Introduction

In the fast-paced world of forex trading, having a well-defined strategy is crucial for consistent success. One popular approach for short-term traders is the forex scalping strategy. This comprehensive guide provides valuable insights into the intricacies of forex scalping strategy, equipping traders with the knowledge needed to navigate the markets and maximize their profits.

Understanding Forex Scalping Strategy

Forex scalping is a trading technique that aims to profit from small price movements within short timeframes. Scalpers enter and exit trades quickly, capitalizing on rapid price fluctuations. This strategy requires precision, discipline, and a deep understanding of market dynamics.

Scalping Timeframes

Scalping in forex trading involves rapid execution of trades to capitalize on small price movements within short timeframes. Timeframes play a crucial role in determining the effectiveness and profitability of your forex scalping strategy. Choosing the right timeframe requires careful consideration of various factors to align with your trading style and market conditions. In this section, we will explore different timeframes used in forex scalping strategy and highlight their significance in optimizing your trading approach.

Why Timeframes Matter in Forex Scalping Strategy

Timeframes represent the duration of price data displayed on a chart. Each timeframe offers a unique perspective on market dynamics, influencing the speed and frequency of trading opportunities. When it comes to forex scalping strategy, selecting the appropriate timeframe is essential to identify quick price movements and execute trades with precision. Let’s delve into some common timeframes used in forex scalping strategy.

1. 1-Minute Chart

The 1-minute chart is one of the most popular timeframes for scalpers due to its ability to capture rapid price fluctuations. This timeframe provides a granular view of price action, allowing traders to spot short-term patterns and trends. Forex scalping strategy traders using the 1-minute chart focus on executing trades swiftly, aiming to profit from small price movements within seconds or minutes.

2. 3-Minute Chart

The 3-minute chart provides a slightly broader perspective compared to the 1-minute chart. It allows forex scalping strategy traders to analyze price movements over slightly longer periods while still capturing short-term trading opportunities. The 3-minute chart offers a balance between speed and the ability to identify meaningful price patterns and trends.

3. 5-Minute Chart

The 5-minute chart is a common choice for forex scalping strategy traders who prefer slightly longer timeframes. It provides a wider view of price action while still allowing traders to act quickly on shorter-term opportunities. The 5-minute chart offers a balance between capturing small price movements and identifying broader market trends.

Finding the Perfect Fit for Your Forex Scalping Strategy

Choosing the right timeframe for your forex scalping strategy requires a thorough understanding of your trading style, preferences, and market conditions. Consider the following factors to find the perfect fit for your forex scalping strategy:

1. Trading Style and Personal Preferences

Your trading style and personal preferences should align with the chosen timeframe. If you enjoy fast-paced trading and quick decision-making, shorter timeframes like the 1-minute or 3-minute chart may suit your forex scalping strategy. On the other hand, if you prefer a slightly more relaxed trading pace with a broader perspective, the 5-minute chart could be a better fit.

2. Market Volatility and Liquidity

Market volatility and liquidity influence the choice of timeframe in forex scalping strategy. Higher volatility generally leads to more frequent price movements, making shorter timeframes more suitable for your forex scalping strategy. In highly liquid markets, such as major currency pairs during active trading sessions, forex scalping strategy traders can take advantage of tighter spreads and faster trade execution, benefiting from shorter timeframes.

3. Time Commitment

Consider the time you can dedicate to forex scalping strategy. Shorter timeframes require more active monitoring and rapid decision-making. If you have limited time for trading or prefer a more relaxed trading approach, longer timeframes may be more appropriate for your forex scalping strategy.

4. Testing and Optimization

Conduct thorough testing and optimization to determine which timeframe yields the best results for your forex scalping strategy. Backtest your strategy on different timeframes and analyze the performance metrics, such as profitability and win rate, to refine your forex scalping strategy. This process will help you identify the timeframe that aligns with your trading goals and maximizes your chances of success.

Scalping Techniques and Tools

When it comes to implementing a successful Forex scalping strategy, traders need to utilize effective techniques and the right tools. By employing these strategies and using specific tools, scalpers can enhance their ability to identify favorable entry and exit points within the fast-paced Forex market. Let’s explore some popular scalping techniques and tools used by traders to achieve success in their Forex scalping strategies.

1. Price Action Scalping

Price action analysis is a widely used technique in Forex scalping strategies. Traders who rely on price action focus on studying raw price data, including support and resistance levels, candlestick patterns, and chart formations, to make trading decisions. By closely monitoring price patterns such as flags, triangles, and double tops or bottoms, scalpers can identify potential breakout or reversal opportunities. This enables them to enter and exit trades quickly for profit. Price action analysis is a key component of any successful Forex scalping strategy.

