Introduction

MetaTrader 5 (MT5) is a popular trading platform used by forex traders worldwide. One important consideration when choosing a broker for MT5 trading is the minimum deposit requirement. In this comprehensive guide, we will delve into the significance of the minimum deposit, explore the requirements of popular MT5 brokers, discuss the benefits of a reasonable minimum deposit, factors influencing deposit amounts, finding the right balance between minimum deposit and broker reliability, managing the deposit effectively, considerations for beginners, and alternative options for traders with limited capital.

Understanding Minimum Deposit in MetaTrader 5

A minimum deposit refers to the initial amount of money that traders must deposit into their trading account to start trading on the MT5 platform. This requirement varies among brokers and is an essential factor to consider when selecting a broker. The minimum deposit plays a crucial role in accessibility, platform exploration, and risk management.

Minimum Deposit Requirements in Popular MT5 Brokers

Different MT5 brokers have varying minimum deposit requirements. It is important to compare and evaluate these requirements before making a decision. Factors that influence minimum deposit amounts include broker regulations, account types, and additional services provided. Traders should consider these requirements to find a broker that aligns with their financial capabilities and trading goals.

Benefits of a Reasonable Minimum Deposit

A reasonable minimum deposit offers several benefits to traders:

Accessibility for Traders with Limited Capital

A reasonable MetaTrader 5 minimum deposit requirement enhances accessibility for traders with limited capital. Not everyone has substantial funds to invest in trading, especially when starting out. By setting a reasonable MetaTrader 5 minimum deposit, brokers allow individuals with smaller account sizes to participate in the forex market and access the advanced features and tools offered by the platform.

For example, imagine a trader who is interested in exploring the potential of forex trading but has limited funds available. A reasonable MetaTrader 5 minimum deposit requirement, such as $100 or $200, enables them to open an account and start trading. This accessibility provides an opportunity for individuals with smaller budgets to enter the market, learn, and potentially grow their capital over time.

2. Opportunity to Explore the MetaTrader 5 Platform and its Features

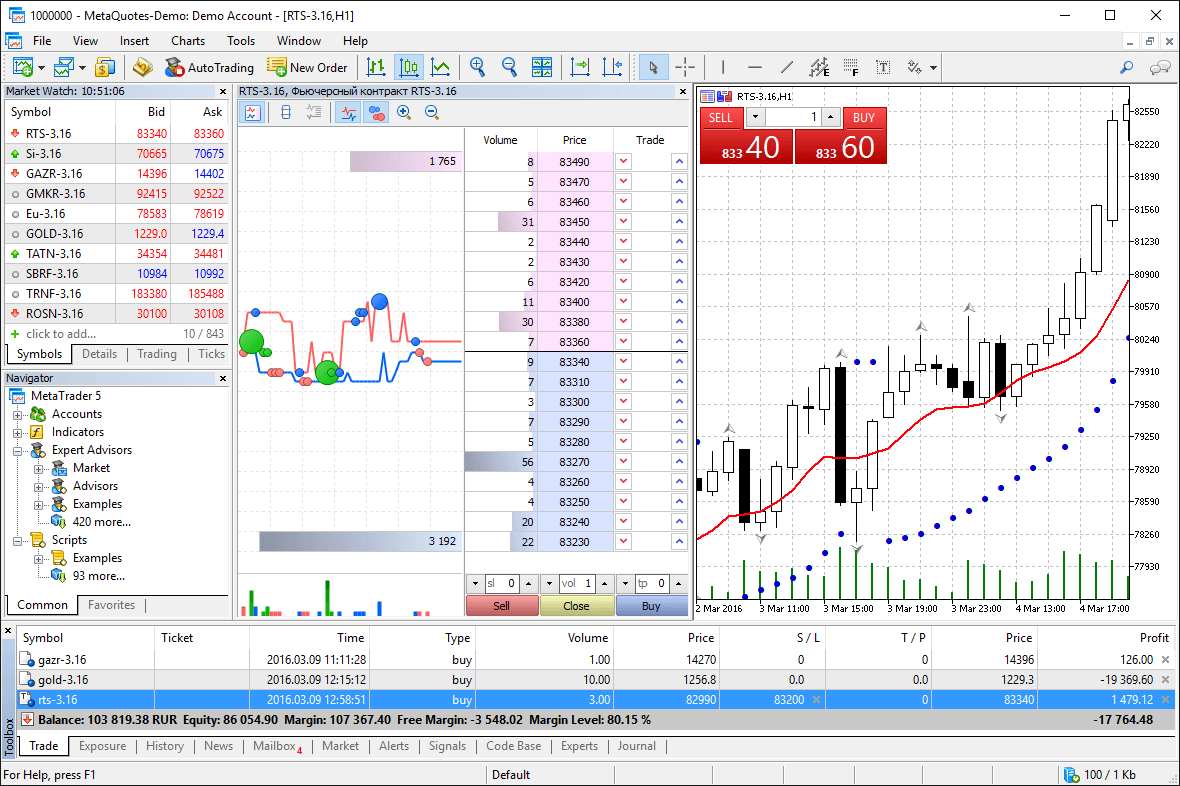

The MetaTrader 5 platform is renowned for its comprehensive set of features and advanced trading tools. It offers a wide range of charting capabilities, technical indicators, customizable trading strategies, and automated trading options. By setting a reasonable MetaTrader 5 minimum deposit, brokers allow traders to explore and take full advantage of the functionalities offered by the platform.

