Introduction

Active stocks present some of the most exciting opportunities and risks in the stock market. These shares are characterized by high trading volume and dramatic price movements. In this article, we will dive deep into the world of the most active stocks, examining their history, current landscape, and what it means for investors.

Understanding Stock Market Activity

In the realm of investments, the stock market stands as an embodiment of dynamic and constant change. To comprehend the phenomenon of the most active stocks, it’s vital to have a strong grasp of the concept of stock market activity.

At its core, stock market activity represents the volume of trading happening within a specific period. This activity is driven by countless individual decisions, as traders buy and sell shares based on their assessments of companies’ value and future prospects. The cumulative outcome of these decisions influences the direction of stock prices, and in turn, determines which stocks become the most active stocks on a given day.

Several factors can contribute to heightened stock market activity. These include economic announcements, company earnings reports, geopolitical events, and even broad social trends. When news of such events emerges, it can trigger a flurry of trading as investors rush to either buy or sell shares. Companies that are heavily impacted by these events are often among the most active stocks.

For example, let’s consider a tech company that announces a ground-breaking product. This announcement could cause a surge in trading activity for that company’s shares as investors anticipate increased profits. The result could be a sharp rise in the share price, marking the company as one of the most active stocks in the market.

High volume plays a crucial role in shaping the landscape of the most active stocks. Stocks that are heavily traded are often seen as more liquid, which makes them attractive to investors as they can be bought or sold without significantly impacting the stock price. This high volume can lead to increased volatility, with prices rising or falling quickly within a short period.

The Most Active Stocks in History

Investors and traders alike have long been fascinated by the most active stocks. These are shares that, due to several influencing factors, have experienced significant fluctuations in their trading volumes and prices.

The most active stocks in history are often tied to companies that have ushered in new technological advances or disrupted their respective industries. An understanding of these historic examples can provide valuable lessons for identifying and investing in potentially active stocks.

For instance, one of the most significant periods of stock market activity was during the late 1990s and early 2000s, known as the “dot-com boom.” During this era, internet-based companies, often referred to as “dot-coms,” saw an extraordinary surge in their stock prices. These were some of the most active stocks of the time. Companies like Amazon and eBay, despite experiencing initial volatility, have become enduring powerhouses in today’s market.

Similarly, Apple and Microsoft, during their early years, were among the most active stocks in the market. Their landmark products, like Apple’s iPhone or Microsoft’s Windows operating systems, created substantial buzz in the market, driving up their stock activity. The stocks of these tech giants continue to be active, reflecting their sustained ability to innovate and influence market trends.

In recent history, Tesla became one of the most active stocks with its groundbreaking approach to electric vehicles. Its unconventional business tactics and its CEO’s, Elon Musk, unique persona and unpredictability have contributed to high trading volumes and significant price swings.

Looking at these most active stocks in history, it’s clear that innovation and disruption play a significant role in driving stock activity. Companies that introduce game-changing technologies or challenge the status quo in their industries often attract increased investor attention, leading to high trading volumes and price volatility.

However, it’s important to note that not all most active stocks have resulted in long-term success stories. The dot-com bubble is a cautionary tale, as many of the companies that saw their stocks soar during this period eventually crashed, leading to substantial losses for investors. Therefore, while active stocks can offer high potential returns, they also come with considerable risk.

Current Most Active Stocks

In today’s rapidly changing market, keeping tabs on the most active stocks can provide insights into where the market might be heading. The active stocks represent a dynamic, evolving picture of market trends, investor sentiments, and overall economic health.

As of now, the most active stocks span several sectors. They often include tech companies, pharmaceutical firms, energy corporations, and emerging industries like clean energy and AI technology.

Let’s look at a few categories in which the most active stocks frequently appear:

Tech Stocks: In the modern digital era, tech companies tend to be among the most active stocks. Giants such as Apple, Google, and Amazon often see high trading volume due to their significant market influence and continual innovations. Simultaneously, newer players like Zoom and Shopify have also seen increased activity due to the digital shift accelerated by global events.

Pharmaceutical Stocks: Another sector where active stocks frequently reside is pharmaceuticals. Companies like Pfizer, Moderna, and Johnson & Johnson have seen increased activity in recent times, mostly driven by the development and distribution of COVID-19 vaccines.

Energy Stocks: The energy sector is another major player when it comes to the most active stocks. This includes traditional energy companies, like ExxonMobil and Chevron, and increasingly, green energy companies such as Tesla and NextEra Energy.

