Introduction

XM Global is a renowned brokerage firm that has made a name for itself in the online trading industry. One of the key factors contributing to its success is the widely acclaimed MetaTrader 4 (MT4) trading platform. In this comprehensive guide, we will explore the features, benefits, and advantages of XM Global MT4, as well as provide insights on setting up an account, navigating the platform, and implementing successful trading strategies.

Features and Benefits of XM Global MT4

XM Global MT4 provides traders with a host of features and benefits that contribute to its popularity and effectiveness as a trading platform. Let’s delve deeper into these features and explore the advantages they offer to traders.

- User-Friendly Interface: XM Global MT4 offers a user-friendly interface that is easy to navigate, even for novice traders. The platform’s intuitive design allows users to quickly adapt to its functionalities, making it accessible to traders of all experience levels. Whether you’re a beginner or an advanced trader, XM Global MT4 ensures a seamless and hassle-free trading experience.

- Customizable Trading Environment: Traders can personalize their trading environment on XM Global MT4 to suit their preferences and trading strategies. The platform allows users to customize chart layouts, color schemes, and indicator settings, providing flexibility in tailoring the platform to individual trading needs. This level of customization enhances traders’ comfort and efficiency in executing their strategies.

- Wide Range of Financial Instruments: XM Global MT4 offers an extensive selection of financial instruments for trading. Traders can access major forex currency pairs, commodities, indices, cryptocurrencies, and more. This diverse range of instruments enables traders to diversify their portfolios and take advantage of various market opportunities across different asset classes.

- Advanced Charting Tools and Technical Analysis: XM Global MT4 is equipped with advanced charting tools and a wide range of technical indicators. Traders can apply various charting styles, draw trendlines, and analyze price patterns to identify potential trading opportunities. The platform also provides an extensive library of built-in technical indicators, empowering traders to conduct thorough technical analysis and make informed trading decisions.

- Execution Speed and Reliability: XM Global MT4 offers fast and reliable trade execution, ensuring that traders can enter and exit positions promptly. This feature is crucial, particularly in volatile markets or when executing time-sensitive trading strategies. The platform’s efficiency in executing trades helps traders capitalize on market movements and take advantage of favorable trading conditions.

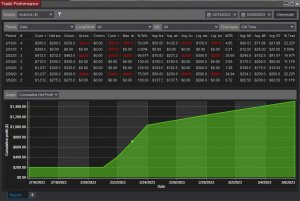

- Access to Expert Advisors (EAs) and Automated Trading Systems: XM Global MT4 supports the use of Expert Advisors (EAs) and automated trading systems. Traders can develop or choose from a wide range of EAs to automate their trading strategies. EAs can execute trades, monitor markets, and apply pre-defined rules, even when the trader is not actively present. This feature enables traders to take advantage of trading opportunities 24/7 without manual intervention.

- Risk Management Tools: XM Global MT4 offers various risk management tools to help traders protect their capital and manage risk effectively. Traders can set stop-loss and take-profit levels to automatically exit trades at predetermined price points, limiting potential losses and securing profits. These risk management tools provide traders with greater control over their trading positions, contributing to a disciplined and structured trading approach.

- Mobile Trading and Accessibility: XM Global MT4 provides mobile trading capabilities, allowing traders to monitor markets and execute trades on-the-go. The platform’s mobile app is compatible with both iOS and Android devices, providing flexibility and accessibility to traders wherever they are. Mobile trading ensures that traders can stay connected to the markets and take advantage of trading opportunities at any time.

- Educational Resources and Support: XM Global offers a wealth of educational resources and support to assist traders in improving their trading skills and knowledge. Traders can access educational materials, webinars, tutorials, and market analysis reports directly through the XM Global website or within the MT4 platform itself. These resources equip traders with valuable insights and empower them to make more informed trading decisions.

- Demo Accounts for Practice: XM Global MT4 provides traders with the option to open demo accounts, allowing them to practice trading strategies and explore the platform’s functionalities without risking real money. Demo accounts offer a risk-free environment where traders can hone their skills, test new trading strategies, and gain confidence before transitioning to live trading.