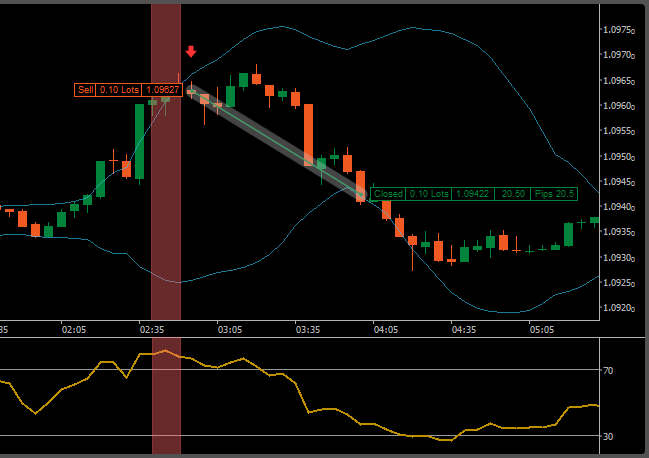

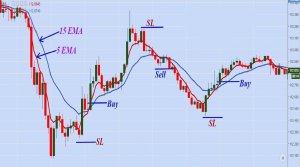

2. Scalping with Indicators

While price action analysis is popular among scalpers, many traders also incorporate technical indicators to complement their Forex scalping strategies. These indicators help traders identify trends, momentum, and overbought or oversold conditions in the market, providing additional confirmation for trade entries and exits.

Some commonly used indicators for Forex scalping include moving averages (MAs), Bollinger Bands (BB), and the Relative Strength Index (RSI). Moving averages can help identify trend direction and potential support and resistance levels. Bollinger Bands provide a visual representation of price volatility, allowing scalpers to identify breakouts or reversals within the bands. The RSI measures the speed and change of price movements, helping scalpers identify overbought or oversold conditions and potential reversals. Combining indicators with price action analysis can lead to more accurate and reliable trading signals in Forex scalping.

3. Tick Charts and Volume Analysis

To gain further insights into market dynamics and trading activity, scalpers often use tick charts and volume analysis as additional tools. Tick charts display price movements based on the number of trades executed rather than time intervals. This allows scalpers to see price action more clearly and capture quick moves within the market. Volume analysis provides information about the number of shares or contracts traded within a specific period. Monitoring volume can help scalpers assess market liquidity and identify potential entry and exit points. High trading volume often indicates increased market participation, making it easier for scalpers to enter and exit trades at desired prices.

By combining tick charts and volume analysis with other scalping techniques, traders can gain a more comprehensive understanding of market activity and potentially improve the accuracy of their scalping strategies. These tools are valuable additions to any Forex scalping strategy.

Identifying Scalping Opportunities

One of the key aspects of a successful forex scalping strategy is the ability to identify high-probability trading opportunities within the fast-paced market environment. Traders who specialize in scalping must have a keen eye for spotting potential trades and executing them swiftly. Let’s explore some effective techniques and indicators that can assist in identifying scalping opportunities in line with the forex scalping strategy.

1. Price Patterns and Chart Formations

Price patterns and chart formations play a crucial role in scalping as they provide valuable insights into potential market reversals or continuation. By recognizing these patterns, traders can anticipate price movements and make informed trading decisions aligned with the forex scalping strategy. Some commonly observed price patterns in scalping include:

- Flags and Pennants: These short-term consolidation patterns often indicate a continuation of the current trend. When the price breaks out of these patterns, scalpers can enter trades in the direction of the prevailing trend, implementing their forex scalping strategy.

- Triangles: Triangles, whether symmetrical, ascending, or descending, signify a period of consolidation and suggest a potential breakout. Scalpers closely monitor triangle patterns for potential entry opportunities in line with their forex scalping strategy.

- Double Tops and Double Bottoms: These patterns occur when the price fails to break a previous high or low, indicating a potential reversal. Scalpers look for confirmation signals before entering trades based on these patterns, incorporating their forex scalping strategy.

By keeping a watchful eye on price patterns and chart formations, scalpers can identify short-term opportunities that align with their forex scalping strategy.

2. Short-Term Support and Resistance Levels

Support and resistance levels are crucial in forex trading, and they hold particular significance for scalpers implementing the forex scalping strategy. These levels represent zones where buying or selling pressure is expected to be significant, leading to potential price reactions. In scalping, traders often seek quick profits within these support and resistance zones.

