Introduction

The world of Forex trading presents lucrative business opportunities for individuals in Kenya seeking financial independence and wealth creation. In this comprehensive guide, we will explore the Forex trading business in Kenya, examining the regulatory landscape, the process of starting a Forex trading business, developing effective trading strategies, risk management techniques, and the resources available to traders. By delving into these key areas, aspiring traders in Kenya can gain valuable insights into building a successful Forex trading business.

Understanding Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies with the aim of generating profits from fluctuations in their exchange rates. As the largest and most liquid financial market globally, Forex trading offers numerous advantages such as high liquidity, flexibility, and potential for significant returns. However, it is crucial to recognize the risks involved, including market volatility and the potential loss of capital.

Forex Trading Regulations in Kenya

When engaging in the forex trading business in Kenya, it is vital to understand the regulatory framework that governs the industry. Forex trading regulations aim to protect investors, promote fair trading practices, and maintain the integrity of the financial markets. In Kenya, regulatory bodies such as the Capital Markets Authority (CMA) play a crucial role in overseeing forex trading activities.

The CMA is the principal regulator of the capital markets in Kenya and is responsible for licensing and supervising forex brokers and other market participants. The regulatory framework provides guidelines and standards that forex brokers must adhere to when offering their services to Kenyan traders.

One of the primary objectives of forex trading regulations in Kenya is to ensure transparency and prevent fraudulent activities. Forex brokers operating in Kenya are required to obtain licenses from the CMA, which involves meeting specific capital requirements and demonstrating compliance with regulatory guidelines. Licensed brokers are subject to ongoing supervision and monitoring to ensure they maintain the necessary standards.

Regulatory authorities also impose rules to protect traders’ funds in the forex trading business in Kenya. Forex brokers are typically required to segregate client funds from their own operational funds. This separation of funds ensures that clients’ money is protected in the event of the broker’s insolvency.

Furthermore, regulations often mandate that brokers must provide transparent pricing and execution to clients involved in the forex trading business in Kenya. This means that brokers must disclose their pricing structures, spreads, and any fees or commissions charged. Additionally, brokers are expected to execute trades promptly and accurately, ensuring fair treatment for all clients.

To safeguard the interests of traders in the forex trading business in Kenya, forex brokers may be required to implement risk management measures. These measures can include providing negative balance protection, which prevents traders from losing more than their initial investment. The use of leverage may also be regulated to limit the amount of leverage that traders can utilize, reducing the risk of significant losses.

Another critical aspect of forex trading regulations in Kenya is the prevention of money laundering and other illicit activities. Brokers are required to implement robust anti-money laundering (AML) and know your customer (KYC) procedures. These procedures involve verifying the identity of clients, monitoring transactions, and reporting any suspicious activities to relevant authorities.

Traders engaging in the forex trading business in Kenya are encouraged to choose regulated brokers. Dealing with regulated brokers provides an additional layer of security and ensures that traders’ rights are protected. By adhering to these regulations in the forex trading business in Kenya, traders can operate in a secure and transparent trading environment. It is crucial for individuals involved in the forex trading business in Kenya to stay informed about the latest regulatory developments and choose regulated brokers to protect their investments.

Starting a Forex Trading Business in Kenya

Starting a Forex Trading Business in Kenya requires careful planning, diligent research, and a solid understanding of the Forex market. With the growing popularity of Forex trading in Kenya, more individuals are exploring this business opportunity to generate income and achieve financial independence. In this comprehensive guide on starting a Forex trading business in Kenya, we will cover essential steps, considerations, and strategies.

Understanding the Forex Market in Kenya

Before diving into the process of starting a Forex trading business, it is crucial to understand the Forex market in Kenya. The Forex market is a decentralized global market where currencies are bought and sold. It operates 24 hours a day, five days a week, providing traders with ample opportunities to profit from currency price movements. In Kenya, Forex trading has gained popularity due to its accessibility, potential for high returns, and the ability to trade various currency pairs.