Setting Up an Account with XM Global

Setting up an account with XM Global is a straightforward process that allows traders to access the powerful XM Global MT4 platform and embark on their trading journey. Whether you are a beginner or an experienced trader, opening an account with XM Global provides you with a gateway to the world of online trading with the industry-leading MT4 platform.

To get started with XM Global MT4, you will need to visit the XM Global website and click on the “Open an Account” button. This will initiate the registration process, where you will be required to provide some basic personal information, such as your name, email address, and country of residence. It is important to ensure that the information provided is accurate and up to date.

During the registration process, you will also need to choose the type of account that suits your trading needs. XM Global offers various account types, including Micro, Standard, and XM Zero accounts, each with its own features and trading conditions. You can select the account type that aligns with your trading preferences, risk tolerance, and investment goals.

Once you have completed the registration form and chosen your account type, you will proceed to the next step, which involves verifying your identity and address. XM Global adheres to strict regulatory requirements and, therefore, requires traders to provide valid identification documents, such as a passport or driver’s license, for identity verification. Additionally, you will need to provide a proof of address document, such as a utility bill or bank statement, to verify your residential address.

After submitting the necessary identification and address verification documents, XM Global will review and verify your information. This process is typically completed within a short timeframe, allowing you to proceed with funding your trading account.

Funding your XM Global MT4 account is a crucial step in getting started with live trading. XM Global offers a variety of secure and convenient funding options, including bank transfers, credit/debit cards, and electronic payment systems. Traders can choose the method that is most convenient for them and follow the instructions provided to complete the deposit process.

It is important to note that XM Global prioritizes the security of clients’ funds and implements strict security measures to ensure the safety of transactions and personal information. The use of SSL encryption technology and segregated client accounts provides an added layer of protection.

Once your trading account is funded, you can log in to the XM Global MT4 platform using the login credentials provided during the registration process. The platform offers a user-friendly interface, allowing you to navigate seamlessly through the various features and functionalities.

Before you start trading on XM Global MT4, it is recommended to familiarize yourself with the platform and its tools. Take advantage of the comprehensive charting tools, technical indicators, and real-time market data available on MT4. These features enable you to analyze the markets, identify trading opportunities, and make informed trading decisions.

Navigating the MT4 Platform

The XM Global MT4 platform is designed to provide traders with a seamless and intuitive trading experience. By familiarizing yourself with its various features and functions, you can efficiently navigate the platform and make the most of its capabilities to enhance your trading activities.

The XM Global MT4 platform comprises several key components that are essential for navigating and executing trades. These components include the market watch, charts, trade execution panels, and order management tools. Let’s explore each of these in more detail:

1. Market Watch: The market watch window on the XM Global MT4 platform provides you with real-time streaming quotes for a wide range of financial instruments. You can customize the market watch by adding or removing instruments of your choice. This allows you to focus on the specific assets you are interested in trading, ensuring a clutter-free and personalized trading experience. By keeping an eye on the prices and spreads in the market watch, you can quickly identify trading opportunities.

2. Charts: Charts are one of the most powerful tools available on the XM Global MT4 platform. They provide visual representations of price movements and enable you to perform technical analysis. By clicking on the “Charts” tab, you can access various chart types, including line charts, bar charts, and candlestick charts. You can also apply technical indicators and drawing tools to the charts to analyze price patterns, identify trends, and make informed trading decisions. The ability to save and load different chart templates allows you to switch between different setups effortlessly.

3. Trade Execution Panels: The trade execution panels on XM Global MT4 enable you to execute trades quickly and efficiently. You can access the trade execution panel by clicking on the “New Order” button. From this panel, you can specify the instrument you want to trade, set the trade size, and choose the type of order (e.g., market order or pending order). The trade execution panel also allows you to set stop-loss and take-profit levels to manage your risk effectively. By inputting the desired trade parameters, you can execute trades with just a few clicks.

4. Order Management Tools: Once you have executed trades, the order management tools on XM Global MT4 provide you with comprehensive control over your positions. The “Terminal” window displays your open positions, account balance, and trade history. You can modify or close your positions directly from the terminal window. Additionally, you can set trailing stops to protect your profits and adjust your stop-loss and take-profit levels as market conditions change. The order management tools help you stay on top of your trades and manage them effectively.

