Introduction

The EUR/JPY currency pair holds significant importance in the forex market, attracting traders from around the globe. With TradingView as a powerful platform for EUR/JPY trading, you can unlock a world of opportunities. This comprehensive guide will provide you with the knowledge and tools to master EUR/JPY trading on TradingView. Explore how to analyze charts, develop effective strategies, and manage risks to navigate the currency markets successfully.

Understanding EUR/JPY Trading

The EUR/JPY currency pair holds significant importance in the foreign exchange market. As traders strive to make informed decisions and navigate the currency markets, TradingView offers a comprehensive platform for EUR/JPY trading. By understanding the intricacies of EUR/JPY trading on TradingView, traders can unlock a world of opportunities and enhance their trading experience.

What is EUR/JPY?

EUR/JPY represents the exchange rate between the euro (EUR) and the Japanese yen (JPY). This currency pair is influenced by various factors, including economic indicators, central bank policies, geopolitical events, and market sentiment. Traders closely monitor EUR/JPY for potential profit opportunities presented by the fluctuations in exchange rates.

TradingView as a Platform for EUR/JPY Trading

TradingView is a widely respected trading platform that offers a range of features specifically tailored for EUR/JPY trading. With its user-friendly interface and advanced functionality, TradingView provides traders with real-time market data, customizable charts, and a vibrant community of traders. Whether you are a beginner or an experienced trader, TradingView equips you with the necessary resources to analyze, strategize, and execute EUR/JPY trades effectively.

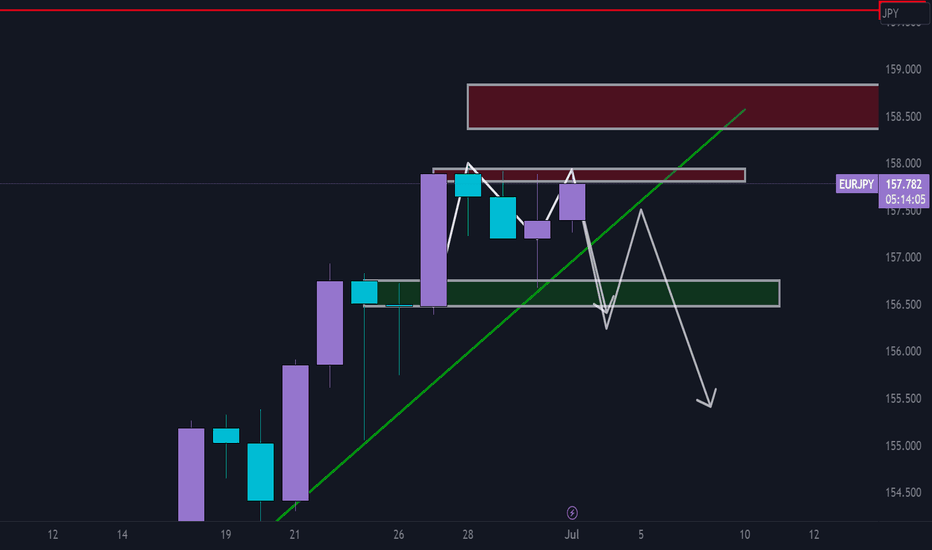

Analyzing EUR/JPY Charts on TradingView

Analyzing EUR/JPY charts is crucial for identifying trends, patterns, and potential trading opportunities. TradingView’s charting tools empower traders to analyze historical price data, monitor real-time EUR/JPY price movements, and apply technical indicators. By utilizing tools such as trendlines, support and resistance levels, and oscillators like the MACD or RSI, traders can gain valuable insights into the EUR/JPY market and make informed trading decisions.

Fundamental Factors Influencing EUR/JPY Prices

To navigate EUR/JPY trading on TradingView successfully, it is crucial to understand the fundamental factors that influence the exchange rate between the euro and the Japanese yen. Factors such as interest rate differentials, GDP growth, inflation rates, political developments, and central bank policies all play a significant role in determining EUR/JPY prices. TradingView provides access to real-time economic data, news events, and market analysis, enabling traders to stay informed and make informed decisions.

Developing EUR/JPY Trading Strategies on TradingView

Developing a well-defined trading strategy is paramount for success in EUR/JPY trading on TradingView. TradingView allows traders to backtest, simulate, and optimize their EUR/JPY trading strategies. Traders can explore various strategies, such as trend following, breakout trading, or range trading, using TradingView’s platform. By analyzing historical price data, identifying entry and exit points, and setting risk management parameters, traders can enhance their EUR/JPY trading strategies.

