Introduction

Welcome to the world of investing in S&P 500 Index ETF, better known as SPY, using one of the most comprehensive trading platforms out there, TradingView. SPY trading has always been popular among traders due to the ETF’s diverse exposure to the S&P 500’s top companies. TradingView, on the other hand, provides an array of features that can optimize your trading experience with SPY. Let’s delve deeper into the realm of SPY TradingView strategies to harness the potential of this unique combination.

Understanding SPY

When it comes to the world of Exchange Traded Funds (ETFs), the SPDR S&P 500 ETF, colloquially known as SPY, stands out as one of the most prominent. SPY essentially tracks the S&P 500 Index, which comprises 500 of the largest U.S. companies. For investors using SPY TradingView, understanding the basics of SPY is the first step towards becoming a proficient trader.

To get the best out of your SPY TradingView experience, it’s essential to grasp what SPY represents. Unlike trading individual stocks, trading SPY gives you exposure to a vast range of sectors and companies. This is because the S&P 500 Index, which SPY mirrors, is constructed to be representative of the US economy. As such, investing in SPY is akin to investing in the U.S. stock market as a whole.

This wide exposure is one of the reasons why SPY is a popular choice for both beginners and seasoned traders on SPY TradingView. For beginners, it provides a relatively easy and less risky entry point into the stock market. On the other hand, for seasoned traders, SPY offers a convenient way to gain broad market exposure without investing in individual stocks.

SPY is particularly appealing because it allows for various investment strategies. Whether you’re a long-term investor aiming for steady growth or a short-term trader seeking to capitalize on market volatility, SPY TradingView can accommodate your strategy. SPY’s liquidity and tight bid-ask spreads also make it an attractive option for day trading.

Moreover, through SPY TradingView, you get access to comprehensive market data and technical analysis tools, which can be instrumental in making informed trading decisions. Whether you’re analyzing SPY’s price trends, comparing it to other ETFs or indices, or setting up price alerts, TradingView has the tools you need.

However, it’s important to remember that while SPY offers a broad market representation, it’s not without risk. Factors such as market volatility, economic downturns, and interest rate changes can all impact SPY’s value. As with any investment, it’s crucial to perform thorough research and analysis before diving in.

Fortunately, with SPY TradingView, you have a robust platform that not only allows you to trade but also aids in understanding market trends and managing potential risks. The combination of SPY’s market coverage and TradingView’s analytical depth forms a solid foundation for a successful trading journey.

Connecting SPY with TradingView

The first step in successfully navigating the financial markets is having the right tools at your disposal. That’s where TradingView comes in. It’s a comprehensive, user-friendly platform with a wealth of features that make it easier to access, analyze, and trade a wide range of financial instruments, including the SPDR S&P 500 ETF Trust, or SPY.

Initiating the process of SPY TradingView is remarkably straightforward. Simply enter ‘SPY’ into TradingView’s search bar, and you’re presented with an array of information. This includes real-time and historical price data, detailed charts, and a host of technical analysis tools. These resources offer an unparalleled insight into the SPY’s performance, helping traders to make informed investment decisions.

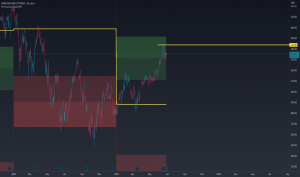

TradingView’s charting functionality is particularly well suited to SPY TradingView. It allows traders to visualize SPY’s price movements over time, which can reveal patterns and trends that may influence future performance. Traders can apply various chart types, like candlestick, line, or bar charts, each providing a different perspective on price data.

Moreover, in the world of SPY TradingView, technical analysis tools are essential. Indicators such as Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI) can provide insights into SPY’s momentum, volatility, and other market dynamics. TradingView offers these and many other indicators, providing traders with a complete toolkit to analyze and forecast SPY’s movements.

Another significant benefit of SPY TradingView is the ability to place trades directly through the platform. Depending on the broker, you can use TradingView’s platform to execute your SPY trades. This seamless integration between analysis and execution can streamline your trading process and help you capitalize on market opportunities more efficiently.

Additionally, SPY TradingView offers a social networking component, bringing together a community of traders who share insights, strategies, and ideas about a variety of financial instruments, including SPY. Here, you can learn from others, validate your strategies, and stay updated with market trends.

SPY Trading Strategies on TradingView

To make the most out of SPY TradingView, you need to leverage both basic technical analysis and advanced techniques. Whether you’re a novice trader or seasoned expert, these strategies can be a crucial part of your trading arsenal.