Trading Tools and Resources on XM Global MT4

XM Global MT4 provides traders with a wide array of trading tools and resources to enhance their trading experience and improve their decision-making process. With the comprehensive suite of tools and resources available on the platform, traders can gain valuable insights, conduct in-depth analysis, and make informed trading decisions. Let’s explore the various trading tools and resources offered by XM Global MT4.

1. Market Analysis Tools: XM Global MT4 offers a variety of market analysis tools to help traders stay updated with the latest market trends and make informed trading decisions. Traders can access real-time market data, including price quotes, charts, and historical data. By utilizing these tools, traders can analyze market movements, identify patterns, and spot potential trading opportunities.

The “xm global mt4” platform provides an extensive range of technical indicators that can be applied to charts, enabling traders to conduct thorough technical analysis. Traders can customize their charts by adding indicators such as moving averages, oscillators, and trend lines. These indicators help traders identify trends, support and resistance levels, and potential entry and exit points for their trades.

2. Expert Advisors (EAs): EAs are automated trading systems that can be used on XM Global MT4. These EAs are designed to execute trades based on pre-defined trading strategies and algorithms. Traders can choose from a vast library of EAs or create their own using the platform’s built-in programming language, MetaQuotes Language (MQL). EAs can help traders automate their trading process, eliminate human emotions from trading decisions, and take advantage of trading opportunities even when they are away from their screens.

3. Economic Calendar: The economic calendar provided by XM Global MT4 is a valuable tool for traders. It offers a schedule of important economic events, such as central bank meetings, economic releases, and geopolitical events. Traders can use the economic calendar to stay informed about upcoming events that may impact the financial markets. By understanding the potential market-moving events, traders can adjust their trading strategies and manage their positions accordingly.

4. Educational Materials: XM Global understands the importance of continuous learning in the trading journey. As such, the platform provides a range of educational materials to support traders in their quest for knowledge and skill development. Traders can access educational articles, video tutorials, webinars, and seminars covering various trading topics. These educational resources cater to traders of all levels, from beginners to experienced professionals. By leveraging these resources, traders can enhance their understanding of trading concepts, learn new strategies, and stay updated with the latest market trends.

5. Demo Accounts: XM Global MT4 offers demo accounts, allowing traders to practice their trading strategies and familiarize themselves with the platform’s features without risking real money. Demo accounts provide a risk-free environment for traders to test different trading techniques, explore the functionality of the platform, and gain confidence in their trading abilities. This feature is particularly beneficial for novice traders who are new to online trading and want to gain hands-on experience before trading with real funds.

6. Research and Analysis: XM Global provides traders with comprehensive research and analysis materials to assist them in making informed trading decisions. Traders can access daily market analysis reports, market insights, and trade ideas prepared by the platform’s team of experts. These reports cover a wide range of financial instruments, providing traders with valuable market insights and potential trading opportunities. By utilizing these research and analysis materials, traders can stay updated with market developments and make more informed trading decisions.

Trading Strategies and Tips for Success on XM Global MT4

Implementing effective trading strategies is crucial for achieving success on XM Global MT4. By employing the right techniques and following proven methodologies, traders can enhance their trading performance and increase their chances of profitability. Here are some key strategies and tips to consider:

1. Develop a Solid Trading Plan

Before engaging in any trades on XM Global MT4, it is essential to develop a well-defined trading plan. This plan should outline your trading goals, preferred trading style, risk tolerance, and specific entry and exit criteria for trades. Incorporate your preferred timeframes, indicators, and chart patterns into your plan to create a systematic approach to trading.

2. Utilize Technical Analysis Tools

XM Global MT4 offers a wide range of technical analysis tools that can assist in identifying potential trade setups. Take advantage of the various indicators, oscillators, and drawing tools available on the platform. These tools can help you analyze price trends, identify support and resistance levels, and generate trading signals based on your chosen strategy.

3. Practice Proper Risk Management

Risk management is a critical aspect of successful trading. XM Global MT4 allows you to implement risk management techniques such as setting stop-loss orders and take-profit levels. Use these features to protect your capital and limit potential losses. It is advisable to only risk a small percentage of your trading capital on each trade, typically no more than 1-2% of your account balance.