Emerging Industries: Emerging industries, such as artificial intelligence (AI), cloud computing, and electric vehicles (EVs), also harbor some of the most active stocks. Companies in these industries, like Tesla, NVIDIA, and AMD, often experience heightened activity due to their potential for disruption and high growth.

While this provides a snapshot of the current most active stocks, it’s important to remember that the landscape can change quickly. Regular market analysis and staying informed about global events are critical for any investor looking to capitalize on these active stocks. Remember, high activity often goes hand in hand with high volatility, so while the potential for profit can be significant, so too can the risk.

Why Investors Should Care About the Most Active Stocks

Investing is more than just buying and holding stocks, hoping they will rise over time. To truly maximize their returns, savvy investors often keep a close eye on the most active stocks in the market. But why is this so important? There are several reasons why these stocks can be crucial to your investment strategy.

Potential for High Returns

Firstly, the most active stocks often have significant price volatility. This means that the price of these stocks can move drastically in a short period. For investors who can accurately predict these movements, there is a potential for substantial returns.

A company’s stock becomes highly active for a variety of reasons, such as an upcoming product launch, a significant business merger, or an innovative breakthrough. These events can lead to increased trading volume and price swings, offering lucrative opportunities for investors.

Insights into Market Trends

Secondly, the most active stocks can provide valuable insights into overall market trends. These stocks often represent sectors or industries experiencing growth or significant changes. By monitoring these stocks, investors can stay ahead of the market and identify emerging trends before they become mainstream.

For example, if tech stocks are among the most active stocks, it may indicate increased market interest in technology. This could be a sign for investors to consider investing in this sector.

Better Understanding of Risk

Thirdly, tracking the most active stocks can lead to a better understanding of risk. These stocks are typically more volatile and, therefore, riskier than less active stocks. However, the risk associated with active stocks is not always a downside.

In fact, learning how to navigate the risks of the most active stocks can make an investor more adaptable and resilient in the face of market volatility. By understanding these risks and learning how to mitigate them, investors can potentially improve their overall portfolio performance.

Enhanced Decision-Making Capabilities

Finally, monitoring the most active stocks can enhance an investor’s decision-making capabilities. Because these stocks require careful observation and quick decision-making, they can help sharpen an investor’s trading skills.

The practice of analyzing and trading these active stocks can lead to improved analytical skills, better reaction times to market changes, and an increased understanding of market dynamics. These skills are invaluable for any investor and can lead to better investment decisions across all types of stocks, not just the most active stocks.

Tools for Monitoring Active Stocks

Navigating the ever-changing landscape of the most active stocks can be a challenging task without the right tools. With the advent of technology and the proliferation of online resources, investors now have an array of platforms and tools at their disposal to monitor the performance of these dynamic stocks.

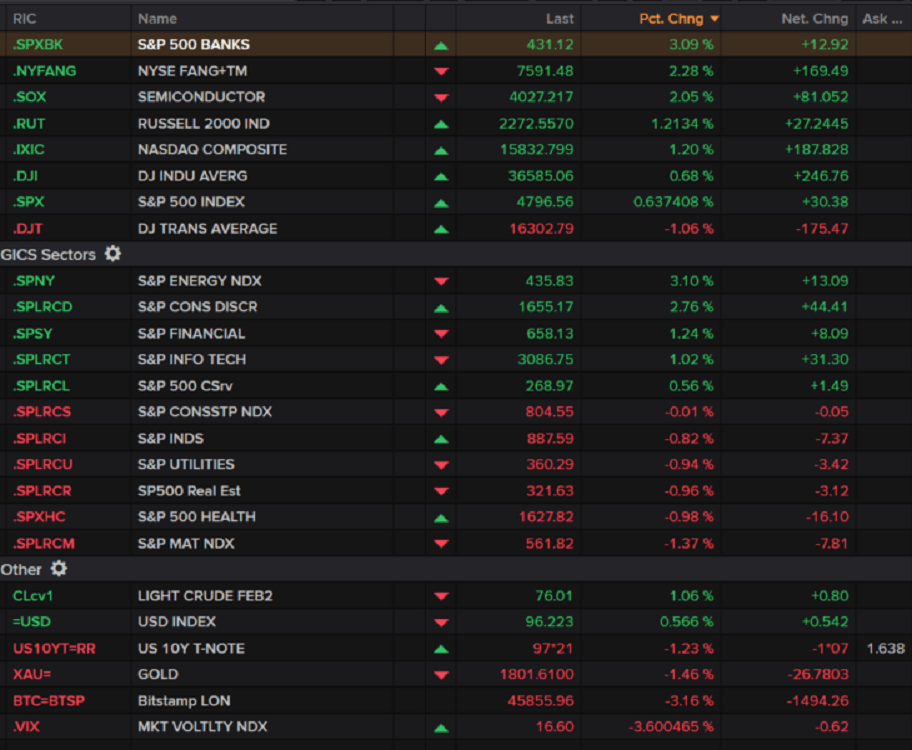

- Stock Screeners: Stock screeners like Finviz and MarketWatch are versatile tools that allow you to filter stocks based on specific criteria, such as volume, price, market cap, and sector. Using a stock screener can help you identify the most active stocks based on trading volume and other pertinent indicators.

