Forex trading is a vast field, where success often hinges on the adept use of technical analysis tools. Among these tools, the Bollinger Bands stand out as a crucial resource for traders. In this article, we delve deep into the bollinger bands strategy, understanding its nuances, benefits, and how to effectively employ it in your trading endeavors.

Understanding Bollinger Bands

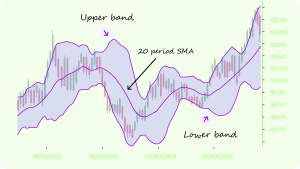

At its core, the Bollinger Bands strategy revolves around three primary bands. These are the Middle Band, Upper Band, and Lower Band. These bands represent moving averages and standard deviations, which provide insights into potential price movements.

The Middle Band is essentially a simple moving average, generally defaulting to 20 periods. Surrounding this Middle Band are the Upper and Lower Bands, which signify the standard deviations from the moving average. Essentially, these bands expand and contract based on market volatility.

Setting up Bollinger Bands

1. The Basics of Bollinger Bands

Bollinger Bands consist of three primary lines: the Middle Band (a simple moving average), and two outer bands (Upper and Lower Bands) which act as the standard deviations. The primary objective of the bollinger bands strategy is to monitor the distance between these bands, indicating market volatility.

2. Selection of Period

The foundation of this strategy is the moving average, often defaulting to a 20-period setting. However, the selection of the period is crucial. Some traders adjust this default setting based on their market observations and strategy. A shorter period might be more responsive to price changes, while a longer period might offer a smoother overview.

3. Determining Standard Deviation

Standard deviation plays a pivotal role in the bollinger bands strategy. Typically set at 2, the standard deviation determines the distance of the Upper and Lower Bands from the Middle Band. A higher deviation means wider bands, suggesting more volatility, whereas narrower bands (with a lower deviation) indicate less volatility.

4. Platform Setup

For executing the bollinger bands strategy efficiently, traders need to integrate Bollinger Bands on their preferred trading platforms. Most modern platforms, whether MetaTrader or Thinkorswim, offer Bollinger Bands as a built-in indicator. Accessing the indicator settings allows users to adjust the period and standard deviation in line with their bollinger bands strategy.

5. Visual Customization

The beauty of the bollinger bands strategy is not just in its effectiveness but also in its adaptability. On most trading platforms, traders can customize the visual appearance of the bands – adjusting their color, thickness, or style. While this doesn’t influence the strategy’s efficiency, it aids in better visual interpretation, especially when multiple indicators are at play.

6. Pairing with Other Indicators

Although Bollinger Bands are powerful on their own, their efficacy in the bollinger bands strategy can be enhanced when paired with other indicators. For example, integrating the Relative Strength Index (RSI) can help pinpoint overbought or oversold conditions, ensuring that traders don’t misinterpret signals solely based on the bands.

7. Continuous Monitoring and Adjustments

The world of trading is dynamic. As such, what worked today might not be as effective tomorrow. Thus, an essential aspect of the bollinger bands strategy is continuously monitoring and adjusting the settings. The markets evolve, and so should your strategies

Key Concepts Related to Bollinger Bands Strategy

1. The Three Bands

Central to the bollinger bands strategy are three distinctive bands:

- Middle Band: This is the heart of the strategy. Essentially a simple moving average, it typically defaults to a 20-period average. However, traders can adjust this period based on their preferences and the specificities of the assets they’re trading.

- Upper and Lower Bands: These represent volatility in the market. They’re determined by adding and subtracting a standard deviation from the middle band. The nature of these bands is dynamic; they widen during periods of increased volatility and contract during more stable times. Their behavior plays a pivotal role in the bollinger bands strategy.