4. Follow a Trading Journal

Maintaining a trading journal on XM Global MT4 can be invaluable for tracking and evaluating your trading performance. Record your trades, including the reasons for entering and exiting positions, as well as your emotions and observations during the trade. Regularly review your journal to identify patterns, strengths, and weaknesses in your trading approach, enabling you to make necessary adjustments and improvements.

5. Stay Informed with Market Analysis

XM Global provides access to market analysis tools and resources within MT4. Make use of these features to stay updated with market news, economic events, and expert insights. Stay informed about major financial announcements, as they can have a significant impact on market volatility and trading opportunities. Analyze market trends and seek opportunities aligned with your trading strategy.

6. Implement Proper Trade Execution

Proper trade execution is crucial for successful trading. XM Global MT4 allows you to enter trades with precision and efficiency. Pay attention to the bid/ask prices, spreads, and liquidity of the instruments you trade. Ensure that you have a stable internet connection and consider utilizing limit orders to enter trades at specific price levels.

7. Continuously Educate Yourself

The world of trading is constantly evolving, and it is important to stay updated with the latest market trends, trading strategies, and industry developments. XM Global offers educational resources, webinars, and tutorials to enhance your trading knowledge. Consider participating in relevant courses or workshops to further refine your trading skills and gain new insights.

8. Remain Disciplined and Manage Emotions

Maintaining discipline and managing emotions are crucial for long-term trading success. Stick to your trading plan and avoid impulsive decisions driven by fear or greed. Accept that losses are part of trading and remain focused on your overall trading strategy. Implementing proper risk management techniques will help you stay grounded and avoid emotional trading decisions.

Customer Support and Assistance

XM Global takes pride in offering exceptional customer support services to its traders. Traders can contact the support team through various channels, such as phone, email, or live chat. Response times are prompt, ensuring that traders receive timely assistance for their inquiries or technical issues. The support team is available in multiple languages to cater to the diverse needs of global clients.

Advantages and Considerations of XM Global MT4

- Wide Range of Financial Instruments: XM Global MT4 offers traders access to a diverse range of financial instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. This wide selection allows traders to diversify their portfolios and take advantage of various market opportunities.

- Competitive Spreads and Execution Quality: XM Global is known for its competitive spreads, ensuring cost-effective trading for its clients. Moreover, the platform’s execution quality is reliable, allowing traders to enter and exit trades swiftly, thereby minimizing slippage and maximizing potential profits.

- User-Friendly Interface: XM Global MT4 features a user-friendly interface that is intuitive and easy to navigate. Traders, whether beginners or experienced, can quickly adapt to the platform and utilize its functionalities efficiently.

- Advanced Charting Tools and Technical Analysis: The platform provides advanced charting tools and a wide range of technical indicators, enabling traders to conduct thorough technical analysis. Traders can customize their charts, apply indicators, and identify trading patterns to make well-informed trading decisions.

- Expert Advisors (EAs) and Automated Trading: XM Global MT4 supports the use of expert advisors (EAs) and automated trading systems. Traders can develop or purchase EAs to automate their trading strategies, execute trades based on pre-defined criteria, and take advantage of market opportunities 24/7, even when they are away from their trading screens.

Considerations of XM Global MT4

- Spreads and Fees: While XM Global offers competitive spreads, it is essential for traders to consider the specific spreads and fees associated with different financial instruments and account types. Understanding the costs involved is crucial for effective financial planning and profitability.

- Overnight Fees and Swaps: Traders should be aware of overnight fees and swaps charged for holding positions overnight. These fees can vary depending on the financial instrument and market conditions. It is important for traders to factor in these costs when managing their positions.

- Market Volatility: XM Global MT4 provides traders with access to a wide range of markets, including volatile ones such as forex and cryptocurrencies. While volatility presents potential profit opportunities, it also carries higher risks. Traders should carefully assess their risk tolerance and employ appropriate risk management strategies to mitigate potential losses.

