Introduction

In today’s interconnected world, forex trading has become increasingly accessible through online platforms. In this comprehensive guide, we will explore the ins and outs of online forex trading, its advantages, and how you can get started in this dynamic market.

Understanding Online Forex Trading

In the modern era, advancements in technology have revolutionized the financial markets, including the world of forex trading. One significant development is the rise of forex online trading, which has transformed the way individuals participate in the foreign exchange market. In this section, we will delve deeper into the various aspects of online forex trading, exploring its benefits, features, and the tools available to traders.

The Benefits of Forex Online Trading

Forex online trading offers numerous advantages to traders of all levels of experience. First and foremost, it provides accessibility and convenience. With just a computer or mobile device and an internet connection, traders can access the forex market from anywhere in the world, eliminating the need for physical trading floors or traditional brokerage firms.

Furthermore, online forex trading allows for increased flexibility in terms of trading hours. The forex market operates 24 hours a day, five days a week, providing traders with the opportunity to participate in the market at their preferred times. This flexibility is especially valuable for those who have other commitments or are located in different time zones.

The Role of Online Forex Brokers

To engage in forex online trading, traders must select a reputable online forex broker. These brokers act as intermediaries, providing traders with access to the forex market and facilitating the execution of trades. When choosing a broker, it is essential to consider factors such as regulatory compliance, trading platforms offered, transaction costs, customer support, and the range of currency pairs available.

Online forex brokers typically offer different types of trading accounts to cater to the needs of various traders. These may include standard accounts, mini accounts, and even demo accounts for practicing and honing trading skills without risking real money. It is crucial for traders to carefully review and compare the account types and their associated features before making a decision.

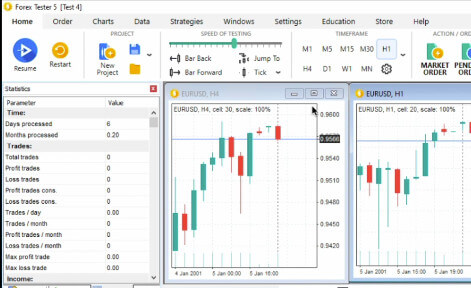

Trading Platforms for Forex Online Trading

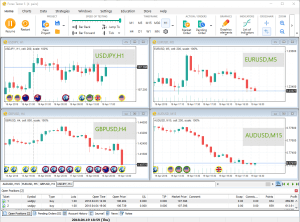

Trading platforms serve as the gateway to forex online trading. These software applications are provided by online brokers and offer traders access to real-time market data, charting tools, technical indicators, order execution capabilities, and more. Popular trading platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are widely recognized and utilized by traders worldwide for their comprehensive features and user-friendly interfaces.

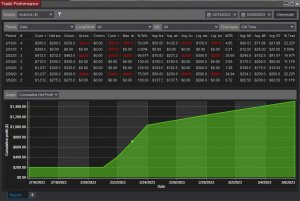

Trading platforms enable traders to analyze price movements, monitor currency pairs, place trades, and manage their positions. They also provide access to historical data, allowing traders to conduct backtesting and refine their trading strategies. Additionally, trading platforms often offer mobile versions, enabling traders to monitor and execute trades on-the-go through their smartphones or tablets.

Tools and Analysis Techniques for Forex Online Trading

Successful forex online trading requires traders to employ various tools and analysis techniques to make informed trading decisions. Technical analysis, one of the most widely used approaches, involves studying historical price data and identifying patterns, trends, and potential entry and exit points. Traders can utilize a wide range of technical indicators, such as moving averages, oscillators, and Bollinger Bands, to assist in their analysis.

Fundamental analysis is another crucial aspect of forex online trading. It involves assessing economic indicators, news events, and geopolitical factors that influence currency values. Fundamental analysis helps traders understand the underlying forces driving price movements and make predictions based on economic data releases, central bank decisions, and geopolitical developments.

Risk Management in Forex Online Trading

Effective risk management is a fundamental aspect of forex online trading. Traders must establish risk parameters, including determining their risk tolerance, setting appropriate stop-loss levels, and applying sound money management principles. Proper risk management helps protect traders from excessive losses and ensures the longevity of their trading endeavors.

Moreover, traders should always stay informed about market conditions, closely monitor their open positions, and avoid making impulsive trading decisions based on emotions. Disciplined adherence to trading plans and strategiesis crucial for maintaining consistency and minimizing the impact of emotional biases.

Continuous Learning and Improvement in Forex Online Trading

Forex online trading is a dynamic and ever-evolving field, and traders must continuously update their knowledge and skills to stay ahead of the game. Engaging in ongoing learning and education is essential for understanding new market trends, trading strategies, and technological advancements.