Research and Education for Forex Trading Business in Kenya

The first step in starting a Forex trading business in Kenya is conducting thorough research and acquiring the necessary knowledge. Traders should familiarize themselves with the basics of Forex trading, including terminology, trading concepts, and technical analysis tools. Educational resources such as online courses, books, webinars, and seminars can provide valuable insights and help traders develop a strong foundation for their Forex trading business in Kenya.

Selecting a Reliable Forex Broker in Kenya

Choosing a reputable and reliable Forex broker is essential for the success of your Forex trading business in Kenya. Consider factors such as regulation, security of funds, trading platforms, customer support, fees, and available trading instruments when selecting a Forex broker in Kenya. Look for brokers that are regulated by recognized authorities, such as the Capital Markets Authority (CMA) in Kenya or international regulatory bodies like the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) to ensure the credibility and security of your Forex trading business in Kenya.

Creating a Trading Plan for Your Forex Trading Business in Kenya

A well-defined trading plan is crucial for every Forex trading business in Kenya. Outline your trading goals, risk tolerance, preferred trading strategies, and the amount of capital you are willing to invest in your Forex trading business in Kenya. Define clear entry and exit criteria, risk management rules, and profit targets. A trading plan helps you stay disciplined, manage your emotions, and make consistent trading decisions in your Forex trading business in Kenya.

Setting Up a Trading Account for Your Forex Trading Business in Kenya

Once you have selected a Forex broker for your Forex trading business in Kenya, the next step is to open a trading account. Provide the necessary identification documents and complete the registration process according to the broker’s requirements. Ensure you choose the appropriate account type that aligns with your trading objectives for your Forex trading business in Kenya. Some brokers offer demo accounts that allow you to practice trading with virtual money before risking real funds in your Forex trading business in Kenya.

Learning and Implementing Trading Strategies in Your Forex Trading Business in Kenya

Developing effective trading strategies is a key aspect of starting a Forex trading business in Kenya. Explore various trading strategies, such as trend following, breakout trading, or swing trading, and choose the ones that resonate with your trading style and risk appetite in your Forex trading business in Kenya. Backtest your strategies using historical data to assess their effectiveness before implementing them in live trading in your Forex trading business in Kenya.

Risk Management and Capital Preservation in Your Forex Trading Business in Kenya

Successful Forex trading in your Forex trading business in Kenya requires effective risk management techniques. Determine the amount of risk you are comfortable with for each trade and set appropriate stop-loss orders to limit potential losses in your Forex trading business in Kenya. Avoid overtrading and risking too much capital on a single trade. Implement sound money management principles to preserve your trading capital and ensure long-term sustainability in your Forex trading business in Kenya.

Continuous Learning and Adaptation for Your Forex Trading Business in Kenya

The Forex market is dynamic and constantly evolving, so it’s essential to stay updated with market news, economic indicators, and geopolitical events that can impact currency prices. Continuously educate yourself through reputable sources, attend webinars, read market analysis reports, and stay connected with other traders to adapt to the changing market conditions in your Forex trading business in Kenya. Adaptability and flexibility are key to surviving and thriving in the Forex trading business in Kenya.

Developing a Forex Trading Strategy

Developing a robust and effective Forex trading strategy is crucial for traders in Kenya aiming to establish a successful Forex trading business. A well-defined strategy helps traders make informed decisions, manage risks, and increase the likelihood of consistent profitability in their forex trading business in Kenya. Let’s explore the key elements of developing a Forex trading strategy while considering the unique aspects of the forex trading business in Kenya.

1. Define Your Trading Goals and Risk Tolerance

Before diving into the development of a trading strategy for your forex trading business in Kenya, it is essential to define your trading goals and risk tolerance. Clearly understanding what you aim to achieve from your forex trading business in Kenya will guide the selection of suitable trading techniques and timeframes. Are you seeking short-term gains or long-term investment growth? Do you have a specific monthly income target? Clarifying your goals helps shape your trading strategy accordingly. Additionally, determine your risk tolerance, which reflects your comfort level with potential losses. Establishing these parameters from the outset will ensure that your forex trading strategy aligns with your goals and risk tolerance in the context of your forex trading business in Kenya.

