Introduction

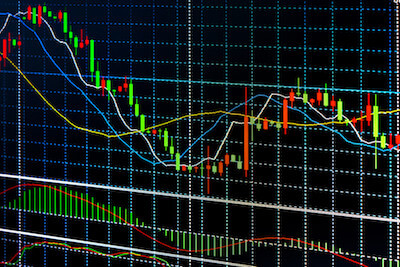

In the vast world of technical analysis, the Double Bollinger Band Strategy stands out as a versatile tool, enabling traders to better decipher market conditions. Its significance in the contemporary trading arena is unmatched, offering valuable insights into potential entry and exit points.

Understanding Bollinger Bands

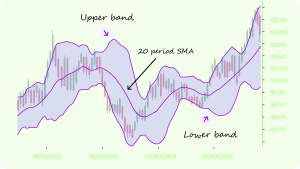

Before diving deep into the double strategy, let’s lay a foundation by understanding the basics of Bollinger Bands. They are a set of volatility bands placed above and below a moving average. While John Bollinger, the man behind this technique, designed these bands in the 1980s, their relevance remains potent even today. The bands consist of three main components: the middle, upper, and lower bands, effectively encapsulating price movements.

Delving into Double Bollinger Bands

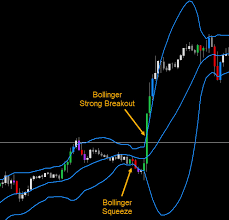

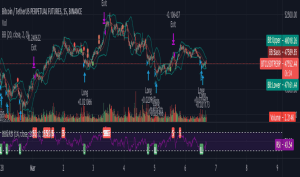

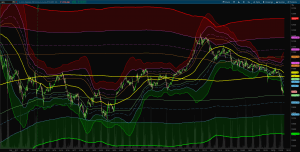

What elevates the Double Bollinger Band Strategy above its single counterpart? Essentially, it’s the addition of another set of bands. These bands, while rooted in the same principle, offer an enhanced lens through which traders can view market volatility and price action. To implement this on a chart, traders typically deploy two sets of Bollinger Bands, one with a standard deviation of 1 and another with a standard deviation of 2.

How the Double Bollinger Band Strategy Works

At its core, the Double Bollinger Band Strategy is designed to provide traders with a more detailed and expansive view of market volatility and potential price direction. By using two sets of Bollinger Bands, traders can determine and validate potential trade signals with increased accuracy. Let’s delve deeper into how the double bollinger band strategy functions, offering a unique advantage in the world of technical analysis.

Foundational Understanding

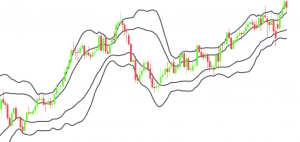

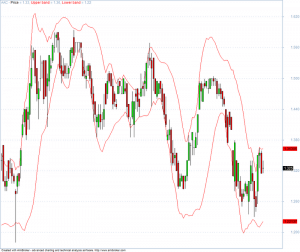

To appreciate the double bollinger band strategy, it’s essential to first grasp the basics of a single Bollinger Band. A typical Bollinger Band consists of a middle band being a simple moving average, and two outer bands that represent standard deviations away from this middle band. When prices fluctuate, the bands expand and contract, giving a visual representation of market volatility.