Basic Technical Analysis for SPY Trading

As a foundation for SPY trading, understanding basic technical analysis is vital. Let’s take a deeper look at three key components.

- Price Action Analysis:

A fundamental aspect of SPY TradingView is the ability to analyze the price action of SPY. This involves studying the historical price movements of the ETF and identifying certain patterns that could indicate future price directions. With TradingView’s advanced charting features, you can easily plot SPY’s price action over various timeframes, ranging from minutes to years, to help forecast where prices might be headed.

- Trend Analysis:

When trading SPY on TradingView, one strategy that often yields results is trend analysis. This involves identifying the general direction in which SPY’s price is moving – upward (bullish trend) or downward (bearish trend). TradingView provides several trend identification tools, including trend lines and moving averages, to help spot these trends and make informed trading decisions.

- Moving Averages:

Another valuable tool in the SPY TradingView toolkit is the use of moving averages. A moving average smooths out price data by creating a constantly updated average price, helping you to identify SPY’s price momentum and directional trend. TradingView allows you to easily apply various types of moving averages to your SPY chart.

Advanced Techniques for SPY Trading

Once you’ve got a grip on basic technical analysis, TradingView offers more advanced techniques that you can integrate into your SPY TradingView strategy. These include:

- Volume Analysis:

One of the more sophisticated techniques for trading SPY on TradingView is volume analysis. This involves observing the number of shares traded during a particular period. A high trading volume often indicates strong investor interest and can be associated with the start of new trends. TradingView provides easy-to-read volume bars and indicators that can aid in this analysis.

- Relative Strength Index (RSI):

The RSI is a momentum oscillator that measures the speed and change of price movements, helping to identify overbought or oversold conditions. On SPY TradingView, you can use the RSI to gauge the momentum of SPY’s price movements and predict potential reversals.

- Fibonacci Retracement:

Traders often use Fibonacci retracements to identify potential levels of support and resistance. By applying this tool on TradingView to your SPY chart, you can identify strategic points for setting buy or sell orders.

Crafting a Coherent SPY Trading Strategy

The best SPY TradingView strategy is one that blends both basic and advanced techniques based on your comfort level, risk tolerance, and trading goals. The versatility of TradingView’s platform allows you to tailor these techniques to your specific needs, optimizing your chances for successful SPY trades.

Risk Management in SPY Trading

Managing risk is a fundamental aspect of any form of trading, including trading SPY on TradingView. As SPY represents a broad spectrum of the stock market, understanding how to manage risk in this environment is crucial. Effective risk management in SPY TradingView can mean the difference between sustained success and detrimental losses.

Understanding the Nature of SPY

First, to manage risk in SPY TradingView, it’s necessary to understand the nature of SPY. As an ETF that tracks the S&P 500, SPY’s performance mirrors the general market conditions. This means that if the market is doing well, SPY is likely to do well. Conversely, if the market is struggling, SPY is likely to reflect that downturn.

The inherently diversified nature of SPY can be both a blessing and a curse. On one hand, because SPY comprises 500 different companies, individual company risk is significantly mitigated. On the other hand, this diversification means that SPY is exposed to the full range of market risks, including economic downturns, policy changes, and other macroeconomic factors.

Setting Stop-Loss Orders in SPY TradingView

One of the most straightforward ways to manage risk when trading SPY on TradingView is by setting stop-loss orders. A stop-loss order is a trade order to sell a security when it reaches a certain price and is designed to limit an investor’s loss on a security position. In the case of SPY TradingView, you can set a stop-loss order at a certain price point to ensure you don’t sustain significant losses if SPY’s price drops.

Portfolio Diversification

Although SPY is already a diversified investment, it’s essential not to put all your eggs in one basket when trading on TradingView. Consider diversifying your portfolio with other securities to manage risk effectively. This can include other ETFs, bonds, commodities, or even cash. A well-diversified portfolio can better weather market fluctuations and protect against losses.

Limiting Capital Exposure in SPY TradingView

Another strategy for managing risk when trading SPY on TradingView is to limit your capital exposure. This means not investing more money than you can afford to lose. Even though SPY TradingView provides opportunities for significant returns, it’s essential to remember that losses are also possible. By only investing what you’re willing to lose, you can ensure that a poor trade doesn’t have a devastating impact on your financial situation.