Traders can expand their knowledge through various channels, including online courses, webinars, educational resources provided by brokers, and participation in trading communities and forums. Demo accounts play a vital role in practice and experimentation, allowing traders to test new strategies and techniques without risking real funds.

Learning from past trading experiences, both successes, and failures, is also crucial for growth and improvement. Keeping a trading journal can help identify patterns, strengths, and weaknesses, enabling traders to fine-tune their strategies and enhance their decision-making process.

Getting Started with Online Forex Trading

The world of online forex trading presents a wealth of opportunities for individuals seeking to participate in the global currency market. With the right knowledge and tools, you can embark on a rewarding journey to potentially generate profits. This comprehensive guide will walk you through the essential steps to get started with forex online trading and position yourself for success.

Understanding Forex Online Trading

Forex online trading involves the buying and selling of currencies through online platforms. These platforms, provided by reputable forex brokers, enable traders to access the forex market in real-time. The forex market operates 24 hours a day, five days a week, allowing for flexibility and convenience in executing trades.

Choosing a Reliable Forex Online Broker

The first crucial step in getting started with forex online trading is selecting a reliable forex broker. Conduct thorough research to find a broker that aligns with your trading goals and offers a user-friendly online trading platform. Look for brokers that are regulated by reputable financial authorities to ensure the safety of your funds and the integrity of the trading environment.

Opening an Account

Once you have chosen a forex online broker, the next step is to open an account. Visit the broker’s website and complete the account registration process. You will be required to provide personal information and undergo identity verification procedures to comply with anti-money laundering regulations. Ensure that you carefully read and understand the terms and conditions of the broker before proceeding.

Funding Your Trading Account

After successfully opening an account, you need to fund it to start trading. Most forex online brokers offer various funding options, including bank transfers, credit/debit cards, and electronic payment systems. Choose the method that is most convenient for you and follow the instructions provided by the broker to deposit funds into your trading account.

Navigating the Online Trading Platform

Once your trading account is funded, you can access the online trading platform provided by your chosen broker. Take the time to familiarize yourself with the platform’s features and tools. Forex online trading platforms typically offer live price charts, technical indicators, order placement options, and account management functionalities. Explore the platform’s interface and practice navigating its different sections.

Educate Yourself on Forex Online Trading

To succeed in forex online trading, it is crucial to acquire a solid understanding of the market and its dynamics. Take advantage of the educational resources offered by your broker, such as video tutorials, webinars, and trading guides. Learn about key concepts like currency pairs, exchange rates, pips, lots, and leverage. Familiarize yourself with technical analysis tools and fundamental analysis principles to make informed trading decisions.

Developing a Trading Strategy

A well-defined trading strategy is essential for consistent success in forex online trading. Determine your financial goals, risk tolerance, and preferred trading style. Consider factors such as timeframes, market volatility, and currency pairs that align with your trading strategy. Develop a robust trading plan that outlines entry and exit criteria, risk management techniques, and guidelines for managing open positions.

Practicing with a Demo Account

Most forex online brokers offer demo accounts that allow you to practice trading in a simulated environment using virtual funds. Take advantage of this feature to gain hands-on experience without risking real money. Use the demo account to test your trading strategy, practice executing trades, and refine your skills. Monitor your performance, learn from mistakes, and make necessary adjustments to improve your trading approach.

Risk Management in Forex Online Trading

Risk management is a crucial aspect of forex online trading. Establish risk management rules that help protect your trading capital. Set appropriate stop-loss orders to limit potential losses and determine take-profit levels to secure profits. Avoid overleveraging your trades, and only risk a small percentage of your account balance per trade. Regularly review andrevise your risk management strategy as you gain experience and adapt to changing market conditions.

Continuous Learning and Improvement

Forex online trading is a dynamic and ever-evolving market. Stay committed to continuous learning and improvement to enhance your trading skills. Keep up with market news, economic events, and geopolitical developments that can impact currency prices. Stay updated on technical analysis techniques and fundamental analysis insights. Engage with online trading communities, participate in forums, and seek mentorship from experienced traders to gain valuable insights and broaden your knowledge base.

Monitoring and Evaluating Performance

Regularly monitor and evaluate your performance as a forex online trader. Keep a trading journal to record your trades, including entry and exit points, reasons for the trade, and notes on the outcome. Analyze your trading journal to identify patterns, strengths, and weaknesses in your trading strategy. Learn from both profitable and losing trades to refine your approach and make informed adjustments.

