Introduction to the MT5 Backtesting Simulator

The MetaTrader 5 (MT5) platform is a popular trading platform used by millions of traders worldwide. It offers a range of advanced tools and features to support various trading strategies. One of the most important aspects of successful trading is the ability to analyze and test strategies using historical data. This process, known as backtesting, allows traders to determine the potential effectiveness of a trading strategy before risking real money. In this article, we will delve into the MT5 backtesting simulator, a powerful tool that enables traders to optimize their strategies with ease.

Getting Started with the MT5 Backtesting Simulator

To begin using the MT5 backtesting simulator, you’ll first need to download and install the MetaTrader 5 platform. You can download the platform from the official MetaQuotes website or your broker’s website, depending on your preferences. Once installed, create a demo account to access the backtesting features without risking real funds.

Selecting the Market and Trading Instrument

After setting up a demo account, choose the desired market and trading instrument you wish to backtest. MT5 supports a variety of markets, including forex, stocks, indices, and commodities. Simply navigate to the “Market Watch” window, find the instrument you want to backtest, and drag it onto a new chart.

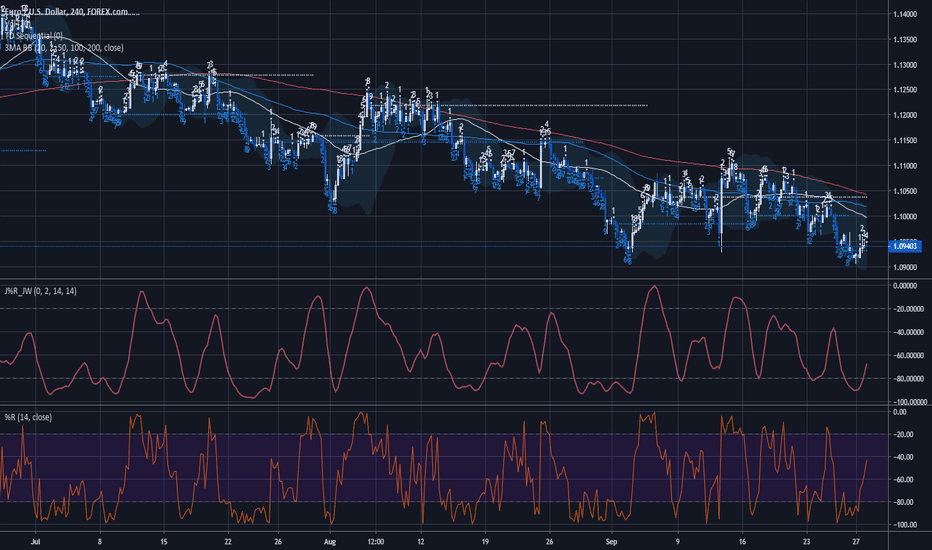

Choosing the Appropriate Time Frame

The next step is to select the time frame that best suits your trading strategy. The MT5 backtesting simulator supports various time frames, ranging from one minute to one month. Keep in mind that choosing the right time frame is crucial, as it can significantly impact the accuracy and relevance of your backtesting results.

Configuring the Backtesting Environment

Before running a backtest, you’ll need to configure the backtesting environment to ensure accurate results. This includes acquiring historical data, adjusting backtesting parameters, and setting up the appropriate modeling method.

Acquiring Historical Data

The quality of historical data is paramount for accurate backtesting. The MT5 platform provides built-in historical data for various trading instruments, which you can access by navigating to the “History Center” (F2). If you require more extensive or custom data, you can import it from external sources, such as paid data providers or your broker.

Adjusting the Backtesting Parameters

Once you have acquired the necessary historical data, you’ll need to adjust the backtesting parameters. These include the spread settings, modeling method, and optimization parameters. The spread settings determine the difference between the bid and ask prices, which can significantly affect your strategy’s performance. The modeling method determines how the MT5 backtesting simulator will process the historical data, with options such as “Every tick,” “1-minute OHLC,” and “Open prices only.” Finally, optimization parameters are used to fine-tune your strategy, allowing you to test multiple variations to identify the most effective approach.

Expert Advisors (EAs) and Indicators

In the MT5 platform, trading strategies are implemented using Expert Advisors (EAs) and Indicators. These are programmable scripts that automate trading decisions and provide insight into market conditions.