2. Choose a Trading Style

In the forex trading business in Kenya, there are various trading styles available, and selecting the one that aligns with your personality and lifestyle is crucial. Common trading styles include scalping, day trading, swing trading, and position trading. Scalping involves profiting from small price movements within short timeframes, while day trading involves opening and closing positions within a single trading day. Swing trading aims to capture medium-term price swings, holding positions for several days to weeks. Position trading involves holding positions for more extended periods, often based on fundamental analysis. Consider the time commitment, market analysis techniques, and risk management requirements associated with each trading style. Choose a trading style that suits your preferences and allows you to effectively manage your forex trading business in Kenya.

3. Conduct Market Analysis

Market analysis is a fundamental aspect of developing a Forex trading strategy for your forex trading business in Kenya. As a forex trader in Kenya, it is crucial to analyze both technical and fundamental factors to identify potential trading opportunities. Technical analysis involves studying price charts, identifying patterns, and utilizing technical indicators to forecast future price movements. Fundamental analysis focuses on macroeconomic factors, news events, and geopolitical developments that can impact currency values.

In the context of the forex trading business in Kenya, it is important to consider specific factors that influence the Kenyan forex market. Monitor the exchange rates of the Kenyan shilling, analyze economic indicators such as GDP growth, inflation rates, and interest rates, and stay updated on regional political developments that may impact currency pairs involving the Kenyan shilling. Incorporating these factors into your market analysis will provide valuable insights for developing your forex trading strategy in the Kenyan market.

4. Set Entry and Exit Criteria

Establishing clear entry and exit criteria is essential for executing trades effectively in your forex trading business in Kenya. Entry criteria determine when to enter a trade, while exit criteria define when to close a trade and secure profits or limit losses. Entry criteria may involve specific technical indicators, chart patterns, or a combination of factors indicating a favorable trading opportunity. For example, you may use indicators like moving averages, relative strength index (RSI), or Bollinger Bands to identify entry points. Exit criteria can be determined by setting profit targets based on support and resistance levels, trailing stop-loss orders, or using indicators that suggest a potential trend reversal.

In your forex trading business in Kenya, setting entry and exit criteria should take into account the unique characteristics of the Kenyan forex market. Consider incorporating factors such as key economic announcements, political events, and central bank decisions that can significantly impact currency movements involving the Kenyan shilling.

5. Implement Risk Management Techniques

Effective risk management is critical for the long-term success of your forex trading business in Kenya. Proper risk management helps protect your trading capital and ensures sustainability in the face of potential losses. One commonly used technique is determining the appropriate position size for each trade based on your risk tolerance and account size. This involves setting a maximum percentage of your trading capital that you are willing to risk on each trade. For example, you may limit your risk exposure to 2% of your trading capital per trade.

Additionally, implementing stop-loss orders is crucial to limit potential losses in case the market moves against your position. Trailing stop-loss orders can also be utilized to secure profits as the market moves in your favor. Regularly reviewing and adjusting your risk management techniques as your forex trading business in Kenya evolves is essential to ensure that your risk exposure remains within acceptable levels.

6. Regularly Evaluate and Adjust Your Strategy

The forex market is dynamic, and market conditions can change rapidly. Therefore, it is important to regularly evaluate and adjust your trading strategy as needed. Keep track of your trading performance, analyze your trades, and identify patterns or areas for improvement. By reviewing your strategy regularly, you can adapt to evolving market conditions, optimize your trading approach, and refine your risk management techniques. Backtesting your strategy on historical data can also help validate its effectiveness and identify potential areas for improvement.

Risk Management in Forex Trading

Risk management plays a critical role in the forex trading business in Kenya. Effectively managing risks can help traders protect their capital, minimize losses, and enhance their long-term profitability. In this section, we will delve into the importance of risk management in the forex trading business in Kenya and explore various strategies and techniques that Kenyan traders can employ to mitigate risks.

