Introduction

Trading Central Gold is a powerful platform that provides valuable analysis and insights for gold trading. In this comprehensive guide, we will explore the world of gold trading and delve into the features, tools, and resources offered by Trading Central Gold. Discover how this specialized platform empowers traders to make informed decisions and maximize their success in gold trading.

Understanding Gold Trading

Gold has been a coveted asset for centuries, known for its intrinsic value and as a hedge against economic uncertainties. In this section, we will explore the fundamentals of gold trading, including the factors influencing gold prices and market trends. Understanding the dynamics of the gold market is essential for successful trading.

Introduction to Trading Central Gold

Trading Central Gold is a leading platform dedicated to providing advanced analysis and insights specifically tailored for gold traders. This section will introduce Trading Central Gold, highlighting its key features and benefits. Traders can leverage this platform to access expert analysis, technical indicators, and comprehensive reports designed to enhance their gold trading strategies.

Technical Analysis in Gold Trading

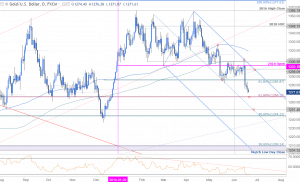

Technical analysis plays a pivotal role in the world of gold trading, providing traders with valuable insights into price movements, trends, and potential entry and exit points. Trading Central Gold offers a comprehensive range of technical analysis tools and indicators specifically designed for gold traders. By leveraging these tools, traders can enhance their understanding of the gold market and make informed trading decisions.

- Understanding Technical Analysis

Technical analysis involves studying historical price and volume data to forecast future market movements. It is based on the premise that market trends repeat themselves, and past price patterns can provide insights into future price behavior. Traders using Trading Central Gold have access to a wide array of technical analysis tools, including indicators, chart patterns, and oscillators.

- Key Technical Indicators for Gold Trading

Trading Central Gold offers a variety of technical indicators that are highly relevant to gold trading. These indicators help traders identify potential entry and exit points, gauge market sentiment, and confirm the strength of price trends. Some key technical indicators used in gold trading include:

- Moving Averages: Moving averages help identify the overall direction of the gold price trend. Traders can use different timeframes, such as the 50-day or 200-day moving average, to understand short-term and long-term price trends.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in the gold market, indicating potential reversal points.

- Bollinger Bands: Bollinger Bands consist of a moving average and two standard deviation lines. They help traders identify periods of low volatility (narrow bands) and potential breakouts or reversals (wide bands) in the gold price.

- Fibonacci Retracement: Fibonacci retracement levels are derived from mathematical ratios and help identify potential support and resistance levels in the gold price. Traders can use these levels to anticipate price reversals or continuation of trends.

- Chart Patterns and Trends

Trading Central Gold provides traders with access to advanced charting capabilities, enabling the identification of various chart patterns and trends. These patterns and trends, such as head and shoulders, double tops or bottoms, and ascending or descending triangles, can offer valuable insights into potential price movements. By recognizing these patterns and understanding their implications, traders can make more accurate predictions about the direction of gold prices.

- Using Trading Central Gold Indicators

Trading Central Gold offers a unique set of proprietary indicators that are specifically tailored to gold trading. These indicators integrate seamlessly with the platform’s charting tools, providing traders with clear and actionable signals. Traders can customize indicator settings and apply them to different timeframes, enabling them to align their strategies with their preferred trading styles.

- Combining Technical Analysis with Fundamental Analysis

While technical analysis is essential for understanding price movements, traders should also consider fundamental factors that influence the gold market. Fundamental analysis involves evaluating economic data, geopolitical events, central bank policies, and market sentiment to gain a comprehensive understanding of the factors impacting gold prices. Trading Central Gold provides access to economic calendars and market analysis reports, enabling traders to integrate fundamental analysis into their trading strategies.

Trading Central Gold Indicators

Trading Central Gold offers a suite of powerful indicators designed specifically for gold trading. These indicators provide data-driven insights that empower traders to make well-informed decisions and maximize their potential for success in the gold market. Let’s delve deeper into the Trading Central Gold indicators and explore how they can be utilized to enhance gold trading strategies.

- Gold Trend Analysis: Trading Central Gold provides trend analysis indicators that help traders identify the prevailing direction of gold prices. These indicators analyze historical price data and highlight the strength and duration of trends, enabling traders to align their trading strategies accordingly. By utilizing these trend analysis indicators, traders can capture significant price movements and make timely trading decisions.

