results, ensuring a balance between optimization and real-world applicability is crucial.

The Broader Ecosystem: Python Libraries for Advanced Backtesting

Python has rapidly emerged as a linchpin in the financial world, especially when it comes to the realm of backtesting. As traders venture to backtest momentum strategy Python, they often find themselves at the crossroads of multiple libraries. Each of these tools offers unique functionalities that facilitate advanced backtesting processes. This article will unwrap the broader ecosystem of Python libraries designed for this purpose, providing a clearer path for traders looking to optimize their momentum strategies.

Why Backtesting is Crucial

Before diving deep, it’s vital to understand why backtesting holds such gravitas. For any trading strategy, especially momentum-based ones, historical data acts as a mirror to the past, reflecting potential future outcomes. When you backtest momentum strategy Python, you’re essentially gauging how a particular approach would have performed if applied in past market scenarios. This retrospection helps tweak, refine, and ultimately validate a strategy’s efficiency.

Python’s Unwavering Stance in Backtesting

Python’s ascendancy in backtesting is no fluke. Its simplicity, combined with computational power, makes it an ideal tool for traders. But the true strength lies in its vast library ecosystem. Whether you’re a novice aiming to backtest momentum strategy Python or a seasoned trader seeking advanced tools, Python’s ecosystem has something for everyone.

Backtrader: The All-Rounder

One of the most renowned libraries, Backtrader, is designed for both beginners and experts. Its intuitive design allows for quick strategy development, and its visualization capabilities make results interpretation a breeze. For those keen to backtest momentum strategy Python, Backtrader offers a mix of simplicity and depth.

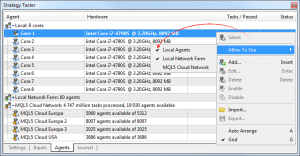

QuantConnect: Cloud-Powered Backtesting

QuantConnect is a paradigm shift from traditional backtesting libraries. Harnessing the power of the cloud, it offers lightning-fast backtesting speeds. Additionally, its collaborative platform allows traders worldwide to share and brainstorm strategies. If you’re looking to backtest momentum strategy using Python on a global scale, QuantConnect might just be your answer.

Zipline: The Professional’s Choice

Zipline is often the go-to for professional algorithmic traders. Powered by Python, it offers an exhaustive set of features for backtesting and algorithm development. With Zipline, traders can backtest momentum strategy Python with a granularity that’s hard to match. Its integration with platforms like Quantopian also provides traders with a rich database of strategies and research.

Conclusion

Backtesting is the compass that directs trading strategies, and Python is the navigator ensuring accuracy in this direction. For traders keen on harnessing the momentum strategy, it’s evident that to backtest momentum strategy Python is not just a recommendation but a requisite. In the capricious world of trading, this combination might just be the anchor traders have been seeking.