Professional Forex Indicators

Introduction

Forex trading is an exciting and dynamic industry with limitless opportunities for traders to make a profit. However, it is also a complex market, which requires constant vigilance and careful analysis to make accurate decisions. Professional forex indicators are an essential tool for traders who want to make successful trades consistently. In this comprehensive guide, we will discuss the best professional forex indicators, how to use them effectively, and what factors to consider when choosing the right indicator for your trading strategy.

Types of Professional Forex Indicators

There are various types of professional forex indicators that traders can use to analyze the market. Each of these indicators uses a different approach to help traders identify profitable trading opportunities.

Trend Indicators

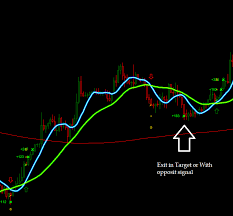

Trend indicators are used to identify the direction of the market trend. The two main types of trend indicators are moving averages and trendlines. Moving averages are used to smooth out price fluctuations and help traders identify the trend direction. Trendlines are used to connect the highs or lows of the price chart to identify the trend direction.

Oscillators

Oscillators are used to identify overbought and oversold market conditions. The two main types of oscillators are the Relative Strength Index (RSI) and the Stochastic Oscillator. The RSI measures the strength of a currency pair and helps traders identify potential reversal points. The Stochastic Oscillator helps traders identify overbought and oversold conditions in the market.

Volume Indicators

Volume indicators are used to measure the volume of trades in the market. The two main types of volume indicators are On-Balance Volume (OBV) and Chaikin Money Flow. OBV measures the buying and selling pressure in the market, while Chaikin Money Flow measures the volume and price of the currency pair.

Sentiment Indicators

Sentiment indicators are used to measure the market sentiment. The two main types of sentiment indicators are Commitment of Traders (COT) and the Market Sentiment Index. COT measures the number of long and short positions in the market, while the Market Sentiment Index measures the bullish or bearish sentiment in the market.

Support and Resistance Indicators

Support and resistance indicators are used to identify key levels in the market. The two main types of support and resistance indicators are Pivot Points and Fibonacci retracements. Pivot Points are used to identify potential support and resistance levels, while Fibonacci retracements are used to identify potential price levels that the currency pair could retrace.

Factors to Consider when Choosing Professional Forex Indicators

When choosing professional forex indicators, it is important to consider the following factors:

Timeframe

The timeframe you are trading in will determine the type of indicator you use. Short-term traders will use different indicators than long-term traders.

Market Volatility

Highly volatile markets will require different indicators than less volatile markets. It is important to choose indicators that are appropriate for the market conditions.

Trading Strategy

Your trading strategy will determine the type of indicator you use. Scalping strategies will require different indicators than position trading strategies.

Risk Management

Risk management is crucial in forex trading. It is important to choose indicators that help you manage risk effectively.

Top Professional Forex Indicators for Successful Trading

Here are the top professional forex indicators that can help traders identify profitable trading opportunities:

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following momentum indicator that helps traders identify potential trend reversals. The MACD is calculated by subtracting the 26-period EMA from the 12-period EMA.

Relative Strength Index (RSI)

The RSI is an oscillator that helps traders identify overbought and oversold market conditions. The RSI is calculated by dividing the average of the gains by the average of the losses over a specific period.

Bollinger Bands

Bollinger Bands are volatility indicators that help traders identify potential trend reversals. They are calculated using a moving average and two standard deviations from the moving average.

Fibonacci Retracement

Fibonacci retracement is a support and resistance indicator that helps traders identify potential retracement levels. The retracement levels are based on the Fibonacci sequence.

Ichimoku Kinko Hyo

Ichimoku Kinko Hyo is a trend-following indicator that helps traders identify potential trend reversals. It is composed of five lines that provide traders with multiple signals to enter or exit trades.

How to Use Professional Forex Indicators Effectively

Here are some tips on how to use professional forex indicators effectively:

Understanding the signals

It is important to understand the signals provided by the indicators. Traders should not rely solely on the indicators but should also consider other factors such as price action, market sentiment, and news events.

Combining different indicators

Traders should not rely on a single indicator but should consider using a combination of indicators to identify potential trading opportunities. This can help reduce false signals and increase the accuracy of trading decisions.

Backtesting and Optimization

Backtesting is the process of testing a trading strategy using historical data. Traders can use backtesting to optimize their trading strategy and identify the best combination of indicators for their trading style.

Trading Psychology

Trading psychology is an essential factor in forex trading. Traders should have a disciplined approach to trading and should not let emotions such as fear or greed influence their trading decisions.

Conclusion

Professional forex indicators are an essential tool for traders who want to make successful trades consistently. In this comprehensive guide, we have discussed the best professional forex indicators, how to use them effectively, and what factors to consider when choosing the right indicator for your trading strategy. By following these tips, traders can improve their trading results and unlock profitable trades in the forex market.