Keeping a Close Eye on Broader Market Trends

Because SPY’s performance is tied to the broader market, keeping a close eye on macroeconomic indicators can help manage risk. This involves following financial news, understanding economic policies, and being aware of significant events that could impact the market. Monitoring these factors can help you anticipate potential downturns and adjust your SPY TradingView strategy accordingly.

Navigating Market Conditions

Understanding and navigating market conditions is an integral part of using SPY TradingView. Because SPY, or the S&P 500 ETF, represents a large cross-section of the economy, its performance is influenced by the broader market conditions. By using TradingView’s robust tools and resources, traders can assess these conditions more accurately and formulate effective strategies.

One of the critical aspects of navigating market conditions using SPY TradingView is monitoring the economic indicators. These indicators, such as GDP, unemployment rates, or consumer confidence indices, can provide valuable insights into the current state of the economy. For example, a rise in GDP might signal a growing economy, potentially leading to an increase in SPY’s value. Similarly, a high unemployment rate might indicate economic distress, potentially causing a drop in SPY’s value. Keeping an eye on these indicators can help traders predict potential price movements in SPY.

Another key aspect of navigating market conditions with SPY TradingView involves understanding market trends. Market trends refer to the general direction in which the price of an asset or a market is moving. Traders often classify trends as upward (bullish), downward (bearish), or sideways (range-bound). Identifying the trend is essential as it allows traders to align their trading strategy with the market’s direction. For instance, in a bullish trend, traders might consider buying SPY, while in a bearish trend, they might consider selling or shorting SPY.

But what if the market is volatile? Market volatility refers to the rate at which the price of an asset increases or decreases for a set of returns. It is usually measured by the standard deviation of the returns. Navigating volatile market conditions can be challenging, but SPY TradingView can be a useful tool during such times. For instance, traders can use TradingView’s charting features to identify technical patterns that might occur more frequently during periods of high volatility. These patterns can guide traders on potential entry or exit points.

Moreover, risk management is even more crucial during volatile market conditions. By setting stop-loss orders and only risking a small percentage of their trading capital on any single trade, traders can limit their potential losses.

Last but not least, understanding market sentiment is also crucial when navigating market conditions with SPY TradingView. Market sentiment refers to the overall attitude of investors towards a particular market or asset. When the majority of traders are optimistic about SPY, the market sentiment is said to be bullish. Conversely, when most traders are pessimistic about SPY, the market sentiment is said to be bearish. Traders can gauge market sentiment through various indicators available on TradingView, such as the Fear & Greed Index or the Market Sentiment widget.

The Future of SPY Trading

As we propel further into the 21st century, the future of trading the SPY ETF (SPY trading) presents an intriguing combination of traditional practices and novel technologies. Driven by the constant evolution of financial markets and the increasing sophistication of trading platforms such as TradingView, SPY trading is set to undergo substantial transformations in the years to come.

The first significant aspect to consider in the future of SPY TradingView practice is the ongoing development of financial technology (fintech). With the rise of artificial intelligence (AI), big data, and machine learning, the tools available to traders will continue to evolve, offering more sophisticated ways to analyze and predict market trends. Traders using SPY TradingView will likely have access to AI-powered trading algorithms and predictive models to inform their decisions, potentially automating certain aspects of trading and creating more efficient ways to manage portfolios.

The role of blockchain technology and cryptocurrencies in the financial world could also have a ripple effect on SPY trading. Blockchain’s transparency, security, and decentralized nature have already started transforming various areas of finance. It might be that in the future, platforms like SPY TradingView will integrate blockchain technology to offer enhanced security and efficiency in transactions.

Another crucial aspect to ponder in the future of SPY TradingView is the role of regulatory changes. As global economies continue to intertwine and digital trading platforms grow, it’s likely that new regulations will be implemented to ensure market fairness and stability. Traders should anticipate these changes and understand how they may impact their SPY trading strategies.

The SPY TradingView duo’s future also promises a shift towards more sustainable and socially responsible investing. With increasing awareness of environmental, social, and governance (ESG) factors in the investing community, SPY ETF itself might undergo changes in its composition to reflect these values. Traders will need to monitor these changes and adjust their strategies accordingly.

Conclusion

The combination of SPY TradingView is a powerful tool for any trader. The comprehensive nature of SPY, coupled with the extensive features of TradingView, creates a trading experience that is both diverse and enriched. Although navigating the realms of SPY trading may seem daunting initially, with careful analysis, strategic planning, and effective risk management, anyone can turn it into a profitable endeavor. Remember, the world of trading is constantly evolving, and so should you as a trader. Happy trading!