When traders have access to the MetaTrader 5 platform through a reasonable minimum deposit, they can familiarize themselves with the user interface, experiment with different technical indicators, test automated trading strategies, and gain a deeper understanding of the platform’s capabilities. This hands-on experience with MetaTrader 5 can significantly enhance their trading skills and knowledge, leading to better decision-making and improved trading outcomes.

3. Flexibility in Managing Risk and Position Sizing

A reasonable MetaTrader 5 minimum deposit requirement provides traders with flexibility in managing risk and position sizing. Risk management is a critical aspect of successful trading, and having the ability to adjust trade sizes according to individual risk tolerances is vital.

With a reasonable MetaTrader 5 minimum deposit, traders can allocate their capital more effectively and adopt proper risk management techniques. They have the freedom to adjust position sizes based on their risk appetite, which allows for a more controlled and balanced approach to trading. This flexibility enables traders to implement strategies that align with their risk management preferences, helping to protect their capital while seeking profitable trading opportunities.

Factors Influencing Minimum Deposit Amounts

Several factors influence the minimum deposit requirements set by brokers:

MetaTrader 5 (MT5) is a widely used trading platform that requires a minimum deposit for account activation. Understanding the factors that influence MetaTrader 5 minimum deposit amounts is essential for traders. In this comprehensive guide, we will explore the key factors that impact minimum deposit requirements, including broker regulations, trading account types and features, additional services, market competition, and risk management considerations. By understanding these factors, traders can make informed decisions and choose a broker that aligns with their financial capabilities and trading objectives.

Broker Regulations and Licensing Requirements

One of the primary factors affecting MetaTrader 5 minimum deposit requirements is broker regulations and licensing requirements. Regulatory bodies, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), enforce standards and guidelines to ensure a fair and transparent trading environment. Compliance with these regulations often leads to higher minimum deposit requirements to meet financial obligations and enhance client protection. Brokers adhering to strict regulations may set higher minimum deposit requirements to maintain sufficient capital reserves and implement robust risk management systems, as mandated by regulatory authorities such as the FCA or ASIC.

Trading Account Types and Features

Different trading account types and features offered by brokers can significantly influence MetaTrader 5 minimum deposit amounts. Brokers typically provide various account options tailored to meet the diverse needs of traders. Basic or standard accounts generally have lower minimum deposit requirements, while premium or VIP accounts with enhanced features may require a higher minimum deposit. Premium accounts often provide traders with access to additional tools, lower spreads, priority customer support, and personalized services. As a result, brokers may set higher minimum deposit requirements to cater to the more experienced or high-volume traders who opt for these premium account types.

Additional Services and Trading Conditions

The availability of additional services and trading conditions can also impact MetaTrader 5 minimum deposit requirements. Brokers offering comprehensive services, such as research tools, educational resources, market analysis, or premium features like social trading platforms or copy trading, may require a higher minimum deposit. These additional services entail costs for the broker, and setting a higher minimum deposit ensures that traders utilizing these services have a sufficient trading capital. Traders should evaluate the value of these services in relation to their trading needs and carefully assess the overall trading conditions, including spreads, commissions, and leverage offered by the broker, to fully understand the costs associated with trading beyond the minimum deposit requirement.

Market Competition and Broker Strategy

Market competition among brokers can influence the minimum deposit amounts for MetaTrader 5 accounts. In a highly competitive market, brokers may adjust their minimum deposit requirements to attract a specific segment of traders. Some brokers may choose to offer lower minimum deposits to appeal to retail traders or beginners in order to expand their client base. Conversely, brokers targeting professional or institutional traders may set higher minimum deposits to cater to their specific needs and requirements. Traders should be cautious when comparing brokers solely based on minimum deposit amounts, as it is crucial to evaluate the overall offering, including the quality of services, trading conditions, regulatory compliance, and the broker’s overall reliability.

