Introduction

In the fast-paced world of financial markets, algorithmic trading has become the backbone of many trading strategies. Among them, the momentum trading algorithm stands out, designed to capitalize on existing market trends and leverage them for profit.

Understanding Momentum in Trading

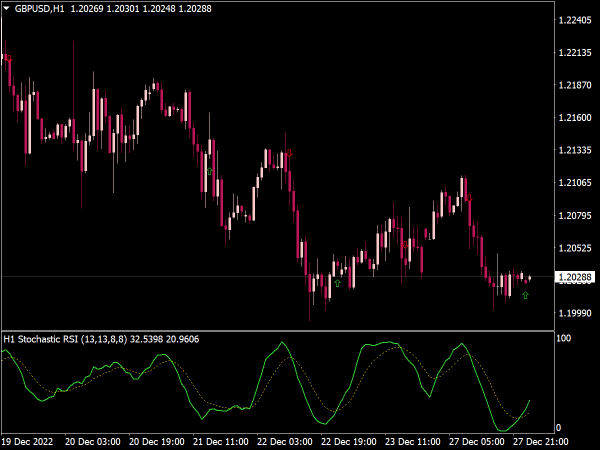

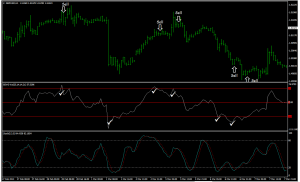

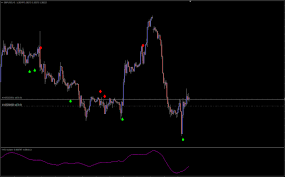

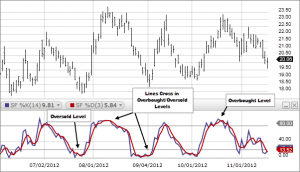

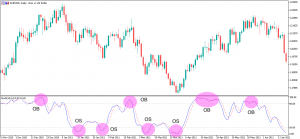

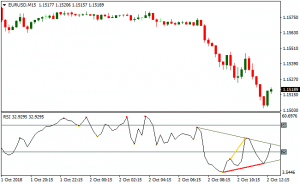

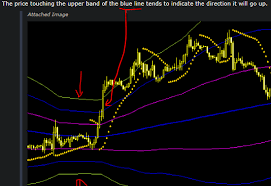

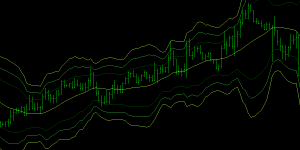

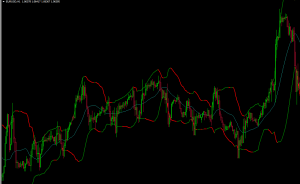

Momentum, in trading, can be visualized as a train in motion. The idea is simple: buy securities that are moving upwards and sell those on a downtrend. However, identifying this momentum requires a more analytical approach. This is where tools such as Moving Averages and the Relative Strength Index (RSI) come into play. These indicators, among others, provide traders with a clear snapshot of market momentum, acting as the foundation for the momentum trading algorithm.

The Core Components of a Momentum Trading

Data Acquisition

Every momentum trading begins its journey with data. The quality and timeliness of the data fed into the system play a crucial role in its overall performance. Real-time data, sourced from reliable feeds, provides the algorithm with the raw material it needs to gauge market movements. This data typically includes price movements, trade volumes, and any other pertinent market metrics that can influence momentum.