Seeking Professional Guidance

If you feel overwhelmed or require additional guidance, consider seeking professional assistance. Forex online trading mentors or trading coaches can provide valuable insights and help you navigate the complexities of the market. Their experience and expertise can accelerate your learning curve and help you avoid common pitfalls.

Key Concepts in Online Forex Trading

In the world of online forex trading, understanding key concepts is essential for success. Let’s delve deeper into the fundamental concepts that form the backbone of forex trading and explore how they apply to the online trading environment.

Currency Pairs and Exchange Rates In forex online trading, currencies are traded in pairs. Each pair represents the value of one currency relative to another. The exchange rate indicates the amount of the quote currency required to purchase one unit of the base currency. Major currency pairs, such as EUR/USD or GBP/USD, are the most actively traded pairs and offer high liquidity in the online forex market.

Pips, Lots, and Leverage Pips are the smallest unit of measurement in online forex trading. They represent the price movement of a currency pair. For most currency pairs, a pip is equivalent to 0.0001, except for pairs involving the Japanese yen, where it is 0.01. Lots refer to the volume or size of a trade. Standard lots are typically 100,000 units of the base currency. Leverage allows traders to control larger positions with a smaller amount of capital. It magnifies both profits and losses, so proper risk management is crucial when utilizing leverage in online forex trading.

Technical and Fundamental Analysis Forex online trading involves analyzing the market using two primary approaches: technical analysis and fundamental analysis. Technical analysis focuses on historical price data and indicators to identify patterns, trends, and potential entry and exit points. Traders using technical analysis examine charts, use indicators such as moving averages and oscillators, and apply various charting tools. Fundamental analysis, on the other hand, involves evaluating economic indicators, geopolitical events, and market news that can impact currency values. By analyzing factors such as GDP growth, interest rates, and employment data, fundamental analysts aim to predict currency movements based on economic fundamentals.

Order Types and Execution In online forex trading, various order types are available to enter and exit trades. Market orders are executed at the current market price. Limit orders allow traders to buy or sell at a specific price, while stop orders are triggered when the market reaches a specified price level. Traders can also use take-profit orders to automatically close a position when a predetermined profit target is reached. The execution of orders in online forex trading is typically fast and efficient, with trades being executed almost instantaneously due to the high liquidity of the forex market.

Risk Management and Stop-Loss Orders Managing risk is crucial in online forex trading. Traders must employ effective risk management strategies to protect their capital. One common risk management tool is the stop-loss order, which is placed to automatically exit a trade if it reaches a predefined level of loss. By setting stop-loss orders, traders limit potential losses and ensure that they adhere to their risk tolerance levels. Stop-loss orders are an integral part of responsible risk management in online forex trading.

Building a Solid Forex Trading Strategy

A well-defined trading strategy is crucial for success in the dynamic world of forex online trading. A solid strategy helps traders navigate the complexities of the market, make informed decisions, and manage risk effectively. In this section, we will explore the key components of building a robust forex trading strategy in the context of online trading.

Understanding Your Goals and Risk Tolerance

Before diving into the specifics of your trading strategy, it is essential to define your financial goals and risk tolerance. Are you looking for short-term gains or long-term investment growth? Understanding your goals will shape the timeframes and approaches you take in your trades. Additionally, assessing your risk tolerance will guide your risk management strategies, determining how much capital you are willing to put at stake in each trade.

Analyzing Market Conditions and Trends

Successful forex trading requires a comprehensive understanding of market conditions and trends. As an online trader, you have access to real-time market data, economic indicators, and news releases that impact currency prices. Conducting thorough technical and fundamental analysis will help you identify trends, anticipate market movements, and make informed trading decisions. Use technical indicators, chart patterns, and economic calendars to gather the necessary information for your analysis.

Selecting a Trading Style and Timeframe

Forex online trading offers various trading styles and timeframes, each suited to different trader preferences and goals. Common trading styles include day trading, swing trading, and position trading. Day traders execute multiple trades within a single day, taking advantage of short-term price fluctuations. Swing traders aim to capture medium-term trends, while position traders take a longer-term view, holding trades for weeks or even months. Choose a trading style and timeframe that aligns with your personality, time availability, and risk tolerance.

Developing a Trading Plan and Risk Management Strategies

A trading plan serves as a roadmap for your forex online trading activities. It outlines the rules and guidelines that govern your trades, including entry and exit criteria, risk management strategies, and position sizing. Your plan should incorporate a clear risk-reward ratio, defining how much you are willing to risk in each trade relative to the potential reward. Consider using stop-loss orders and take-profit levels to limit losses and secure profits. Stick to your plan consistently and avoid making impulsive decisions based on short-term market fluctuations.