Market Volatility and Risk Management

Market volatility and risk management considerations indirectly impact MetaTrader 5 minimum deposit requirements. During periods of high volatility, brokers may require higher minimum deposits to ensure that traders have sufficient capital to withstand potential market swings and manage their risk effectively. Increased market volatility can result in wider spreads, increased margin requirements, and higher risks. By setting higher minimum deposit requirements, brokers aim to protect both the traders and themselves from potential excessive losses and account defaults during turbulent market conditions.

Finding the Right Balance: Minimum Deposit vs. Broker Reliability

While minimum deposit is an important factor, it should not be the sole criterion when choosing a broker. It is crucial to assess the reliability and reputation of the broker beyond the minimum deposit requirement. Traders should consider factors such as regulatory compliance, execution quality, customer support, and overall trading conditions to ensure a safe and secure trading environment.

Tips for Managing Minimum Deposit Effectively

1. Set Realistic Expectations

When trading with a limited MetaTrader 5 minimum deposit, it is crucial to set realistic expectations. Understand that a smaller deposit may limit the number of trades or the size of positions that can be taken. By acknowledging the limitations of the MetaTrader 5 minimum deposit, traders can avoid taking excessive risks or expecting unrealistic profits.

2. Practice Effective Risk Management

Proper risk management is vital for traders of all levels, especially when dealing with the MetaTrader 5 minimum deposit. Consider implementing the following risk management techniques:

- Use Stop-Loss Orders: Set stop-loss orders for every trade to define the maximum loss you are willing to tolerate. This helps limit potential losses and protects your account from significant drawdowns, even with the MetaTrader 5 minimum deposit.

- Implement Position Sizing: Determine the appropriate position size based on your risk tolerance and the size of your MetaTrader 5 minimum deposit. Avoid overexposure by risking only a small percentage of your account balance on each trade.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket. Diversify your trades across different currency pairs or other financial instruments to spread risk and minimize the impact of individual trades, even with the MetaTrader 5 minimum deposit.

3. Focus on High-Probability Trades

With the MetaTrader 5 minimum deposit, it is crucial to focus on high-probability trades that offer a favorable risk-to-reward ratio. Conduct thorough technical and fundamental analysis using the tools available in MetaTrader 5 to identify trading opportunities with higher chances of success, even with the MetaTrader 5 minimum deposit.

4. Utilize Leverage Wisely

Leverage can amplify both potential profits and losses, and it is important to use it wisely, even with the MetaTrader 5 minimum deposit. While leverage allows traders to control larger positions with a smaller deposit, it also increases risk. Exercise caution when using leverage and ensure that you fully understand the implications, including the potential impact on your MetaTrader 5 minimum deposit.

5. Take Advantage of Demo Trading

Before risking real money, utilize the demo trading feature available in MetaTrader 5 to practice and refine your trading strategies. Demo trading allows you to test your approach in a risk-free environment using virtual funds. Use this opportunity to familiarize yourself with the platform, test different trading strategies, and gain confidence before committing your MetaTrader 5 minimum deposit.

6. Continuously Educate Yourself

Invest in your trading education to enhance your skills and knowledge, even with the MetaTrader 5 minimum deposit. Stay updated with market news, economic events, and industry trends. MetaTrader 5 provides access to educational resources, webinars, and trading forums, allowing you to expand your understanding of the markets and refine your trading strategies, even with the MetaTrader 5 minimum deposit.

7. Regularly Evaluate and Adjust

Review your trading performance regularly and make adjustments as needed, even with the MetaTrader 5 minimum deposit. Analyze your trades, identify strengths and weaknesses, and learn from your experiences. Continuously refine your strategy based on your performance and adapt to changing market conditions, taking into account the MetaTrader 5 minimum deposit.

Additional Considerations for Beginners

For beginners in forex trading, navigating the world of MetaTrader 5 (MT5) and understanding the minimum deposit requirement in MetaTrader 5 is crucial. The MetaTrader 5 minimum deposit serves as a starting point for new traders, allowing them to access the MT5 platform and begin their trading journey. Here are some additional considerations that beginners should keep in mind when it comes to MetaTrader 5 minimum deposit:

1. Importance of Education and Demo Trading

Before committing a significant amount of capital, beginners should prioritize education and gaining practical experience through demo trading. Utilizing the educational resources provided by brokers, such as tutorials, webinars, and trading guides, can help beginners understand the various features and functionalities of the MetaTrader 5 platform. Demo trading allows them to practice their strategies and get familiar with the platform’s interface without risking real money.

By dedicating time to education and demo trading, beginners can build a strong foundation of knowledge and gain confidence in their trading abilities. This process helps them make informed decisions and reduces the risk of making costly mistakes early on.

2. Seeking Brokers with Educational Resources and Support

To support their learning journey, beginners should consider choosing brokers that offer comprehensive educational resources and support. These resources may include educational articles, video tutorials, and regular webinars conducted by experienced traders. Such materials can provide valuable insights into trading concepts, technical analysis, risk management strategies, and more.