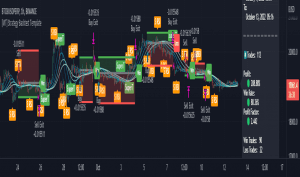

Signal Generation

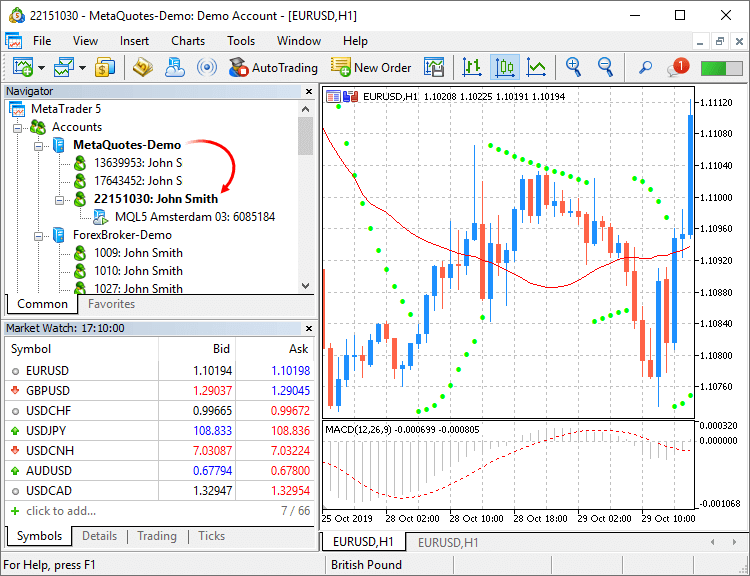

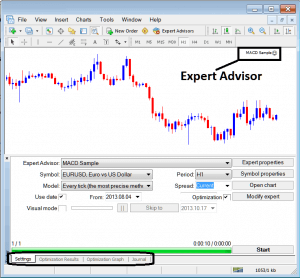

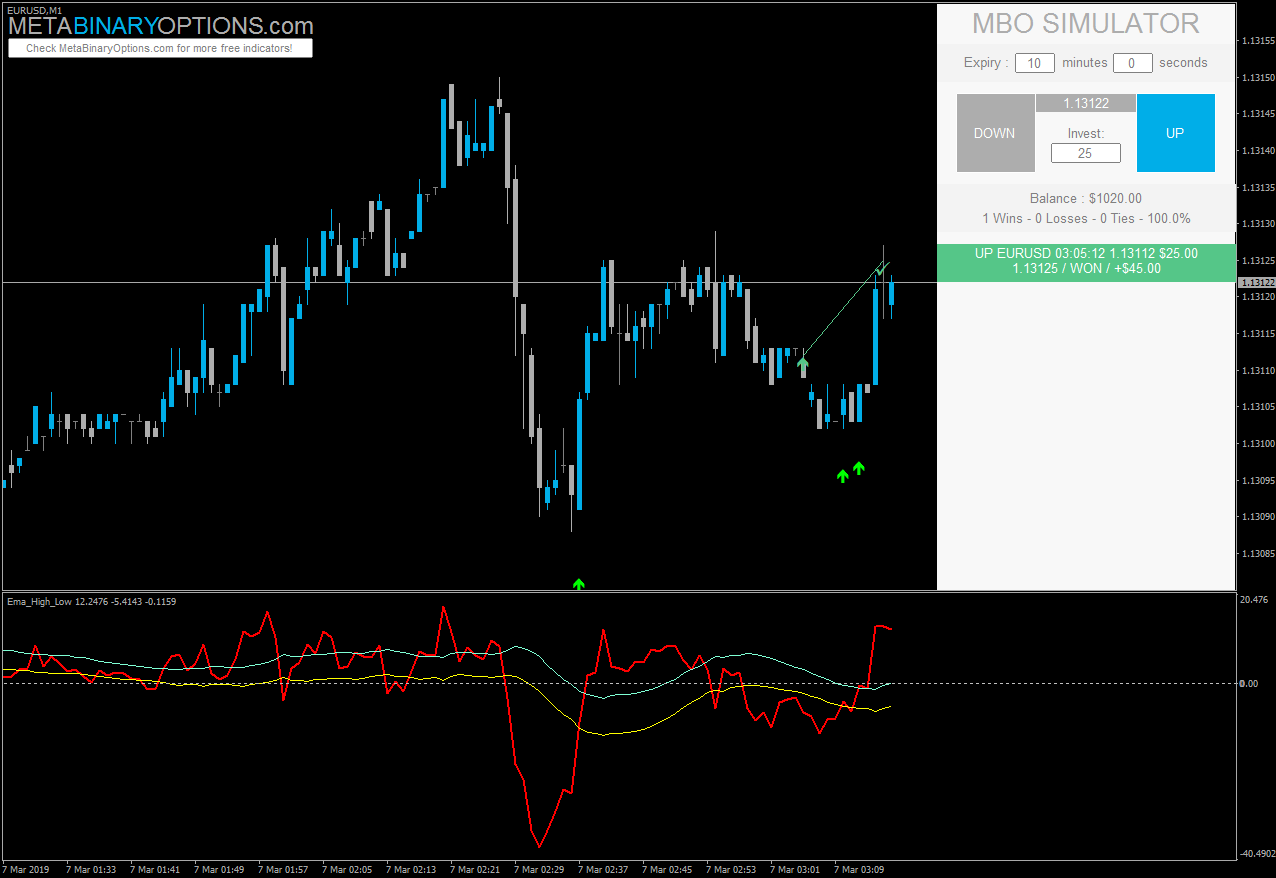

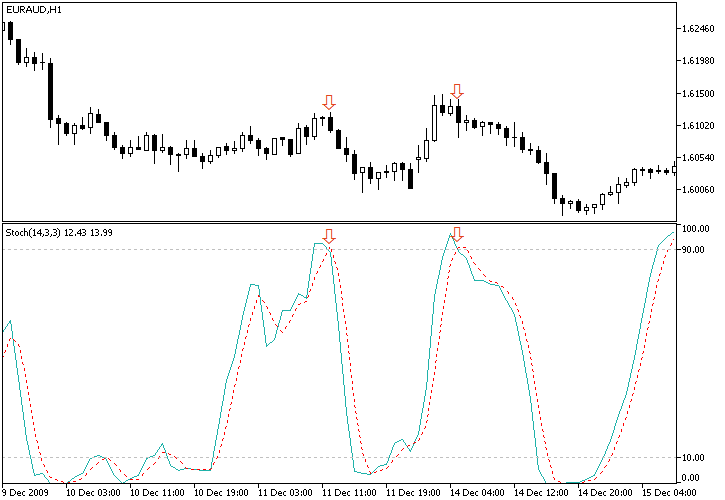

Signal generation is arguably the heart of this trading algorim. Here, the algorithm processes the acquired data using predefined sets of rules to determine potential trading opportunities. These rules often center on momentum indicators, such as Moving Averages or the Relative Strength Index (RSI). When certain conditions are met, the algorithm generates a signal, either to buy or sell a security.

Execution

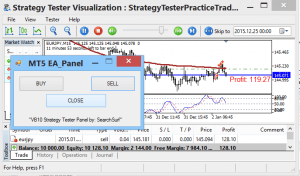

Once a signal is generated, the next step for the momentum trading algorithm is execution. Automated trading ensures that orders are placed swiftly and efficiently in the market. The speed at which these algorithms operate gives them an edge over manual trading, as they can execute trades within milliseconds of identifying an opportunity. This rapid response is especially vital in volatile markets, where momentum can change quickly.

Risk Management

While the primary goal of momentum trading is to identify and act on profitable trading opportunities, it’s equally vital to consider the associated risks. As a result, integrated risk management features are essential. These might include setting stop-loss levels, which automatically sell a security if its price drops to a certain level, or take-profit levels, which sell the security once it reaches a desired profit margin. This automated risk management ensures that the trader’s exposure is limited and aligns with their risk tolerance.

Feedback Loop

An often-overlooked component of the momentum trading algorithm is the feedback loop. After every trade, the algorithm evaluates the outcomes against its predictions. This self-assessment allows the algorithm to refine its rules and adapt to changing market conditions. The feedback loop ensures that the system remains dynamic and can evolve in line with market trends and behaviors.

Benefits of a Momentum Trading Algorithm

Efficient Data Processing One of the standout benefits of the momentum trading algorithm is its capacity to process vast amounts of data at lightning speed. Unlike human traders who may struggle to analyze multiple data sources simultaneously, the momentum trading algorithm seamlessly interprets live data feeds, ensuring that traders have access to real-time insights into market movements.

Emotionless Trading Decisions Human emotions can often skew trading decisions, leading to potentially costly mistakes. The momentum trading algorithm, being a machine, is devoid of emotions. It strictly adheres to predefined rules, ensuring that trades are executed based on logic and analysis rather than sentiment. This eliminates the potential pitfalls of fear, greed, or overconfidence that might affect manual trading.