2. Bollinger Bounce

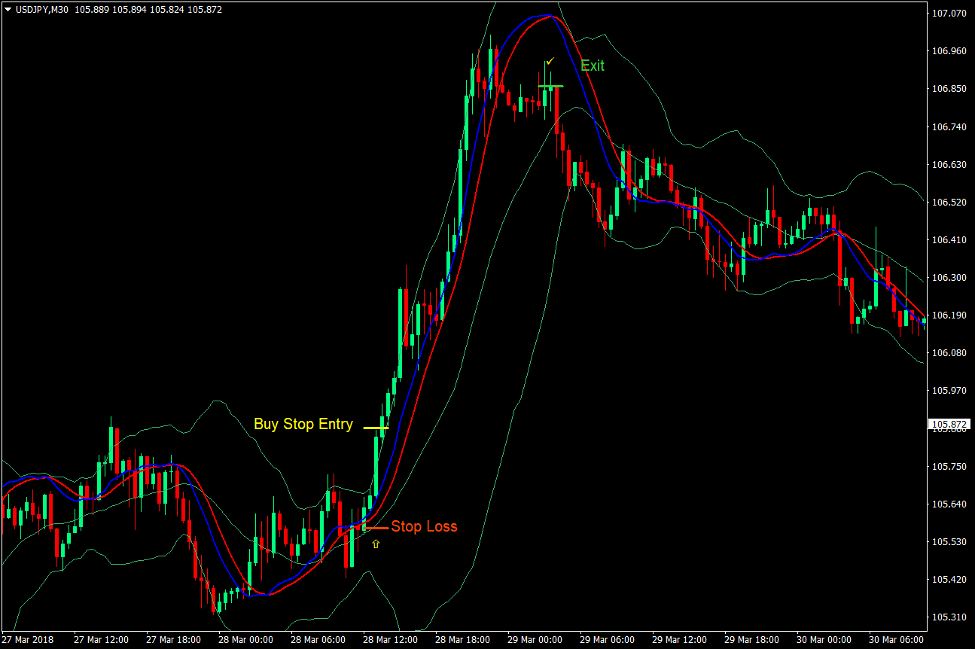

A foundational concept in the bollinger bands strategy, the Bollinger Bounce refers to the tendency of prices to “bounce” off the upper and lower bands. It’s an embodiment of the market’s cyclical nature. When prices touch or break through the upper band, it often indicates that the asset might be overbought. Conversely, if the prices graze the lower band, it could hint at the asset being oversold. Traders using the bollinger bands strategy monitor these touches closely as potential signals for entry or exit points.

