Introduction

Welcome to the captivating world of arbitrage trading, a key concept in the financial markets, known for its potential to generate profit with minimal risk. Arbitrage trading, in its most basic form, is a strategy that traders employ to take advantage of price discrepancies in different markets.

Unraveling the Principles of Arbitrage Trading

The underlying principle of arbitrage trading is quite straightforward: “buy low, sell high.” However, in the context of arbitrage trading, this principle applies to simultaneous transactions in different markets. The goal of arbitrage trading is to identify and exploit price inefficiencies in different markets for the same asset.

Understanding the Types of Arbitrage Trading

Arbitrage trading, a lucrative and fascinating domain of the financial market, exhibits a multitude of types, each unique and catering to various trading styles. As a trader delves deeper into the realm of arbitrage, understanding these variations becomes paramount.

The first variant, spatial arbitrage, is one of the most traditional forms of arbitrage trading. This form exploits price discrepancies for the same asset across different locations or markets. For instance, a trader using spatial arbitrage may purchase a commodity at a lower price in one market and simultaneously sell it at a higher price in another market.

Temporal arbitrage, another form of arbitrage trading, involves exploiting price discrepancies of the same asset at different times. This strategy often necessitates a detailed understanding of market trends and asset price movements. Traders employing this strategy buy an asset when its price is low and sell when the price increases, within a relatively short time frame.

Statistical arbitrage is a more complex form of arbitrage trading that involves sophisticated mathematical models. This strategy is based on the statistical mispricing of one or more assets according to their expected values. The approach usually involves a large number of trades and an extended time frame for the prices to return to their statistical norm, bringing in the profit.

Risk arbitrage, or merger arbitrage, is another form of arbitrage trading primarily used in the stock market. This strategy involves capitalizing on the price discrepancies that occur when a company announces a merger or acquisition. Traders using this strategy buy the stocks of the company being acquired and short-sell the stocks of the acquiring company, thereby profiting from the price changes.

Each of these types of arbitrage trading requires a unique set of skills, resources, and risk tolerance. As the world of arbitrage trading evolves, traders continually refine their strategies, bringing about new types of arbitrage strategies. Therefore, an in-depth understanding of these types and their functioning is crucial for anyone looking to venture into the exciting world of arbitrage trading.

Delving into the Arbitrage Trading Mechanism

In the world of finance, arbitrage trading represents one of the unique strategies that participants use to secure profits. To truly appreciate the intricacies of arbitrage trading, it is crucial to delve deeper into its functioning mechanism.

At its core, arbitrage trading is the practice of simultaneously buying and selling an asset or a security on two different markets to cash in on the price discrepancy. This opportunity arises due to market inefficiencies and can provide traders with a risk-free profit assuming the transaction is executed correctly.

Let’s break down the mechanics of arbitrage trading:

The first step in the process is the identification of an arbitrage opportunity. Traders use various tools, such as software and algorithms, to scan the markets and pinpoint any potential price discrepancies. In some cases, traders may manually observe these opportunities. However, considering the rapid pace of financial markets, the use of automated tools has become more commonplace.

Once an opportunity is identified, the trader quickly buys the undervalued asset in one market and sells it in another where it is priced higher. It’s important to note that these transactions are carried out almost simultaneously. Speed is crucial in arbitrage trading as price discrepancies can correct themselves within moments.

The third phase of arbitrage trading is the completion of both transactions. The entire process may appear seamless due to automated trading systems. Still, there are inherent risks, such as one transaction failing to complete, leading to potential losses.

Upon the successful completion of both transactions, the trader secures a risk-free profit. The profit is essentially the difference in price of the asset between the two markets, minus any transaction costs.

Finally, it is essential to note that arbitrage trading requires substantial volume to make significant profits, as the price discrepancies are typically minimal. Therefore, most arbitrage traders carry out these strategies with large amounts of capital.

Profitability of Arbitrage

The profitability of arbitrage trading is an appealing factor that draws many traders to this strategy. In theory, arbitrage trading offers an opportunity to earn risk-free profits. This possibility arises from exploiting price inefficiencies between different markets for the same asset.

One of the primary factors influencing profitability in arbitrage trading is the trader’s ability to identify arbitrage opportunities swiftly. These opportunities typically exist for a brief period before the market corrects the price discrepancies. As a result, the speed of detection and execution becomes a crucial aspect in determining the potential profit in arbitrage trading.

Additionally, the size of the price discrepancy also impacts the profitability of arbitrage trading. Larger price gaps can potentially offer higher profits. However, larger price gaps may also indicate higher risks, such as low liquidity in one of the markets, which could impede the execution of arbitrage trades.

Technological advancements have significantly influenced the profitability of arbitrage trading. Traders who employ advanced trading software and algorithms capable of high-frequency trading often have the upper hand in detecting and executing arbitrage trades. These high-speed trading systems can process vast amounts of market data in real-time, identifying arbitrage opportunities that a human trader might miss.

However, it’s important to note that while technology can increase the speed and efficiency of arbitrage trading, it also escalates competition among traders. As more traders use sophisticated tools, arbitrage opportunities may become scarce and more challenging to find. Therefore, profitability might require constant technological upgrades and investment in cutting-edge trading tools.

