Introduction

The Williams Alligator indicator is a powerful technical analysis tool developed by Bill Williams that helps traders identify trends and potential reversals in the market. Algorithmic trading has become increasingly popular in the modern financial world, and Python, with its versatility and extensive libraries, is an excellent programming language for implementing the Williams Alligator indicator. In this article, we will explore how to use Williams Alligator Python to develop an advanced trading analysis strategy.

Setting up the Python Environment

Before diving into the Williams Alligator Python implementation, you must first set up your Python environment.

Installing Python and Setting Up a Virtual Environment

Download and install Python from the official website, then create a virtual environment to keep your project dependencies organized. Virtual environments allow you to install Python packages without interfering with your system-wide installations.

Installing Necessary Python Libraries

Install the required Python libraries for working with financial data and visualizations. Some essential libraries include pandas for data manipulation, NumPy for numerical computations, and Matplotlib or Plotly for data visualization.

Introduction to Jupyter Notebook for Interactive Coding

Jupyter Notebook is an open-source web application that allows you to create and share documents containing live code, equations, visualizations, and narrative text. It is an excellent tool for implementing and testing your Williams Alligator Python code interactively.

Loading and Preparing Financial Data in Python

To implement the Williams Alligator indicator, you first need to load and prepare historical price data.

Using Pandas to Load Historical Price Data

Pandas is a powerful data manipulation library in Python. Use it to load historical price data from various sources such as CSV files, Excel spreadsheets, or online financial data providers like Yahoo Finance or Alpha Vantage.

Cleaning and Preprocessing the Data

Clean and preprocess the data by checking for missing values, duplicates, or outliers. Ensure that the data is in the correct format and time series is sorted chronologically.

Visualizing the Data with Matplotlib or Plotly

Visualize the price data using Python libraries like Matplotlib or Plotly to get an overview of the market trends before implementing the Williams Alligator indicator.

Implementing the Williams Alligator Indicator in Python

With the data prepared, you can now implement the Williams Alligator Python indicator.

Explanation of Smoothed Moving Averages (SMAs)

Smoothed moving averages (SMAs) are a type of moving average that places equal weight on all price data points in the specified period. They provide a smooth curve that helps identify trends and potential reversals.

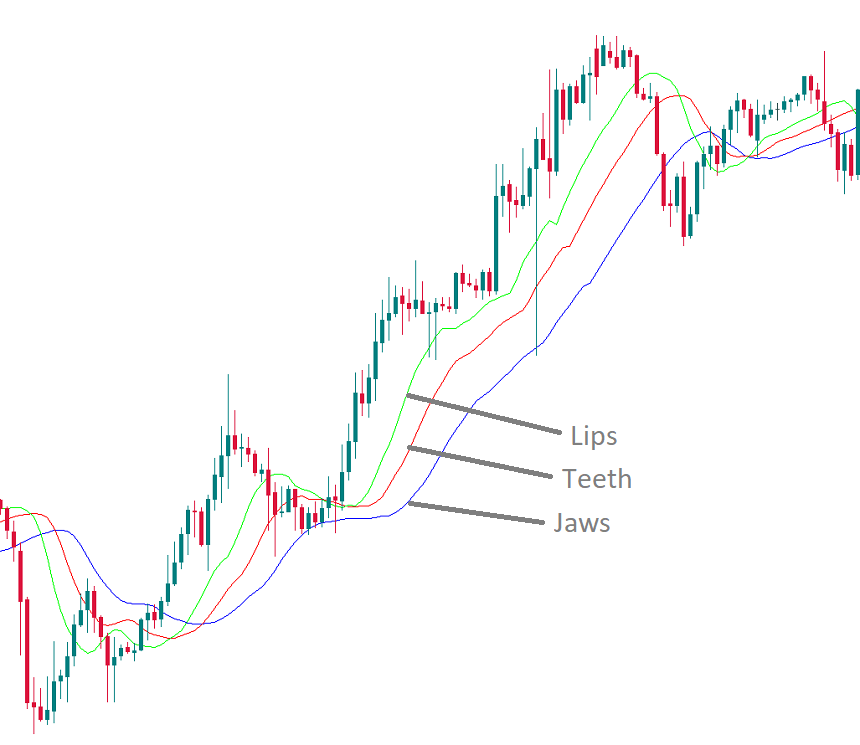

Calculating the Jaw, Teeth, and Lips of the Alligator Indicator

The Williams Alligator indicator consists of three SMAs: the Jaw (13-period SMA), the Teeth (8-period SMA), and the Lips (5-period SMA). Calculate these three SMAs using the historical price data, and shift the Teeth and Lips forward by 8 and 5 periods, respectively, to align with the future price movement.