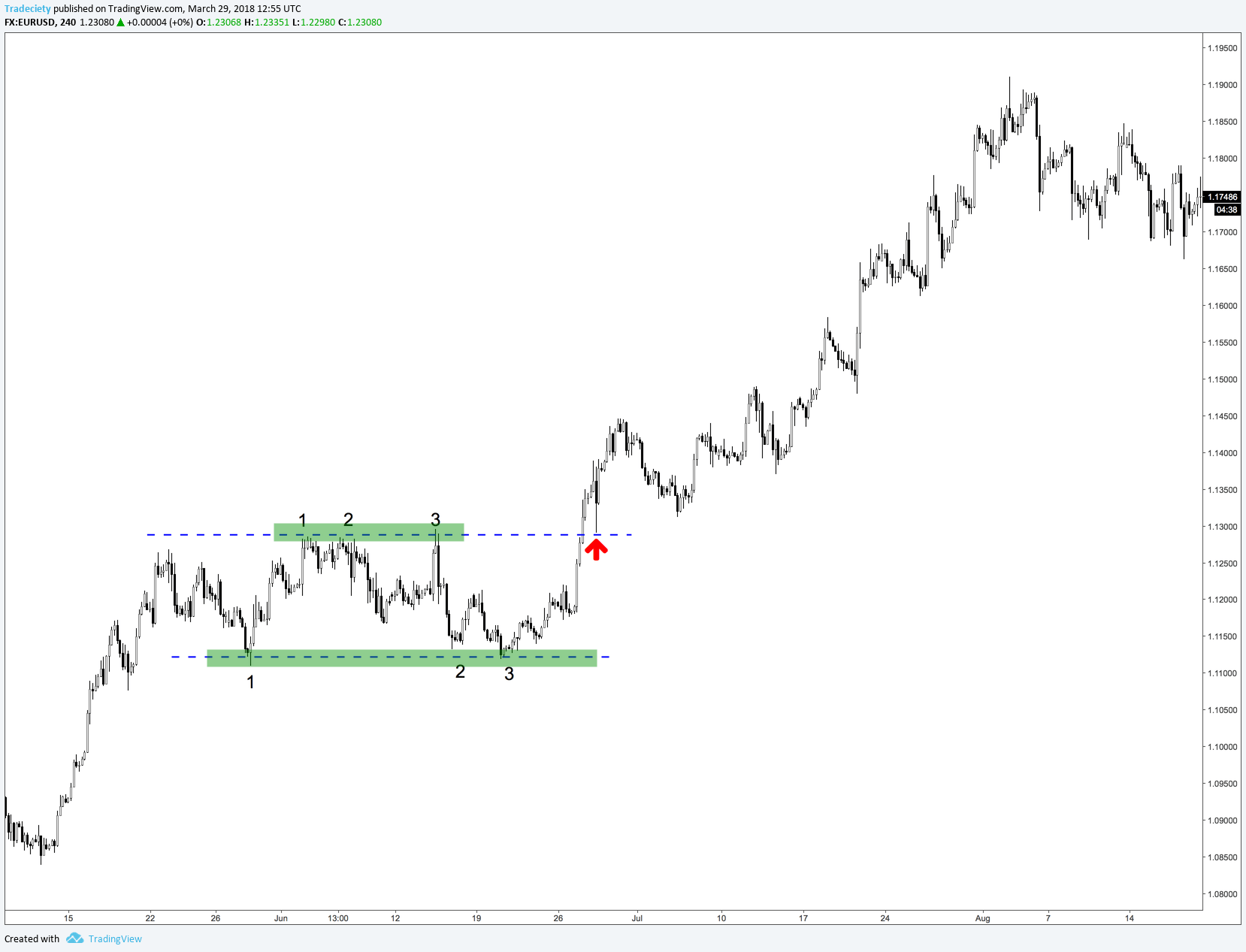

3. Bollinger Squeeze

The Bollinger Squeeze is another cornerstone of the bollinger bands strategy. It occurs when the bands come close together, signaling a period of low volatility. For traders, this squeeze is like the calm before the storm, often indicating a major price move on the horizon. Recognizing the squeeze in real-time and predicting the subsequent direction of the breakout can be the difference between a successful trade and a missed opportunity.

4. Combining with Other Indicators

While the bollinger bands strategy is robust in its own right, its strength can be magnified when used in conjunction with other technical indicators. For instance, combining the strategy with the Relative Strength Index (RSI) can offer deeper insights into potential overbought or oversold conditions, enhancing the predictive power of the bollinger bands strategy.

5. The Role of Market Volatility

At its core, the bollinger bands strategy is a reflection of market volatility. The bands’ behavior—whether they’re contracting or expanding—offers traders a window into the market’s current temperament. This insight can be pivotal in timing trades and setting stop-loss or take-profit points.

Common Mistakes to Avoid

- Sole Reliance on Bollinger Bands: One of the primary mistakes traders make is relying solely on the Bollinger Bands strategy for decision-making. While Bollinger Bands can be a powerful indicator of price movements and potential reversals, using it in isolation can often result in a skewed perspective. It’s always prudent to complement this strategy with other technical indicators like the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI) for a more holistic view of the market.

- Misinterpreting the Bands’ Expansion and Contraction: A fundamental aspect of this strategy is the interpretation of the bands’ movements. Many novice traders mistake the bands’ contraction (squeeze) as an immediate buy or sell signal, expecting a major price move. While the squeeze can indeed indicate potential volatility, determining the direction of the breakout is crucial. Similarly, just because the bands are expanding doesn’t mean the price will maintain its current direction.

- Ignoring the Middle Band: The focus often remains on the upper and lower bands, but the middle band, representing the simple moving average, is equally significant in the Bollinger Bands strategy. Overlooking the middle band can mean missing out on crucial trend reversal indications. A price crossing the middle band can sometimes be an early sign of a trend change, especially if other indicators support this movement.