- Support and Resistance Levels: Support and resistance levels are crucial areas on a price chart where buying or selling pressure may be expected. Trading Central Gold indicators identify these levels based on historical price patterns, allowing traders to anticipate potential reversals or breakouts. By incorporating support and resistance indicators in their analysis, traders can determine optimal entry and exit points and effectively manage their risk.

- Volatility Indicators: Volatility is a key characteristic of the gold market, and Trading Central Gold offers indicators that measure and analyze volatility levels. These indicators help traders gauge market sentiment and anticipate potential price fluctuations. By considering volatility indicators in their analysis, traders can adjust their trading strategies to align with prevailing market conditions and optimize their risk-to-reward ratios.

- Momentum Indicators: Trading Central Gold indicators also include momentum-based tools that assess the strength and speed of price movements in the gold market. These indicators provide insights into whether an uptrend or downtrend is gaining or losing momentum, helping traders identify potential reversal or continuation patterns. By incorporating momentum indicators, traders can make informed decisions and capture profitable trading opportunities.

- Oscillators: Trading Central Gold offers a range of oscillators that assist traders in identifying overbought or oversold conditions in the gold market. These indicators measure the speed and magnitude of price changes and provide signals when the market reaches extreme levels. By using oscillators, traders can identify potential market turning points and make contrarian or trend-following trading decisions.

- Pattern Recognition: Pattern recognition indicators provided by Trading Central Gold identify common chart patterns, such as triangles, wedges, and head and shoulders formations, among others. These indicators automatically detect these patterns and provide traders with signals when such patterns are forming or completing. By leveraging pattern recognition indicators, traders can anticipate potential price movements and adjust their trading strategies accordingly.

- Fibonacci Retracement: Trading Central Gold offers Fibonacci retracement indicators, which help traders identify potential support and resistance levels based on the Fibonacci sequence. These indicators highlight the key retracement levels derived from the golden ratio, allowing traders to identify areas where price reversals or consolidations may occur. By utilizing Fibonacci retracement indicators, traders can validate their analysis and make more accurate trading decisions.

Utilizing Trading Central Gold Charts

Trading Central Gold offers a robust charting feature that empowers traders to gain valuable insights into gold price movements and make informed trading decisions. By utilizing Trading Central Gold charts effectively, traders can enhance their gold trading strategies and optimize their trading outcomes.

1. Access to Comprehensive Charting Tools

Trading Central Gold provides traders with a wide range of charting tools and features that enable them to analyze gold price patterns and trends. These tools include various chart types, such as line charts, bar charts, and candlestick charts, allowing traders to choose the most suitable visualization method for their analysis. By accessing these comprehensive charting tools, traders gain a holistic view of gold price movements and can identify potential trading opportunities.

2. Identifying Support and Resistance Levels

One of the key aspects of technical analysis is identifying support and resistance levels on price charts. Trading Central Gold charts make it easy for traders to pinpoint these crucial levels, which represent areas where the price tends to encounter buying or selling pressure. By incorporating support and resistance levels into their analysis, traders can determine optimal entry and exit points for their gold trades. This helps in minimizing risks and maximizing potential profits.

3. Applying Technical Indicators

Trading Central Gold charts allow traders to apply a variety of technical indicators to enhance their analysis. These indicators include popular tools like moving averages, relative strength index (RSI), and stochastic oscillators, among others. By overlaying these indicators on the price chart, traders can identify trends, gauge market momentum, and generate buy or sell signals. This combination of technical indicators and chart analysis helps traders make well-informed decisions based on multiple signals and indicators.

4. Spotting Chart Patterns

Chart patterns are graphical formations that occur on price charts and provide insights into potential future price movements. Trading Central Gold charts enable traders to easily spot and analyze these patterns, such as head and shoulders, double tops, or ascending triangles. Recognizing chart patterns can help traders anticipate trend reversals, breakouts, or continuation patterns, allowing them to adjust their trading strategies accordingly. By leveraging these chart patterns, traders can improve the accuracy of their entry and exit points.

5. Customizing Chart Settings

Trading Central Gold offers flexible chart customization options to suit individual trading preferences. Traders can adjust chart timeframes, from minutes to daily, weekly, or monthly intervals, depending on their trading strategies. This customization allows traders to analyze short-term or long-term price trends effectively. Additionally, traders can apply different color schemes, add annotations, and save chart templates, enhancing their trading experience and efficiency.

6. Integrating Chart Analysis with Market Reports

Trading Central Gold combines chart analysis with comprehensive market reports, providing traders with a holistic view of the gold market. These reports offer expert insights, trend analysis, and key support and resistance levels. Traders can integrate the information from these reports with their chart analysis, corroborating their findings and reinforcing their trading decisions. This synergy between chart analysis and market reports helps traders make well-rounded and data-driven trading choices.

