Introduction

Price action trading is a popular and effective approach to trading in financial markets. It is based on the idea that the market price of an asset reflects all the relevant information about that asset and its future price movements. In this article, we will take a closer look at price action trading and what it can offer traders of all levels.

What is Price Action?

Price action is a term used in technical analysis to describe the movement of a financial asset’s price. It is a method of analyzing and trading financial markets that relies solely on the use of price charts and market data to make informed trading decisions.

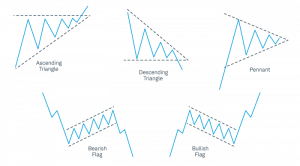

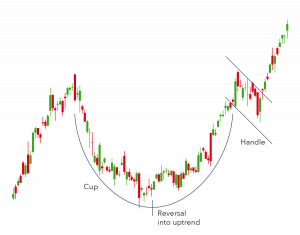

In price action trading, traders focus on the price movement of an asset and use this information to identify potential trade opportunities. They use chart patterns, support and resistance levels, trendline analysis, and candlestick patterns to make informed decisions and to profit from market movements.

Price action trading does not rely on the use of indicators or algorithms, making it a simple and straightforward approach to trading. By focusing on market data and price movements, traders can gain a deeper understanding of market dynamics and make informed decisions based on market sentiment.

Price action is a comprehensive and effective approach to trading that offers many benefits over other methods. By embracing price action, traders can achieve their financial goals, experience the benefits of successful trading, and enjoy a more straightforward and transparent approach to the markets.

Key Terminology and Concepts in Price Action Trading Strategy

Price action trading has its own set of key terminology and concepts that traders must be familiar with to be successful. Here are a few key terms and concepts in price action trading:

- Candlestick Patterns: Candlestick patterns are visual representations of price movements on a chart and can indicate potential market trends and price reversals. Common candlestick patterns include the doji, hammer, shooting star, and more.

- Support and Resistance: Support and resistance are key levels in the market where price is expected to find buying or selling interest. Traders use support and resistance levels to identify potential trade opportunities and to profit from market movements.

- Trendline Analysis: Trendline analysis involves drawing lines on a chart to identify the direction of a trend and potential areas of support or resistance. Trendlines can be used to identify the direction of a trend and to make informed trading decisions.

- Pin Bar and Inside Bar Patterns: Pin bar and inside bar patterns are specific candlestick patterns that can indicate potential price reversals in the market. These patterns provide valuable information about market sentiment and can be used to make informed trading decisions.

- Price Action Confirmations: Price action confirmations are additional signals that traders can use to confirm the validity of their price action trades. These signals can help traders increase the accuracy of their trades and improve their overall trading results.

- Risk Management: Risk management is the process of managing the potential for loss in trading. Price action traders use proper risk management strategies, such as setting stop-loss orders and using position sizing strategies, to limit their potential losses and increase their chances of success.

By familiarizing yourself with these key terms and concepts in price action trading, you can improve your understanding of the markets and make informed trading decisions. Remember, the key to success in price action trading is to stay informed, stay patient, and approach trading with discipline and a well-defined plan.

Benefits of Price Action Trading

Price action trading is a popular approach to trading that offers many benefits over other methods. Here are a few key benefits of price action trading:

- Simplicity: Price action trading is a simple approach to trading that focuses on the price movement of an asset, rather than relying on complex indicators or algorithms. This simplicity makes price action trading accessible to traders of all levels and can help reduce the confusion and complexity often associated with other forms of trading.

- Flexibility: Price action trading can be applied to any financial market, including stocks, currencies, commodities, and more. This flexibility allows traders to trade a variety of markets and to capitalize on market movements, no matter the underlying asset.

- Market Transparency: Price action trading relies on market data and price movements to make trading decisions, providing a high degree of market transparency. This transparency allows traders to make informed decisions and to better understand the underlying forces driving market movements.

- Risk Management: Price action trading places a strong emphasis on proper risk management, helping traders to avoid over-trading and to stay disciplined in their approach to the markets. By having a well-defined risk management strategy in place, traders can reduce their potential losses and increase their chances of success.

- Adaptability: Price action trading is a dynamic approach to trading that can be adapted to changing market conditions. By continuously monitoring the markets and adjusting their trading plans as necessary, traders can stay ahead of the curve and profit from market movements.