When the price approaches a strong support level, scalpers may look for potential buying opportunities as the price is likely to bounce off that level, in line with their forex scalping strategy. Conversely, when the price approaches a robust resistance level, scalpers may consider short-selling opportunities, expecting the price to reverse and move downward, adhering to their forex scalping strategy.

Scalpers utilize various technical tools such as trendlines, moving averages, and pivot points to identify these key support and resistance levels, aligning with their forex scalping strategy. By monitoring price behavior around these levels, scalpers can pinpoint potential entry and exit points for their trades.

3. Volatility-Based Indicators

Volatility is a key factor in scalping as it determines the magnitude of price movements within a short timeframe, an essential aspect of the forex scalping strategy. Scalpers thrive on volatility, seeking markets that offer sufficient price action to capture quick profits. Therefore, utilizing volatility-based indicators can help identify suitable scalping opportunities in line with the forex scalping strategy.

One commonly used volatility indicator is the Average True Range (ATR). ATR measures the average price range over a specific period, providing insights into market volatility. Scalpers often look for higher ATR values as it indicates increased price volatility, allowing for potentially larger profit opportunities, consistent with their forex scalping strategy.

Another useful volatility-based indicator is Bollinger Bands. Bollinger Bands consist of a moving average and two standard deviation lines. When the price approaches the outer bands, it suggests an expansion in volatility, potentially signaling a scalping opportunity in line with the forex scalping strategy.

4. Momentum Oscillators

Momentum oscillators are popular technical indicators used by scalpers to assess the strength and speed of price movements, a key aspect of the forex scalping strategy. These indicators help identify overbought and oversold conditions, indicating potential reversal or continuation points.

The Relative Strength Index (RSI) is a commonly used momentum oscillator. It measures the speed and change of price movements, ranging from 0 to 100. When the RSI reaches extreme levels (typically above 70 or below 30), it suggests overbought or oversold conditions, respectively. Scalpers may consider entering trades when the RSI reverses from these extreme levels, aligning with their forex scalping strategy.

Another popular momentum oscillator is the Stochastic Oscillator. It compares the closing price of an asset to its price range over a specified period. Similar to the RSI, the Stochastic Oscillator indicates overbought and oversold conditions. Scalpers use this indicator to identify potential entry points when the Stochastic lines cross or when they exit extreme levels, adhering to their forex scalping strategy.

Entry and Exit Strategies

Precise entry and exit strategies are essential for scalping. Scalpers often use market orders to enter trades quickly, aiming to capture small price movements. Setting realistic profit targets and utilizing trailing stops helps lock in profits and protect against sudden reversals. Implementing stop-loss orders is crucial for managing risk, allowing traders to exit trades if the market moves against their position.

Risk Management in Scalping

Risk management is a crucial aspect of any trading strategy, and forex scalping strategy is no exception. In the fast-paced world of scalping, where trades are executed quickly and profits are sought from small price movements, effective risk management techniques play a vital role in protecting capital and ensuring long-term success. In this article, we will delve deeper into the importance of risk management in forex scalping strategy and explore various approaches to safeguard your trades.

Understanding the Risks in Forex Scalping Strategy

Forex scalping strategy, with its focus on short-term trades and rapid price movements, presents specific risks that traders must be aware of. These risks include:

- Market Volatility: Scalping trades are executed within short timeframes, where volatility can be high. Sudden price fluctuations can lead to significant losses if trades are not managed properly.

- Execution Risk: Rapid trade execution in scalping can be susceptible to slippage, where the execution price differs from the expected price due to market liquidity or order processing delays.

- Overtrading: The fast-paced nature of scalping can tempt traders to take on excessive trades, leading to increased transaction costs and potential loss of focus.

- Psychological Pressure: Scalping requires quick decision-making and can induce emotional stress, leading to impulsive trading decisions that may not align with the overall strategy.

Setting Stop-Loss Orders

One of the fundamental risk management tools in scalping is the use of stop-loss orders. A stop-loss order is placed at a predetermined price level, at which the trade is automatically closed to limit potential losses. By setting a stop-loss order, traders define their maximum acceptable loss for each trade, ensuring that losses are contained within predefined risk parameters. The placement of stop-loss orders should be based on technical analysis, support and resistance levels, or other relevant indicators.