Speed of Execution In the world of trading, speed can make all the difference between a profitable trade and a missed opportunity. The momentum trading algorithm’s ability to execute trades almost instantaneously gives traders a significant edge. When a market signal aligns with the algorithm’s criteria, trades are made swiftly, capitalizing on fleeting market momentum.

Continuous Market Monitoring The momentum trading algorithm doesn’t need to rest, eat, or sleep. It offers continuous market monitoring, scanning multiple instruments across various markets. This round-the-clock vigilance ensures that no potential trading opportunity, no matter how brief, goes unnoticed.

Enhanced Risk Management The momentum trading algorithm isn’t just about seizing opportunities; it’s also about safeguarding investments. Most algorithms come integrated with risk management features, such as setting stop-loss or take-profit levels. This ensures that even in volatile markets, the downside risk remains controlled and within a trader’s predefined limits.

Adaptability and Learning Many modern momentum trading algorithms incorporate machine learning techniques, allowing them to learn from past trades and adapt. This means that over time, the algorithm can refine its strategies, making it more attuned to specific market conditions or a trader’s unique risk profile.

Consistency in Strategy Application A well-defined trading strategy is only as good as its application. The momentum trading algorithm provides unmatched consistency. Every time a market condition aligns with the algorithm’s set parameters, the same trading action is taken, ensuring a uniform approach.

Diversification and Scalability With the ability to monitor several markets simultaneously, the momentum trading algorithm allows traders to diversify their portfolios effortlessly. Furthermore, as a trader’s strategy and capital grow, the algorithm can scale its operations, catering to an expanded set of instruments or a more significant trading volume.

Challenges and Considerations in

Overfitting Issues

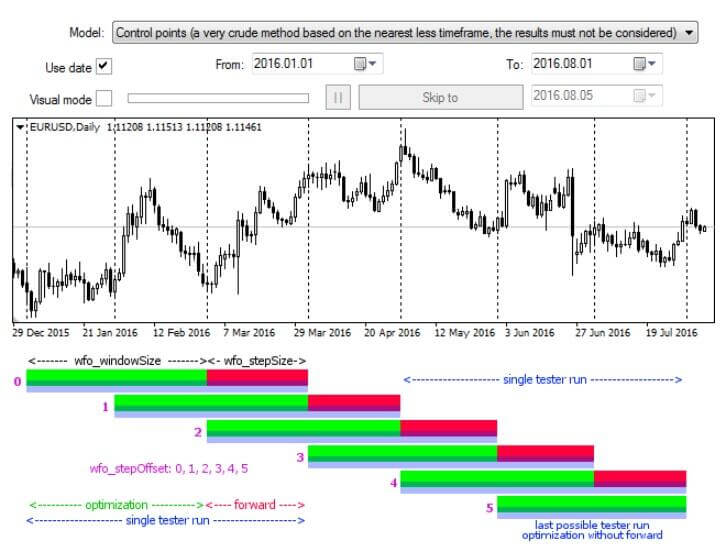

One of the most significant challenges faced in developing a momentum trading algorithm is overfitting. Overfitting occurs when the algorithm is too closely tailored to historical data. Instead of identifying genuine patterns and trends, an overfitted algorithm might end up “memorizing” past events, making it less adaptive and effective for future market scenarios. Traders must ensure that their momentum trading algorithm is designed to generalize from past data rather than reproduce it, ensuring it remains adaptable and responsive to new market data.

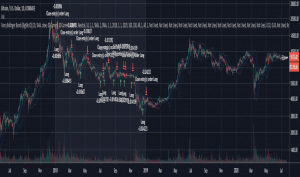

Handling Market Reversals

The essence of a momentum trading algorithm is to capitalize on prevailing market trends. However, markets are dynamic, and trends can reverse unexpectedly due to various reasons like geopolitical events, economic announcements, or global crises. A sudden market reversal can present challenges for momentum-based strategies, especially if the algorithm isn’t designed to recognize and adapt to rapid changes in market direction. Fine-tuning the momentum trading algorithm to incorporate mechanisms to detect potential reversals is crucial for long-term trading success.