The profitability of arbitrage trading also hinges on the trading costs involved. Each trade incurs transaction costs, which include brokerage fees, commissions, and, in some cases, taxes. For an arbitrage trade to be profitable, the gain from the price difference must be greater than the total transaction cost.

Moreover, the volume of trade can significantly affect the profitability of arbitrage trading. Arbitrage opportunities with a higher trade volume can yield more profits. However, traders should also consider the liquidity risk associated with large trade volumes, especially in less liquid markets.

Navigating Risks in Arbitrage

Understanding the complexities of arbitrage trading requires a deep dive into the risks involved. Despite its alluring prospects, arbitrage trading isn’t without its pitfalls. An understanding of these potential risks and how to navigate them is crucial for any trader venturing into the world of arbitrage trading.

One of the primary risks in arbitrage trading is execution risk. This involves the possibility of the price of an asset changing before the arbitrageur has the chance to execute all components of the trade. Given that arbitrage trading involves exploiting temporary price discrepancies, the time delay between when the arbitrageur spots the opportunity and when they execute the trade can significantly impact profitability. In extreme cases, it could even lead to losses. To mitigate this risk, arbitrageurs often use high-speed automated trading systems to execute their trades as quickly as possible.

Another significant risk in arbitrage trading is counterparty risk. This risk arises when one party in a trading contract defaults or fails to meet their obligations. In arbitrage trading, this could happen if the party from whom you’ve bought an asset fails to deliver, or if the party to whom you’ve sold an asset fails to pay. The most effective way to navigate this risk is by dealing only with reputable counter-parties and diversifying the counter-parties you trade with.

Then, there’s the risk of model failure. Since arbitrage trading often involves complex mathematical models to spot and calculate potential arbitrage opportunities, any flaws or inaccuracies in these models can lead to incorrect decision making. Regular reviewing and updating of models can help arbitrageurs mitigate this risk.

Liquidity risk is another challenge in arbitrage trading. Some arbitrage opportunities occur in illiquid markets, where the lack of buyers or sellers can make it difficult for the arbitrageur to execute their trades at the expected prices. When this happens, the potential profits from the arbitrage opportunity could evaporate. To navigate this risk, arbitrageurs often restrict their activities to more liquid markets.

Finally, there’s regulatory risk. Different countries have different laws and regulations governing financial markets and arbitrage trading, and these laws can change over time. Any changes could impact the profitability of arbitrage opportunities or even make some forms of arbitrage illegal. Therefore, staying informed about regulatory changes in the markets you’re active in is an essential part of navigating the risks of arbitrage trading.

Harnessing Tools and Technology

In the contemporary financial world, technology has become a core component in executing successful strategies, and this is particularly true for arbitrage trading. To effectively engage in arbitrage trading, one needs to leverage sophisticated tools and technology that can identify potential opportunities rapidly and execute trades at lightning-fast speeds.

The crux of arbitrage trading lies in spotting and acting on price discrepancies across different markets almost simultaneously. Given the high-paced and dynamic nature of financial markets, these discrepancies are fleeting. They often disappear in moments due to the constant ebb and flow of supply and demand affecting prices across the globe.

Given the above, the conventional manual approach to arbitrage trading is nearly impossible in today’s world. The speed at which a human can identify and execute trades is simply insufficient to seize these brief opportunities. Therefore, technology steps in to bridge this gap.

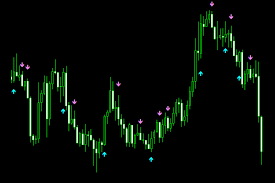

Specialized software programs and automated trading systems are essential tools for modern arbitrage trading. These systems leverage advanced algorithms to monitor numerous markets in real-time. They are programmed to detect price discrepancies for the same asset across different markets instantly.

Once these price discrepancies are identified, the next crucial step in arbitrage trading is execution. A delay in execution can lead to missed opportunities, as the price discrepancy might disappear. Hence, these technological systems are designed for high-frequency trading, executing buy and sell orders simultaneously across different markets to capitalize on the identified price discrepancies.

Furthermore, the rise of machine learning and artificial intelligence has begun to shape the landscape of arbitrage trading. These technologies can enhance the performance of arbitrage trading systems by enabling them to learn from past data and improve their decision-making processes over time. They can recognize patterns and predict future price movements, creating more opportunities for profitable trades.

However, while technology plays an integral role in successful arbitrage trading, it’s not without its challenges. For instance, technical glitches can lead to significant losses. Also, maintaining and upgrading high-speed automated systems can be expensive. Therefore, it’s essential for anyone considering arbitrage trading to fully understand these technological tools and the investment required.

The Impact of Arbitrage on Financial Markets

Arbitrage trading plays a pivotal role in shaping the dynamics of financial markets, influencing various aspects ranging from market efficiency to pricing and liquidity. By capitalizing on price discrepancies across different markets, arbitrage traders contribute to the overall functioning and stability of the financial ecosystem. Let’s delve deeper into the impact of arbitrage trading on financial markets.

