Introduction

Saxo Bank is a Danish online investment bank that offers a wide range of financial products and services, including forex trading. If you’re considering trading with Saxo Bank, it’s important to understand the requirements for opening an account, including the minimum deposit amount. In this article, we’ll take a closer look at the Saxo Bank minimum deposit, as well as the other factors you should consider before opening an account, such as the trading platforms, spreads, ECN trading, and regulatory requirements.

Saxo Bank Minimum Deposit: Understanding the Details

When it comes to trading with Saxo Bank, one of the key factors to consider is the minimum deposit required to open an account. In this article, we’ll take a closer look at the Saxo Bank minimum deposit and what you need to know to get started with trading.

Amount of the Saxo Bank Minimum Deposit

The amount of the Saxo Bank minimum deposit required to open an account typically starts at $2,000. However, the exact amount may vary based on the type of account you’re opening and the type of products and services you want to access.

Additional Fees and Charges

In addition to the Saxo Bank minimum deposit, you may also need to pay additional fees and charges for certain products and services. For example, there may be fees for account maintenance, inactivity, or for accessing premium features. Before opening an account with Saxo Bank, it’s important to understand the fees and charges that may apply and to factor them into your trading plan.

Ways to Fund Your Account with the Saxo Bank Minimum Deposit

When it comes to trading with Saxo Bank, one of the key steps is funding your account. In this part, we’ll take a closer look at the ways to fund your account with the Saxo bank minimum deposit and what you need to know to get started.

Bank Transfers

One of the most common ways to fund your account with Saxo Bank is by bank transfer. This method typically involves transferring funds directly from your bank account to your Saxo Bank account. Bank transfers are a safe and secure way to fund your account and they typically take several business days to complete.

Credit Cards

Another option for funding your account with Saxo Bank is by credit card. This method is convenient and fast, and it allows you to quickly deposit funds into your account. However, it’s important to note that there may be fees associated with using a credit card to fund your account, and there may be restrictions on the amount you can deposit.

Electronic Payment Services

In addition to bank transfers and credit cards, you may also be able to fund your account with Saxo Bank using electronic payment services, such as PayPal or Skrill. This method is typically fast and convenient, and it allows you to quickly deposit funds into your account. However, it’s important to note that there may be fees associated with using electronic payment services, and there may be restrictions on the amount you can deposit.

Saxo Bank Minimum Deposit Requirements

Saxo Bank Minimum Deposit required to open an account with Saxo Bank can vary depending on the type of account you choose. However, the minimum deposit typically starts at $2,000. In addition to the minimum deposit, you may also need to pay additional fees and charges, such as account maintenance fees, deposit fees, and withdrawal fees.

When making a deposit, Saxo Bank accepts a range of methods, including bank transfer, credit/debit cards, and online payment services. It’s important to choose a deposit method that’s convenient for you and to consider any fees that may be associated with each method.

Why the Saxo Bank Minimum Deposit Important

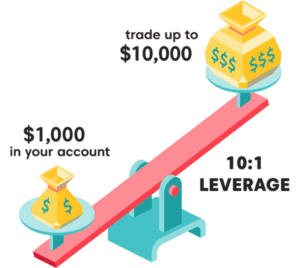

The minimum deposit is an important consideration when choosing a broker because it helps to determine the level of risk you’re willing to take on. By setting a minimum deposit, Saxo Bank is able to ensure that traders have enough funds to cover their trading activities and that they have a genuine interest in trading.

Additionally, Saxo Bank Minimum Deposit can help to ensure that traders are able to access the products and services they need to be successful. For example, a higher minimum deposit may be required to access certain trading platforms or advanced features.

Saxo Bank Trading Platforms: A Closer Look

One of the key factors to consider when choosing a broker is the trading platform they offer. In this article, we’ll take a closer look at the Saxo Bank trading platforms and what you need to know before opening an account.

Overview of Saxo Bank Trading Platforms

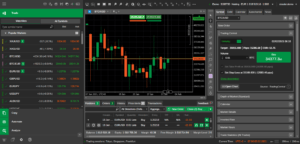

Saxo Bank offers a number of different trading platforms to choose from, each with its own features and benefits. Whether you’re a beginner or an experienced trader, you’re sure to find a platform that’s right for you.

Some of the key features of Saxo Bank’s trading platforms include advanced charting tools, customizable interfaces, and real-time market data. The platforms are also designed to be user-friendly, with intuitive interfaces that make it easy to place trades and manage your portfolio. Additionally, Saxo Bank offers mobile trading apps for iOS and Android, so you can stay connected to the markets no matter where you are.

Key Features and Benefits of Saxo Bank Trading Platforms

Saxo Bank’s trading platforms offer a range of features and benefits that are designed to meet the needs of traders of all levels. Some of the key features and benefits include:

- Advanced charting tools: Saxo Bank’s trading platforms offer a range of advanced charting tools, including technical analysis indicators and drawing tools, to help you make informed trading decisions.

- Customizable interfaces: The trading platforms are highly customizable, so you can personalize your interface to suit your trading style and preferences.

- Real-time market data: Saxo Bank’s trading platforms provide real-time market data and news, so you can stay up-to-date on market developments.

- User-friendly interfaces: The platforms are designed to be user-friendly, with intuitive interfaces that make it easy to place trades and manage your portfolio.

- Mobile trading: Saxo Bank offers mobile trading apps for iOS and Android, so you can stay connected to the markets no matter where you are.

Saxo Bank Spreads: Understanding the Costs of Forex Trading

One of the key factors to consider when trading forex is the spread, which is the difference between the bid price and the ask price of a currency pair. In this article, we’ll take a closer look at the Saxo Bank spreads and what you need to know before opening an account.