Testing and Refining Your Strategy

Once you have developed your initial trading strategy, it is crucial to test and refine it using historical data. Forex online trading platforms often provide access to historical price data, allowing you to backtest your strategy and evaluate its performance. Analyze the results and make necessary adjustments to optimize the strategy’s effectiveness. Be mindful of over-optimization, as overly complex strategies may not perform well in live trading conditions. Strive for simplicity and adaptability in your approach.

Continuous Evaluation and Improvement

The forex market is ever-evolving, and your trading strategy should evolve with it. Continuously evaluate the performance of your strategy in real-time trading conditions. Monitor the market, assess the impact of economic events, and be open to adjusting your strategy when necessary. Maintain a trading journal to track your trades and reflect on your decision-making process. Learn from both your successes and failures, and seek opportunities for improvement. Engage with the online forex trading community to gain insights and share experiences with fellow traders.

Implementing Your Forex Trading Strategy

With a well-defined and thoroughly tested trading strategy, it’s time to implement it in your forex online trading activities. Execute trades based on the parameters set in your trading plan, adhering to your risk management strategies. Continuously monitor your trades, making adjustments as needed. Evaluate your trades regularly, and be disciplined in following your strategy even during challenging market conditions.

Technical Analysis in Online Forex Trading

Technical analysis is a widely used approach in online forex trading that involves analyzing historical price data to make informed trading decisions. Traders utilize various tools, indicators, and chart patterns to identify trends, predict price movements, and determine optimal entry and exit points. By understanding the principles of technical analysis, traders can gain valuable insights into market dynamics and improve their trading performance.

Importance of Technical Analysis in Forex Online Trading

Technical analysis plays a crucial role in online forex trading as it helps traders identify potential trading opportunities and make informed decisions based on historical price patterns and market trends. By studying past price movements, traders aim to forecast future price direction and anticipate market reversals or continuations. Technical analysis complements fundamental analysis by providing valuable insights into the market’s behavior and psychology.

Key Components of Technical Analysis

Technical analysis encompasses a range of tools and techniques. Let’s explore some key components widely used in online forex trading:

- Chart Patterns: Chart patterns, such as triangles, head and shoulders, and double tops/bottoms, provide visual representations of price movements. Traders analyze these patterns to predict potential price reversals or continuations.

- Indicators: Technical indicators, such as moving averages, oscillators (e.g., Relative Strength Index), and Bollinger Bands, help traders identify overbought or oversold conditions, momentum shifts, and trend strength. These indicators provide valuable signals for entry and exit points.

- Support and Resistance Levels: Support and resistance levels are areas on the price chart where prices tend to find support (bounce back) or face resistance (halt or reverse). Traders use these levels to identify potential price turning points and set profit targets or stop-loss levels.

- Trend Analysis: Identifying and analyzing trends is a crucial aspect of technical analysis. Traders assess the direction and strength of trends (e.g., uptrend, downtrend, or sideways) to align their trades with the prevailing market sentiment.

- Candlestick Patterns: Candlestick patterns provide information about price action within a specific time period. Patterns like doji, engulfing, and hammer can indicate potential reversals or continuations, offering traders insights into market sentiment.

Applying Technical Analysis in Forex Online Trading

When applying technical analysis in online forex trading, traders utilize these tools to generate trading signals and develop strategies. By combining different indicators and chart patterns, traders seek confirmation and increase the probability of successful trades. Here are some common technical analysis techniques used in forex online trading:

- Trend Following: Traders identify established trends and look for opportunities to enter trades in the direction of the trend. Moving averages, trendlines, and breakouts are often used to confirm trend direction and validate potential trade setups.

- Breakout Trading: Breakout traders aim to identify price levels where a significant breakout is likely to occur. By analyzing support and resistance levels, traders anticipate potential breakouts and enter trades as price breaks above or below these key levels.

- Reversal Trading: Traders focus on identifying potential trend reversals. They look for chart patterns, such as double tops or bottoms, and use indicators like the RSI or MACD to confirm trend exhaustion and potential reversal points.

- Support and Resistance Trading: Traders monitor support and resistance levels to identify areas where price could reverse or experience significant price reactions. They enter trades when price bounces off support or resistance levels or breaks through them.

- Risk Management: Technical analysis is not only about identifying potential entry and exit points but also about managing risk. Traders use stop-loss orders, position sizing techniques, and risk-reward ratios to manage their trades and limit potential losses.

Fundamental Analysis in Online Forex Trading

Fundamental analysis focuses on evaluating economic indicators, news events, and central bank policies that impact currency values. Understanding macroeconomic factors such as GDP, employment data, and interest rates enables traders to assess the strength and potential direction of a currency. By incorporating fundamental analysis into their strategies, traders gain a broader perspective of the market and make informed trading decisions.

