Introduction

Bollinger Bands have long been a staple in the toolkit of many traders. Originating as a tool to gauge volatility, they’ve grown in usage due to their intuitive design and practical application. Within this context, the Bollinger Band Breakout becomes a focal point, presenting lucrative trading opportunities. Yet, how do traders efficiently spot these breakouts? Enter the Bollinger Band Breakout Screener. A tool designed to filter through the noise and highlight potential breakout scenarios.

Understanding Screeners in Trading

Trading in the financial markets can often seem like searching for a needle in a haystack. With thousands of stocks, commodities, and currencies to choose from, finding the right trading opportunity at the right time is daunting. This is where trading screeners come in, acting as filters to highlight potential investment avenues based on predefined criteria. One such innovative tool that’s captured the attention of traders globally is the Bollinger Band Breakout Screener.

What are Trading Screeners?

At its core, a trading screener is a digital tool designed to filter through vast amounts of market data to pinpoint specific conditions or criteria set by the trader. Imagine sifting through thousands of stock charts daily. Not only is this task time-consuming, but it’s also prone to human error. Trading screeners automate this process, scanning the markets continuously and alerting traders to potential opportunities.

The Rise of the Bollinger Band Breakout Screener

Among the myriad of screeners available, the Bollinger Band Breakout Screener stands out, especially for those keen on volatility-based trading strategies. Bollinger Bands, a popular technical analysis tool, essentially provides a visual representation of an asset’s price volatility. When prices break through these bands, it often signifies significant price movement, be it upward or downward.

The Bollinger Band Breakout Screener focuses on these breakout moments. Instead of traders having to monitor multiple charts to catch a breakout, this screener alerts them the moment a potential breakout is on the horizon. It streamlines the process, ensuring traders don’t miss out on potential opportunities.

How Does the Bollinger Breakout Screener Work?

The efficiency of the Bollinger Band Breakout Screener lies in its methodology. The screener constantly tracks the proximity of asset prices to the Bollinger Bands. Once a price touches or crosses these bands, the screener flags it.

For traders, this is invaluable. A breakout can indicate the start of a new trend or a false breakout, leading to a price reversal. Having a tool that alerts them to such movements in real-time allows for quick decision-making and strategy adjustment.

Why Use the Bollinger Breakout Screener?

The Bollinger Band Breakout Screener isn’t just about convenience; it’s about enhancing trading strategies. By focusing on Bollinger Band breakouts, traders can:

- Increase Efficiency: Instead of manually tracking multiple assets, the screener does the heavy lifting.

- Reduce Emotional Trading: Relying on a systematic tool minimizes impulsive decisions and enhances objective trading.

- Integrate with Other Tools: The Bollinger Band Breakout Screener can be combined with other indicators to refine trading signals further.

The Essence of the Bollinger Band Breakout

The trading world is intricate, with a myriad of tools and techniques to help traders decipher the most opportune moments to enter or exit a trade. Among these tools, Bollinger Bands stand out, often hailed for their practicality and dynamic nature. But what truly captivates traders globally is the pivotal moment of a Bollinger Band breakout. To truly harness its essence and potential, the bollinger band breakout screener becomes a quintessential tool for every trader.

Bollinger Bands: A Brief Overview

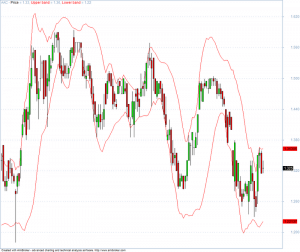

Before diving into the core of the breakout, let’s get a grasp on Bollinger Bands themselves. Crafted by John Bollinger in the 1980s, these bands are volatility indicators placed above and below a moving average. Essentially, they adjust themselves based on market conditions. The wider the bands, the higher the volatility; conversely, narrow bands signify lower volatility.

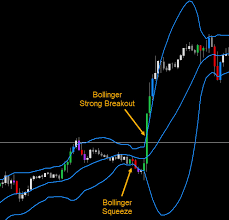

Spotting the Breakout

A Bollinger Band breakout is when the price of an asset moves beyond the upper or lower band. It signifies that the asset is trading outside its usual volatility range, which could indicate a significant price move is looming. Traders look at these breakouts as signals, either to buy or sell, based on the direction of the breakout.

However, spotting a genuine breakout is where the challenge lies. Not all price movements beyond the band signify a sustainable trend. This is where the bollinger band breakout screener comes into play.

The Role of the Breakout Screener

So, what makes the bollinger band breakout screener so instrumental? First, it does the hefty task of scanning through countless assets, pinpointing those displaying breakout characteristics. Given that markets are inundated with data and rapid price changes, manual analysis can be both tedious and inefficient. The screener’s automation aids in detecting breakout opportunities swiftly and accurately.