Daily Market Analysis and Reports

When it comes to gold trading, staying informed about the latest market trends and developments is crucial. Trading Central Gold provides a comprehensive suite of daily market analysis and reports specifically tailored for gold traders. By leveraging these insightful resources, traders can make informed decisions and seize profitable opportunities in the gold market. Let’s explore the key features and benefits of Trading Central Gold’s daily market analysis and reports.

1. Timely Updates and Expert Analysis

Trading Central Gold’s daily market analysis and reports provide timely updates on the gold market. With access to real-time information, traders can stay ahead of the curve and respond quickly to market fluctuations. The reports are prepared by a team of experienced analysts who specialize in gold trading, offering valuable insights and expert analysis.

2. Comprehensive Coverage of Gold Market Trends

Trading Central Gold covers a wide range of gold market trends in its daily analysis and reports. Traders can expect detailed coverage of factors influencing gold prices, including geopolitical events, economic indicators, central bank decisions, and investor sentiment. By understanding these trends, traders can make well-informed decisions and adjust their trading strategies accordingly.

3. Technical Analysis and Indicators

Trading Central Gold incorporates technical analysis into its daily market analysis and reports. Technical indicators, such as moving averages, support and resistance levels, and chart patterns, are utilized to identify potential trading opportunities and assess the strength of market trends. Traders can gain valuable insights into entry and exit points based on these technical indicators.

4. Key Price Levels and Targets

The daily market analysis and reports from Trading Central Gold often include key price levels and targets for gold. These levels serve as important reference points for traders, helping them set profit targets and manage risk effectively. By understanding the potential price movements and targets, traders can develop realistic expectations and make informed decisions.

5. Market Sentiment and Investor Psychology

Trading Central Gold’s daily market analysis and reports provide insights into market sentiment and investor psychology. Understanding market sentiment is crucial for successful trading, as it helps traders gauge the overall mood and expectations of market participants. By analyzing sentiment indicators and investor psychology, traders can align their strategies with market sentiment and identify potential trading opportunities.

6. Trade Ideas and Recommendations

The daily market analysis and reports often include trade ideas and recommendations based on Trading Central Gold’s analysis. These trade ideas may suggest potential entry and exit points, along with recommended stop-loss levels and profit targets. Traders can use these recommendations as a starting point for their own analysis and adapt them to their trading strategies.

7. Risk Management Strategies

Trading Central Gold emphasizes the importance of risk management in its daily market analysis and reports. Traders are provided with risk management strategies and guidelines to help protect their capital and manage their exposure effectively. By incorporating these risk management principles, traders can mitigate potential losses and maintain consistent profitability.

8. Educational Insights

In addition to market analysis and recommendations, Trading Central Gold’s daily reports often contain educational insights. These insights may include explanations of trading concepts, chart patterns, and technical indicators, helping traders expand their knowledge and improve their trading skills. By continuously learning from the educational insights provided, traders can enhance their understanding of the gold market and refine their trading strategies.

Trading Central Gold Strategies

Trading Central Gold provides a variety of strategies tailored specifically for gold trading. These strategies are designed to assist traders in maximizing their trading potential and capitalizing on opportunities in the gold market. By incorporating these strategies into their trading approach, traders can enhance their decision-making process and improve their chances of success. Let’s explore some key strategies recommended by Trading Central Gold:

- Trend Following Strategy: One popular strategy recommended by Trading Central Gold is trend following. This strategy involves identifying and capitalizing on the prevailing trend in the gold market. Traders using this approach monitor price movements and technical indicators to determine the direction of the trend. By entering trades in the direction of the trend, traders aim to ride the momentum and capture substantial profit potential.

- Breakout Strategy: Another effective strategy suggested by Trading Central Gold is the breakout strategy. This strategy involves identifying key support and resistance levels in the gold market and entering trades when the price breaks out of these levels. Traders using this approach anticipate significant price movements following a breakout, aiming to capitalize on the momentum and capture quick profits.

- Swing Trading Strategy: Swing trading is a strategy that seeks to capture short-to-medium-term price swings in the gold market. Trading Central Gold recommends this strategy for traders looking to take advantage of intermediate price fluctuations. Swing traders identify swing highs and swing lows, entering trades when the price retraces or reverses from these levels. By focusing on shorter timeframes, swing traders aim to capture smaller, yet consistent, profits.

- Support and Resistance Strategy: Support and resistance levels play a crucial role in technical analysis. Trading Central Gold emphasizes the significance of these levels in gold trading. Traders using this strategy identify key support and resistance zones and make trading decisions based on the price’s reaction to these levels. They may enter trades when the price bounces off support or breaks through resistance, taking advantage of potential price reversals or continuations.