- Overestimating Overbought and Oversold Conditions: When prices consistently touch or surpass the upper band, the asset may be considered overbought, and when they touch the lower band, it might be seen as oversold. However, in a strong trending market, prices can remain overbought or oversold for extended periods. Blindly shorting an overbought market or buying an oversold one without considering the broader trend can be detrimental to the trading portfolio.

- Setting Inflexible Parameters: The default setting for Bollinger Bands is a 20-day moving average with a 2 standard deviation for the upper and lower bands. While this might work for many scenarios, sticking rigidly to these parameters without adapting to the market can be a mistake. The Bollinger Bands strategy is flexible, and traders should feel comfortable adjusting these settings to better fit the asset or timeframe they are trading.

- Neglecting the Broader Market Context: While Bollinger Bands can provide insights into potential price actions, it’s essential to understand the broader market context. Factors like major news events, economic announcements, and other macro indicators can influence price movements beyond what’s predicted by Bollinger Bands.

Benefits of Using Bollinger Bands

The forex trading landscape is teeming with tools and strategies designed to give traders an edge in predicting market movements. Among these, the Bollinger Bands have emerged as an immensely popular and versatile tool. By understanding the advantages of implementing this strategy, traders can make more informed decisions and potentially enjoy greater profitability. Let’s delve deeper into the benefits of this esteemed strategy.

1. Clear Identification of Overbought and Oversold Markets

One of the primary advantages of this strategy is its ability to highlight overbought and oversold conditions in the market. When the price of a currency pair touches or exceeds the upper band, it often indicates an overbought condition. Conversely, when it touches or drops below the lower band, the market could be oversold. By keeping an eye on these movements, traders using the bollinger bands strategy can identify potential reversal points and make trades accordingly.

2. Recognition of Volatility Shifts

Volatility is a crucial factor in the forex market, influencing the potential profit and risk associated with trades. The strategy provides clear visual cues about volatility shifts. When the bands contract, it indicates a period of low volatility, while band expansion signifies increased volatility. By recognizing these patterns, traders can adjust their strategies to either capitalize on or protect themselves from potential market swings.

3. Versatility Across Timeframes

Whether you’re a scalper working with minute charts or a long-term trader analyzing weekly data, the bollinger bands strategy can be applied effectively. This adaptability makes it a versatile tool suitable for various trading styles and strategies.

4. Improved Risk Management

By offering insights into potential price reversals and volatility shifts, the bollinger bands strategy can assist traders in setting more accurate stop-loss and take-profit levels. When combined with other technical analysis tools, it can further refine entry and exit points, thereby enhancing a trader’s risk management capabilities.

5. Detection of Continuation and Breakout Patterns

The ‘Bollinger Squeeze’, a central component of the strategy, is a potent pattern that signals potential breakouts. When the bands come close together, indicating reduced volatility, a subsequent expansion can signal the beginning of a significant price movement. Recognizing this early can provide traders with lucrative trading opportunities.

6. Enhanced Decision Making with Complementary Indicators

While the strategy is powerful on its own, its efficacy can be further enhanced when used in tandem with other indicators. For instance, combining Bollinger Bands with the Relative Strength Index (RSI) can help in confirming overbought or oversold signals, providing traders with an added layer of confidence in their decisions.

7. Aiding in Trend Identification

In the forex market, understanding the direction and strength of a trend can be the difference between profit and loss. The positioning of price in relation to the bands can give insights into potential trend continuations or reversals. If the price remains near the upper band while traveling across, it could indicate a strong uptrend. Conversely, if it hovers near the lower band, a downtrend might be in play.

Limitations and Cautions

- False Breakouts: One of the common pitfalls of the Bollinger Bands strategy is the occurrence of false breakouts. There are times when the price seems to break through the upper or lower band, suggesting a potential trend, only to revert back into the band’s range. Relying solely on band breakouts without considering other indicators can result in misguided trading decisions.

- Overreliance on Bands for Predictions: The Bollinger Bands strategy revolves around the principle of mean reversion, assuming that prices will always revert to the mean (middle band) over time. However, during strong trending markets, prices can “ride” the bands for extended periods. An overreliance on the strategy in such scenarios might lead to missed profitable opportunities or potential losses.