Furthermore, the bollinger band breakout screener offers precision. While a visual scan might give traders a general idea, the screener’s algorithms ensure that the breakout detected meets specific criteria, reducing the chances of false alarms.

Integrating the Breakout and the Screener

For traders to fully capture the essence of the Bollinger Band breakout, integrating the knowledge of the breakout with the functionality of the bollinger band breakout screener becomes essential. The screener assists in:

- Timing: Ensuring traders can react promptly to a breakout.

- Validation: Confirming that a breakout is genuine and not just a false signal.

- Analysis: Providing a more in-depth look at the asset, especially when the screener is paired with other tools or indicators.

Components of the Bollinger Band Breakout Screener

1. Price Proximity to the Bollinger Bands

The most primary function of the Bollinger Band Breakout Screener is to assess where the current price stands concerning the Bollinger Bands. By doing so, the screener can instantly identify if the price is nearing or has crossed the upper or lower band – an early signal of a potential breakout or breakdown.

2. Adjustable Sensitivity

To cater to individual trading styles and market conditions, a good Bollinger Band Breakout Screener offers adjustable sensitivity settings. Traders can set the screener to alert them when the price is either very close to or slightly further away from the Bollinger Bands. This ensures that they can either adopt an aggressive stance, acting on early signals, or a conservative one, waiting for more confirmed moves.

3. Timeframe Flexibility

Different traders operate on different timeframes. Whether it’s intraday traders looking at 15-minute charts or swing traders analyzing daily charts, the Bollinger Band Breakout Screener allows for flexibility. By adjusting the screener’s timeframe, traders can receive alerts tailored to their specific trading style.

4. Historical Data Analysis

To gauge the significance of a potential breakout, it’s often helpful to understand past behavior. An advanced Bollinger Band Breakout Screener incorporates historical data, allowing traders to see past breakout instances and their subsequent price movements. This aids in forming a predictive analysis based on historical patterns.

5. Integration with Other Indicators

While the Bollinger Bands are potent on their own, they often shine brightest when combined with other indicators. A comprehensive Bollinger Band Breakout Screener integrates seamlessly with other technical analysis tools. For instance, a screener might highlight a breakout and simultaneously indicate an overbought status on the RSI (Relative Strength Index), providing traders with a richer context.

6. Alerts and Notifications

In the fast-paced world of trading, time is of the essence. A Bollinger Breakout Screener excels in delivering real-time alerts and notifications, ensuring traders don’t miss potential breakout opportunities. These can be in the form of push notifications, emails, or even SMS, depending on the platform.

7. Customizable Visualization

For visual traders, how the data is represented can make a world of difference. Modern Bollinger Band Breakout Screeners often come with customizable visualization tools. Whether traders prefer candlestick patterns, bar graphs, or line charts, the screener accommodates these preferences while highlighting potential breakouts.

Choosing the Right Screener Tool

1. Defining Your Needs

Before diving into the marketplace of screeners, you need to outline what you require from a Bollinger Band Breakout Screener. Are you looking for real-time data or is end-of-day data sufficient? Do you prefer a simple interface or are advanced features like back-testing more up your alley? By clearly defining your requirements, you can focus on screeners that align with your trading strategy.

2. Database Size and Quality

A screener is only as good as the data it processes. When evaluating the right Bollinger Band Breakout Screener, consider its data sources. The best screeners pull data from reputable exchanges and financial institutions, ensuring accuracy and comprehensiveness. A comprehensive database can efficiently track more assets, giving traders a broader field of potential opportunities.

3. Frequency of Updates

In the fast-paced world of trading, outdated data can be a liability. The ideal Bollinger Band Breakout Screener should offer frequent updates, especially if you’re trading on smaller timeframes. Real-time data provides traders with the most up-to-date insights, helping them capitalize on emerging breakout opportunities as they occur.

4. User Interface and Usability

A complex tool isn’t necessarily a better one. The right Bollinger Band Breakout Screener should strike a balance between advanced features and user-friendly interfaces. Especially for traders who aren’t tech-savvy, an intuitive design can make all the difference. Features like customizable filters, visual charts, and alert systems can greatly enhance the user experience.

5. Versatility and Integration

While the primary goal is to identify Bollinger Band breakouts, the most effective screeners often integrate with other indicators and tools. For instance, a Bollinger Band Breakout Screener that also interfaces with the Relative Strength Index (RSI) or Moving Averages can provide a more holistic view of the market, allowing for more informed decisions.

6. Price Point

Price is always a consideration. Some screeners are free but may come with limitations or ads, while others have monthly subscription fees but offer a plethora of advanced features. Weigh the benefits against the costs. Sometimes, investing in a more sophisticated Bollinger Breakout Screener can lead to increased profits in the long run.

7. Community and Support

A vibrant community and robust support system can be invaluable. A Bollinger Band Breakout Screener backed by a community means access to shared insights, strategies, and potential troubleshooting help. Moreover, companies that prioritize customer support can guide users in maximizing the tool’s potential.