Position Sizing and Leverage Considerations

Proper position sizing is crucial in risk management for scalping. Traders must determine the appropriate position size based on their risk tolerance, account size, and the specific market conditions. It is advisable to risk only a small percentage of the trading capital on each trade, typically between 1% and 3%. By keeping position sizes in check, traders can protect their capital from excessive losses and have the flexibility to withstand temporary drawdowns.

Leverage, while providing the opportunity to amplify gains, also increases the risk in scalping. Traders should exercise caution when utilizing leverage, ensuring that they understand its implications and consider the potential impact on their risk management strategy. It is important to select a leverage level that aligns with your risk appetite and trading objectives.

Monitoring Market Conditions and Adapting to Risk

Successful risk management in forex scalping strategy requires ongoing monitoring of market conditions and the ability to adapt to changing circumstances. Traders should stay updated on economic news, major announcements, and central bank decisions that may impact currency pairs. Heightened volatility or unexpected events may warrant adjustments to risk management parameters, such as tightening stop-loss levels or reducing position sizes to account for increased uncertainty.

Avoiding Overtrading and Maintaining Discipline

Overtrading can be detrimental to risk management in scalping. Traders should avoid the temptation to take on excessive trades driven by impulsive decisions or a fear of missing out on opportunities. Instead, they should adhere to their trading plan, focusing on high-probability setups that meet the criteria of their strategy. Maintaining discipline in trade selection and execution helps mitigate the risks associated with overtrading.

Diversification and Risk Spreading

Diversification is another risk management technique that can be applied in scalping. Instead of concentrating all trades on a single currency pair or market, traders can spread their risk by diversifying across multiple currency pairs or instruments. This helps reduce the impact of any adverse price movements in a single trade and increases the potential for capturing profitable opportunities across different markets.

Regular Performance Analysis and Adjustments

To ensure effective risk management in forex scalping strategy, it is essential to regularly review and analyze trading performance. Traders should keep a trading journal to track trades, record the reasoning behind each trade, and evaluate the outcome. By analyzing past trades, traders can identify any recurring mistakes, refine their strategies, and make necessary adjustments to their risk management approach.

Scalping Tips and Best Practices

Scalping in the forex market requires traders to be highly focused, disciplined, and nimble. To enhance your forex scalping strategy and maximize your profits, consider implementing the following tips and best practices.

1. Choose High-Liquidity Currency Pairs: When scalping, it’s crucial to focus on highly liquid currency pairs. These pairs, such as EUR/USD, USD/JPY, and GBP/USD, offer ample trading opportunities due to their active trading volume and tight spreads. Opting for high-liquidity currency pairs is an essential aspect of a successful forex scalping strategy.

2. Use Shorter Timeframes: Scalping involves quick trades, so utilizing shorter timeframes, such as 1-minute, 3-minute, and 5-minute charts, is vital. These shorter intervals provide the necessary granularity to capture rapid price movements, spot potential trade setups, and make timely decisions within your forex scalping strategy.

3. Master Price Action Analysis: Price action analysis is a fundamental aspect of successful forex scalping. Monitor price patterns, support and resistance levels, and candlestick formations to identify entry and exit points. By mastering price action analysis, you can gain valuable insights into market sentiment and potential price reversals within your forex scalping strategy.

4. Keep an Eye on Economic Calendar: Staying informed about economic news releases and key events is crucial for forex scalping. Regularly consult the economic calendar to anticipate potential price spikes or increased volatility that can create scalping opportunities within your forex scalping strategy. Exercise caution during news releases to manage the risks associated with rapid price movements.

5. Maintain Strict Risk Management: Effective risk management is vital in scalping. Set strict stop-loss orders to limit potential losses if the market moves against your position. Determine your position size based on your risk tolerance and desired risk-to-reward ratio within your forex scalping strategy. Proper risk management helps safeguard your trading capital.

6. Control Your Emotions: Emotions can significantly impact your forex scalping strategy. Keep emotions such as fear and greed in check and adhere to your trading plan. Avoid revenge trading or chasing trades that do not meet your predefined criteria within your forex scalping strategy. Maintaining discipline and emotional control is key to successful scalping.

7. Utilize Technology and Automation: Technology can enhance your forex scalping strategy. Utilize trading platforms with advanced charting features, real-time data feeds, and customizable order types to execute trades efficiently. Consider using automation tools like trailing stops or expert advisors (EAs) to manage trades and exit positions based on predetermined parameters within your forex scalping strategy.

8. Scalp During High Activity Times: Scalping is most effective during periods of high market activity and liquidity. Take advantage of the opening of major forex trading sessions, such as the London, New York, or Asian sessions, to maximize trade execution and reduce the likelihood of slippage within your forex scalping strategy.