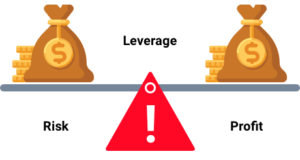

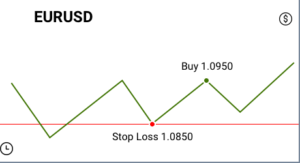

Overview of Spreads in Forex Trading

A spread is the difference between the bid price and the ask price of a currency pair, and it represents the cost of trading that currency pair. In general, the tighter the spread, the lower the cost of trading. When trading forex, it’s important to understand the concept of spreads and to choose a broker that offers competitive spreads.

Saxo Bank Spreads on Major Currency Pairs

Saxo Bank offers competitive spreads on major currency pairs, such as EUR/USD and USD/JPY. The exact spread you’ll pay will depend on the type of account you have and the currency pair you’re trading. Saxo Bank also offers both fixed and variable spreads, so you can choose the type of spread that best fits your trading style.

Impact of Spreads on Trading Costs

The spread is an important factor to consider when trading forex because it represents the cost of trading that currency pair. In general, the tighter the spread, the lower the cost of trading. By choosing a broker with competitive spreads, you can help to reduce your trading costs and maximize your returns.

Availability of Fixed and Variable Spreads

Saxo Bank offers both fixed and variable spreads, so you can choose the type of spread that best fits your trading style. Fixed spreads are set at a specific level and remain constant, regardless of market conditions. Variable spreads, on the other hand, can fluctuate based on market conditions.

Saxo Bank and ECN Trading: Understanding the Benefits and Advantages

One of the options available for traders is ECN trading, which is a type of trading that offers greater transparency and lower costs by matching trades directly between buyers and sellers, without the intervention of a middleman. In this article, we’ll take a closer look at Saxo Bank and ECN trading and what you need to know before opening an account.

Overview of ECN Trading

ECN trading is a type of trading that offers greater transparency and lower costs by matching trades directly between buyers and sellers, without the intervention of a middleman. ECN accounts offer access to deep liquidity and the ability to trade with other traders and institutions in real-time. ECN trading is typically favored by professional and institutional traders who want to take advantage of the tightest spreads available and to trade in an environment that is free from market manipulation.

Saxo Bank and ECN Trading

Saxo Bank offers ECN accounts for traders who want to take advantage of the benefits of ECN trading. With an ECN account, you’ll have access to deep liquidity and the ability to trade with other traders and institutions in real-time. You’ll also be able to take adv

Regulatory Body for Saxo Bank: Ensuring Safe and Secure Trading

When choosing a broker, it’s important to consider the regulatory body that oversees the broker’s operations. In this article, we’ll take a closer look at the regulatory body for Saxo Bank and what you need to know before opening an account.

Overview of Regulatory Bodies in Forex Trading

Regulatory bodies are organizations that oversee the operations of financial institutions, including online investment banks and forex brokers. The role of these bodies is to ensure that financial institutions comply with laws and regulations, and to protect the interests of investors.

Regulatory Body for Saxo Bank

Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority (DFSA) and the Financial Conduct Authority (FCA) in the UK. Saxo Bank is also a member of the Danish Bankers Association, which is a trade organization for Danish banks.

Why Regulatory Bodies are Important

Regulatory bodies are important because they help to ensure that financial institutions comply with laws and regulations and that they operate in a safe and secure manner. By choosing a broker that is regulated by a reputable financial authority, you can help to ensure that your funds are protected and that you have access to a fair and transparent trading environment.

Restricted Countries for Saxo Bank: Understanding the Limitations

While Saxo Bank is available in many countries around the world, there are some restrictions in place for certain countries. In this article, we’ll take a closer look at the restricted countries for Saxo Bank and what you need to know before opening an account.

Overview of Restrictions in Forex Trading

Restrictions in forex trading are typically based on local regulations and laws, and they may limit the types of products and services that are available to residents of certain countries. Some countries may have restrictions on forex trading due to concerns about financial stability, while others may have restrictions in place due to cultural or political reasons.

Restricted Countries for Saxo Bank

Saxo Bank is available in many countries around the world, but there are some restrictions in place for certain countries. The restrictions are typically based on local regulations and laws, and they may limit the types of products and services that are available to residents of those countries.

Before opening an account with Saxo Bank, it’s important to check if your country is restricted. If your country is restricted, you may not be able to trade with Saxo Bank or you may be limited in the types of products and services that are available to you.

Conclusion

Saxo Bank is a well-respected online investment bank that offers a wide range of financial products and services, including forex trading. To ensure a successful trading experience, it’s important to understand the various factors that are involved, including the minimum deposit requirements, trading platforms, spreads, ECN trading, regulatory body, and restricted countries.

Saxo Bank Minimum Deposit to open an account with Saxo Bank typically starts at $2,000, and you may also need to pay additional fees and charges. Saxo Bank offers a range of trading platforms, including advanced charting tools, customizable interfaces, real-time market data, and mobile trading apps. The spreads offered by Saxo Bank are competitive, and they offer both fixed and variable spreads. Saxo Bank also offers ECN trading for traders who want to take advantage of the benefits of ECN trading, including access to deep liquidity and the ability to trade with other traders and institutions in real-time.

Saxo Bank is regulated by several financial authorities, including the Danish Financial Supervisory Authority and the Financial Conduct Authority in the UK. Saxo Bank is available in many countries around the world, but there are some restrictions in place for certain countries. Before opening an account with Saxo Bank, it’s important to check if your country is restricted and to understand the limitations that may be in place.