Price action trading is a comprehensive and effective approach to trading that offers many benefits over other methods. By embracing price action trading, traders can achieve their financial goals, experience the benefits of successful trading, and enjoy a more straightforward and transparent approach to the markets.

Support and Resistance

Support and resistance are key levels in the market where price is expected to find buying or selling interest. These levels can be used to make informed trading decisions and to profit from market movements.

Support levels are price levels at which buying interest is expected to emerge, preventing the price from falling further. Resistance levels, on the other hand, are price levels at which selling interest is expected to emerge, preventing the price from rising further.

Traders can use support and resistance levels to identify potential trade opportunities. For example, when price approaches a support level, traders may look to buy, while when price approaches a resistance level, traders may look to sell. Additionally, traders may look for price to break through support or resistance levels, as these can indicate potential trend changes and trade opportunities.

Support and resistance levels can be identified through various forms of market analysis, including trendline analysis, chart patterns, and price action. It’s important to note that support and resistance levels are not absolute and can be subject to change based on market conditions.

By incorporating support and resistance levels into your price action trading strategy, you can gain a deeper understanding of market dynamics and make informed trading decisions. Remember, the key to success in price action trading is to stay informed, stay patient, and approach trading with discipline and a well-defined plan.

Trendline Analysis

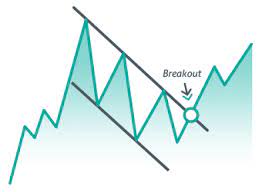

Trendline analysis is a key component of price action trading and involves drawing lines on a chart to identify the direction of a trend and potential areas of support or resistance. By understanding the direction of a trend and the key levels of support and resistance, traders can make informed trading decisions and profit from market movements.

To perform trendline analysis, traders typically draw lines connecting two or more price points on a chart. These lines can then be used to identify the direction of a trend and to identify potential areas of support and resistance. Traders may look for price to bounce off support or resistance levels, or for price to break through these levels, as these can indicate potential trade opportunities.

It’s important to note that trendlines are not absolute levels of support or resistance and can be subject to change based on market conditions. Traders should continuously monitor their trendlines and adjust them as necessary to reflect changing market conditions.

In addition to trendline analysis, traders may also use other forms of market analysis, such as support and resistance levels, candlestick patterns, and price action confirmations, to increase the accuracy of their trades and improve their overall results.

By incorporating trendline analysis into your price action trading strategy, you can gain a deeper understanding of market trends and make informed trading decisions. Remember, the key to success in price action trading is to stay informed, stay patient, and approach trading with discipline and a well-defined plan.

Pin Bar and Inside Bar Patterns

Pin bar and inside bar patterns are specific candlestick patterns that can indicate potential price reversals in the market. These patterns provide valuable information about market sentiment and can be used to make informed trading decisions.

Pin Bar Pattern: A pin bar pattern is a single candlestick pattern that is characterized by a long wick and a small body. The long wick represents the rejection of price at a certain level and indicates that the market is either overbought or oversold. A pin bar pattern can indicate a potential price reversal, and traders may look to enter trades in the direction of the reversal.

Inside Bar Pattern: An inside bar pattern is a two-candlestick pattern where the range of the second candle is completely inside the range of the preceding candle. This pattern can indicate indecision in the market and can be used to identify potential breakouts. Traders may look to enter trades in the direction of the breakout once price confirms a clear direction.

It’s important to note that while pin bar and inside bar patterns can provide valuable information about market sentiment, they should be used in conjunction with other forms of market analysis and price action confirmations for increased accuracy. Additionally, it’s important to use proper risk management strategies and to always approach trading with caution and discipline.

By incorporating pin bar and inside bar patterns into your price action trading strategy, you can improve your results and achieve your trading goals. Remember, the key to success in price action trading is to stay informed, stay patient, and approach trading with discipline and a well-defined plan.

Price Action Confirmations

Price action confirmations are additional signals that traders can use to confirm the validity of their price action trades. These signals can help traders increase the accuracy of their trades and improve their overall trading results. Here are a few common types of price action confirmations:

- Technical Indicators: Technical indicators, such as moving averages or momentum indicators, can be used to confirm price action signals. For example, a trader may look for a bullish crossover in a moving average to confirm a bullish price action signal.