Visualizing the Williams Alligator Indicator on a Price Chart

Plot the Jaw, Teeth, and Lips of the Williams Alligator Python indicator on the price chart to visualize the trend and potential reversals.

Developing a Williams Alligator Trading Strategy with Python

Once you have implemented the Williams Alligator indicator, you can develop a trading strategy based on its signals.

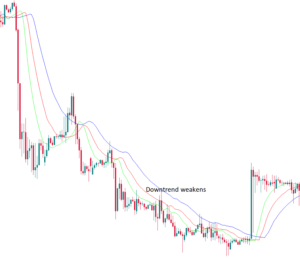

Identifying Buy and Sell Signals Using the Alligator Indicator

Buy signals occur when the Lips cross above the Teeth and Jaw, while sell signals arise when the Lips cross below the Teeth and Jaw. Implement these rules in your Python code to generate trading signals.

Incorporating Risk Management and Position Sizing

Risk management is crucial in trading. Incorporate position sizing and stop-loss orders in your Williams Alligator Python trading strategy to protect your capital and manage risk effectively.

Backtesting the Trading Strategy with Historical Data

Backtest your trading strategy using historical price data to assess its performance and identify potential areas for improvement.

Optimizing the Williams Alligator Indicator Strategy

After backtesting the trading strategy, you may need to optimize its parameters to improve its performance.

Evaluating the Performance of the Trading Strategy

Analyze the results of your backtest, focusing on performance metrics such as win rate, profit factor, and risk-reward ratio.

Parameter Optimization Using Grid Search or Other Techniques

Experiment with different parameter values for the Jaw, Teeth, and Lips of the Williams Alligator indicator. Techniques such as grid search or genetic algorithms can help identify the optimal parameter combination.

Fine-tuning the Trading Strategy Based on Performance Metrics

Based on the performance analysis, fine-tune your Williams Alligator Python trading strategy by adjusting the parameters, entry and exit rules, or risk management techniques.

Integrating the Williams Alligator Indicator with Other Technical Analysis Tools

Combining the Williams Alligator indicator with other technical analysis tools can enhance your trading strategy’s effectiveness.

Combining the Alligator Indicator with Other Indicators

Integrate the Alligator indicator with other technical analysis tools like RSI, MACD, or Stochastic Oscillator to create a multi-factor trading strategy.

Implementing a Multi-Factor Trading Strategy

Develop a multi-factor trading strategy by combining the Williams Alligator Python signals with those from other technical indicators to filter out false signals and improve the strategy’s overall performance.

Analyzing the Performance of the Combined Trading Strategy

Backtest the combined trading strategy using historical data and evaluate its performance using the same metrics as before.

Automating the Williams Alligator Trading Strategy

With a well-optimized trading strategy in place, you can automate your Williams Alligator Python strategy for real-time trading.

Connecting to a Broker API

Connect to a broker API (e.g., Alpaca, Interactive Brokers, etc.) to access real-time market data and execute trades programmatically.

Implementing Real-Time Data Streaming

Implement real-time data streaming in your Python code to receive up-to-date market information and generate trading signals based on the Williams Alligator indicator.

Executing Trades and Managing Orders Programmatically

Using the broker API, execute trades and manage orders programmatically based on the signals generated by your Williams Alligator Python trading strategy.

Monitoring and Evaluating the Performance of the Automated Williams Alligator Strategy

Continuously monitor and evaluate the performance of your automated trading strategy to ensure its ongoing success.

Setting Up Performance Tracking and Logging

Implement performance tracking and logging in your Python code to record your strategy’s performance metrics and track its success over time.

Analyzing the Performance Metrics and Making Necessary Adjustments

Regularly analyze the performance metrics of your automated Williams Alligator Python strategy, making adjustments as needed to improve its effectiveness.

Continuously Monitoring the Strategy and Updating as Needed

Monitor your trading strategy continuously, updating it as needed to adapt to changing market conditions or to incorporate new insights and techniques.

Conclusion

Implementing the Williams Alligator indicator with Python allows traders to develop advanced trading strategies and automate their execution. By following the steps outlined in this article, you can harness the power of the Williams Alligator Python implementation to improve your trading performance and adapt to the ever-changing financial markets. Remember, success in trading requires consistency, discipline, and a commitment to continuous learning and improvement.