Introduction

Forex trading is an exciting and potentially profitable activity that attracts many individuals worldwide. To enhance their trading experience and boost their chances of success, traders often utilize various tools and techniques. One such essential tool is forex trend indicators MT4. These indicators are designed to identify and analyze market trends, which can help traders make better-informed decisions. In this comprehensive guide, we will discuss various forex trend indicators available on the MetaTrader 4 (MT4) platform, their applications, and how to combine them for optimal results.

Types of Forex Trend Indicators in MT4

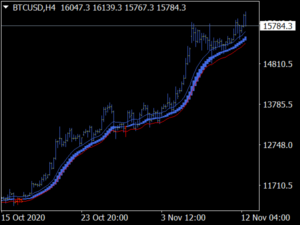

Moving Averages (MA)

Moving Averages are among the most popular forex trend indicators MT4 has to offer. They are used to smooth out price fluctuations and help traders identify the underlying trend direction. There are four main types of Moving Averages:

Simple Moving Average (SMA)

The SMA is calculated by adding the closing prices of a specific number of periods and dividing the sum by that number of periods. This indicator is straightforward but may lag behind the current market price due to its simplicity.

Exponential Moving Average (EMA)

The EMA is similar to the SMA but gives more weight to recent price data. This makes it more responsive to recent price changes and less prone to lag.

Weighted Moving Average (WMA)

The WMA also assigns more importance to recent price data, but it does so in a linear fashion. This means that each data point has a unique weight, with the most recent data having the highest weight.

Smoothed Moving Average (SMMA)

The SMMA is a blend of the SMA and EMA, as it takes the average of the last N periods, including the current one. This results in a smoother line that reduces the impact of sudden price changes.

Bollinger Bands (BB)

Bollinger Bands are another popular forex trend indicator MT4 traders use. Developed by John Bollinger, this indicator consists of three lines: an SMA (usually 20 periods) and two standard deviation lines above and below the SMA. The distance between the bands represents market volatility, with the bands widening during periods of high volatility and contracting during low volatility.

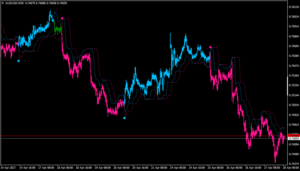

Parabolic Stop and Reverse (PSAR)

The PSAR is a versatile forex trend indicator MT4 users can apply to determine potential trend reversals and establish stop-loss levels. The indicator appears as a series of dots above or below the price bars, with the dots moving closer to the price as the trend progresses.

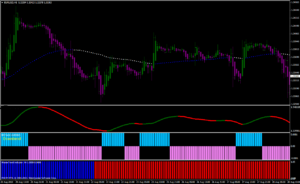

Average Directional Index (ADX)

The ADX is a non-directional forex trend indicator MT4 traders use to measure the strength of a trend. It ranges between 0 and 100, with values above 25 indicating a strong trend and values below 20 suggesting a weak or non-existent trend.

Ichimoku Kinko Hyo

Ichimoku Kinko Hyo, also known as the Ichimoku Cloud, is a comprehensive forex trend indicator MT4 traders can use to gauge trend direction, momentum, and potential support and resistance levels. The indicator consists of five lines, each providing unique insights into the market’s behavior.

Zigzag Indicator

The Zigzag indicator is a forex trend indicator MT4 users employ to identify significant price swings and filter out market noise. The indicator connects price highs and lows through a series of straight lines, helping traders visualize the overall trend structure.

How to Add Forex Trend Indicators to MT4

Download and Installation Process

To use forex trend indicators MT4, you must first download and install them. Follow these steps:

- Find the relevant trend indicator through online sources or the MT4 marketplace.

- Download the indicator file (usually in .mq4 or .ex4 format).

- . Install the indicator in MT4 by placing the file in the “Indicators” folder within the “MQL4” directory of your MT4 installation.