Additionally, brokers with dedicated customer support teams can be beneficial for beginners who may have questions or need assistance with the MetaTrader 5 platform. Prompt and reliable support can help beginners navigate any challenges they may encounter during their trading journey.

3. Starting with a Lower MetaTrader 5 Minimum Deposit

For beginners, it is often recommended to start with a lower MetaTrader 5 minimum deposit when opening a trading account. This approach allows them to familiarize themselves with the trading environment and gain practical experience without committing a substantial amount of capital. Starting with a lower MetaTrader 5 minimum deposit enables beginners to manage their risk more effectively and learn from their trading activities without significant financial pressure.

As beginners become more comfortable with the MetaTrader 5 platform and gain confidence in their trading abilities, they can consider gradually increasing their MetaTrader 5 minimum deposit amounts. This gradual approach allows them to assess their progress, adjust their strategies, and gradually scale up their trading activities.

4. Balancing Risk and Reward

While beginners may be eager to start trading, it is important to strike a balance between risk and reward. The MetaTrader 5 minimum deposit serves as a risk management tool, ensuring that traders have a sufficient amount of capital to withstand potential losses. Beginners should approach trading with a disciplined mindset, setting realistic profit targets and adhering to proper risk management techniques.

By carefully managing risk and focusing on consistent and controlled trading, beginners can develop a solid foundation for long-term success. It is crucial to avoid excessive risk-taking and maintain a prudent approach to protect their MetaTrader 5 trading capital.

Alternative Options for Traders with Limited Capital

For traders with limited capital, there are alternative options available in MetaTrader 5 that can enable participation in the forex market without the need for a substantial initial deposit. These options cater to individuals who want to start trading with smaller amounts or those who are still exploring the forex market. By utilizing these alternatives, traders can gain valuable experience, refine their trading skills, and gradually increase their capital over time. Here are several alternative options to consider:

- Micro and Nano Accounts: Many brokers offer micro and nano accounts within the MetaTrader 5 platform, allowing traders to start with a significantly smaller minimum deposit compared to standard accounts. These accounts are designed to accommodate traders with limited capital and offer reduced contract sizes. With a micro or nano account, traders can execute trades with a lower financial commitment, making it an attractive option for beginners or those with limited funds. These account options are particularly beneficial for traders looking to get started with MetaTrader 5 minimum deposit requirements.

- Forex Bonus Promotions and Welcome Offers: Some brokers provide bonus promotions or welcome offers that can boost a trader’s initial capital. These promotions may include deposit bonuses, trading credits, or cashback incentives. By taking advantage of these offers, traders can supplement their account balance and increase their trading opportunities without depositing additional funds. However, it’s important to carefully review the terms and conditions associated with bonus promotions to understand any requirements or restrictions. Forex bonus promotions and welcome offers are an excellent way to maximize the potential of your MetaTrader 5 minimum deposit.

- Social Trading Platforms and Copy Trading: Social trading platforms integrated within MetaTrader 5 offer an innovative solution for traders with limited capital. These platforms allow users to connect with experienced traders and copy their trades in real-time. By following successful traders and replicating their trading strategies, individuals with limited capital can participate in the forex market and potentially generate profits. Social trading platforms provide an opportunity to learn from experienced traders, observe their decision-making process, and gain valuable insights into the dynamics of the market. Social trading platforms are particularly helpful for traders who want to make the most of their MetaTrader 5 minimum deposit.

- Forex Trading Contests: Some brokers organize trading contests within the MetaTrader 5 platform, where traders can compete with each other for cash prizes or other rewards. These contests often have low entry fees, making them accessible to traders with limited capital. Participating in trading contests can not only provide an opportunity to win prizes but also serve as a platform to showcase trading skills, learn from other participants, and gain exposure within the trading community. Forex trading contests are an exciting way to make the most of your MetaTrader 5 minimum deposit.

- Investment Pools and Managed Accounts: Investment pools or managed accounts are options for traders who prefer a more hands-off approach or lack the time and expertise to actively trade. These services allow traders to pool their funds with a professional trader or investment firm who will make trading decisions on their behalf. The minimum deposit requirements for investment pools or managed accounts can vary, but they often provide access to experienced traders and the potential for returns without requiring extensive trading knowledge. Investment pools and managed accounts are excellent options to explore when considering your MetaTrader 5 minimum deposit.

Conclusion

Understanding the minimum deposit requirement in MetaTrader 5 is crucial for selecting a suitable broker and accessing the MT5 platform. While the minimum deposit plays a significant role in accessibility and risk management, it should be considered alongside other important factors such as broker reliability and trading conditions. By managing the minimum deposit effectively, considering alternative options, and focusing on continuous learning, traders can navigate the forex market with confidence and maximize their trading potential.