Risk Management in Online Forex Trading

Risk management plays a vital role in online forex trading as it helps traders protect their capital and navigate the inherent volatility of the forex market. Implementing effective risk management strategies is essential for long-term success and mitigating potential losses. In this section, we will delve deeper into risk management techniques specifically tailored for forex online trading.

1. Assessing Risk Tolerance and Setting Risk Parameters

Before engaging in forex online trading, it is crucial to assess your risk tolerance. Every trader has a different comfort level when it comes to risk, and it is important to align your trading activities accordingly. Determine the percentage of your capital that you are willing to risk per trade or per day. This will help establish risk parameters that guide your decision-making process.

2. Position Sizing and Leverage Considerations

Proper position sizing is a fundamental aspect of risk management in forex online trading. It involves determining the appropriate trade size based on your risk tolerance and the specific trade setup. Using position sizing calculators and considering the impact of leverage can help determine the optimal trade size. It is important to remember that while leverage can amplify potential profits, it can also increase losses, so it should be used judiciously.

3. Setting Stop-Loss Orders

A key risk management tool in forex online trading is the use of stop-loss orders. A stop-loss order is an instruction to automatically close a trade at a predetermined price level, limiting potential losses. By setting a stop-loss order at a reasonable level based on your risk parameters and technical analysis, you can control the amount of capital at risk for each trade. It is essential to place stop-loss orders at levels that reflect the underlying market conditions and account for potential market volatility.

4. Take-Profit Levels and Trailing Stops

In addition to stop-loss orders, setting take-profit levels is another risk management technique in forex online trading. A take-profit level represents the target price at which you want to exit a trade and secure profits. It is important to define your take-profit level based on your trading strategy and analysis. Trailing stops are also useful tools that adjust the stop-loss level as the trade moves in your favor, allowing for potential profit capture while protecting against reversals.

5. Diversification and Correlation Analysis

Diversifying your forex online trading portfolio can help manage risk by spreading exposure across multiple currency pairs or assets. Correlation analysis is crucial in this process as it helps identify the relationships between different currency pairs. By understanding the correlations, you can avoid overexposure to similar trades and reduce the impact of adverse market movements on your overall portfolio.

6. Monitoring and Regular Evaluation

Risk management is an ongoing process in forex online trading. It requires continuous monitoring of trades, market conditions, and economic events that may impact currency movements. Regularly evaluating the performance of your risk management strategies and adjusting them as needed is crucial to adapt to changing market dynamics. Keeping a trading journal can aid in this evaluation process by documenting your trades, risk management decisions, and their outcomes.

7. Emotion Control and Discipline

Emotional control and discipline are integral aspects of risk management in forex online trading. Emotions such as fear, greed, and impatience can lead to irrational trading decisions and undermine risk management efforts. Implementing a trading plan and sticking to it, regardless of short-term market fluctuations, can help maintain discipline and prevent impulsive actions. Additionally, managing leverage responsibly and avoiding overtrading can reduce the potential for emotional decision-making.

Continuous Learning and Improvement in Online Forex Trading

The forex market is dynamic and constantly evolving. Continuous learning is essential for staying updated with market trends, new trading strategies, and technological advancements. Utilize demo accounts to practice and refine strategies in a risk-free environment. Backtesting strategies with historical data helps assess their viability and performance. Embrace a growth mindset, learn from trading mistakes, and seek mentorship or guidance from experienced traders.

**Emotions and Psychology in Online Forex TradingManaging emotions and maintaining discipline are crucial aspects of successful online forex trading. Recognize the impact of emotions such as fear and greed on trading decisions and develop strategies to manage them effectively. Stick to your trading plan and avoid impulsive actions based on emotions. Cultivate a resilient mindset that can withstand the inevitable ups and downs of the market, ensuring a long-term focus on consistent profitability.

Forex Trading Tools and Resources

A wide range of tools and resources are available to support online forex traders. Economic calendars and news feeds keep traders informed about important events and announcements that can impact the market. Trading journals and analysis tools help track and evaluate trades for continuous improvement. Engaging with online trading communities and forums allows for knowledge sharing, networking, and learning from experienced traders.

Conclusion

Online forex trading offers an exciting opportunity to participate in the global currency market from the convenience of your own home. By understanding the fundamentals, developing a robust trading strategy, and utilizing the available tools and resources, you can navigate the world of online forex trading with confidence. Remember to continuously learn, manage risk effectively, and maintain discipline in order to achieve long-term success in this dynamic market.