Adding the Indicator to a Chart

Once the forex trend indicator MT4 file is installed, you can add it to your chart by following these steps:

- Open the Navigator window by pressing Ctrl+N or selecting “Navigator” from the “View” menu.

- Locate the indicator within the “Indicators” section of the Navigator window.

- Drag the indicator onto the chart to apply it.

Customizing the Indicator Settings

You can customize the forex trend indicators MT4 settings to fit your trading preferences:

- Adjust input parameters by right-clicking on the indicator and selecting “Properties.”

- Change color schemes by modifying the “Colors” tab.

- Modify visualization settings, such as displaying the indicator on specific timeframes, in the “Visualization” tab.

Combining Forex Trend Indicators for Better Results

Using multiple forex trend indicators MT4 offers can lead to better results by providing complementary insights and reducing the impact of false signals. Here are some popular combinations:

Moving Average Crossover Strategies

These strategies involve using two different moving averages, such as an EMA and SMA, to generate buy and sell signals when they cross each other. For example, when the shorter-term EMA crosses above the longer-term SMA, it can be a signal to buy. Conversely, when the shorter-term EMA crosses below the longer-term SMA, it may be a signal to sell.

Bollinger Bands and Moving Averages

Combining Bollinger Bands with Moving Averages can help traders identify potential trend reversals and breakouts. For instance, when the price breaks above the upper Bollinger Band and is accompanied by a bullish moving average crossover, it might signal a potential uptrend.

PSAR and Moving Averages

The PSAR can be combined with Moving Averages to confirm trend direction and strength. When the PSAR dots are below the price and a moving average crossover occurs, it may indicate a bullish trend. Similarly, when the PSAR dots are above the price and a moving average crossover takes place, it could signal a bearish trend.

ADX with Other Trend Indicators

The ADX can be paired with other forex trend indicators MT4 to measure the strength of a trend and filter out weak or false signals. For example, combining the ADX with a moving average crossover strategy can help traders avoid entering trades during periods of low trend strength.

Forex Trend Indicators MT4 Examples of Trading Strategies Using Forex Trend Indicators

Trend-following Strategies

These strategies aim to capitalize on strong market trends. Here are two examples using forex trend indicators MT4:

Moving Average Crossover System

This system involves using two moving averages (e.g., 50-period EMA and 200-period SMA) to generate trading signals. When the shorter-term EMA crosses above the longer-term SMA, it signals a potential long trade. Conversely, when the shorter-term EMA crosses below the longer-term SMA, it signals a potential short trade.

Bollinger Bands Breakout System

This system relies on Bollinger Bands to identify potential breakouts from a trading range. When the price breaks above the upper Bollinger Band with high volume and momentum, it might signal a potential long trade. Similarly, when the price breaks below the lower Bollinger Band, it could indicate a potential short trade.

Counter-trend Strategies

Counter-trend strategies aim to profit from trend reversals or corrections. Here are two examples using forex trend indicators MT4:

Bollinger Bands Reversal System

This system uses Bollinger Bands to identify potential trend reversals. When the price reaches the upper Bollinger Band and shows signs of reversal (e.g., bearish candlestick patterns or divergence), it might signal a potential short trade. Conversely, when the price reaches the lower Bollinger Band and exhibits signs of reversal (e.g., bullish candlestick patterns or divergence), it could indicate a potential long trade.

PSAR Reversal System

This system relies on the PSAR to identify potential trend reversals. When the PSAR dots switch from being above the price to below the price, it may signal a potential long trade. Similarly, when the PSAR dots switch from being below the price to above the price, it could indicate a potential short trade.

Limitations of Forex Trend Indicators

While forex trend indicators MT4 provides can be invaluable tools for traders, they have some limitations:

Lagging Nature of Some Indicators

Some forex trend indicators, such as Moving Averages, are lagging indicators, meaning they are based on past price data. This can result in delayed signals, causing traders to enter trades late and potentially miss profitable opportunities.

False Signals and Whipsaws

Forex trend indicators can occasionally produce false signals or whipsaws, leading to losses or premature trade exits. This is particularly common during periods of low volatility or sideways markets.