- Fundamental Factors: Fundamental factors, such as economic data releases or central bank announcements, can also be used to confirm price action signals. For example, a trader may look for positive economic data releases to confirm a bullish price action signal in the market.

- Volume: Volume is the number of shares or contracts traded in a specific period of time. It can be used to confirm price action signals, as higher volume typically indicates stronger market sentiment and a higher likelihood of a sustained price move.

- Market Structure: Market structure, such as trendlines or support and resistance levels, can also be used to confirm price action signals. For example, a trader may look for a price action signal to occur at a key level of support or resistance for added confirmation.

By using price action confirmations, traders can increase the accuracy of their trades and reduce the risk of false signals. However, it’s important to use price action confirmations in conjunction with a well-defined trading plan and to not rely solely on confirmations to make trading decisions. The best approach is to use price action confirmations as an additional tool in your trading arsenal, along with your knowledge of price action and market analysis.

Implementing Price Action

Implementing price action trading strategies involves developing a trading plan, identifying trading opportunities, setting stops and limits, and managing risk. Here are a few steps to follow to implement a price action trading strategy:

- Develop a Trading Plan: Start by developing a clear and concise trading plan that outlines your trading goals, risk management strategy, and the markets you will be trading. This plan should include your entry and exit rules, as well as your position sizing and risk management strategies.

- Identify Trading Opportunities: Use your knowledge of price action and market analysis to identify potential trading opportunities. Look for key levels of support and resistance, trendlines, and candlestick patterns to help you make informed decisions.

- Set Stops and Limits: Use stop-loss orders to limit your potential losses and take-profit orders to lock in profits. It’s important to have a well-defined risk management strategy in place to help you stay disciplined and avoid over-trading.

- Manage Risk: Proper risk management is key to success in price action trading. Make sure to never trade more than you can afford to lose and to always have a plan in place for managing risk. This may include using position sizing strategies, setting stop-loss orders, and diversifying your portfolio.

- Monitor Your Trades: Continuously monitor your trades and stay up-to-date on market developments. Make adjustments to your trades as necessary, based on market conditions and your trading plan.

By following these steps, you can effectively implement a price action trading strategy and achieve your trading goals. Remember, trading is a journey, and it takes time, patience, and discipline to achieve success. Stay focused on your goals, continuously improve your skills, and always approach trading with caution and a well-defined plan.

Enhancing Your Price Action Trading Skills

To get the most out of price action trading, it’s important to continuously improve your skills and knowledge. Here are a few tips to help you enhance your price action trading skills:

- Mental and Emotional Preparation: Trading requires mental and emotional discipline, so it’s important to be prepared for the ups and downs of the market. This can include developing a positive mindset, managing stress, and staying focused on your goals.

- Practice and Backtesting: Practice your price action trading skills by backtesting your strategies on historical market data. This will help you to refine your approach and improve your results. You can also practice your skills by paper trading in a demo account before committing real money to the market.

- Keep a Trading Journal: Keeping a trading journal is a great way to reflect on your trades and identify areas for improvement. Write down your thoughts, insights, and lessons learned from each trade to help you become a better trader.

- Stay Informed: Staying informed about the markets and economic events is crucial for success in price action trading. Read market news, follow financial experts, and attend educational events to stay up-to-date on the latest market developments.

- Seek Professional Guidance: If you’re feeling overwhelmed or unsure about your trading strategy, consider seeking professional guidance from a trading mentor or coach. They can provide valuable insights, advice, and support to help you improve your skills and achieve your trading goals.

By continuously working on enhancing your price action trading skills, you can improve your results and become a more successful trader. Remember, trading is a marathon, not a sprint, so stay patient, disciplined, and focused on your goals, and you will achieve the success you’re looking for.

Conclusion

Price action trading is a simple and effective approach to trading that can be applied to any financial market. By understanding the key principles of price action, including support and resistance, trendline analysis, and candlestick patterns, traders can make informed trading decisions and achieve their financial goals. With its focus on market data and transparency, price action trading provides a reliable and straightforward approach to trading that can be embraced by traders of all levels.