Risk Management in EUR/JPY Trading on TradingView

Effective risk management is a critical aspect of EUR/JPY trading on TradingView, as it helps protect capital and ensure long-term profitability. TradingView provides risk management tools that allow traders to set stop-loss orders, manage position sizes, and monitor their trades. By incorporating risk management principles into their EUR/JPY trading strategies, traders can minimize potential losses and maximize their trading performance.

Leveraging TradingView’s Community and Educational Resources

TradingView’s platform offers more than just advanced charting and analysis tools. Traders can tap into the power of the TradingView community to gain insights, share ideas, and learn from other EUR/JPY traders. Engaging in discussions, accessing educational resources, and following experienced traders can provide valuable guidance and foster growth in EUR/JPY trading skills on TradingView.

TradingView as a Platform for EUR/JPY Trading

TradingView serves as a robust and feature-rich platform for EUR/JPY trading. With its comprehensive suite of tools and resources, TradingView empowers traders to analyze, strategize, and execute trades with precision and efficiency. Let’s explore how TradingView facilitates EUR/JPY trading and why it is the platform of choice for many traders.

Real-time Market Data and Charting Tools

TradingView provides access to real-time market data, including live EUR/JPY prices, bid/ask quotes, and volume information. Traders can monitor the currency pair’s price movements in real-time, enabling them to spot opportunities and make timely trading decisions. The platform’s advanced charting tools allow traders to customize their charts, apply technical indicators, and overlay multiple timeframes, empowering them to conduct thorough analysis and gain deeper insights into the EUR/JPY market dynamics.

Wide Range of Technical Indicators and Drawing Tools

To support technical analysis in EUR/JPY trading, TradingView offers a vast selection of technical indicators and drawing tools. Traders can choose from popular indicators such as moving averages, Bollinger Bands, MACD, and RSI, among others, to analyze price trends, identify potential reversals, and generate trading signals. Furthermore, TradingView’s drawing tools enable traders to mark support and resistance levels, draw trendlines, and annotate their charts, facilitating precise analysis and enhancing decision-making capabilities.

Advanced Charting Features and Analysis Techniques

TradingView provides advanced charting features that enhance the EUR/JPY trading experience. Traders can switch between different chart types, including candlestick, line, and bar charts, based on their preferred visual representation of price data. Moreover, TradingView supports various charting techniques, such as chart patterns recognition, Fibonacci retracements, and harmonic patterns, enabling traders to identify key levels and predict potential price movements with greater accuracy.

Integrated News and Economic Calendar

Staying informed about the latest news and economic events is essential for successful EUR/JPY trading. TradingView integrates news feeds and economic calendars into its platform, allowing traders to access real-time news updates, market analysis, and economic indicators relevant to EUR/JPY trading. By staying abreast of the latest developments, traders can make informed decisions based on the impact of news events on the EUR/JPY exchange rate.

Social Community and Collaboration

TradingView fosters a vibrant community of traders, providing a platform for social interaction, idea sharing, and collaboration. Traders can engage with other EUR/JPY traders, follow their strategies, and discuss market trends and insights. The ability to connect with like-minded individuals allows traders to gain valuable perspectives, exchange trading ideas, and enhance their knowledge of EUR/JPY trading. Additionally, TradingView’s social features enable traders to share charts, publish trading ideas, and receive feedback from the community, promoting growth and learning opportunities.

Backtesting and Strategy Optimization

Testing and fine-tuning trading strategies are crucial steps in successful EUR/JPY trading. TradingView’s platform facilitates strategy development, backtesting, and optimization. Traders can create and test their EUR/JPY trading strategies using historical price data, simulate trades, and analyze performance metrics. By assessing the historical effectiveness of their strategies, traders can identify strengths and weaknesses, make necessary adjustments, and optimize their approach to EUR/JPY trading.

Technical Analysis for EUR/JPY Trading on TradingView

Technical analysis is a fundamental aspect of successful EUR/JPY trading on TradingView. By utilizing TradingView’s advanced tools and features, traders can effectively analyze price charts, identify trends, and make informed trading decisions. In this section, we will delve deeper into the world of technical analysis and explore how TradingView can assist you in your EUR/JPY trading endeavors.