- Trading Platforms: Online trading platforms such as E*Trade, TD Ameritrade, and Robinhood not only allow you to execute trades but also offer tools to monitor stock activity. These platforms often include real-time charts, news updates, and analytical tools that can help you track the most active stocks.

- Financial News Sites: Websites like CNBC, Yahoo Finance, and Bloomberg provide up-to-the-minute news and analysis of the most active stocks. These sites often feature lists of the day’s most active stocks, allowing investors to quickly see which stocks are experiencing the most trading activity.

- Social Media and Forums: Platforms like Twitter, Reddit (particularly the r/wallstreetbets subreddit), and Stocktwits have become crucial tools for gauging market sentiment around the most active stocks. These platforms offer a window into the conversations and trends among retail investors, which can sometimes influence stock activity.

- Real-time Charting Tools: For technical analysis, real-time charting tools like TradingView can be invaluable. These tools provide detailed, real-time charts of the most active stocks. They allow investors to apply various technical indicators, such as moving averages and relative strength index (RSI), to detect patterns and trends in stock prices.

- Economic Calendars: These tools, available on sites like Forex Factory and Investing.com, track market-moving events, such as earnings reports, economic data releases, and central bank speeches. Such events can lead to increased activity in certain stocks.

- Mobile Apps: In today’s fast-paced world, having access to information on-the-go is crucial. Mobile apps like Robinhood, Webull, and Thinkorswim allow investors to monitor the most active stocks directly from their mobile devices, anytime and anywhere.

Expert Opinions

Expert opinions can offer valuable insights into the most active stocks. Market analysts and industry experts often provide commentary and predictions on these stocks. Listening to these voices can offer a deeper understanding of market trends and potential investment opportunities.

How to Invest in the Most Active Stocks

Investing in the most active stocks may seem daunting due to their volatile nature. However, with a well-defined strategy, proper research, and a clear understanding of the market, you can maximize the potential returns from these stocks. Let’s take a deep dive into the steps you should follow when investing in the most active stocks.

Understanding the Most Active Stocks

Before investing, it’s important to know what defines the most active stocks. These are stocks that have a high trading volume within a given trading period. They are often characterized by significant price fluctuations, attracting investors seeking high returns. However, they also pose a higher risk compared to less volatile stocks.

Identifying the Most Active Stocks

The first step in investing in the most active stocks is identifying them. Several financial news websites and trading platforms provide lists of the day’s most active stocks. Look for stocks with high trading volumes and significant price movements.

Researching the Most Active Stocks

After identifying potential stocks to invest in, conduct thorough research. Look into the company’s fundamentals, including its earnings reports, news events, and market trends. Analyzing this data will help you understand why the stock is active and whether its activity is likely to result in an upward or downward price trend.

Setting a Budget

Investing in the most active stocks can be risky. Therefore, it’s crucial to set a budget that reflects your risk tolerance. Be ready for the possibility of loss and never invest more than you can afford to lose.

Choosing an Investment Strategy

When it comes to investing in the most active stocks, different strategies can be adopted. Day trading involves buying and selling stocks within a single trading day and can be a good strategy for highly active stocks. On the other hand, swing trading involves holding onto stocks for several days to capture short-term trends, while long-term investing banks on the stock’s growth over months or years.

Executing Your Trades

Once you’ve decided on your strategy, it’s time to execute your trades. Online brokerage platforms offer the easiest and fastest way to buy and sell stocks. However, be sure to consider the transaction fees, as these can eat into your profits when trading the most active stocks.

Monitoring Your Investments

Investing in the most active stocks is not a ‘set it and forget it’ situation. Constant monitoring is crucial as these stocks can be very volatile. Be ready to adjust your strategies based on market trends and always stay updated with news affecting your stocks.

Conclusion

Investing in the most active stocks can be both an exhilarating and challenging experience. The potential for high returns is often balanced by increased risk. However, with careful analysis, the right tools, and a solid strategy, investors can navigate the active stock landscape successfully. The world of active stocks is always evolving, offering new opportunities for those willing to do their homework.