Enhancing Market Efficiency

Arbitrage trading significantly contributes to market efficiency by ensuring that prices across different markets for the same asset converge to a fair value. When a price discrepancy arises, arbitrageurs swiftly enter the market to buy at the lower price and sell at the higher price, effectively narrowing the gap. This process eliminates the profit opportunity, aligning prices and preventing further arbitrage trades. As a result, arbitrage trading promotes market efficiency by reducing inefficiencies and ensuring prices accurately reflect market conditions.

Influencing Asset Pricing

The presence of arbitrageurs actively participating in arbitrage trading impacts asset pricing in the financial markets. As they exploit price discrepancies, they bring immediate pressure on the prices of the underlying assets. If an asset is undervalued in one market relative to another, arbitrageurs will buy in the undervalued market and sell in the overvalued market, leading to an increase in demand and subsequent price adjustment. This process helps align prices across different markets, facilitating fairer and more accurate asset valuations.

Boosting Market Liquidity

Arbitrage trading contributes to market liquidity by increasing trading activity and overall transaction volumes. As arbitrageurs exploit price discrepancies, their buy and sell orders inject liquidity into the markets. Their actions provide counterparties for trades and enhance the overall market depth. Increased liquidity enhances market efficiency and reduces the bid-ask spreads, benefiting all market participants by enabling smoother trade execution and better price discovery.

Promoting Market Stability

Arbitrage trading can act as a stabilizing force in financial markets, particularly during times of market stress or volatility. When market participants panic or irrational pricing occurs, arbitrage traders step in to capitalize on any resulting price discrepancies. By executing trades to correct these imbalances, they help restore market equilibrium and reduce excessive volatility. This stabilizing effect contributes to the overall confidence and stability of the financial markets.

Fostering Market Integration

Arbitrage trading facilitates the integration of various markets, both domestic and international. As traders exploit price differentials across different markets, they help align prices and reduce any disparities that may arise due to localized factors or restrictions. This process promotes cross-border investment and encourages capital flows between markets, leading to increased interconnectedness and integration of global financial systems.

Encouraging Market Transparency

This trading brings increased transparency to financial markets. As traders actively search for and exploit price discrepancies, they contribute to price discovery and expose any hidden or latent information that may impact asset valuations. Through their actions, arbitrageurs provide valuable market signals and help disseminate information to other market participants, leading to greater transparency and improved decision-making.

Legal and Regulatory Considerations

When engaging in this trading, it is crucial to have a clear understanding of the legal and regulatory landscape. While arbitrage trading itself is a legitimate practice, certain legal and regulatory considerations must be taken into account to ensure compliance and ethical trading practices. Let’s delve deeper into these considerations.

1. Market Regulations: Various financial markets have specific regulations in place to govern trading activities, including arbitrage trading. These regulations aim to maintain market integrity, transparency, and fair practices. Traders must familiarize themselves with the rules and guidelines set by the regulatory authorities governing the specific markets they operate in.

2. Insider Trading: Insider trading is strictly prohibited in most jurisdictions and can have severe legal consequences. Traders engaging in arbitrage trading should be aware of any non-public information that could provide them with an unfair advantage. It is essential to strictly adhere to insider trading regulations to maintain the integrity of the markets.

3. Market Manipulation: While arbitrage involves capitalizing on price inefficiencies, it is crucial to distinguish between legitimate arbitrage opportunities and market manipulation. Manipulating prices or engaging in deceptive practices to create artificial price discrepancies is illegal and can lead to significant penalties. Traders should always operate within the boundaries of fair and ethical trading practices.

4. Jurisdictional Considerations: Different countries and jurisdictions have varying laws and regulations concerning arbitrage trading. Traders must understand the legal framework within which they operate and comply with the specific requirements of the jurisdiction. This includes obtaining necessary licenses, registering with regulatory bodies, and complying with reporting and disclosure obligations.

5. Cross-Border Considerations: it often involves trading activities across multiple jurisdictions. Traders must be aware of the legal implications of conducting cross-border transactions. Each jurisdiction may have its own set of rules and regulations regarding capital movements, tax implications, and reporting requirements. Complying with these requirements is essential to avoid any legal complications.

6. Compliance Programs and Risk Management: To navigate the legal and regulatory landscape effectively, traders should establish robust compliance programs and risk management systems. This includes implementing internal controls, conducting regular audits, and ensuring compliance with relevant laws and regulations. Having a comprehensive understanding of the legal framework and actively managing compliance risks is crucial for long-term success in arbitrage trading.

7. Regulatory Changes: Regulatory frameworks and requirements can evolve over time. Traders must stay updated with any changes in regulations that may impact arbitrage trading activities. Keeping abreast of regulatory developments helps traders adapt their strategies and ensure ongoing compliance with the latest legal requirements.

Conclusion

Arbitrage trading is an integral part of the financial markets, offering traders the potential for risk-free profits by exploiting market inefficiencies. While it presents certain challenges and risks, with the right tools, quick decision-making, and an understanding of market dynamics, traders can successfully navigate the landscape of this trading.