Understanding Technical Analysis

Technical analysis involves studying historical price data and using various tools to identify patterns, trends, and potential price movements. It is based on the belief that historical price patterns tend to repeat themselves, and by analyzing these patterns, traders can make predictions about future price movements.

EUR/JPY Charting Tools on TradingView

TradingView provides an extensive range of charting tools specifically designed for EUR/JPY trading. These tools allow traders to visualize and analyze price movements over different timeframes, ranging from minutes to months. By using TradingView’s charts, traders can apply technical analysis techniques to identify patterns, support and resistance levels, and key price levels.

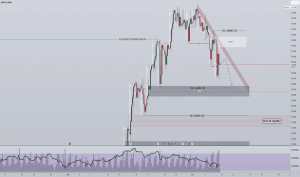

Technical Indicators on TradingView

TradingView offers a wide selection of technical indicators that can be applied to EUR/JPY charts. These indicators help traders identify trends, momentum, overbought or oversold conditions, and other important signals. Some commonly used technical indicators for EUR/JPY trading on TradingView include moving averages, relative strength index (RSI), stochastic oscillator, and Bollinger Bands. Traders can customize the parameters of these indicators to suit their trading strategies and preferences.

Drawing Tools and Annotations

TradingView’s platform allows traders to draw trendlines, support and resistance levels, and other annotations directly on the EUR/JPY charts. These drawing tools help visualize important levels and patterns, facilitating a better understanding of price dynamics. Traders can mark key levels, draw channels, and highlight significant chart patterns to aid in their analysis and decision-making process.

Candlestick Patterns and Analysis

Candlestick patterns provide valuable insights into the price action and sentiment of the market. TradingView offers a wide variety of candlestick patterns and recognition tools that can assist traders in identifying potential reversals, continuation patterns, and trend changes. By understanding and interpreting these candlestick patterns on TradingView, traders can make more accurate predictions about future price movements of EUR/JPY.

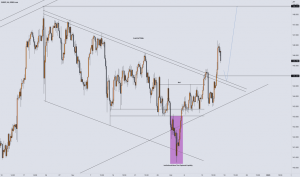

Using Multiple Timeframes

TradingView enables traders to analyze EUR/JPY from multiple timeframes simultaneously. This feature allows for a comprehensive analysis of the currency pair’s price action across different time horizons. Traders can spot trends and patterns on higher timeframes for overall market direction and use lower timeframes for precise entry and exit points. Utilizing multiple timeframes on TradingView can enhance the accuracy of your technical analysis for EUR/JPY trading.

Backtesting and Strategy Optimization

TradingView’s platform offers the ability to backtest and optimize trading strategies for EUR/JPY trading. Traders can simulate their strategies using historical price data to assess their performance over time. By backtesting on TradingView, traders can evaluate the effectiveness of their strategies, identify strengths and weaknesses, and make necessary adjustments. The optimization feature allows traders to fine-tune their strategies by adjusting parameters and finding the optimal settings for maximum profitability.

Utilizing TradingView Alerts

TradingView’s alert system is a valuable tool for EUR/JPY traders. Traders can set custom alerts based on various conditions, such as price levels, indicator crossovers, or pattern formations. These alerts can be received through email, SMS, or in-app notifications, keeping traders informed about potential trading opportunities even when they are not actively monitoring the charts. TradingView alerts help traders stay updated and take timely actions in their EUR/JPY trading.

Fundamental Analysis for EUR/JPY Trading on TradingView

Fundamental analysis plays a significant role in understanding the underlying forces that drive the EUR/JPY exchange rate. By utilizing TradingView’s platform, traders can access a wealth of fundamental data, news, and analysis to make informed trading decisions. In this section, we will explore the key aspects of fundamental analysis for EUR/JPY trading on TradingView and highlight how this approach can enhance your trading strategies.

Economic Indicators and Data Releases

When conducting fundamental analysis for EUR/JPY trading on TradingView, it is crucial to monitor and interpret key economic indicators and data releases. Economic indicators provide valuable insights into the health and performance of the economies of the Eurozone and Japan, which directly impact the EUR/JPY exchange rate. TradingView offers real-time access to economic calendars, allowing traders to stay updated on upcoming data releases such as GDP figures, employment reports, inflation rates, and central bank decisions.