Overreliance on a Single Indicator

Relying solely on one forex trend indicator MT4 offers can be risky, as no single indicator can provide a complete picture of the market. Combining multiple indicators and using other tools, such as fundamental analysis and risk management, is essential for a well-rounded trading strategy.

Multi-timeframe Analysis Using Forex Trend Indicators

Importance of Analyzing Different Timeframes

Analyzing different timeframes can provide traders with a broader perspective on market trends and help identify potential trade opportunities.

Using Trend Indicators on Multiple Timeframes

Applying forex trend indicators MT4 on multiple timeframes can provide valuable insights into market trends and potential reversals. For example, Moving Averages, Bollinger Bands, and Ichimoku Kinko Hyo can be used on various timeframes to gauge trend direction, strength, and potential support and resistance levels.

How to Use Multi-timeframe Analysis in Trading Strategies

Multi-timeframe analysis (MTFA) is a technique that traders use to analyze financial instruments by examining multiple timeframes simultaneously. This approach helps traders to get a comprehensive understanding of the market, identify trends, and make more informed trading decisions. Here’s how you can incorporate multi-timeframe analysis into your trading strategies:

- Choose your timeframes: Start by selecting at least two timeframes to analyze. These should include a higher timeframe (e.g., daily, weekly, or monthly) and a lower timeframe (e.g., 15-min, 1-hour, or 4-hour). The higher timeframe provides an overview of the larger market trends, while the lower timeframe helps you pinpoint trade entries and exits.

- Analyze the higher timeframe: Begin your analysis by examining the higher timeframe. Look for major support and resistance levels, trendlines, and chart patterns. This will help you understand the overall market sentiment and the dominant trend.

- Analyze the lower timeframe: Next, switch to the lower timeframe and look for similar patterns and levels. This will give you a more granular view of the market and help you identify potential trade setups.

- Confirm trend direction: Ensure that the trends on both timeframes align with one another. If the higher timeframe shows an uptrend, look for buying opportunities on the lower timeframe. Conversely, if the higher timeframe shows a downtrend, focus on selling opportunities on the lower timeframe.

- Identify trade entries and exits: Once you’ve confirmed the trend direction on both timeframes, use technical indicators, price action, and other tools to identify precise entry and exit points for your trades. For instance, you might look for a breakout above resistance on the lower timeframe to confirm a long position in an uptrend.

- Use appropriate risk management: With your trade setup identified, apply proper risk management techniques, such as setting stop-loss orders and position sizing based on your risk tolerance. This helps protect your capital and ensures that you can remain in the market for the long run.

- Monitor and adjust: Regularly review and update your multi-timeframe analysis as market conditions change. Be prepared to adjust your trading strategy and risk management parameters accordingly.

Evaluating the Performance of Forex Trend Indicators

Using Backtesting to Assess Indicator Effectiveness

Backtesting is a process where traders test their forex trend indicators MT4 and strategies on historical data to assess their effectiveness. This involves:

- Selecting a historical data set: Choose a data set that covers a diverse range of market conditions to ensure a comprehensive evaluation.

- Defining the trading strategy and rules: Establish the entry and exit criteria, risk management rules, and other parameters for the strategy.

- Running the backtest: Apply the strategy to the historical data and evaluate the results.

Analyzing Backtest Results

After running the backtest, traders should analyze the results, focusing on key performance metrics such as:

- Profit factor: The ratio of gross profit to gross loss, indicating the strategy’s overall profitability.

- Win rate: The percentage of winning trades relative to the total number of trades.

- Risk-reward ratio: The comparison of potential profit to potential loss, measuring the strategy’s riskiness.

Adjusting and Optimizing

Forex Trend Indicators

After analyzing the backtest results, traders can identify areas of improvement and adjust their forex trend indicators MT4 and strategies accordingly. This may involve:

- Fine-tuning input parameters: Adjusting the settings of the trend indicators to optimize their performance.