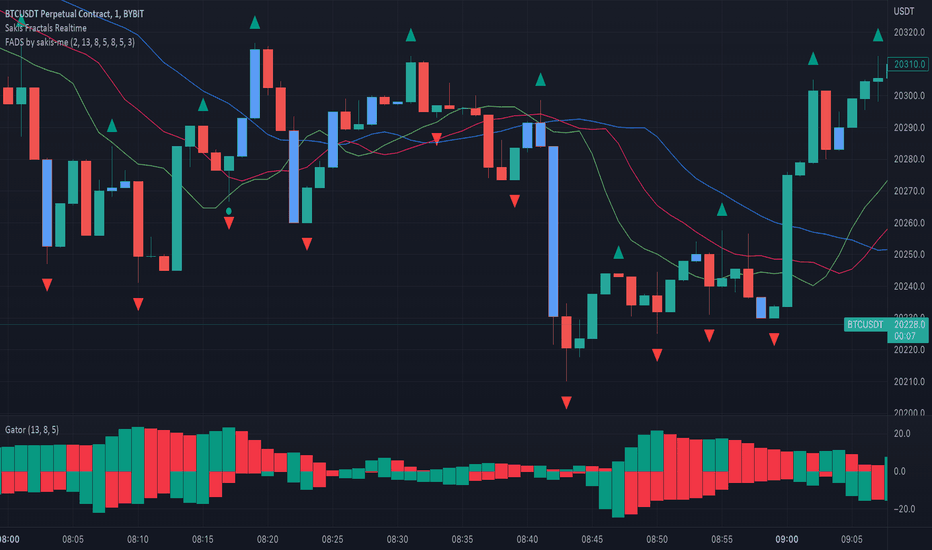

Overview of Expert Advisors and Indicators

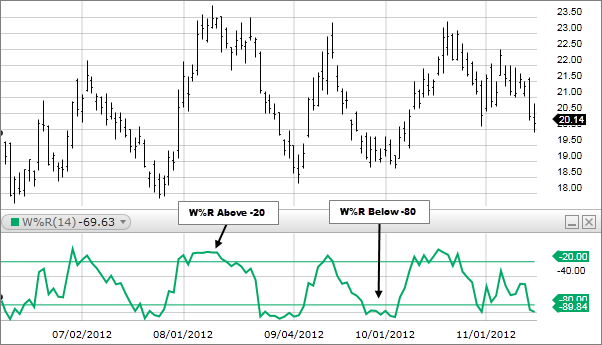

Expert Advisors are algorithmic trading systems that execute trades based on predefined rules and conditions. They can automate complex strategies and help traders save time and minimize human errors. Indicators, on the other hand, are visual tools that analyze price movements and provide insights into market trends, momentum, and volatility.

Built-in EAs and Indicators in MT5

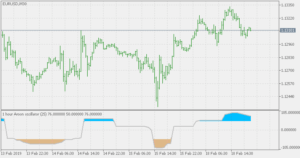

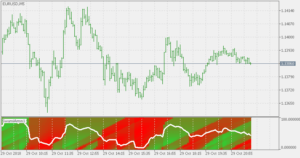

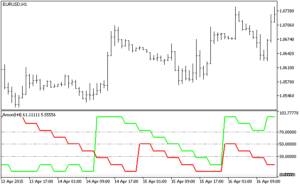

The MT5 platform comes with a range of built-in EAs and Indicators that cater to various trading styles and strategies. Some popular built-in Indicators include the Moving Average, RSI, and MACD, while built-in EAs include the Moving Average Crossover and the MACD Sample. These built-in tools can serve as a starting point for building and testing your trading strategies.

Importing Custom EAs and Indicators

If you require more specialized EAs or Indicators, you can import custom tools developed by third-party programmers or create your own using the MetaEditor. This feature allows you to tailor your trading strategies to suit your specific needs and preferences.

Configuring EAs and Indicators for Backtesting

Once you’ve selected the appropriate EAs and Indicators, you’ll need to configure their settings for the backtest. This includes adjusting parameters such as the entry and exit criteria, risk management rules, and trading conditions. Ensure that these settings align with your intended trading strategy to achieve accurate backtesting results.

Running the MT5 Backtesting Simulator

With your backtesting environment configured and your EAs and Indicators set up, you’re now ready to run the MT5 backtesting simulator.