By analyzing these economic indicators and their potential impact on the EUR/JPY exchange rate, traders can make informed trading decisions. For example, positive economic data from the Eurozone, such as robust GDP growth or a decline in unemployment rates, may strengthen the euro and lead to a potential appreciation against the Japanese yen. Conversely, negative economic data may weaken the euro and result in a depreciation against the yen.

Central Bank Policies and Monetary Policy Decisions

Another crucial aspect of fundamental analysis in EUR/JPY trading on TradingView is monitoring the monetary policy decisions of the European Central Bank (ECB) and the Bank of Japan (BoJ). Central bank policies play a significant role in shaping currency valuations and exchange rates. By analyzing the statements, reports, and press conferences of these central banks, traders can gain insights into the future direction of interest rates, quantitative easing programs, and other monetary policy tools.

TradingView provides access to central bank announcements and commentary, allowing traders to stay updated on policy decisions and their potential impact on the EUR/JPY exchange rate. For instance, if the ECB signals a more hawkish stance by suggesting the possibility of raising interest rates, the euro may strengthen against the yen. Conversely, if the BoJ implements expansionary monetary policies, such as increasing bond purchases or lowering interest rates, it may lead to yen depreciation against the euro.

Geopolitical Developments and Market Sentiment

Geopolitical developments and market sentiment are critical factors that influence the EUR/JPY exchange rate. Political events, such as elections, trade negotiations, and geopolitical tensions, can significantly impact market sentiment and currency movements. Traders need to monitor news and geopolitical developments to assess their potential implications for the EUR/JPY exchange rate.

TradingView offers real-time news feeds and analysis from various sources, helping traders stay informed about geopolitical events and their potential impact on currency markets. By assessing the market sentiment, traders can make more accurate predictions about the future direction of the EUR/JPY exchange rate. Positive market sentiment, driven by favorable geopolitical developments or increased risk appetite, may lead to euro appreciation against the yen. Conversely, negative sentiment may result in yen strength against the euro.

Integrating Fundamental Analysis with Technical Analysis on TradingView

To make well-rounded trading decisions in EUR/JPY trading on TradingView, it is essential to integrate fundamental analysis with technical analysis. While fundamental analysis provides insights into the underlying economic factors, technical analysis helps identify trends, patterns, and potential entry and exit points.

TradingView’s platform offers a wide range of technical analysis tools, including charting capabilities, indicators, and drawing tools. By combining fundamental and technical analysis, traders can gain a comprehensive understanding of the EUR/JPY market and make more informed trading decisions. For example, if positive economic data aligns with a bullish technical pattern, it may strengthen the conviction to enter a long position on EUR/JPY.

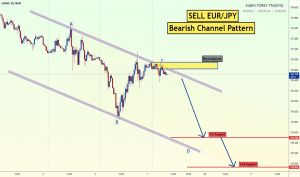

Developing EUR/JPY Trading Strategies on TradingView

When it comes to EUR/JPY trading on TradingView, having a well-defined and effective trading strategy is crucial for success. TradingView offers a range of powerful tools and features that can assist you in developing and refining your EUR/JPY trading strategies. In this section, we will explore the key considerations and steps involved in developing successful strategies on EUR/JPY tradingview.

Understanding Market Dynamics

Before diving into strategy development, it is essential to have a solid understanding of the market dynamics that impact EUR/JPY trading. Factors such as economic indicators, central bank policies, geopolitical events, and market sentiment can influence the exchange rate between the euro and the Japanese yen. Stay updated with the latest news and developments related to these factors, as they can provide valuable insights for strategy development.

Define Your Trading Goals and Risk Tolerance

The first step in developing a trading strategy on EUR/JPY tradingview is to define your trading goals and risk tolerance. Determine your desired level of profitability, time horizon for trades, and acceptable level of risk. This will help shape the overall approach and framework of your strategy.

Selecting a Trading Style

EUR/JPY trading can be approached through various trading styles, including day trading, swing trading, or position trading. Each style has its own characteristics and timeframes. Assess your personal preferences, available time for trading, and risk tolerance to select the most suitable trading style for your strategy.

Technical Analysis Tools on TradingView

TradingView offers a comprehensive suite of technical analysis tools that can enhance your strategy development process. Utilize various indicators, chart patterns, and drawing tools to identify potential entry and exit points. Experiment with different combinations of indicators and timeframes to refine your trading strategy.