- Incorporating additional indicators or filters: Adding other indicators or filters to improve the strategy’s effectiveness and reduce false signals.

- Adapting the strategy to different market conditions: Modifying the strategy to perform well in various market environments, such as trending or ranging markets.

Risk Management in Forex Trading Using Trend Indicators

Importance of Risk Management

Risk management is a critical aspect of successful forex trading, as it helps traders protect their capital and stay in the game for the long term.

Setting Stop-loss and Take-profit Levels

Forex trend indicators MT4 can be used to set stop-loss and take-profit levels, ensuring that traders minimize losses and lock in profits:

- Using trend indicators to set stop-loss levels: Indicators such as Moving Averages, Bollinger Bands, or PSAR can help traders determine appropriate stop-loss levels based on trend direction and volatility.

- Setting take-profit levels based on trend strength: Traders can use indicators like the ADX to gauge trend strength and set take-profit levels accordingly.

Position Sizing and Risk-Reward Ratio

Position sizing and maintaining a favorable risk-reward ratio are essential components of risk management:

- Calculating position size based on risk tolerance: Traders should determine the appropriate position size according to their risk tolerance and the size of their trading account.

- Balancing risk and reward in trading decisions: Striking a balance between potential profits and potential losses is crucial for long-term trading success.

Advanced Forex Trend Indicator Concepts

Understanding and Using Divergence

Divergence occurs when the price of a currency pair and a technical indicator move in opposite directions, indicating a potential trend reversal or weakening trend:

- Types of divergence: a. Regular divergence: Occurs when the price makes higher highs (or lower lows) while the indicator makes lower highs (or higher lows), signaling a potential trend reversal. b. Hidden divergence: Occurs when the price makes lower highs (or higher lows) while the indicator makes higher highs (or lower lows), suggesting trend continuation.

- Combining divergence with trend indicators: Traders can use divergence in conjunction with forex trend indicators MT4 to identify potential reversals and enhance trading signals.

Incorporating Price Action Analysis with Trend Indicators

Price action analysis can provide additional insights when used alongside forex trend indicators MT4:

- Identifying support and resistance levels: These levels can help traders determine potential entry and exit points, as well as stop-loss levels.

- Analyzing candlestick patterns: Candlestick patterns can provide clues about market sentiment and potential trend reversals or continuations.

- Combining price action with trend indicators for enhanced trading signals: Integrating price action analysis with forex trend indicators MT4 can lead to more accurate and reliable trading signals.

Building Custom Forex Trend Indicators for MT4

Introduction to MetaQuotes Language 4 (MQL4)

MQL4 is a programming language used to create custom indicators, scripts, and Expert Advisors (EAs) for the MT4 platform.

Basics of Creating a Custom Indicator

Creating a custom forex trend indicator MT4 involves:

- Defining the indicator properties: Specify the input parameters, buffers, and other properties of the indicator.

- Implementing the indicator calculation: Write the code for the indicator’s calculations based on price data.

- Designing the indicator visualization: Create the graphical representation of the indicator on the chart.

Testing and Debugging Custom Indicators

After building a custom forex trend indicator MT4, traders should test and debug it to ensure it performs as intended:

- Test the indicator on historical data: Apply the custom indicator to historical price data and observe its performance.

- Identify and fix coding errors: Debug the MQL4 code to address any issues that arise during testing.

- Optimize the indicator settings: Fine-tune the input parameters and visualization settings to optimize the indicator’s performance.

Conclusion

Forex trend indicators MT4 are valuable tools that can help traders identify market trends, make better-informed trading decisions, and ultimately improve their trading performance. By understanding the various types of trend indicators available on the MT4 platform, combining them for enhanced results, and using risk management techniques, traders can develop robust trading strategies and increase their chances of success in the forex market. Moreover, with a solid understanding of advanced concepts like divergence and price action analysis, traders can further refine their trading skills and customize their approach to the ever-evolving financial markets.