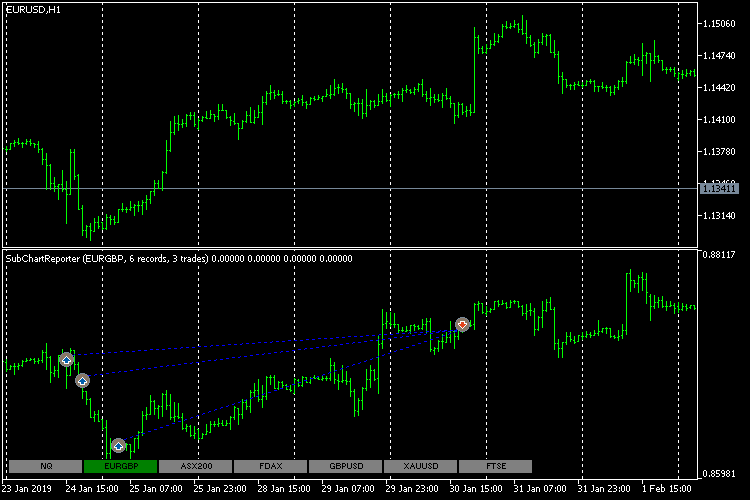

Implementing the Double Bands

The double bollinger band strategy essentially incorporates two distinct sets of Bollinger Bands. The first set uses a standard deviation of 1, while the second set uses a standard deviation of 2. This creates a multi-layered indicator where you have a total of five lines: two outer bands, two inner bands, and the middle simple moving average.

Identifying Trade Signals

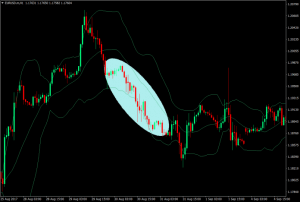

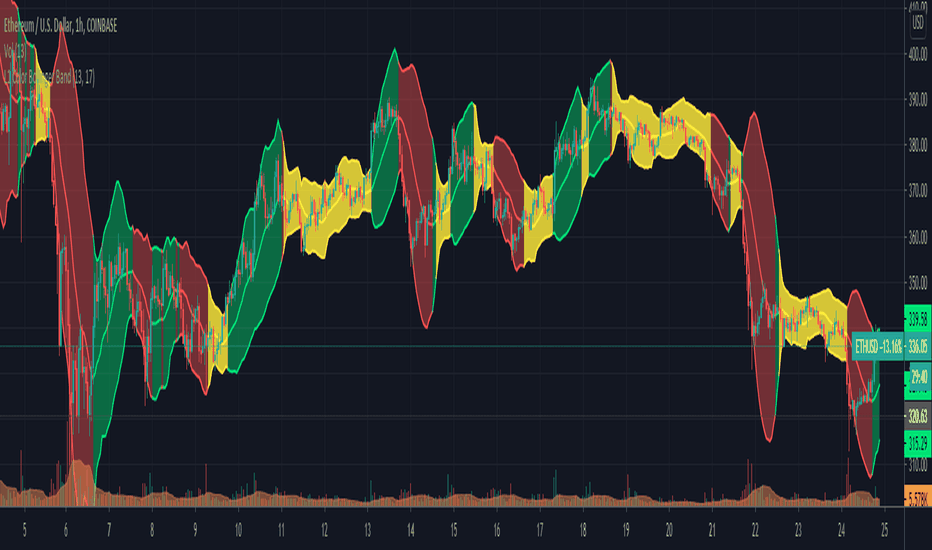

When utilizing the double bollinger band strategy, the outer bands – those linked with a standard deviation of 2 – act as territories that determine potential overbought or oversold market conditions. If the price touches or crosses these outer bands, it could be an indication that the market is reaching an extreme, and a reversal could be imminent.

On the other hand, the inner bands – associated with a standard deviation of 1 – play a crucial role in confirming potential trading signals. For example, if a price was to touch the outer upper band (indicating a potential overbought condition) and then recedes to interact with the inner upper band, this could be interpreted as a confirmation of a bearish reversal. Similarly, when prices touch the outer lower band and then rise to engage with the inner lower band, it could indicate a bullish reversal.

Maximizing the Strategy

One of the primary benefits of the double bollinger band strategy is its ability to reduce the risk of false signals. By providing an additional layer of validation, traders can make more informed decisions. For instance, if a trader is unsure about a potential bullish signal upon the price touching the outer lower band, they can wait for further confirmation when the price interacts with the inner band. This double-checking mechanism enhances the accuracy of trade entries and exits.