Maximizing the Use of the Bollinger Breakout Screener

1. Understanding the Core Functionality

At its heart, the Bollinger Band Breakout Screener scans the market for instances when a particular asset’s price breaches the confines of its Bollinger Bands, indicating a potential breakout. A deep understanding of how the screener functions, including its algorithms and criteria for determining breakouts, is crucial. This ensures you’re well-prepared to interpret and act upon the results it produces.

2. Customizing Settings for Specific Markets

While a one-size-fits-all approach might work for some, the Bollinger Breakout Screener truly shines when tailored to specific markets or assets. Different markets have unique volatilities and behavioral patterns, which means the screener’s default settings might not always be optimal. Regularly tweaking and testing the settings can refine your results, ensuring the screener is attuned to your specific trading environment.

3. Integrating Additional Indicators

The Bollinger Band Breakout Screener is a powerful tool, but when combined with other indicators, it becomes even more potent. Consider cross-referencing screener results with indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or even simple moving averages. This multi-faceted approach can provide a fuller picture, helping you discern between genuine breakout opportunities and false alarms.

4. Setting up Timely Alerts

Time is of the essence in trading, and responding swiftly to a potential breakout can be the difference between profit and loss. Customize your Bollinger Band Breakout Screener to send real-time alerts or notifications. Whether it’s an email, a mobile push notification, or an audible alarm, make sure you’re immediately informed when the screener spots a potential opportunity.

5. Regularly Reviewing and Adjusting

Markets evolve, and what worked yesterday might not be as effective today. Regularly review the performance of your Bollinger Band Breakout Screener. Are there too many false positives? Or perhaps it’s missing potential breakouts? By routinely assessing and recalibrating the screener’s settings, you ensure it remains an effective tool in your trading toolkit.

6. Educating Yourself Continually

The Bollinger Band Breakout Screener, like all trading tools, is as effective as the trader using it. Dedicate time to educating yourself not just on the screener but also on broader market trends, Bollinger Band strategies, and technical analysis nuances. The more you know, the better equipped you’ll be to interpret the screener’s results and make informed decisions.

7. Avoiding Over-reliance

While the Bollinger Band Breakout Screener is undoubtedly an asset, it shouldn’t be the sole basis for your trading decisions. Always use the screener as part of a broader strategy, taking into account other indicators, market news, and fundamental analysis. A balanced, holistic approach to trading invariably yields the best results.

Automating the Screening Process

1. The Role of the Bollinger Breakout Screener in Automation:

Automation in trading is all about reducing the manual effort involved in repetitive tasks and enhancing accuracy. The Bollinger Band Breakout Screener is designed to identify potential breakout points automatically. Instead of traders poring over countless charts to spot these crucial moments, the screener does the heavy lifting.

2. Setting Up Automatic Alerts:

One of the most significant advantages of the Screener is its capability to set up automatic alerts. These alerts can be configured to notify a trader the moment a potential breakout is detected. Whether it’s through a pop-up notification on your trading platform, an email, or a message on your mobile trading app, you’re instantly in the loop, enabling quick action.

3. Integrating with Trading Bots:

The modern trader often leverages trading bots to execute trades based on certain predefined conditions. With the Bollinger Breakout Screener, this becomes especially relevant. Once the screener identifies a potential breakout, it can send a signal to a trading bot to execute a trade. This ensures that the trader can capitalize on opportunities even if they aren’t actively monitoring the market.

4. Continuous Monitoring and Updates:

Automation doesn’t mean “set it and forget it.” The Bollinger Breakout Screener continuously monitors the markets across various timeframes. Whether you’re a day trader focusing on short intervals or a swing trader analyzing daily charts, the screener keeps scanning, ensuring no potential breakout goes unnoticed.

5. The Flexibility of Customization:

The Bollinger Breakout Screener isn’t a rigid tool. Modern iterations of the screener allow for customization. Traders can adjust the sensitivity of the breakout parameters, ensuring the screener aligns with their trading strategy. This ensures that alerts and automation are fine-tuned to individual trading styles.

6. The Balance of Automation and Manual Oversight:

While the Breakout Screener offers a high degree of automation, it’s vital for traders to maintain manual oversight. The screener provides data and potential signals, but market conditions, news events, and other external factors can influence trade outcomes. A balanced approach, where the screener’s insights are complemented by human judgment, often yields the best results.

Conclusion

The Bollinger Breakout Screener emerges as an invaluable tool in a trader’s arsenal. By efficiently identifying breakout scenarios, it saves time and introduces an element of objectivity into the trading process. However, like all tools, its efficiency lies in its user’s ability to wield it effectively. Continuous practice, refinement, and integration with other trading tools remain crucial for maximizing its potential.