- Technical Requirements and Internet Connectivity: To trade on XM Global MT4, traders need a stable internet connection and a compatible device. Traders should ensure their devices meet the minimum technical requirements and have a reliable internet connection to avoid disruptions during trading.

- Regulatory Compliance and Client Fund Protection: XM Global is regulated by reputable authorities, ensuring a safe and secure trading environment for its clients. However, traders should be aware of the regulatory framework and the jurisdiction under which their account operates. Additionally, understanding the measures taken by XM Global to protect client funds is essential for peace of mind.

The Future of XM Global MT4

The future of XM Global MT4 looks promising, as the platform continues to evolve and adapt to the ever-changing landscape of online trading. With a strong emphasis on innovation, customer satisfaction, and technological advancements, XM Global is dedicated to providing traders with an exceptional trading experience on the MT4 platform. Let’s explore the key factors shaping the future of XM Global MT4 and how it positions itself as a frontrunner in the industry.

Enhanced User Experience with XM Global MT4

XM Global understands the importance of user experience in the online trading industry. To meet the evolving needs of traders, the platform is continuously improving its interface and functionalities. Traders can expect a seamless and intuitive user experience, with enhanced customization options to tailor the platform to their preferences. From personalized chart settings to the ability to save templates and layouts, XM Global MT4 offers traders a flexible and user-friendly environment to execute their trading strategies efficiently.

Integration of Advanced Technologies

To stay at the forefront of technological advancements, XM Global MT4 is actively exploring the integration of advanced technologies into the platform. Artificial intelligence (AI), machine learning, and big data analytics are some of the areas being explored. These technologies have the potential to revolutionize trading by providing intelligent insights, automated trade execution, and enhanced risk management capabilities. Traders using XM Global MT4 can anticipate the integration of smart algorithms and advanced analytics tools to gain a competitive edge in the market.

Mobile Trading on the Go

In today’s fast-paced world, mobile trading has become increasingly popular among traders. Recognizing this trend, XM Global is investing in the development of a robust mobile trading platform compatible with XM Global MT4. Traders will be able to access their accounts, monitor markets, execute trades, and manage their positions conveniently from their smartphones or tablets. Mobile trading provides traders with the flexibility to stay connected to the markets wherever they are, ensuring they never miss out on trading opportunities.

Expanding Asset Classes and Trading Opportunities

XM Global is committed to offering a diverse range of financial instruments to cater to the trading preferences of its clients. Traders can expect an expansion in the selection of asset classes available on XM Global MT4, including forex, commodities, indices, and cryptocurrencies. By providing a wide array of trading opportunities, XM Global enables traders to diversify their portfolios and capitalize on various market trends and volatility.

Educational Resources and Trading Support

XM Global recognizes the importance of educating traders and empowering them with knowledge and skills. The platform will continue to invest in comprehensive educational resources, including webinars, tutorials, and educational materials. Traders can access valuable insights, trading strategies, and expert analysis to enhance their trading performance. XM Global’s commitment to ongoing support ensures that traders have the necessary tools and resources to make informed trading decisions.

Seamless Integration with Social Trading

Social trading has gained significant popularity in recent years, as it allows traders to connect, share insights, and learn from each other’s experiences. XM Global MT4 aims to seamlessly integrate social trading features into the platform, allowing traders to engage with a community of like-minded individuals, follow successful traders, and even copy their trades. This integration fosters collaboration, knowledge-sharing, and potentially profitable trading strategies for both experienced and novice traders.

Compliance and Security Measures

As regulatory requirements evolve, XM Global is committed to maintaining the highest standards of compliance and security. The platform adheres to stringent regulatory frameworks and implements robust security measures to safeguard traders’ funds and personal information. Compliance with regulatory authorities ensures transparency and trust, further solidifying XM Global’s reputation as a reliable and secure trading platform.

Conclusion

XM Global MT4 offers traders a powerful and comprehensive trading platform to execute their strategies effectively. With its user-friendly interface, advanced charting tools, and a wide range of financial instruments, XM Global MT4 empowers traders to explore and capitalize on market opportunities. By utilizing the platform’s features, leveraging trading tools and resources, and implementing sound trading strategies, traders can enhance their trading journey and strive for success in the dynamic world of online trading.