Introduction

The foreign exchange market, or forex, is a constantly evolving and dynamic marketplace where currency values are constantly in flux. As a trader, it is important to stay up-to-date with the latest forex news in order to make informed trading decisions. Forex news refers to the economic and financial events, developments, and news that can impact the foreign exchange market and influence currency exchange rates. From interest rate decisions by central banks to political events and natural disasters, forex news can have a significant impact on the market. In this guide, we will dive into the world of forex news, exploring the websites that provide the latest updates, examining the events that have the greatest impact, and offering tips on how to trade the forex news like a pro.

Websites that provide Forex News

In order to stay up-to-date with the latest forex news, it is important to have access to reliable and accurate sources. There are several websites that offer comprehensive coverage of forex news and events, including:

- Reuters: Reuters is a global news agency that provides coverage of financial markets, including the foreign exchange market. The website offers real-time news and analysis, as well as economic calendars and market data.

- Bloomberg: Bloomberg is a financial news and data provider that offers comprehensive coverage of the forex market. The website features real-time news, analysis, and market data, as well as a calendar of upcoming economic events.

- CNN Money: CNN Money is a financial news website that offers coverage of the latest developments in the foreign exchange market. The website features real-time news, analysis, and market data, as well as a calendar of upcoming economic events.

- Forex Factory: Forex Factory is a dedicated forex news website that provides traders with a wealth of information and resources. The website features real-time news and analysis, as well as an economic calendar, market data, and forums for traders to discuss the latest developments in the market.

- Daily FX: Daily FX is a forex news and analysis website that offers real-time news, market data, and analysis, as well as a calendar of upcoming economic events. The website also features educational resources and tools for traders to improve their knowledge of the forex market.

- FXStreet: FXStreet is a forex news and analysis website that offers real-time news, market data, and analysis, as well as a calendar of upcoming economic events. The website also features a range of educational resources and tools for traders, including webinars and eBooks.

- Social media platforms like Twitter and LinkedIn can be valuable sources of real-time news and analysis, as many market commentators and analysts share their insights and opinions on these platforms.

- Forex forums and discussion boards can provide a wealth of information and perspective from other traders and market participants.

- Market research and analysis firms, such as Thomson Reuters and Moody’s, can offer in-depth market analysis and research reports that provide valuable insights into the latest developments in the forex market.

- Broker websites and trading platforms may also provide their own news and analysis services, as well as real-time market data and trading tools.

By using a combination of these resources, traders can stay well-informed about the latest forex news and events, and make informed trading decisions based on the most up-to-date information and analysis.

Examples of Forex News with High Impact on the Market

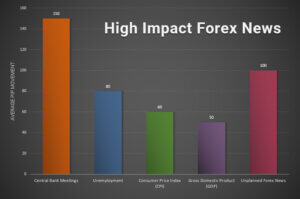

Forex news can have a significant impact on the foreign exchange market, influencing currency exchange rates and affecting the value of trades. Here are some of the key forex news events that can have a high impact on the market:

- Interest rate decisions by central banks: Central banks, such as the Federal Reserve (Fed) in the United States and the European Central Bank (ECB) in Europe, regularly announce decisions on interest rates. These decisions can have a major impact on currency exchange rates, as changes in interest rates can affect the relative value of different currencies and impact the cost of borrowing in a currency.

- Economic data releases: Economic data releases, such as Gross Domestic Product (GDP) reports and employment figures, can provide insight into the health of an economy and influence currency exchange rates. Strong economic data can signal a growing economy and increase demand for a currency, while weak data can signal economic weakness and decrease demand for a currency.

- Political events: Political events, such as elections and policy changes, can have a major impact on currency exchange rates. For example, political instability or uncertainty in a country can decrease demand for its currency, while political stability and stability can increase demand for a currency.

- Natural disasters: Natural disasters, such as hurricanes and earthquakes, can disrupt economic activity and impact currency exchange rates. For example, a natural disaster in a country can disrupt its economy, decrease demand for its currency, and impact the value of trades.

These are just a few examples of the types of forex news events that can have a high impact on the market. By staying up-to-date with the latest news and events, traders can be better prepared to navigate the dynamic world of foreign exchange.

Impact of Forex News on the Market

- Volatility and Liquidity – Forex news releases can cause significant volatility and liquidity in the market, as traders adjust their positions in response to new information.

- Price Movements – Forex news can cause significant movements in currency pairs, as traders buy or sell based on the perceived impact of the news on the underlying economy or financial markets.

- Trading Volume – Forex news can lead to increased trading volume, as traders take advantage of new trading opportunities or adjust their positions in response to changing market conditions.