Fine-tuning the Approach

While the double bollinger band strategy is highly effective, traders might occasionally need to adjust the settings to better align with specific market conditions or assets they are trading. The beauty of this strategy is its adaptability. Traders can modify the period of the simple moving average or even the standard deviations based on their trading preferences, ensuring that the strategy remains relevant and effective across different scenarios.

Benefits of Using Double Bollinger Bands

The world of trading is replete with numerous techniques and strategies to help investors make informed decisions. One of the most formidable tools that have gained significant traction among traders is the double Bollinger band strategy. This strategy, which utilizes two sets of Bollinger bands with different standard deviations, offers a plethora of advantages. Let’s delve deeper into the multiple benefits of incorporating the double Bollinger band strategy into your trading routine.

- Enhanced Accuracy in Market Analysis The primary allure of the double Bollinger band strategy is its heightened accuracy. By having two sets of bands – one with a standard deviation of 1 and the other with a standard deviation of 2 – traders can achieve a more nuanced understanding of the market. The overlap and interaction between these bands provide a clearer picture of potential price movements and trend strengths.

- Improved Signal Confirmation With the double Bollinger band strategy, traders have an additional layer for confirming potential trade signals. When prices touch the outer bands, the inner bands serve as a zone of confirmation. If prices move into this inner zone following an interaction with the outer bands, it often signifies a robust continuation of the prevailing trend, giving traders an added assurance before making a trade decision.

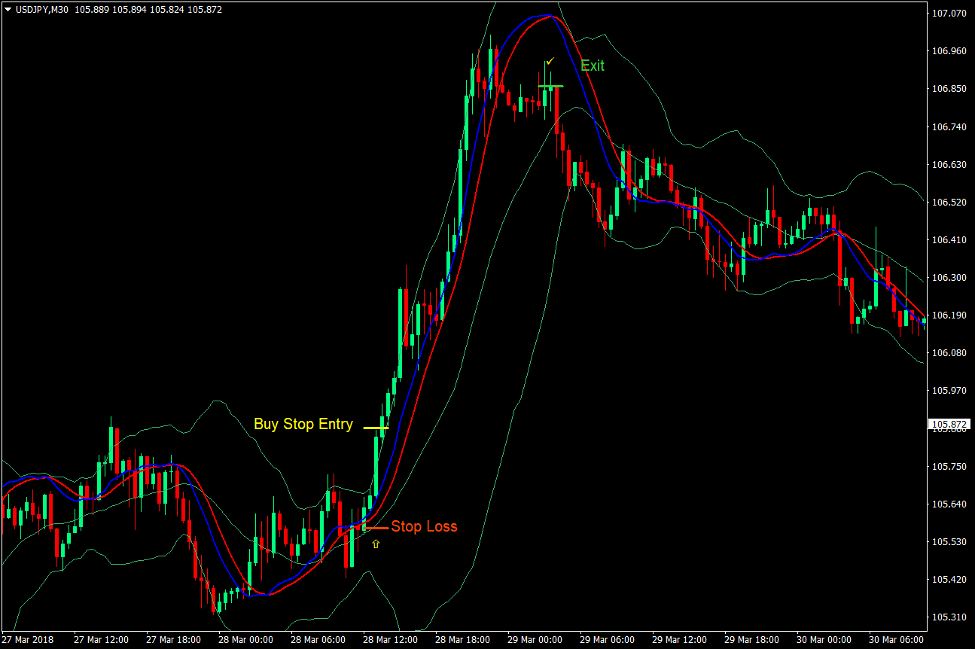

- Better Risk Management Incorporating the double Bollinger band strategy aids in superior risk management. By using both sets of bands, traders can set more accurate stop-loss and take-profit points. The bands essentially act as dynamic support and resistance levels, enabling traders to adjust their positions based on the evolving market conditions and thus minimize potential losses.