- Divergence Strategy: Trading Central Gold highlights the use of divergences as a powerful strategy in gold trading. Divergence occurs when the price of an asset moves in the opposite direction of an oscillator or technical indicator. Traders using this strategy look for divergences between price and indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). Divergences can indicate potential trend reversals or continuation, providing valuable trading signals.

- News-Based Strategy: Fundamental analysis plays a vital role in gold trading, and Trading Central Gold recognizes the importance of staying updated with relevant news and economic events. Traders using this strategy keep a close eye on economic indicators, geopolitical developments, and central bank announcements that impact the gold market. By incorporating news-based analysis into their trading decisions, traders can take advantage of market volatility and make informed trading choices.

Trading Central Gold Alerts and Notifications

In the fast-paced world of gold trading, being aware of market developments and reacting swiftly to opportunities is crucial. Trading Central Gold understands this need and offers a robust alerts and notifications system designed to keep traders informed and empowered. By utilizing the Trading Central Gold alerts and notifications, traders can stay ahead of market trends, capitalize on potential trading opportunities, and make timely decisions. Let’s explore this feature in detail.

The Power of Trading Central Gold Alerts and Notifications

Trading Central Gold’s alerts and notifications feature provides real-time updates on critical market events, technical indicators, and trading opportunities. By customizing their alert preferences, traders can receive instant notifications via email, SMS, or through the Trading Central Gold platform itself. This feature ensures that traders never miss out on important market movements, allowing them to seize favorable trading opportunities and manage risk effectively.

Customizing Alerts to Suit Your Trading Style

One of the key advantages of Trading Central Gold alerts and notifications is the ability to customize them according to individual trading preferences. Traders can choose specific alert triggers based on their preferred technical indicators, price levels, or market conditions. This level of customization ensures that traders receive alerts that are highly relevant to their trading strategies, optimizing their decision-making process.

Real-Time Market Updates

Trading Central Gold alerts and notifications keep traders informed about real-time market updates. This includes breaking news, economic releases, major market movements, and any other events that may impact the gold market. Traders can choose to receive alerts related to specific economic indicators, such as GDP reports, inflation data, or central bank decisions. This feature enables traders to stay informed and react promptly to market-changing events.

Technical Indicators and Trading Signals

Trading Central Gold incorporates technical indicators and trading signals into its alerts and notifications system. Traders can receive alerts based on specific technical patterns, such as moving average crossovers, support and resistance levels, or trend reversals. These alerts serve as valuable trading signals, indicating potential entry or exit points in the market. By utilizing these alerts, traders can apply their trading strategies more effectively and capitalize on favorable market conditions.

Risk Management and Stop-Loss Alerts

Effective risk management is essential in any trading strategy. Trading Central Gold alerts and notifications assist traders in managing risk by providing stop-loss alerts. Traders can set specific price levels at which they would like to be notified of potential stop-loss orders. This ensures that traders are promptly alerted if their predefined risk thresholds are approached or breached, allowing them to take appropriate action to protect their capital.

Integration with Trading Platforms

Trading Central Gold seamlessly integrates with popular trading platforms, further enhancing the convenience of receiving alerts and notifications. Traders can integrate their preferred trading platform with Trading Central Gold, ensuring that alerts are directly delivered to their trading interface. This eliminates the need to constantly switch between platforms and provides a streamlined trading experience.

Utilizing Alerts for Trading Strategy Enhancement

By leveraging Trading Central Gold alerts and notifications, traders can enhance their trading strategies and decision-making process. Traders can evaluate the performance of specific alerts over time, identify patterns, and refine their trading strategies accordingly. This continuous improvement approach helps traders optimize their trading results and adapt to evolving market conditions.

Integration with Trading Platforms

Trading Central Gold understands the importance of seamless integration with popular trading platforms to enhance the overall trading experience. By integrating Trading Central Gold with your preferred trading platform, you can access the platform’s powerful features and tools while executing trades on a familiar interface. Let’s explore the benefits of this integration and guide you on setting up this connection for an optimized trading experience.

1. Access Trading Central Gold’s Features Within Your Trading Platform

Integrating Trading Central Gold with your trading platform allows you to access its comprehensive range of features and tools without switching between different applications. By having everything in one place, you can streamline your workflow and save time, enabling you to focus more on analyzing the market and making informed trading decisions. Whether you are using MetaTrader, NinjaTrader, or another popular trading platform, the integration ensures a seamless experience.