Technological Vulnerabilities

While technology is the backbone of any algorithmic trading strategy, it also introduces its set of challenges. Connectivity issues, software bugs, or hardware failures can hinder the momentum trading algorithm’s performance, leading to missed opportunities or, worse, significant losses. Ensuring robust technological infrastructure, regular system checks, and having contingency plans in place is vital for those heavily reliant on momentum algorithmic trading.

Adapting to Changing Market Conditions

Financial markets are not static. They evolve based on a multitude of factors, including changes in economic policies, technological innovations, or shifts in investor sentiment. A momentum trading algorithm that performed exceptionally well in one market condition might struggle when the dynamics change. Traders need to ensure that their algorithms undergo periodic reviews and updates to remain relevant and effective in various market conditions.

Dependency and Over-reliance

There’s a tendency among traders, especially those new to the algorithmic trading world, to become overly reliant on their systems. While the momentum trading algorithm can offer significant advantages in terms of speed and efficiency, it’s essential to understand its limitations. No algorithm can predict market movements with absolute certainty. Blindly following the algorithm without understanding or oversight can lead to unforeseen risks and losses.

Regulatory and Ethical Concerns

As algorithmic trading, including the use of momentum trading algorithms, becomes more prevalent, it attracts the attention of regulatory bodies worldwide. Concerns about market manipulation, unfair advantages, and a lack of transparency have led to calls for more stringent regulations. Traders employing these algorithms need to be aware of the evolving regulatory landscape and ensure that their trading practices remain compliant.

Fine-Tuning the Algorithm: The Iterative Process

Understanding the Momentum Trading Algorithm’s Feedback Loop

At the heart of refining any algorithm lies the feedback loop. For a momentum trading algorithm, this loop is the process of executing trades, analyzing the outcomes, making necessary changes, and then testing those changes in real-time. This cycle continues repeatedly, ensuring the algorithm becomes more aligned with the trader’s objectives and the ever-evolving market dynamics.

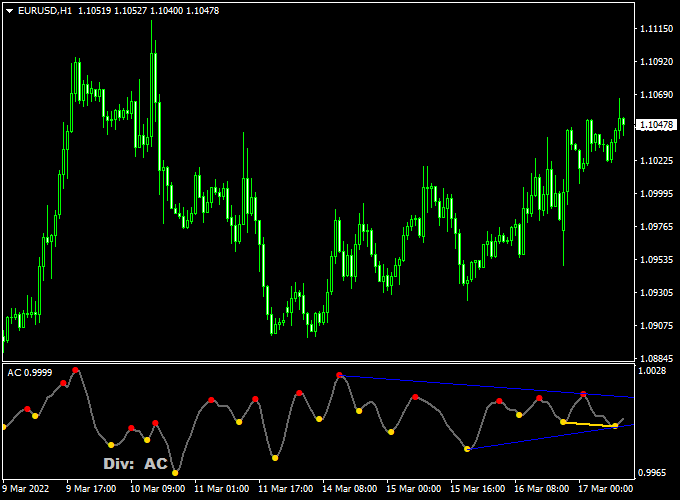

Data Analysis and Performance Metrics

An essential step in fine-tuning a momentum trading algorithm is the analysis of data and performance metrics. This involves closely monitoring how the algorithm performs in various market conditions. For instance, does it effectively capture upward trends? How does it respond to sudden market reversals? By evaluating key performance indicators (KPIs), traders can gauge where the algorithm excels and where it requires improvement.

Adapting to Changing Market Dynamics

Financial markets are in a constant state of flux, driven by factors ranging from economic data releases to geopolitical events. A momentum trading algorithm that performed exceptionally well during a bullish market phase might struggle during a bearish or volatile phase. As a result, traders need to adjust the algorithm’s parameters to ensure it remains effective irrespective of market mood.

Avoiding Overfitting

One of the most common pitfalls when refining a momentum trading algorithm is overfitting. This occurs when the algorithm becomes too tailored to past data, making it less flexible and adaptive to new market scenarios. The iterative process involves ensuring that while the algorithm learns from its past trades, it doesn’t become overly rigid or hyper-specific in its decision-making process.