- Versatility Across Different Market Conditions One of the standout features of the double Bollinger band strategy is its versatility. Whether the market is trending or range-bound, this strategy offers valuable insights. In a trending market, the bands help in identifying the strength and direction of the trend, while in a sideways market, the interaction of prices with the bands can highlight potential breakout or breakdown points.

- Applicability Across Multiple Timeframes Whether you’re a day trader, swing trader, or a long-term investor, the double Bollinger band strategy is adaptable across various timeframes. This flexibility ensures that traders of all styles can harness the power of this strategy, tailoring it to their specific needs and trading goals.

- Reduced Likelihood of False Signals In the trading realm, false signals are a constant challenge. However, the double Bollinger band strategy, with its dual-layer of bands, significantly diminishes the chances of these misleading indications. By waiting for confirmations from the inner bands after price interactions with the outer bands, traders can filter out many of the false alarms that might lead to unprofitable trades.

Potential Pitfalls and How to Avoid Them

1. Over-reliance on the Indicator:

One of the most common missteps when using the Double Bollinger Band Strategy is placing undue trust in the bands alone. Traders sometimes assume that when the price touches or crosses a band, it’s an automatic signal for entry or exit. However, this strategy, like all technical indicators, should not be used in isolation.

Solution: Diversify your analysis. While the Double Bollinger Band Strategy is powerful, integrate it with other technical and fundamental indicators. Combining tools can offer a broader market perspective and reduce dependency on a single signal source.

2. Misinterpreting Volatility:

The Double Bollinger Band Strategy thrives on gauging volatility. However, heightened market volatility can sometimes produce erratic price movements that touch the outer bands frequently. These rapid movements can be mistaken for genuine trading signals.

Solution: Look for confirmations. If the market is particularly volatile, wait for the price to stabilize within the inner bands of the Double Bollinger Band Strategy before considering any trading decision. This patience can help filter out noise and improve trade accuracy.

3. Ignoring the Broader Trend:

In their pursuit of capturing short-term price movements, traders can sometimes neglect the overarching trend. For instance, while the Double Bollinger Band Strategy might suggest a temporary bullish move, the broader market could be in a prolonged bearish phase.

Solution: Always align the Double Bollinger Band Strategy with the bigger market picture. Before executing trades, step back and assess the macro trend. This ensures that you’re not trading counter to a dominant movement.

4. Lack of Flexibility:

Sticking rigidly to pre-defined settings in the Double Bollinger Band Strategy can occasionally backfire. Markets are dynamic, and what works under one set of conditions might falter under another.

Solution: Periodically review and adjust the standard deviation settings of your Double Bollinger Bands. By fine-tuning the strategy based on prevailing market conditions, you increase its effectiveness and adaptability.

5. Overtrading:

The granularity of insights provided by the Double Bollinger Band Strategy can sometimes spur traders to make more trades than necessary, thinking they’re capitalizing on every possible move.

Solution: Remember that quality trumps quantity. Rather than trying to catch every price movement suggested by the Double Bollinger Band Strategy, focus on more pronounced and confirmed signals. This reduces the risk of being caught in minor price fluctuations that lack substantial follow-through.

Steps to Implement the Double Bollinger Band Strategy

1. Choose Your Time Frame

Whether you’re a scalper, day trader, or a swing trader, the first step is to select the time frame that fits your trading style. The double Bollinger band strategy can be applied across various time frames, from the 1-minute chart up to the weekly. Your choice of time frame will influence the subsequent steps and the nature of the signals you’ll receive.

2. Setting Up Your Charting Tool

Once your time frame is set, it’s time to configure your charting software. Most modern charting platforms offer the Bollinger band indicator. For the double Bollinger band strategy, you’ll need to set up two sets of bands:

- The first set will have a period of 20 (default setting) with a standard deviation of 1. This represents the inner band.

- The second set, the outer band, will also have a period of 20 but with a standard deviation of 2.

Ensure both sets are visible and differentiated, perhaps by using contrasting colors.