- Static Standard Deviation: The Bollinger Bands strategy uses a static number for the standard deviation, usually set at two. This assumes that price movements conform to a normal distribution, which isn’t always the case in real-world trading. Sometimes, significant news events or market sentiment shifts can lead to price movements that don’t align with the standard statistical assumptions of the Bollinger Bands strategy.

- Misinterpreting Band Contraction: A contraction or “squeeze” of the bands indicates decreasing volatility and is often viewed as a precursor to a potential breakout. However, the Bollinger Bands strategy does not specify the direction of this breakout. Traders might anticipate a bullish breakout when, in reality, a bearish reversal is on the horizon, and vice versa.

- Delay in Indications: Like many technical indicators, the Bollinger Bands strategy can sometimes lag behind real-time price movements. By the time the bands indicate a buy or sell signal, the optimal entry point might have passed.

Precautions to Take:

- Combine with Other Indicators: To offset the limitations of the Bollinger Bands strategy, it’s wise to combine it with other technical analysis tools. For instance, integrating momentum indicators like the Relative Strength Index (RSI) can help distinguish between genuine and false breakouts.

- Stay Updated: Ensure you stay updated with global news and market shifts. Sometimes, external events can drastically influence price movements, rendering technical indicators less effective.

- Practice Makes Perfect: Before implementing the Bollinger Bands strategy in live trading, practice with a demo account. It gives you a feel of how the bands react to price movements and helps you develop a more intuitive understanding.

- Stay Flexible: The Bollinger Bands strategy, while robust, should not be seen as infallible. It’s essential to remain flexible in your approach, adjusting and recalibrating your strategy as market conditions change.

Enhancing the Bollinger Strategy

Forex trading has seen a surge in the use of technical indicators, and one of the most prevalent is the bollinger bands strategy. This strategy offers traders a visual representation of price volatility and potential overbought or oversold conditions. But while the bollinger strategy is powerful on its own, its potential can be amplified when integrated with other technical tools and approaches.

1. Integrating with Other Technical Indicators

- Relative Strength Index (RSI): RSI is a momentum oscillator that measures the speed and change of price movements. When combined with the bollinger bands strategy, traders can identify more clear-cut overbought or oversold conditions. For instance, if the price touches the upper band while the RSI indicates an overbought condition, it might signal a potential price reversal.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator shows the relationship between two moving averages of a security’s price. By using MACD alongside the bollinger bands strategy, traders can confirm potential buy or sell signals. If the MACD shows a rising trend while the price is near the lower band, it might be a strong buy signal.

2. Using Multiple Time Frame Analysis

While the bollinger bands strategy can be applied on any time frame, utilizing multiple time frames can provide a broader view of the market. For instance, if a trader identifies a buy signal on a daily chart using the bollinger bands strategy, checking the weekly or monthly chart can confirm the long-term trend direction. This layered approach ensures that traders are in sync with both short-term and long-term market movements.

3. Incorporating Price Patterns

Patterns like double tops, double bottoms, triangles, and flags often appear within the Bollinger Bands. Recognizing these patterns within the context of the bollinger bands strategy can provide traders with added confirmation. For instance, a double bottom pattern near the lower band could reinforce a potential buy signal.

4. Adapting to Market Volatility

The nature of this strategy is such that the bands expand during periods of high volatility and contract during low volatility. By adjusting the standard deviation settings, traders can make the bands more responsive or less responsive to price volatility. This customization allows traders to adapt the bollinger bands strategy to different market conditions.

5. Diversifying with Different Assets

The bollinger bands strategy isn’t limited to forex trading. It can be applied to stocks, commodities, and other financial instruments. By diversifying their portfolio and applying the bollinger bands strategy across different assets, traders can spread risk and identify a wider range of trading opportunities.

Conclusion

In the vast world of forex trading, understanding and effectively employing the bollinger bands strategy can be a game-changer. By grasping its intricacies and combining it with other technical indicators, traders can chart a more informed and potentially profitable trading journey. Like all tools, the key lies not just in understanding its mechanics but in effective and informed application.