Manual Oversight and Periodic Reviews

While the power of a momentum trading algorithm lies in its automation, human intervention remains indispensable. Periodic reviews by traders ensure that the algorithm’s actions align with broader trading objectives and strategies. Sometimes, the human touch can identify nuances or market sentiments that might be overlooked by even the most sophisticated algorithms.

Integration of New Technologies

The technological landscape of trading is ever-evolving. New tools, data analytics platforms, and advancements in fields like artificial intelligence can offer fresh insights and capabilities. Integrating these into the momentum trading algorithm can significantly enhance its performance. The iterative process means staying abreast of these innovations and determining how they can be woven into the algorithm’s fabric.

Diversification in Momentum Algorithmic Trading

- To initiate our conversation on diversification in the sphere of momentum algorithmic trading, we must first acknowledge the inherent nature of momentum strategies. Generally, a momentum trading identifies and seeks to capitalize on market trends, betting on the continuation of a prevailing trend based on various technical indicators. While this approach often yields appreciable returns, the reliance on a single strategy can sometimes amplify the risks, especially during market reversals or periods of heightened volatility.Therefore, the role of diversification emerges as a potent tool to balance and mitigate these risks. The first pillar of diversification involves integrating various trading strategies alongside the momentum trading algorithm. For instance, incorporating mean reversion strategies, which bet on price corrections, can serve as a counterbalance to momentum strategies, offering a hedge during sudden market reversals.

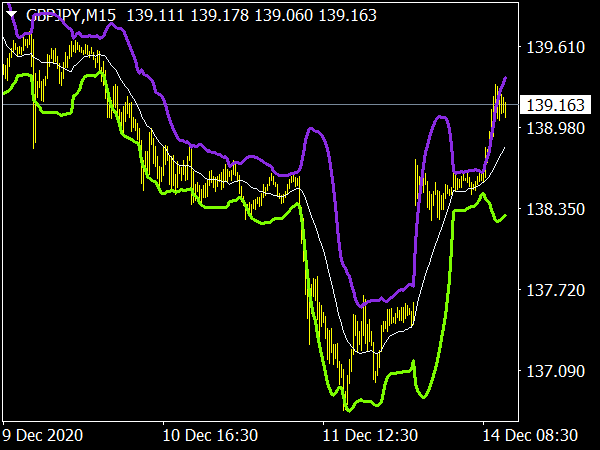

Furthermore, the momentum trading algorithm can be fine-tuned to explore different time frames. Whereas one algorithm might focus on short-term trends, capturing gains from minute-by-minute fluctuations, another might have a medium to long-term focus, seeking to profit from sustained market movements over weeks or months. This temporal diversification can sometimes yield uncorrelated results, providing a protective buffer to the investment portfolio.

Asset diversification stands as another critical component in this diversification narrative. A well-rounded momentum trading algorithm does not confine itself to a single market or asset type. It explores equities, commodities, currencies, and even cryptocurrencies, each having distinct market dynamics and cycles. This expansive approach allows traders to capitalize on opportunities in one market when another is experiencing a downturn, thus maintaining a steady growth trajectory.

But diversification is not solely confined to trading strategies and asset types; it also embraces geographical diversification. A savvy trader employing a momentum trading might scan opportunities globally, identifying trends in various markets around the world. This global approach can potentially unveil lucrative opportunities, especially in emerging markets with different economic cycles compared to established markets.

Moreover, to foster robust diversification, it is essential to continually monitor and adjust the portfolio based on changing market conditions. This dynamic approach ensures that the momentum trading algorithm remains adaptable, capable of pivoting strategies as needed to maintain a well-diversified portfolio.

Ethical Considerations in Algorithmic Trading

Potential for Market Manipulation

At the heart of the ethical debate is the potential for market manipulation. Momentum trading algorithms, by their very nature, respond to and, in some cases, amplify existing market trends. When numerous algorithms act in concert, either by coincidence or design, they can lead to exaggerated market movements. For example, if multiple momentum trading algorithms identify a stock as having positive momentum and begin buying en masse, they can artificially inflate the stock’s value, leading to potential bubbles.