2. Real-Time Analysis and Trading Signals

With the integration, you can receive real-time analysis and trading signals from Trading Central Gold directly within your trading platform. This means you won’t miss out on important market updates, technical analysis insights, and trading opportunities. By staying connected to Trading Central Gold’s analysis and signals, you can make timely and well-informed trading decisions based on reliable market intelligence.

3. Technical Indicators and Charting Tools

Integrating Trading Central Gold with your trading platform brings the platform’s proprietary technical indicators and advanced charting tools to your fingertips. You can access key indicators specifically designed for gold trading, such as trendlines, support and resistance levels, and oscillators, directly within your trading platform. This integration empowers you to conduct comprehensive technical analysis and visualize price movements conveniently.

4. Trade Execution and Management

Integrating Trading Central Gold with your trading platform allows for seamless trade execution and management. You can directly execute trades based on Trading Central Gold’s analysis and signals, all within the familiar interface of your trading platform. Additionally, you can manage and monitor your trades, set stop-loss and take-profit levels, and track your trade performance, all in one place.

5. Personalized Settings and Customization

By integrating Trading Central Gold with your trading platform, you can customize the settings and preferences according to your trading style. You have the flexibility to adapt the platform’s features, indicators, and alerts to align with your specific trading strategies and preferences. This level of customization ensures that you can tailor the integration to your unique trading needs.

Setting up the Integration

Setting up the integration between Trading Central Gold and your trading platform is typically straightforward. It may involve installing a plugin, add-on, or extension provided by Trading Central Gold or your trading platform. The exact process may vary depending on the specific platform you are using. The integration documentation or support resources from Trading Central Gold or your trading platform will guide you through the setup process step-by-step.

Support and Customer Service

At Trading Central Gold, providing exceptional support and customer service is a top priority. The platform understands that efficient and responsive assistance is crucial for traders to have a seamless trading experience. Whether you’re a beginner or an experienced trader, having access to reliable support and guidance can make a significant difference in your gold trading journey. Here’s how Trading Central Gold goes the extra mile to support its users.

Dedicated Support Channels

Trading Central Gold offers a range of dedicated support channels to cater to users’ inquiries and concerns. Their knowledgeable support team is available via email, live chat, and phone, ensuring that traders can easily reach out for assistance whenever needed. Whether you have technical questions, need clarification on platform features, or require guidance on using specific tools, the support team is there to provide prompt and helpful responses.

Responsive Assistance

Trading Central Gold prides itself on its responsive customer support. The platform understands the importance of addressing users’ concerns in a timely manner. When traders encounter any issues or have questions, they can expect a swift response from the support team. Trading Central Gold’s commitment to providing timely assistance ensures that traders can proceed with their trading activities without unnecessary delays or disruptions.

Expert Guidance

In addition to addressing technical inquiries, the support team at Trading Central Gold offers expert guidance to traders. They understand that navigating the complexities of gold trading can be challenging, especially for those new to the market. Therefore, the support team is well-equipped to provide valuable insights, tips, and recommendations to help traders make the most of the Trading Central Gold platform. Their expertise ensures that traders receive accurate information and guidance tailored to their specific needs.

Troubleshooting and Issue Resolution

In the event of technical glitches or platform-related issues, the support team at Trading Central Gold is committed to resolving problems promptly. They have a thorough understanding of the platform’s functionalities and can guide users through troubleshooting steps to resolve any issues they may encounter. The support team’s technical expertise allows them to quickly identify and address problems, minimizing any disruptions to traders’ activities.

Educational Resources

In addition to personalized support, Trading Central Gold offers a variety of educational resources to help traders enhance their gold trading knowledge and skills. These resources may include video tutorials, user guides, FAQs, and blog articles covering various aspects of gold trading. By providing educational materials, Trading Central Gold aims to empower traders with the knowledge they need to make informed decisions and improve their trading performance.

User Feedback and Continuous Improvement

Trading Central Gold values user feedback and actively seeks input to enhance its platform and services. The platform regularly solicits user opinions and suggestions to understand their needs and expectations better. By listening to user feedback, Trading Central Gold can continuously improve its features, tools, and customer service to meet the evolving requirements of its users. This commitment to user-centric development ensures that the platform remains relevant and responsive to traders’ needs.

Conclusion

Trading Central Gold is a valuable resource for traders seeking to maximize their success in gold trading. By utilizing its advanced analysis, technical indicators, and comprehensive reports, traders gain a competitive edge in the gold market. Explore the features and tools offered by Trading Central Gold to enhance your trading strategies and capitalize on the opportunities in gold trading.