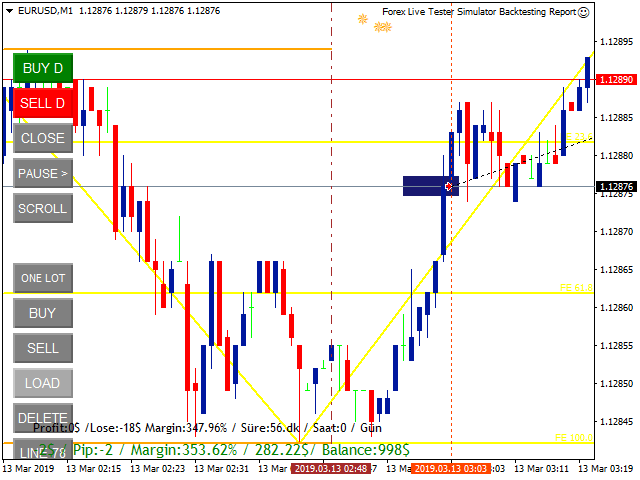

Initiating the Backtest

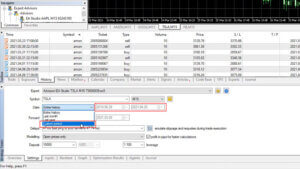

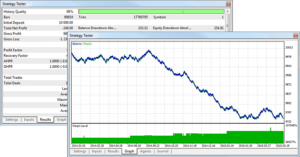

To start a backtest, open the “Strategy Tester” window (Ctrl+R) and select your desired EA from the “Expert Advisor” dropdown menu. Configure the necessary settings, such as the trading instrument, time frame, and date range for the backtest. Once you’re satisfied with your selections, click “Start” to initiate the backtest.

Monitoring the Backtest Progress

During the backtest, you can monitor its progress in the “Strategy Tester” window. This includes information on the number of trades executed, the current profit or loss, and the percentage of the backtest completed. Keep an eye on these metrics to ensure that the backtest is running smoothly and as expected.

Analyzing the MT5 Backtesting Simulator Results

After the backtest has concluded, the MT5 backtesting simulator will generate a detailed report with various performance metrics. These include:

- Summary statistics: This section displays key performance indicators such as total net profit, the percentage of profitable trades, and the Sharpe ratio.

- Trade history: A list of all trades executed during the backtest, including entry and exit prices, trade duration, and profit or loss.

- Equity curve: A graphical representation of your strategy’s performance, illustrating the growth or decline of your account balance over time.

- Drawdown analysis: A measure of the largest peak-to-trough decline in your account balance, providing insights into the potential risk of your trading strategy.

Optimization and Fine-Tuning

To further improve your trading strategy, you can utilize the MT5 backtesting simulator’s built-in optimizer to fine-tune your parameters and settings.

Using the Built-in Optimizer

The optimizer allows you to test multiple variations of your strategy simultaneously, helping you identify the optimal combination of parameters for maximum performance. To access the optimizer, simply select “Optimization” in the “Strategy Tester” window and configure the settings as required.

Setting Optimization Criteria

To ensure that the optimizer provides meaningful results, you’ll need to set specific optimization criteria. These can include factors such as the net profit, drawdown, or the Sharpe ratio. By selecting the most relevant criteria for your strategy, you can ensure that the optimizer identifies the best possible parameter combinations.

Analyzing Optimization Results

After the optimization process is complete, the MT5 backtesting simulator will generate a comprehensive report detailing the performance of each tested variation. Carefully analyze these results to determine which parameter combinations delivered the best overall performance.

Implementing Improvements to the Trading Strategy

With the insights gained from the optimization process, you can make necessary adjustments to your trading strategy, such as fine-tuning entry and exit criteria or implementing more effective risk management rules. This iterative process can help you continually improve your strategy, potentially leading to increased profitability and reduced risk over time.

Conclusion: The Importance of the MT5 Backtesting Simulator

The MT5 backtesting simulator is a powerful tool that can significantly contribute to a trader’s success by allowing them to test and optimize their trading strategies using historical data. By harnessing the advanced features and capabilities of the MT5 platform, traders can gain valuable insights into the potential performance of their strategies and make data-driven decisions to enhance their trading approach.

By committing to a continuous process of learning, testing, and improvement, traders can leverage the MT5 backtesting simulator to minimize risk, maximize returns, and ultimately achieve greater success in their trading endeavors.