Transparency and Fairness

The opaque nature of algorithmic strategies, including momentum trading algorithms, poses another ethical concern. Many of these algorithms are proprietary, meaning their exact workings and strategies are closely guarded trade secrets. While this is understandable from a competitive standpoint, it raises questions about fairness. Can the average investor truly compete in a market dominated by algorithms they don’t understand and can’t see?

Accessibility and Equal Playing Ground

The resources required to develop, deploy, and maintain a sophisticated momentum trading algorithm are substantial. This often means that only large financial institutions or well-funded hedge funds can afford to engage in high-level algorithmic trading. This creates a potential divide between institutional traders and retail investors, raising concerns about creating an uneven playing field where only the elite can benefit from the most advanced trading tools.

Overreliance and Systemic Risk

Momentum trading algorithms, as with other automated strategies, run the risk of traders becoming over-reliant on them. When these algorithms encounter a scenario they aren’t designed for, they might act unpredictably, leading to significant losses. If many traders and institutions rely on similar algorithms, and these algorithms all behave in an unanticipated manner simultaneously, it could introduce systemic risk into the financial markets.

Accountability in Autonomous Decisions

As the momentum trading makes decisions autonomously, an ethical question arises regarding accountability. If an algorithm makes a trade resulting in substantial market disruption or loss, who is responsible? The developer who coded the algorithm? The trader who deployed it? Or the institution that backs the trader?

Future Ethical Considerations

With technology continually advancing, new ethical considerations will inevitably emerge. The integration of machine learning and artificial intelligence into momentum trading algorithms can lead to systems that learn and evolve on their own. This self-evolution further complicates the ethical landscape, making transparency and accountability even more critical.

The Future of Momentum Trading Algorithms

Integration with Advanced Technologies

The most significant push for the momentum trading will likely come from other sectors of technology. Artificial Intelligence (AI) and Machine Learning (ML) are poised to play pivotal roles in refining and enhancing the efficiency of the momentum trading algorithm. By leveraging these technologies, algorithms can learn from vast datasets, identifying even subtle patterns and nuances in market behavior that might escape human analysis.

Customization and Personalization

With advancements in computational power and data analytics, the next wave of momentum trading algorithms may offer unprecedented levels of customization. Traders might be able to tailor algorithms more closely to their unique trading styles, risk appetite, and financial goals. This heightened level of personalization would not only improve trade efficiency but also align more closely with individual trader objectives.

Global Market Interactions

As markets become more interconnected, the momentum trading algorithm’s ability to operate seamlessly across diverse markets will be crucial. Algorithms will be designed to draw insights from global market trends, considering variables from different economies, time zones, and asset classes. This global perspective will allow traders to capitalize on momentum trends that span across borders.

Enhanced Risk Management

Risk is an inherent part of trading. However, the future momentum trading algorithm will likely be equipped with even more sophisticated risk management features. Predictive analytics, paired with real-time market data, will allow the algorithm to forecast potential market downturns or volatility spikes, adjusting trading strategies on-the-fly to mitigate potential losses.

Regulatory and Ethical Evolution

The prominence of the momentum trading algorithm will undoubtedly catch the attention of regulatory bodies. As these algorithms grow in influence, there will be a concerted effort to ensure transparency, fairness, and ethical considerations in their operations. Traders and developers alike will need to navigate an evolving regulatory landscape, ensuring that algorithms operate within established guidelines while still maximizing their potential.

Evolving with Market Dynamics

One constant in financial markets is change. As market dynamics shift due to geopolitical events, economic policies, or global crises, the momentum trading algorithm will need to be agile. Continuous refinement and adaptation will be paramount. Developers will work tirelessly to ensure that their algorithms remain relevant, effective, and attuned to the latest market realities.

Conclusion

In the intricate dance of financial markets, the momentum trading algorithm has carved a niche for itself. By intelligently harnessing market trends, it offers traders an edge in their pursuit of profitability. As technology continues to shape trading’s future landscape, the momentum trading algorithm will undoubtedly remain a crucial player, evolving and adapting to the market’s ever-changing rhythm.