9. Regularly Assess and Adapt: Continually evaluate your scalping performance and assess the effectiveness of your strategies. Keep a trading journal to track your trades, analyze successes and failures, and identify areas for improvement within your forex scalping strategy. Adapt your approach based on changing market conditions and the insights gained from analyzing your trading data.

10. Practice Patience and Perseverance: Scalping requires patience and perseverance. Be patient and persevere through periods of low trading opportunities or drawdowns. Stick to your trading plan, trust in your tested strategies, and execute your forex scalping strategy consistently over time to achieve profitable results.

Scalping vs. Day Trading

Understanding the differences between scalping and day trading is essential. While scalping focuses on quick trades within short timeframes, day trading involves holding trades for a longer duration, typically a single day. Traders should carefully consider their trading goals, personality, and time commitment when choosing between these two strategies.

Developing a Scalping Plan

Developing a well-defined trading plan is essential for successful Forex scalping strategy. A scalping plan provides a structured approach, helping traders navigate the fast-paced nature of scalping and make informed decisions. This article delves into the key steps involved in developing a robust Forex scalping plan, equipping traders with the tools necessary for consistent profitability in their scalping endeavors.

Understanding the Importance of a Scalping Plan

A Forex scalping plan serves as a roadmap, guiding traders through the intricacies of the Forex market. It provides clarity on entry and exit criteria, risk management guidelines, and overall trading objectives. By having a solid plan in place, traders can maintain discipline, reduce emotional biases, and stay focused on executing their scalping strategy with precision.

Step 1: Set Clear Goals and Objectives

The first step in developing a Forex scalping plan is to define clear goals and objectives. Traders should ask themselves what they aim to achieve through scalping. Are they seeking consistent daily profits or targeting specific monthly returns? Setting realistic and measurable goals helps provide a sense of direction and motivation for successful Forex scalping strategy.

Step 2: Determine Scalping Techniques

Next, traders need to determine the specific Forex scalping techniques they will employ. This may include price action analysis, utilizing indicators, or a combination of both. By identifying the preferred techniques, traders can focus their efforts on mastering the necessary skills and fine-tuning their scalping strategy accordingly.

Step 3: Define Entry and Exit Criteria

One of the critical components of a Forex scalping plan is establishing precise entry and exit criteria. Traders need to define the specific conditions or signals that indicate a trading opportunity in their scalping strategy. This may involve identifying price patterns, using technical indicators, or monitoring key support and resistance levels for effective Forex scalping strategy. Additionally, determining the appropriate profit targets and stop-loss levels is essential to ensure risk management in Forex scalping.

Step 4: Implement Risk Management Guidelines

Effective risk management is crucial in Forex scalping strategy. Traders must outline risk management guidelines to protect their capital and minimize potential losses. This includes determining the maximum acceptable risk per trade, setting appropriate position sizes, and implementing stop-loss orders for successful Forex scalping strategy. Maintaining a favorable risk-to-reward ratio helps ensure that potential gains outweigh potential losses in Forex scalping.

Step 5: Select the Ideal Trading Hours

Forex scalping often requires traders to be actively engaged in the market during specific trading hours. Identifying the most liquid and volatile periods can significantly impact Forex scalping success. Traders should analyze historical price movements, consider major news releases, and study market behavior to determine the ideal trading hours that align with their scalping strategy for profitable Forex scalping.

Step 6: Backtest and Refine the Strategy

Backtesting the Forex scalping strategy on historical data is crucial to assess its performance and make necessary adjustments. Traders can use trading platforms or specialized software to simulate trades based on their scalping plan. This process allows them to identify strengths, weaknesses, and areas for improvement in their Forex scalping strategy. Refining the strategy based on backtesting results helps enhance its effectiveness in live trading.

Step 7: Regularly Review and Adapt

The Forex market is dynamic, and scalping strategies may require adjustments over time. Traders should regularly review their Forex scalping plan, analyze trade data, and evaluate its performance. They should identify patterns, assess changing market conditions, and adapt their strategy accordingly. By staying proactive and adaptive, traders can optimize their Forex scalping plan to stay in sync with evolving market dynamics.

Conclusion

Forex scalping strategy offers traders an opportunity to profit from quick price movements in the forex market. By understanding the nuances of scalping timeframes, employing effective techniques and tools, identifying suitable trading opportunities, and managing risk, traders can optimize their scalping performance. Remember, disciplined execution, continuous learning, and adaptation are key factors in achieving long-term success in forex scalping.