Identify Key Support and Resistance Levels

Support and resistance levels play a crucial role in EUR/JPY trading. These levels represent areas where the price tends to bounce off or reverse. TradingView’s platform allows you to identify and plot these levels on your charts. Incorporate support and resistance levels into your strategy to determine potential entry and exit points for trades.

Utilize Trend Analysis

Identifying and following trends is a fundamental aspect of EUR/JPY trading. TradingView offers various tools for trend analysis, including trendlines and moving averages. By analyzing the direction and strength of trends, you can align your trades with the prevailing market momentum.

Incorporate Risk Management Principles

Risk management is a vital component of any trading strategy. Determine your risk-reward ratio and implement appropriate risk management techniques, such as setting stop-loss orders and taking profit targets. TradingView’s platform provides features that allow you to set and manage these parameters effectively.

Backtesting and Optimization

Once you have defined your strategy, it is crucial to backtest and optimize it using historical data on TradingView. Backtesting allows you to assess the performance of your strategy based on past market conditions. Make adjustments to your strategy as necessary, considering different market scenarios and conditions.

Demo Trading and Live Trading

Before implementing your strategy with real money, it is recommended to test it in a demo trading environment on TradingView. This allows you to evaluate its performance in real-time market conditions without risking capital. Once you are confident in your strategy, you can transition to live trading and monitor its effectiveness.

Continuous Monitoring and Refinement

EUR/JPY trading is a dynamic process, and market conditions can change rapidly. Regularly monitor your strategy’s performance and make adjustments as needed. Stay updated with the latest market developments and adapt your strategy accordingly.

Risk Management in EUR/JPY Trading on TradingView

Effective risk management is paramount in EUR/JPY trading on TradingView to safeguard your capital and ensure long-term profitability. By implementing robust risk management strategies, you can mitigate potential losses and protect your trading account. TradingView provides a range of risk management tools and features that empower traders to make informed decisions and manage their risks effectively.

1. Setting Risk Parameters

When engaging in EUR/JPY trading on TradingView, it is crucial to establish clear risk parameters before entering a trade. This includes determining the maximum amount of capital you are willing to risk on any given trade. Setting a risk tolerance level helps you maintain discipline and avoid emotionally driven decisions that can lead to substantial losses. TradingView allows you to customize your risk parameters and set specific stop-loss orders to limit potential downside risk.

2. Position Sizing

Proper position sizing is a fundamental aspect of risk management in EUR/JPY trading on TradingView. By allocating an appropriate portion of your trading capital to each trade, you can effectively control the level of risk exposure. TradingView’s platform enables you to calculate position sizes based on your risk tolerance and desired stop-loss levels. By carefully selecting position sizes, you can manage risk and maintain consistency in your trading approach.

3. Utilizing Stop-Loss Orders

Stop-loss orders are essential tools for managing risk in EUR/JPY trading on TradingView. A stop-loss order is a predetermined price level at which you exit a trade to limit potential losses. By setting a stop-loss order at a reasonable distance from your entry point, you can protect your capital from excessive drawdowns. TradingView’s platform allows you to easily set and adjust stop-loss orders, ensuring that your risk is well-managed in every trade.

4. Trailing Stops

Trailing stops are dynamic stop-loss orders that automatically adjust as the price moves in your favor. They allow you to lock in profits while still giving the trade room to potentially capture further gains. TradingView’s platform provides trailing stop functionality, enabling you to trail your stop-loss level at a specified distance from the current price. This feature allows you to protect profits during favorable market conditions while giving your trades the opportunity to run.

5. Diversification

Diversification is a key risk management strategy in EUR/JPY trading on TradingView. By spreading your capital across multiple trades and different instruments, you can reduce the impact of any single trade on your overall portfolio. TradingView’s platform offers a wide range of trading instruments and currency pairs, allowing you to diversify your trading activities. This diversification helps mitigate the risk associated with individual trades and increases the potential for consistent returns.

6. Regular Evaluation and Review

Continuous evaluation and review of your trading performance are vital for effective risk management in EUR/JPY trading on TradingView. Regularly assess your trading strategies, risk management techniques, and overall performance. Analyze your trades to identify patterns and areas for improvement. TradingView’s comprehensive performance analysis tools can assist you in evaluating your trading results and making data-driven decisions to refine your risk management approach.