Understanding Risk in the Forex Trading Business in Kenya

Forex trading inherently involves a level of risk due to the dynamic nature of the currency markets. Fluctuations in exchange rates, unexpected economic events, and market volatility can all impact trading outcomes. It is vital for traders involved in the forex trading business in Kenya to acknowledge and accept these risks while actively working to manage and mitigate them. Ignoring or underestimating risks can lead to significant financial losses and hinder the success of the forex trading business in Kenya.

Risk Management Strategies for Forex Traders in Kenya

- Setting Stop-Loss Orders: A stop-loss order is a risk management tool that allows traders to define the maximum amount they are willing to lose on a trade. By setting a stop-loss level, traders automatically exit a trade when the market moves against them beyond a predetermined point. This helps limit potential losses and protect capital in the forex trading business in Kenya.

- Position Sizing and Leverage: Determining appropriate position sizes based on risk tolerance is crucial in managing exposure in the forex trading business in Kenya. Kenyan traders should avoid taking on excessive leverage, as it amplifies both potential profits and losses. Carefully assessing the risk-to-reward ratio before entering trades helps ensure that position sizes are aligned with risk management goals in the forex trading business in Kenya.

- Diversification: Spreading trading capital across multiple currency pairs and instruments can help reduce risk in the forex trading business in Kenya. Diversification allows traders to offset potential losses in one trade or market with gains in other trades or markets. By not relying on a single currency pair, Kenyan traders involved in the forex trading business in Kenya can protect themselves from significant losses resulting from unfavorable market movements.

- Use of Risk-to-Reward Ratio: Evaluating the potential reward relative to the potential risk before entering a trade is essential in the forex trading business in Kenya. Establishing a minimum risk-to-reward ratio, such as 1:2 or 1:3, ensures that the potential profit outweighs the potential loss. This approach allows traders to have a positive expectancy over the long term, even if not every trade is profitable in the forex trading business in Kenya.

- Regularly Monitoring and Reviewing Trades: Successful risk management requires ongoing monitoring of trades and regular review of trading strategies in the forex trading business in Kenya. Kenyan traders should track their trades, analyze performance, and make adjustments when necessary. Identifying patterns of success or failure helps refine trading strategies and improve risk management practices in the forex trading business in Kenya.

Emotional Discipline in Risk Management

Emotions can significantly impact risk management decisions in the forex trading business in Kenya. Fear and greed can lead to impulsive trading choices that deviate from pre-established risk management plans. Kenyan traders involved in the forex trading business in Kenya should maintain emotional discipline by adhering to their trading strategies and not succumbing to impulsive actions based on short-term market fluctuations.

Risk Management and the Forex Trading Business in Kenya

In the context of the forex trading business in Kenya, effective risk management is crucial for long-term success. Kenyan traders must prioritize capital preservation and steady, consistent growth in the forex trading business in Kenya. By implementing robust risk management practices, traders can navigate the volatile forex market while protecting their trading capital and positioning themselves for sustainable profitability in the forex trading business in Kenya.

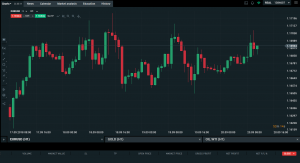

Technical and Fundamental Analysis in Forex Trading

Technical analysis involves analyzing historical price data, chart patterns, and indicators to identify potential market trends and reversals. Fundamental analysis, on the other hand, focuses on evaluating economic factors, geopolitical events, and market news that can influence currency movements. Combining both technical and fundamental analysis enables traders to make well-informed trading decisions in the Kenyan Forex market.

Trading Psychology and Emotions

Trading psychology plays a crucial role in the success of the forex trading business in Kenya. Emotions such as fear, greed, and impatience can significantly impact trading decisions and overall performance. Therefore, understanding and effectively managing these emotions is essential for traders aiming to thrive in the forex trading business in Kenya.