- Risk Management – Forex news can affect traders’ risk management strategies, as they adjust their stop-loss levels, position sizes, or overall risk exposure in response to new information.

- Sentiment – Forex news can impact market sentiment, which can affect traders’ perceptions of the market and their willingness to take positions in certain currency pairs.

- Interest Rates – Forex news can impact interest rates and central bank policy decisions, which can have a significant impact on currency values and trading strategies.

- Economic Indicators – Forex news can provide important economic indicators, such as GDP, inflation, and employment data, which can help traders assess the overall health of an economy and make trading decisions accordingly.

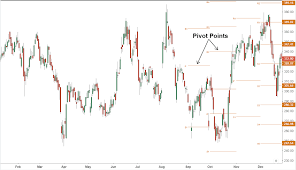

- Technical Analysis – Forex news can impact technical levels on price charts, which can affect the behavior of technical traders and the overall direction of the market.

- Global Events – Forex news can be influenced by global events, such as political elections, natural disasters, or geopolitical tensions, which can have far-reaching effects on the economy and the forex market.

- Market Participants – Forex news can affect the behavior of various market participants, such as retail traders, institutional investors, hedge funds, and central banks, all of which can have a significant impact on market dynamics.

How to Trade Forex News Like a Pro

Trading based on forex news can be a profitable strategy for experienced traders, but it can also be risky for inexperienced traders who are not familiar with the market and the potential impact of news events. Here are some tips for trading forex news like a pro:

- Stay informed and up-to-date – Keep track of upcoming economic events and data releases, and monitor financial news outlets and social media for important updates and analysis.

- Develop a trading plan – Before trading forex news, create a trading plan that outlines your objectives, risk tolerance, and entry and exit strategies.

- Use appropriate risk management strategies – Consider using tools like stop-loss orders, position sizing, and diversification to manage risk.

- Maintain a disciplined approach to trading – Stick to your trading plan and avoid impulsive decisions based on emotion or short-term price movements.

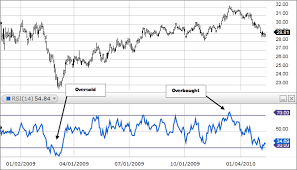

- Consider a range of analysis techniques – Use a combination of fundamental, technical, and sentiment analysis to make informed trading decisions.

- Be mindful of timing – Take note of the timing of news releases and events, as they can affect market liquidity and volatility.

- Keep an eye on market sentiment – Stay aware of market sentiment and try to avoid trading against the prevailing sentiment.

- Stay aware of potential biases – Be aware of your own biases and try to avoid them when making trading decisions.

- Practice risk management before news events – Reduce your position size or close out trades before significant news events to minimize potential losses.

- Learn from your experiences – After each news event, review your trades and analyze your performance to identify areas for improvement.

By following these tips, traders can trade forex news like a pro and increase their chances of success in the dynamic and rapidly-changing world of foreign exchange.

Trading Strategies for Forex News

- Fundamental Analysis – This approach involves analyzing economic data, central bank policy decisions, and other macroeconomic factors to determine the overall health of an economy and the likely direction of currency pairs.

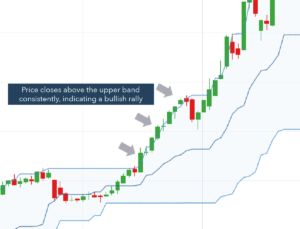

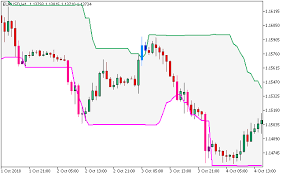

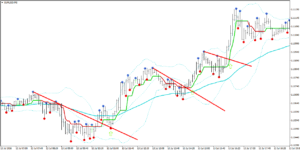

- Technical Analysis – This approach involves analyzing price charts and using technical indicators to identify trading opportunities and potential market trends.

- Sentiment Analysis – This approach involves analyzing market sentiment and assessing the market’s overall mood towards a currency or an economic event. This can be useful in predicting short-term price movements.

- Event-Driven Trading – This approach involves analyzing the potential impact of specific events or news releases on currency markets and taking positions based on that analysis.

- News Trading – This approach involves trading on the immediate reaction to an economic event or news release, often using automated trading algorithms to execute trades quickly.

- Volatility Trading – This approach involves trading based on the expected level of volatility associated with a particular economic event or news release.

- Carry Trading – This approach involves taking advantage of interest rate differentials between currency pairs to generate profit over the long term.

- Correlation Trading – This approach involves analyzing the relationship between currency pairs and taking positions based on that analysis.