3. Understanding the Signals

With your chart ready, familiarize yourself with the signals offered by the double Bollinger band strategy. Essentially:

- Prices touching the outer bands signify overbought (upper band) or oversold (lower band) conditions.

- A move from the outer to the inner band usually suggests a potential trend continuation.

4. Wait for Confirmations

The strength of the double Bollinger band strategy lies in its confirmations. Once the price touches an outer band, you should patiently wait for it to move towards the inner band. This movement often confirms the strength of the prevailing trend, be it bullish or bearish.

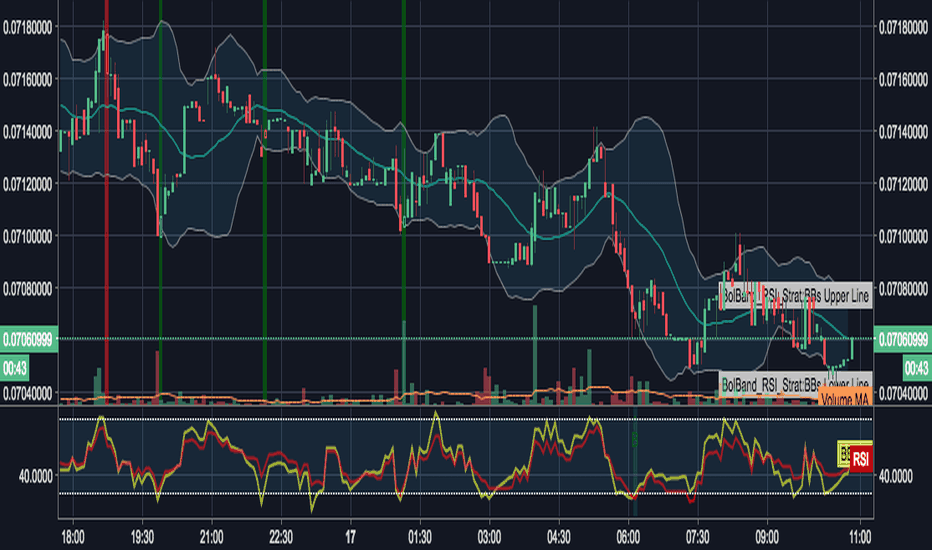

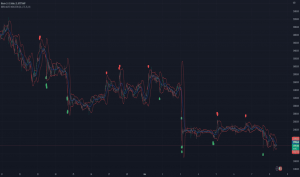

5. Combine with Other Indicators (Optional)

While the double Bollinger band strategy is powerful on its own, some traders opt to combine it with other technical indicators for added assurance. Common choices include the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). These can provide supplementary signals that align with the double Bollinger band strategy’s readings.

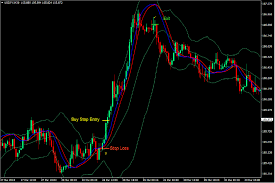

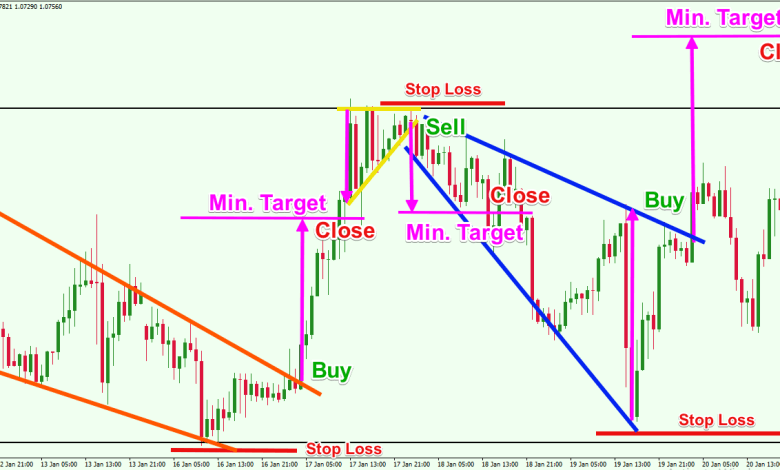

6. Entry and Exit Points

Once all conditions align:

- For a bullish trend: Consider entering a buy trade when the price, after touching the lower outer band, moves up to the lower inner band.