The Impact of Emotions on the Forex Trading Business in Kenya

Emotions can cloud judgment and lead to irrational trading decisions in the forex trading business in Kenya. Fear often arises when traders encounter losses or market volatility, causing them to exit trades prematurely or hesitate to enter potentially profitable trades. Greed, on the other hand, can drive traders to take excessive risks and ignore risk management strategies, leading to significant losses. Impatience may arise when traders expect immediate results, causing them to make impulsive decisions without thorough analysis.

Controlling Emotions for Better Performance in the Forex Trading Business in Kenya

- Develop a Trading Plan: Having a well-defined trading plan is essential for managing emotions in the forex trading business in Kenya. It outlines the trader’s objectives, risk tolerance, and specific strategies to follow. By following a trading plan, traders can avoid impulsive decisions driven by emotions in the forex trading business in Kenya.

- Practice Discipline: Discipline is a key attribute for successful traders in the forex trading business in Kenya. Following predetermined entry and exit points, sticking to risk management rules, and avoiding impulsive trades are crucial for maintaining discipline. Traders should set clear rules and adhere to them, even in the face of emotional pressures in the forex trading business in Kenya.

- Manage Risk Effectively: Implementing proper risk management techniques helps minimize the impact of emotions in the forex trading business in Kenya. Setting stop-loss orders to limit potential losses, using appropriate position sizing, and diversifying the trading portfolio are effective risk management strategies. By focusing on risk control, traders can alleviate the fear of losing large amounts of capital in the forex trading business in Kenya.

- Use Trading Journals: Maintaining a trading journal allows traders to reflect on their emotions and trading decisions in the forex trading business in Kenya. Recording thoughts, emotions, and rationale behind trades helps identify patterns and tendencies driven by emotions. This self-reflection can lead to self-awareness and improvement in decision-making in the forex trading business in Kenya.

- Practice Patience: Forex trading requires patience in the forex trading business in Kenya. Traders should understand that not every trade will be profitable, and markets may exhibit periods of low volatility. By staying patient and avoiding impulsive trading decisions, traders can make more rational choices based on thorough analysis in the forex trading business in Kenya.

Seeking Emotional Support and Mentorship in the Forex Trading Business in Kenya

Engaging in a trading community or finding a mentor can provide valuable emotional support and guidance in the forex trading business in Kenya. Interacting with fellow traders in Kenya who understand the challenges of forex trading can offer encouragement during difficult times. Sharing experiences, discussing strategies, and learning from experienced traders can help novice traders develop the necessary mindset and emotional resilience in the forex trading business in Kenya.

Continuous Learning and Adaptability in the Forex Trading Business in Kenya

In the forex trading business in Kenya, continuous learning is crucial to stay updated with new strategies, market trends, and psychological aspects of trading. Traders in Kenya can attend webinars, workshops, and educational programs to enhance their trading knowledge and improve their emotional control in the forex trading business in Kenya. Adapting to changing market conditions is also vital for success in the forex trading business in Kenya, as markets are dynamic and require traders to adjust their strategies accordingly.

Forex Trading Tools and Resources

Utilizing trading platforms with advanced features and tools is crucial for efficient trading. These platforms offer real-time market data, customizable charts, technical indicators, and order execution capabilities. Additionally, accessing educational resources such as webinars, tutorials, and mentorship programs can enhance traders’ knowledge and skills, enabling them to stay updated with market trends and strategies.

Building a Successful Forex Trading Business in Kenya

Building a successful Forex trading business requires dedication, continuous learning, and the development of strong trading routines. Traders should remain updated with market trends, expand their network by connecting with experienced traders, and participate in trading communities. Embracing a growth mindset and implementing lessons learned from trading experiences are key to achieving long-term success in the Forex trading business in Kenya.

Conclusion

Venturing into the Forex trading business in Kenya offers significant potential for financial growth and independence. By understanding the regulatory landscape, developing effective trading strategies, implementing risk management techniques, and utilizing available resources, aspiring Forex traders can set a solid foundation for their trading businesses. Remember, continuous learning, disciplined trading practices, and adaptability are essential components of a successful Forex trading journey in Kenya.