- Breakout Trading – This approach involves trading based on significant price movements or breakouts of key technical levels.

- Position Trading – This approach involves taking longer-term positions based on fundamental or technical analysis and holding those positions for weeks or months.

When Forex News is Released

Forex news events can take place at any time, but there are certain times when they are most likely to be released. Here are some key times to be aware of when trading based on forex news:

- Interest rate decisions by central banks: Interest rate decisions are typically announced at regular intervals, such as monthly or quarterly. Traders should be aware of the schedule for these announcements and be prepared for potential market movements in response to these events.

- Economic data releases: Economic data releases, such as GDP reports and employment figures, are usually released at specific times, such as monthly or quarterly. Traders should be aware of the schedule for these releases and be prepared for potential market movements in response to these events.

- Political events: Political events, such as elections and policy changes, can take place at any time. Traders should be aware of the potential impact of these events on the market and be prepared for potential market movements in response to these events.

- Natural disasters: Natural disasters can occur at any time, but traders should be aware of the potential impact of these events on the market and be prepared for potential market movements in response to these events.

By understanding the timing of forex news events, traders can be better prepared to navigate the market and make informed trading decisions based on market conditions and events.

Benefits in Trading Forex News

- Provides Trading Opportunities – Forex news can create significant trading opportunities for those who are prepared and informed.

- Increases Market Volatility – Forex news releases can create significant volatility in the markets, which can lead to increased profit potential for traders.

- Helps Identify Market Trends – Forex news can provide important information about the overall health of an economy, which can help traders identify potential market trends.

- Enables Trading on Multiple Timeframes – Forex news can impact trading on multiple timeframes, from short-term intraday trading to long-term position trading.

- Offers Diversification – Trading forex news can provide diversification for traders who are looking to expand their trading activities beyond other markets, such as stocks or commodities.

- Improves Trading Knowledge – Forex news can provide valuable insights into global economics, politics, and financial markets, which can help traders improve their overall trading knowledge.

- Enhances Risk Management – Forex news can help traders better manage their risk by providing important information about potential market events and volatility.

- Increases Trading Volume – Forex news can lead to increased trading volume, which can provide greater liquidity and potentially better trading opportunities for traders.

- Facilitates Automation – Forex news trading can be automated using algorithmic trading strategies, which can help traders execute trades quickly and efficiently.

- Offers High Potential Rewards – Trading forex news can offer high potential rewards, particularly for those who are able to accurately predict market reactions to economic events and news releases. However, it’s important to remember that higher potential rewards come with higher potential risks.

Risks and Challenges in Trading Forex News

- False or Misleading Information – Forex news can be influenced by rumors, speculation, and even deliberate misinformation, which can cause traders to make decisions based on inaccurate or incomplete information.

- Market Reactions that Differ from Expectations – Even if a trader accurately predicts an upcoming economic event, the market’s reaction to that event may not align with their expectations. Unexpected outcomes can result in significant losses.

- Timing Issues – Forex news is often released outside of regular trading hours, which can lead to price gaps and increased volatility when the market opens. This can be particularly challenging for traders who rely on technical analysis.

- Overtrading and Emotional Bias – The high frequency of news releases and the potential for large price swings can lead some traders to overtrade or make impulsive decisions based on emotion rather than analysis.

- High Volatility and Liquidity – Major news events can cause spikes in volatility and liquidity, which can make it difficult to execute trades at desired prices or to exit positions in a timely manner.

- Trading Costs – The costs of executing trades, such as spreads and commissions, can be higher during news events due to increased volatility and liquidity.

- Political and Geopolitical Risk – Forex news can be influenced by political events, such as elections, policy changes, and conflicts. These factors can be unpredictable and difficult to quantify, adding to the risk of forex trading.

- Limited Control Over Market Events – Traders have little control over the economic events and data releases that can impact forex markets, which can make it difficult to manage risk.

- Technical Issues – Technology disruptions, such as internet outages or platform malfunctions, can prevent traders from executing trades or accessing information during critical market events.

- Legal and Regulatory Risks – Forex trading is subject to legal and regulatory requirements, which can vary by jurisdiction. Traders must ensure compliance with applicable laws and regulations, which can add complexity and risk to trading activities.

Conclusion

Forex news can have a significant impact on the foreign exchange market, and trading based on forex news can be a profitable strategy for experienced traders. To trade forex news like a pro, traders should stay informed, use technical analysis, manage risk, keep a trading plan, and be patient. Additionally, traders should be aware of the timing of forex news events, including interest rate decisions by central banks, economic data releases, political events, and natural disasters, and be prepared for potential market movements in response to these events.