- For a bearish trend: Consider a sell entry when the price, after touching the upper outer band, drifts down to the upper inner band.

Your exit points should be determined based on your risk tolerance and trading goals. Some traders opt to exit once the price touches the opposite inner band, while others might wait for further confirmation.

7. Review and Adjust

The forex market is dynamic. Regularly review how the double Bollinger band strategy is serving you. Maybe certain currency pairs offer clearer signals, or perhaps specific time frames align better with your trading style. Stay flexible and adjust as needed.

Optimizing the Double Bollinger Band Strategy

The double Bollinger band strategy, by its very design, provides traders with a sophisticated tool to interpret price movements and volatility. Yet, as with all strategies, periodic optimization ensures that it remains in sync with the ever-evolving market dynamics. But how does one refine and adjust the double Bollinger band strategy to continue reaping its benefits? Let’s delve into that.

Understanding the Basics

The foundation of the double Bollinger band strategy lies in its two sets of Bollinger Bands, with different standard deviations, namely 1 and 2. These bands map out four crucial zones in the market – from strong bearish to strong bullish movements. Keeping these zones in sharp focus is essential for any optimization endeavor.

Market Condition Analysis

For starters, understanding the predominant market conditions is paramount. In a highly volatile market, the double Bollinger band strategy may present numerous potential trade signals as the price frequently touches and crosses the bands. Conversely, in a less volatile, ranging market, signals might be less frequent but can offer higher accuracy.

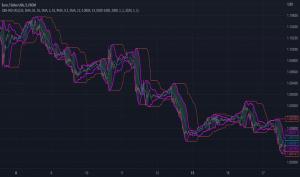

Adjusting the Time Frame

While many traders deploy the double Bollinger band strategy on daily charts, its versatility means it can be applied across multiple timeframes. Depending on your trading style – be it scalping, day trading, or swing trading – adjusting the timeframe can bring a fresh perspective and potentially more trade opportunities. Experimenting with different timeframes can reveal which one syncs best with your approach while leveraging the strengths of the double Bollinger band strategy.

Fine-Tuning the Deviations

The standard deviations of 1 and 2, defining the inner and outer bands respectively, are not set in stone. If you find that the price is too often breaching the outer bands or barely touching the inner bands, consider adjusting the deviations. This doesn’t mean a drastic change but maybe tweaking it to 1.1 or 1.9 can make all the difference in capturing optimal trade setups.

Combining with Other Indicators

One of the potent ways to enhance the effectiveness of the double Bollinger band strategy is to complement it with other technical indicators. For instance, integrating a momentum indicator can help confirm if a perceived trend has the strength to sustain. Or, using a volume indicator can validate if a breakout is backed by significant trading activity. The key is not to clutter the chart but to use complementary tools that reinforce the insights provided by the double Bollinger band strategy.

Regular Backtesting

Any optimization effort should be rooted in data. Periodically backtesting the double Bollinger band strategy ensures that the tweaks and adjustments align with the desired outcomes. It offers insights into what’s working and what needs further refinement.

Staying Educated and Updated

Lastly, the world of trading is in constant flux. New techniques, tools, and algorithms are continually emerging. By staying educated and updated, you can harness the latest methodologies to fine-tune the double Bollinger band strategy, ensuring that it remains a robust and reliable tool in your trading arsenal.

Conclusion

The Double Bollinger Band Strategy is a formidable tool in a trader’s arsenal. Its ability to encapsulate price movements and market volatility offers traders a unique vantage point. While its merits are many, remember to always integrate it within a broader, well-structured trading plan. After all, in the dynamic world of trading, adaptability and a holistic approach often pave the way to success.