7. Embracing Risk-Reward Ratio

The risk-reward ratio is a crucial concept in risk management. It represents the potential reward of a trade relative to the risk taken. Maintaining a favorable risk-reward ratio is important in EUR/JPY trading on TradingView. By selecting trades with potential rewards that outweigh the risks, you increase the probability of achieving profitable outcomes in the long run. TradingView’s platform allows you to assess risk-reward ratios and make informed decisions based on this key metric.

Leveraging TradingView’s Community and Educational Resources

TradingView’s platform extends beyond analysis tools and offers a vibrant community of traders. Engaging with the TradingView community provides opportunities to gain insights, share ideas, and learn from other EUR/JPY traders. Participating in discussions, accessing educational resources, and following experienced traders can broaden your knowledge and enhance your EUR/JPY trading skills.

Trading EUR/JPY Options on TradingView

The EUR/JPY currency pair presents an array of trading opportunities for forex enthusiasts. While spot trading is popular, another avenue to explore is trading EUR/JPY options on TradingView. This comprehensive guide will delve into the intricacies of EUR/JPY options trading on TradingView. Discover the benefits, strategies, and risk management techniques to leverage the potential of this dynamic market.

Understanding EUR/JPY Options Trading

EUR/JPY options provide traders with the right, but not the obligation, to buy (call option) or sell (put option) the currency pair at a predetermined price (strike price) within a specified time frame (expiration date). Options trading offers flexibility and the opportunity to profit from both upward and downward price movements. TradingView provides a robust platform for traders to engage in EUR/JPY options trading and optimize their trading strategies.

TradingView as a Platform for EUR/JPY Options Trading

TradingView’s platform offers a range of tools and features tailored for EUR/JPY options trading. With its intuitive interface and advanced charting capabilities, TradingView provides real-time market data, customizable options chains, and advanced options analysis tools. Whether you are a seasoned options trader or a newcomer, TradingView equips you with the necessary resources to analyze, strategize, and execute EUR/JPY options trades effectively.

Benefits of Trading EUR/JPY Options on TradingView

- Flexibility: EUR/JPY options allow traders to capitalize on market movements with limited risk. Traders can choose from a variety of option strategies to suit their risk tolerance and market outlook.

- Profit Potential: Options trading provides the opportunity to profit from both upward and downward price movements. By utilizing options strategies, traders can potentially generate returns even in volatile market conditions.

- Risk Management: Options allow traders to define their risk upfront by setting the strike price and expiration date. Additionally, options provide the ability to hedge existing positions, mitigating potential losses.

EUR/JPY Options Strategies on TradingView

- Long Call: A long call strategy involves buying a call option on EUR/JPY. Traders use this strategy when they expect the price of EUR/JPY to rise. If the price increases, the trader can profit from the appreciation.

- Long Put: Traders utilize the long put strategy by buying a put option on EUR/JPY when they anticipate the price to decline. If the price decreases, the trader can profit from the downward movement.

- Straddle: A straddle strategy involves simultaneously buying a call option and a put option with the same strike price and expiration date. Traders use this strategy when they expect significant price volatility but are unsure about the direction of the movement. The goal is to profit from a substantial price swing.

- Strangle: Similar to the straddle strategy, a strangle involves buying out-of-the-money call and put options. Traders use this strategy when they anticipate significant volatility but are uncertain about the direction of the price movement. The aim is to profit from a sharp move in either direction.

Risk Management in EUR/JPY Options Trading on TradingView

Implementing effective risk management strategies is essential in EUR/JPY options trading on TradingView. Traders should:

- Set Stop-Loss Orders: Determine the maximum loss you are willing to incur for each options trade and set stop-loss orders accordingly.

- Manage Position Sizes: Avoid overexposure to any single options trade by appropriately managing position sizes relative to your overall trading capital.

- Utilize Options Greeks: Familiarize yourself with options Greeks, such as Delta, Gamma, Theta, and Vega, to understand how changes in price, time, and volatility impact options positions.

- Regularly Monitor Trades: Continuously monitor options trades and be prepared to adjust or exit positions based on changing market conditions.

Conclusion

Mastering EUR/JPY trading on TradingView opens up a world of opportunities in the dynamic forex market. By leveraging TradingView’s platform, analyzing charts, developing effective strategies, and managing risks, you can navigate the complexities of EUR/JPY trading with confidence. Stay updated with technical and fundamental analysis, utilize risk management tools, and engage with the TradingView community to enhance your EUR/JPY trading skills. With TradingView as your ally, you are well-equipped to capitalize on the potential opportunities presented by EUR/JPY trading.